GAB Robins Group of Companies Bundle

What is the story behind GAB Robins Group of Companies?

Delve into the GAB Robins Group of Companies SWOT Analysis, a name synonymous with claims management and loss adjusting, and uncover its fascinating history. From its inception in 1886, this company shaped the insurance landscape, evolving through significant industry shifts. Explore the GAB Robins history and understand its pivotal role in the evolution of claims services.

The GAB Robins Group's journey, from its founding as General Adjustment Bureau to its integration within Sedgwick, provides a compelling case study. Understanding the GAB Robins company background offers insights into the dynamics of the insurance claims sector. This transformation highlights the importance of adaptation and innovation in the face of evolving market demands, offering valuable lessons for businesses today.

What is the GAB Robins Group of Companies Founding Story?

The story of the GAB Robins Group of Companies began in May 1886, with the establishment of the General Adjustment Bureau (GAB) in New York City. The company's creation was driven by the need for standardized and impartial claims assessment within the growing insurance sector. The founders aimed to address inconsistencies and potential biases in how insurance claims, especially those related to property losses, were handled.

The original business model of GAB was simple: to offer independent loss adjusting services to insurance companies. They dispatched adjusters to assess damages for property claims, ensuring fair valuations for both insurers and policyholders. The name 'General Adjustment Bureau' clearly communicated its role as a comprehensive authority on adjustments. The late 19th-century context, marked by rapid industrialization and increased insurance adoption, provided a favorable environment for a specialized claims adjustment entity.

The founders, likely individuals with a strong understanding of the insurance industry, saw an opportunity to professionalize and standardize a crucial part of the insurance value chain. This move aimed to enhance trust and efficiency within the industry. The initial funding likely came from a group of insurance companies or through a bootstrapping approach, as the service addressed a collective industry need. For further insights, explore the Growth Strategy of GAB Robins Group of Companies.

GAB Robins's founding was a response to the insurance industry's need for impartial claims assessment.

- Established in May 1886 in New York City.

- Focused on providing independent loss adjusting services.

- Aimed to standardize and professionalize claims handling.

- Supported by insurance companies or through bootstrapping.

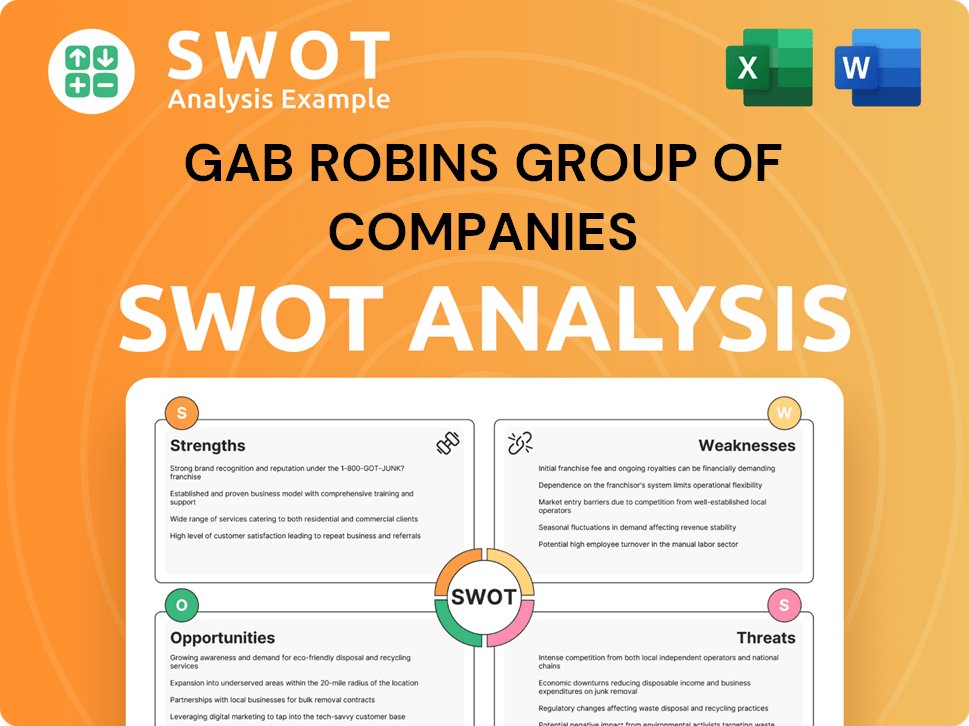

GAB Robins Group of Companies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of GAB Robins Group of Companies?

The early growth of the GAB Robins Group of Companies was characterized by its response to the increasing complexity of insurance claims. GAB Robins history shows that the company expanded its geographical presence beyond New York, establishing offices in other major cities. This expansion was crucial in meeting the growing demand for independent expertise in loss adjusting.

A significant milestone in the GAB Robins company timeline was the 1990 merger with Robins Companies. This merger led to the formation of GAB Robins North America, Inc. The integration aimed to broaden service offerings, particularly in third-party administration (TPA) services, marking a strategic expansion.

Following the merger, GAB Robins expanded into new markets, including more complex liability claims and workers' compensation cases. This expansion reflected the evolving needs of the insurance industry. The company's strategic shift was towards becoming a full-service claims and risk management provider.

GAB Robins' growth efforts were shaped by a strategic shift towards becoming a full-service claims and risk management provider. This move allowed the company to remain competitive in a consolidating industry. The market received these expansions positively, as insurers sought integrated solutions for effective claims management.

Early major clients included prominent insurance carriers of the late 19th and early 20th centuries, benefiting from GAB's standardized claims handling. Leadership transitions focused on integrating corporate cultures and leveraging combined expertise. The company's expansion was a pivotal decision, allowing it to remain competitive.

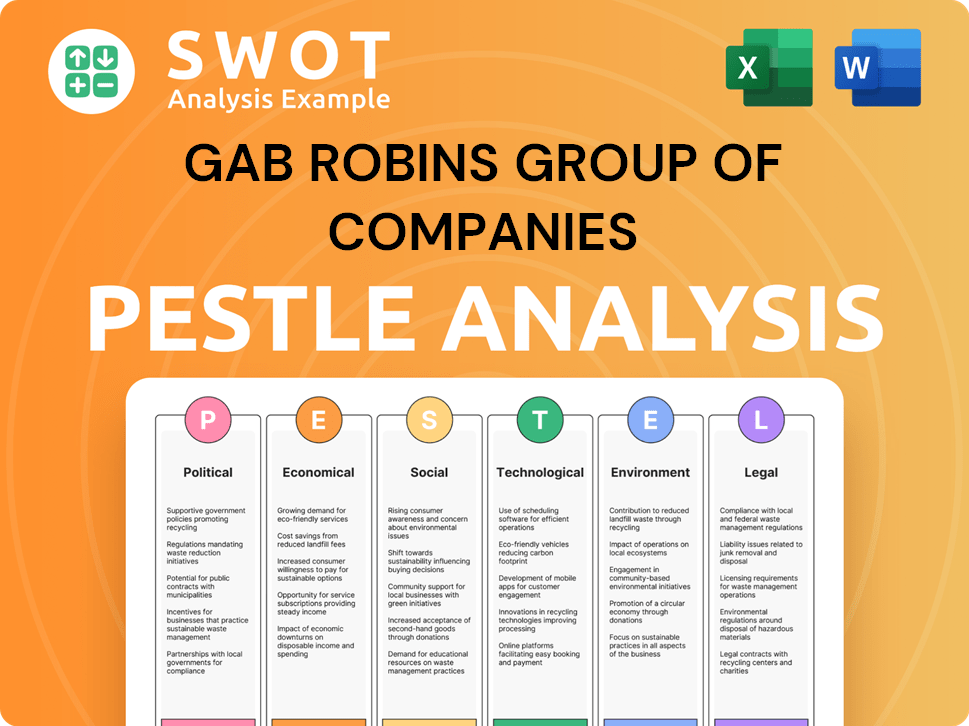

GAB Robins Group of Companies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in GAB Robins Group of Companies history?

The GAB Robins Group of Companies, throughout its history, achieved several significant milestones that shaped the insurance claims landscape. These achievements showcase the company's evolution and impact on the industry, reflecting its adaptability and strategic vision over the years.

| Year | Milestone |

|---|---|

| 1950s | GAB (General Adjustment Bureau) is established, marking the beginning of the company's journey in loss adjusting. |

| 1990 | The merger forming GAB Robins North America combines GAB's adjusting strength with Robins' expertise in managed care. |

| 2011 | GAB Robins North America is acquired by Sedgwick, a significant industry consolidation. |

| 2018 | Sedgwick acquires Cunningham Lindsey, which had previously acquired GAB Robins International operations, further expanding its global reach. |

GAB Robins introduced several innovations that significantly impacted the insurance claims process. A key innovation was the development of standardized claims adjusting protocols, which brought consistency and efficiency to a previously fragmented process. These methodologies and training programs set industry benchmarks, enhancing the quality and speed of claims resolution.

GAB Robins developed standardized claims adjusting protocols to ensure consistency in handling insurance claims. This innovation improved efficiency and reduced variability in the claims process.

The merger with Robins brought expertise in managed care, integrating healthcare cost management into claims handling. This integration helped control costs and improve outcomes in healthcare-related claims.

GAB Robins invested in comprehensive training programs for its adjusters, ensuring a skilled workforce. These programs helped maintain high standards of service and knowledge in the field of loss adjusting.

The company formed major partnerships with numerous insurance carriers, solidifying its position as a trusted third-party administrator. These partnerships expanded its reach and enhanced its service offerings.

GAB Robins invested in technological advancements to improve claims processing and data analysis. This included implementing new software and systems to streamline operations and enhance decision-making.

Through acquisitions and strategic moves, GAB Robins expanded its global presence, offering services in multiple countries. This expansion allowed the company to serve a broader client base and handle claims internationally.

GAB Robins faced various challenges throughout its history, impacting its operations and strategic direction. Economic downturns affected claim volumes and profitability, requiring the company to adapt to changing market conditions. The need to consistently deliver high-quality service across a vast geographical footprint and diverse client base also posed a significant challenge.

Economic downturns often led to fluctuations in claim volumes and profitability, requiring GAB Robins to adjust its strategies. These periods demanded cost-cutting measures and efficient resource allocation to maintain financial stability.

The highly competitive nature of the insurance claims industry necessitated continuous adaptation and innovation. GAB Robins had to constantly improve its services and offerings to stay ahead of its competitors.

The rise of new technologies and the demand for data-driven insights presented both opportunities and challenges. GAB Robins needed to invest in IT infrastructure and analytics capabilities to remain competitive.

Post-acquisition, merging corporate cultures and integrating operations could present challenges. Successfully integrating acquired companies was crucial for achieving synergies and maintaining service quality.

Delivering consistent, high-quality service across a vast geographical footprint and diverse client base was a significant operational challenge. This required effective management and coordination across multiple locations.

Changes in insurance regulations and compliance requirements could impact operations and require adjustments. Staying compliant with evolving regulations was essential for maintaining legal and ethical standards.

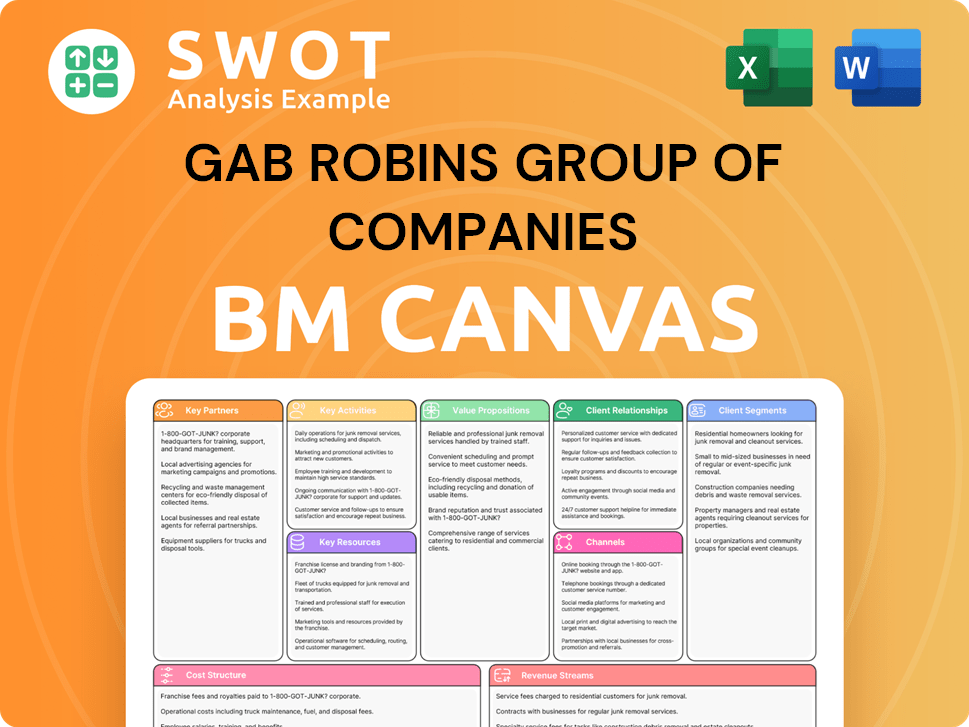

GAB Robins Group of Companies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for GAB Robins Group of Companies?

The GAB Robins Group of Companies, a significant player in the insurance claims and loss adjusting sector, has a history marked by strategic mergers and acquisitions. Its evolution reflects the changing landscape of the insurance industry. The company's journey, from its founding to its integration into Sedgwick, showcases its adaptability and growth.

| Year | Key Event |

|---|---|

| 1886 | General Adjustment Bureau (GAB) was established in New York City, marking the beginning of its claims adjusting services. |

| 1990 | GAB merged with Robins Companies, forming GAB Robins North America, Inc., which expanded into third-party administration. |

| Early 2000s | GAB Robins expanded its international footprint, establishing operations in numerous global markets. |

| 2011 | Sedgwick acquired GAB Robins North America, significantly bolstering its claims management capabilities in the U.S. and Canada. |

| 2014 | Sedgwick acquired VeriClaim, further enhancing its property and casualty adjusting services. |

| 2018 | Sedgwick acquired Cunningham Lindsey, which had previously acquired GAB Robins International operations, consolidating the GAB Robins lineage under the Sedgwick umbrella, creating a global claims management powerhouse. |

| 2019 | The Carlyle Group became the majority owner of Sedgwick, valuing the company at approximately $10.7 billion. |

| 2023 | Sedgwick continued strategic acquisitions, including the purchase of the remaining stake in Sedgwick LeBlanc in Canada, and the claims management business of Munich Re's Hartford Steam Boiler (HSB) in the UK and Ireland. |

| 2024 | Sedgwick expanded its presence in the Australian market through the acquisition of loss adjusting firm, Integra Technical Services' Australian operations. |

Sedgwick, the current entity, is focused on worldwide expansion. This includes strengthening its presence in emerging markets. The goal is to provide comprehensive claims solutions across diverse regions.

Technological advancements are a key focus, with AI and machine learning being utilized to improve claims processing. This leads to enhanced efficiency and accuracy in handling insurance claims. Automation is a key focus.

The third-party claims administration (TPA) market is projected to reach approximately $430 billion by 2030. This indicates significant growth potential for Sedgwick. This growth is driven by increasing demand for specialized claims services.

Sedgwick plans to diversify its service offerings to meet evolving client needs. This includes areas like cyber risk and ESG-related claims. This diversification is crucial for adapting to new market demands.

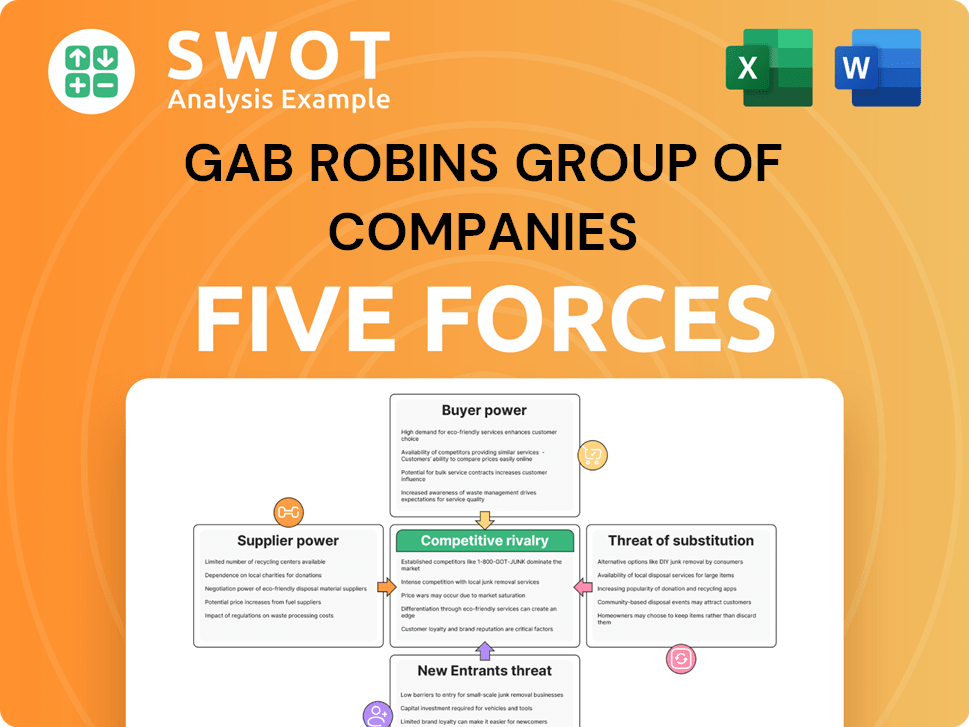

GAB Robins Group of Companies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of GAB Robins Group of Companies Company?

- What is Growth Strategy and Future Prospects of GAB Robins Group of Companies Company?

- How Does GAB Robins Group of Companies Company Work?

- What is Sales and Marketing Strategy of GAB Robins Group of Companies Company?

- What is Brief History of GAB Robins Group of Companies Company?

- Who Owns GAB Robins Group of Companies Company?

- What is Customer Demographics and Target Market of GAB Robins Group of Companies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.