GAB Robins Group of Companies Bundle

Who Does Sedgwick Serve? Unveiling GAB Robins' Customer Demographics and Target Market

In the dynamic world of claims management, understanding customer demographics and target markets is paramount. Sedgwick, a leader in the industry, has strategically adapted its approach, building upon the foundation of companies like GAB Robins. This evolution highlights the importance of identifying and catering to specific client needs for sustained success. This exploration delves into the core of who Sedgwick serves, providing a detailed market analysis.

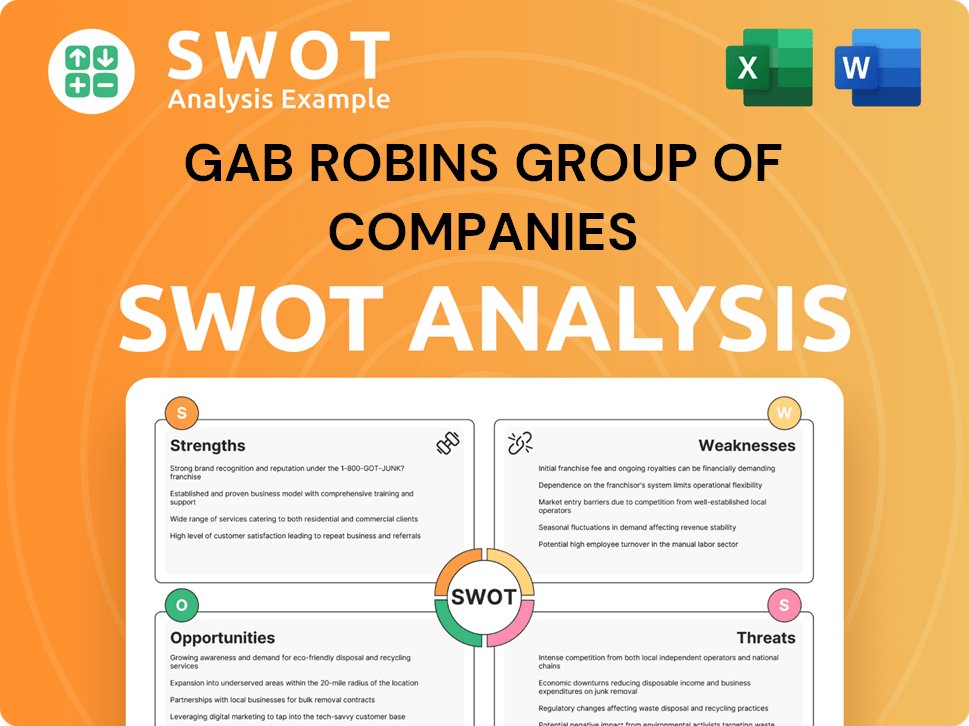

This GAB Robins Group of Companies SWOT Analysis is crucial for understanding the company's strategic focus. Analyzing GAB Robins' customer segmentation and target audience analysis reveals valuable insights into the insurance industry's competitive landscape. Understanding who GAB Robins' clients are and their demographic breakdown is essential for grasping the company's market share analysis and its ability to provide effective service offerings. This deep dive helps to determine the GAB Robins ideal customer profile.

Who Are GAB Robins Group of Companies’s Main Customers?

Understanding the primary customer segments of the [Company Name] is crucial for grasping its market position and strategic focus. The company, operating primarily in a B2B environment, concentrates its services on specific organizational types. This approach allows for tailored solutions within the insurance and claims management sectors. Analyzing the customer demographics provides insights into the company's ability to meet the needs of its target market, which is essential for sustained growth and market share.

The company's target market is clearly defined by its service offerings. Key customer demographics include insurance companies, businesses that are self-insured, and government entities. These organizations benefit from the company's technology-enabled claims and productivity management solutions. By focusing on these segments, the company aims to streamline claims processes, reduce costs, and improve overall operational efficiency for its clients.

The company's strategic direction is heavily influenced by its customer base. The company's ability to meet the evolving needs of its clients is a key factor in its success. Recent developments, such as the acquisition of Bottomline's legal spend management division in February 2024, are designed to enhance service offerings and expand its global presence. This expansion is a direct response to the demands and expectations of its core customer segments.

The company's primary customer segments are insurance companies, self-insured businesses, and government entities. These clients utilize the company's technology-driven claims and productivity management solutions. The focus is on providing services that streamline processes and reduce costs within these organizations.

The target market analysis reveals a strategic focus on B2B clients within the insurance and claims management industries. The company's competitive advantages, including its global reach and technological solutions, are designed to meet the specific needs of these segments. The company's approach allows for tailored solutions within the insurance and claims management sectors.

The company processed over 3.5 million claims in 2023, indicating a significant market presence. The company's overall revenue grew by 7% globally in 2024, reflecting strong performance across its B2B client base. The company's valuation reached approximately $13.2 billion in 2024, driven by a $1 billion equity investment from Altas Partners.

The company's strategic initiatives are focused on expanding its service offerings and global presence. The February 2024 acquisition of Bottomline's legal spend management division enhances its capabilities. The company's 'Sedgwick's Edge' platform, utilizing AI for claims management, highlights its commitment to technological innovation.

The company's primary customers, including insurance companies, self-insured businesses, and government entities, drive its strategic focus. These segments benefit from tailored solutions aimed at streamlining claims processes, reducing costs, and enhancing overall operational efficiency. The company's ability to meet the evolving needs of these clients is critical for sustaining market leadership. For more details, you can explore the Revenue Streams & Business Model of GAB Robins Group of Companies.

- Insurance companies: Require efficient claims processing to reduce expenses and improve customer satisfaction.

- Self-insured businesses: Need solutions to manage workplace injuries, reduce absences, and enhance employee productivity.

- Government entities: Seek claims management services to better serve their constituents and manage public resources effectively.

- The company's focus on technology-driven solutions, such as 'Sedgwick's Edge,' underscores its commitment to meeting the demands of a digitally transforming industry.

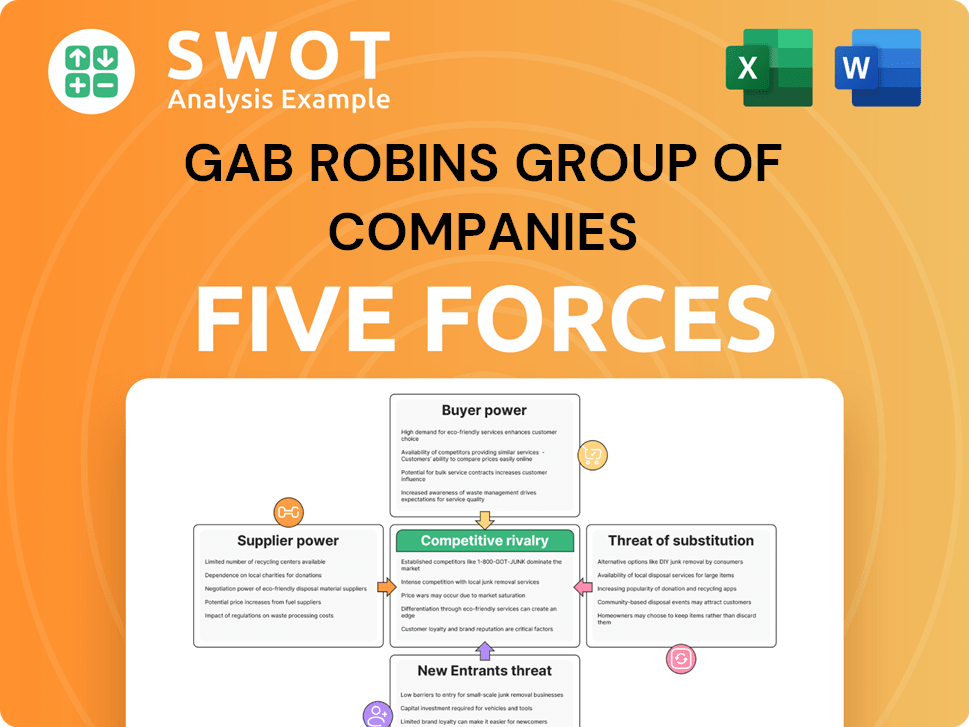

GAB Robins Group of Companies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do GAB Robins Group of Companies’s Customers Want?

The customer needs and preferences for Sedgwick, a company operating within the insurance industry, are centered on efficiency, cost control, and effective risk management. Businesses and organizations seek streamlined claims processes, reduced administrative burdens, and improved outcomes across various claim types, including workers' compensation and property claims. The primary drivers for selecting Sedgwick often involve a desire for reliable and expert claims handling to minimize financial losses and protect brand reputation. This focus directly addresses the core needs of their target market.

A significant pain point that Sedgwick addresses is the rising cost of claims and the need for faster, more efficient processing. Customers expect quick turnaround times and excellent customer service. Sedgwick leverages technology, including AI tools and platforms for claims, incident reporting, and data analysis, to enhance efficiency and accuracy, directly addressing these needs. These needs are central to understanding the company's customer demographics and target market.

The psychological and practical drivers for selecting Sedgwick often stem from the desire for reliable and expert claims handling that minimizes financial losses and protects brand reputation. This is crucial in the context of the company's customer base size and industry focus. Understanding these drivers is essential for a thorough market analysis.

Customers prioritize quick turnaround times and streamlined processes. Sedgwick addresses this through technology and efficient claims management.

Clients seek solutions that help reduce the overall cost of claims. This is a key factor in their decision-making process.

Customers need expert claims handling to minimize financial losses and protect their brand reputation. This builds trust.

The use of AI and data analytics tools to improve accuracy and efficiency is highly valued. This is part of their service offerings.

Clients appreciate services that meet their unique requirements. This contributes to customer retention.

Excellent customer service is a critical expectation. This is essential for building strong client relationships.

Sedgwick's customer-centric approach is highlighted by its focus on tailored services that meet unique client requirements, contributing to a reported 95% client retention rate as of early 2024. This tailoring extends to marketing and product features, with Sedgwick emphasizing personalized service to build trust and demonstrate value, which led to a 15% client retention boost in 2024. For more insights into their strategic approach, consider reading about the Marketing Strategy of GAB Robins Group of Companies.

Customers of Sedgwick, a key player in the insurance industry, have clear expectations regarding the services they receive. These expectations drive the company's operations and strategic decisions.

- Efficient claims processing with quick turnaround times.

- Cost-effective solutions to reduce claims expenses.

- Expertise and reliability in handling various types of claims.

- Use of advanced technology, including AI, for improved accuracy.

- Personalized and tailored services to meet specific client needs.

- Excellent customer service and support throughout the claims process.

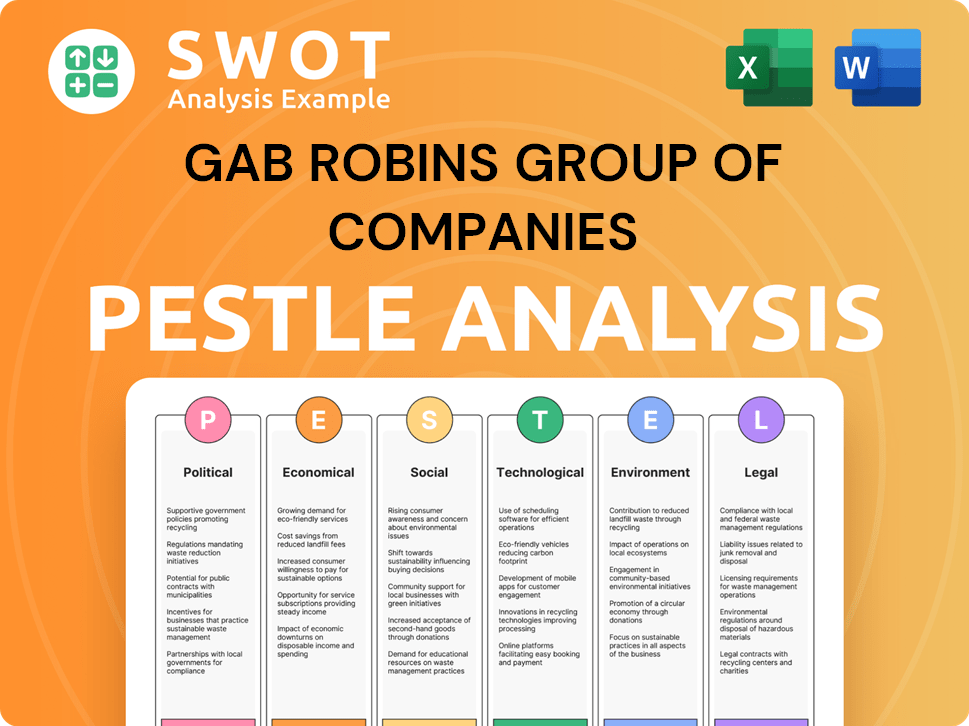

GAB Robins Group of Companies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does GAB Robins Group of Companies operate?

The geographical market presence of the GAB Robins Group of Companies, now operating under the name of Sedgwick, is extensive. As of early 2025, Sedgwick boasts a significant global footprint, with over 300 offices worldwide. This widespread network supports direct client service across 80 countries, allowing the company to serve diverse markets effectively.

This expansive presence is a key element of Sedgwick's strategy to cater to a broad range of clients and provide localized solutions tailored to specific regional needs. The company's approach includes strategic acquisitions and investments to strengthen its foothold in various markets. For example, the acquisition of Cunningham Lindsey in April 2018 was a strategic move to enter and expand within the Australian market, demonstrating a proactive strategy for market entry and growth.

Sedgwick's operations are influenced by global trends. The 'Forecasting 2025' report highlights the impact of factors such as the rising frequency and intensity of natural catastrophes, which necessitate localized disaster recovery and catastrophe planning services. The company's adaptability is crucial for navigating diverse regulatory landscapes and cultural nuances in different geographical markets. This is supported by strategic investments, such as the $1 billion equity investment secured in 2024, earmarked for international expansion.

Sedgwick's strategy includes targeted acquisitions to enter new markets. The acquisition of Cunningham Lindsey in Australia in 2018 is a prime example, demonstrating a proactive approach to market entry and expansion.

- This approach enables the company to establish a presence in regions where it previously lacked direct operations.

- It provides a platform to offer localized solutions and cater to specific regional needs.

- Such strategic moves are crucial for expanding the customer base and increasing market share.

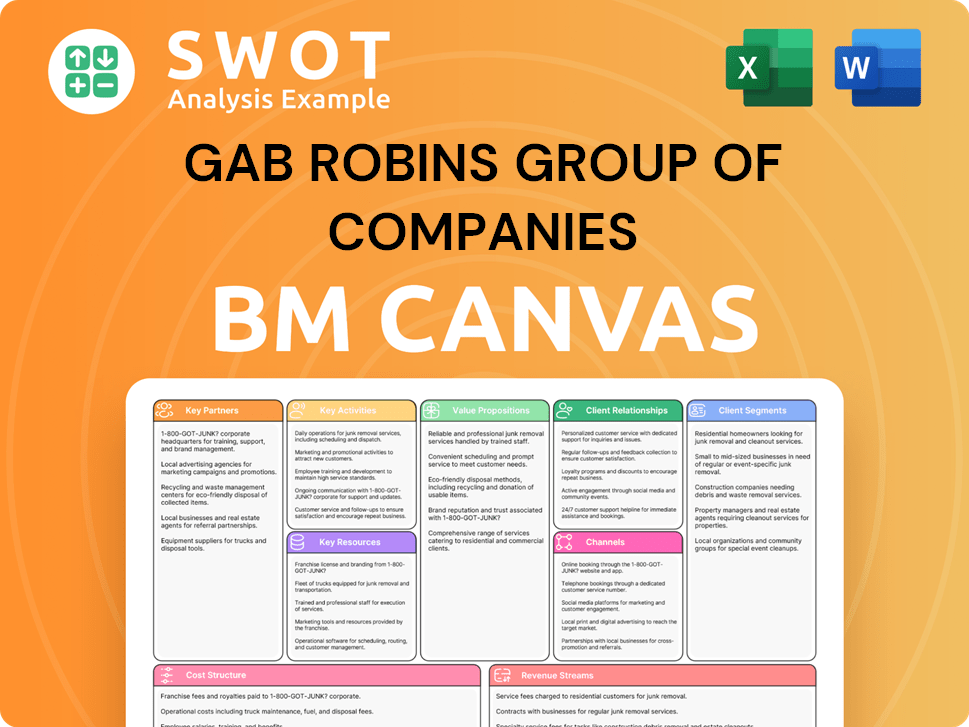

GAB Robins Group of Companies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does GAB Robins Group of Companies Win & Keep Customers?

The customer acquisition and retention strategies of the [Company Name] (operating under the name of Sedgwick) are primarily focused on the business-to-business (B2B) sector. Their approach is designed to attract and retain clients, particularly within the insurance and self-insured business sectors. The company leverages a mix of digital and traditional marketing channels to reach its target market effectively.

Sedgwick's customer acquisition strategy relies heavily on targeted marketing and sales efforts. This includes a strong online presence, utilizing digital marketing to engage with its audience. Traditional channels are also used to ensure broad reach within relevant geographic areas. These combined efforts are part of a broader strategy to capture market share within the claims management sector.

For customer retention, Sedgwick prioritizes building strong relationships through personalized service. This is supported by a customer-centric approach aimed at exceeding client expectations. They offer comprehensive solutions, covering a wide range of claims management services, and actively engage in industry events to build brand awareness. Customer data and CRM systems are crucial for tailoring services and identifying customer needs.

Sedgwick utilizes digital marketing extensively, leveraging the insurance industry's estimated $1.2 billion digital marketing spend in 2024. This includes a strong online presence, focusing on its website and social media platforms. The goal is to engage with its audience and showcase its technology-enabled solutions, which is critical for Owners & Shareholders of GAB Robins Group of Companies.

The company focuses its efforts on key clients such as insurance companies, self-insured businesses, and government entities. This targeted approach helps in efficiently acquiring new customers within their ideal customer profile. This strategy ensures that marketing resources are used effectively to reach the most relevant segments.

Sedgwick emphasizes building strong client relationships through personalized service. This approach has contributed to a 15% client retention boost in 2024 and a reported 95% client retention rate as of early 2024, demonstrating the effectiveness of their customer-centric strategy. They aim to exceed client expectations at every touchpoint.

Loyalty is fostered through comprehensive solutions, covering a wide range of claims management services. This includes workers' compensation, property, and liability claims. By offering a broad spectrum of services, Sedgwick aims to meet all of its clients' needs, improving retention rates.

Sedgwick's strategy also involves continuous technological advancements, such as AI tools for claims management, to improve efficiency and service delivery. The company's tech investments increased by 15% in 2024. Furthermore, the expansion of integrated business solutions beyond traditional claims saw a 15% growth in demand in 2024. These initiatives enhance customer loyalty and lifetime value by providing high-quality, efficient, and tailored services.

Sedgwick actively engages in industry events and thought leadership. They sponsored over 50 industry conferences globally in 2024. This helps build brand awareness and positions them as a leader in claims management, a key aspect of their market analysis.

Customer data and CRM systems are paramount in targeting campaigns and tailoring services. This allows Sedgwick to identify trends, preferences, and needs of different customer segments, which is crucial for understanding their customer demographics.

Technological advancements, such as AI tools for claims management, are continuously integrated to improve efficiency and service delivery. This directly impacts customer satisfaction and retention, improving their service offerings.

There is an increased focus on expanding integrated business solutions beyond traditional claims. This strategic shift aims to enhance customer loyalty and lifetime value by providing high-quality, efficient, and tailored services, crucial for their target market.

Sedgwick emphasizes a customer-centric approach, aiming to exceed client expectations at every touchpoint. This personalized service is a key driver of their high client retention rates, and is a critical factor in their customer acquisition strategies.

Changes in strategy over time include increased investment in technology, with tech investments increasing by 15% in 2024. This focus on continuous improvement and innovation is essential for maintaining a competitive edge.

GAB Robins Group of Companies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GAB Robins Group of Companies Company?

- What is Competitive Landscape of GAB Robins Group of Companies Company?

- What is Growth Strategy and Future Prospects of GAB Robins Group of Companies Company?

- How Does GAB Robins Group of Companies Company Work?

- What is Sales and Marketing Strategy of GAB Robins Group of Companies Company?

- What is Brief History of GAB Robins Group of Companies Company?

- Who Owns GAB Robins Group of Companies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.