GAB Robins Group of Companies Bundle

Unraveling the Legacy: How Did GAB Robins Shape the Insurance World?

Founded in 1872, GAB Robins Group of Companies carved a significant niche in the insurance sector, specializing in loss adjusting and claims management. Its history offers a fascinating glimpse into the evolution of insurance claims, providing valuable lessons for today's investors and industry professionals. The company's acquisition by Crawford & Company in 2014, for £45.8 million, marked a pivotal moment in the claims management landscape.

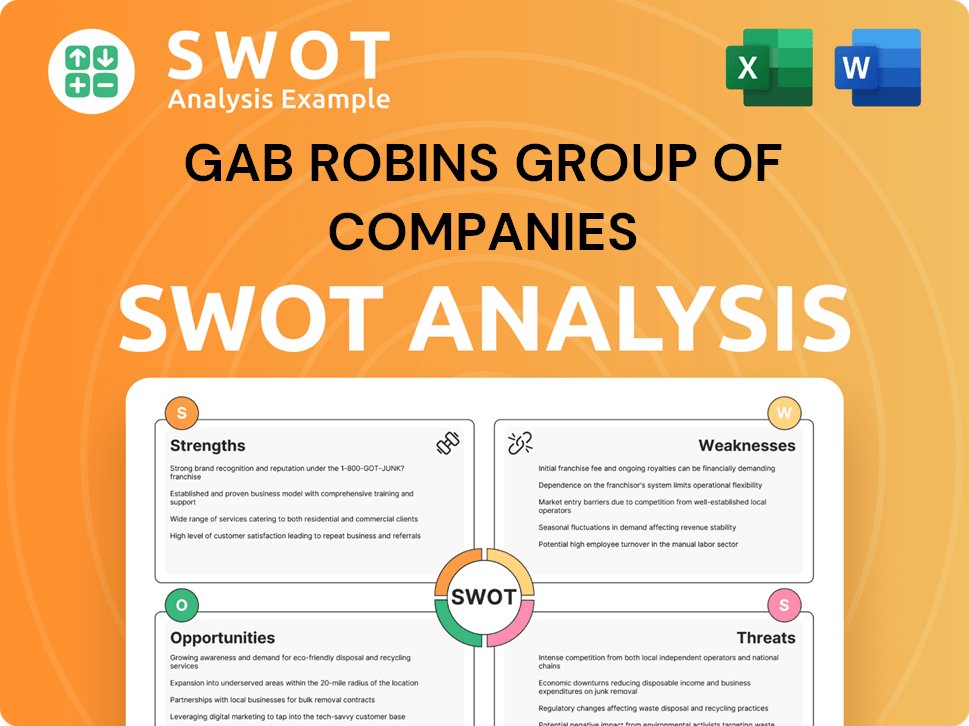

Exploring the operational intricacies of GAB Robins Group of Companies SWOT Analysis, even post-acquisition, is crucial for understanding the dynamics of insurance claims. This analysis provides insights into the company's historical strategies, revenue models, and competitive advantages within the industry. Examining the legacy of GAB Robins helps us understand how it managed insurance claims, its impact on the loss adjusting process, and its overall position within the claims management sector. Understanding the GAB Robins Company's history is key.

What Are the Key Operations Driving GAB Robins Group of Companies’s Success?

The GAB Robins Group of Companies specialized in providing technology-enabled risk, benefits, and integrated business solutions. Their core focus was on claims management and loss adjusting, serving a diverse clientele, including insurance carriers and self-insured entities. The company's operations were centered on key processes designed to streamline and improve the handling of insurance claims.

Their services were tailored to various industries, with a strong presence in property, casualty, construction, marine, and aviation insurance sectors. This allowed them to offer specialized expertise and support across a wide range of claims scenarios. GAB Robins aimed to control costs and improve outcomes for clients dealing with workers' compensation, property, and casualty claims.

The company's value proposition revolved around helping clients manage and resolve claims efficiently. By leveraging technology and in-house technical experts, GAB Robins offered streamlined processes, improved efficiency, and faster, more accurate claim results. This approach aimed to provide a competitive advantage in the insurance claims market.

Comprehensive claims handling, loss adjusting, and specialized services formed the backbone of GAB Robins Group of Companies operations. They focused on various insurance sectors, including property, casualty, construction, marine, and aviation. These services were designed to meet the diverse needs of their clients.

The company created value by helping clients control costs and improve outcomes in claims related to workers' compensation, property, casualty, and other specialized areas. GAB Robins aimed to offer streamlined processes, improved efficiency, and faster, more accurate claim results. This approach provided a competitive advantage in the insurance claims market.

GAB Robins utilized technology like JURIS and Sidekick Agent to offer real-time information and automate tasks. This technological edge enhanced claims management efficiency. Their in-house technical experts further differentiated them from competitors.

- Technology integration was key to streamlining claims processes.

- Real-time information access improved decision-making.

- Automation reduced manual effort and improved accuracy.

- In-house expertise provided specialized support.

GAB Robins Group of Companies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GAB Robins Group of Companies Make Money?

Historically, the GAB Robins Group generated revenue through its loss adjusting and claims management services. These services were essential for insurance companies, helping them manage claims efficiently and effectively.

While specific financial data for GAB Robins Company as a standalone entity isn't readily available due to its acquisition, its operations have been integrated into its acquirer, Sedgwick. This integration allows for a broader understanding of the revenue streams and monetization strategies.

GAB Robins's services now contribute to Sedgwick's revenue, which includes claims administration, managed care, and other related services, reflecting a comprehensive approach to insurance claims.

Sedgwick, a major player in the insurance Third Party Administrator (TPA) market, leverages the services previously offered by GAB Robins. As of April 2025, Sedgwick reported a product revenue of USD $3.2 billion and total annual revenue reaching $5 billion. Their monetization strategies focus on providing technology-enabled solutions to manage complex insurance processes and control costs.

- Claims Administration: Managing the entire claims process from start to finish.

- Managed Care: Offering healthcare management solutions to control medical costs.

- Program Management: Providing specialized services for specific insurance programs.

- Workers' Compensation Services: Handling claims related to workplace injuries.

- Liability Services: Addressing claims related to various liability issues.

The insurance TPA market, where Sedgwick operates, is experiencing significant growth. The global insurance TPA market is projected to reach $511.49 billion by 2030, with a CAGR of 4.6% from 2024 to 2030. For more insights into the competitive landscape, consider exploring the Competitors Landscape of GAB Robins Group of Companies.

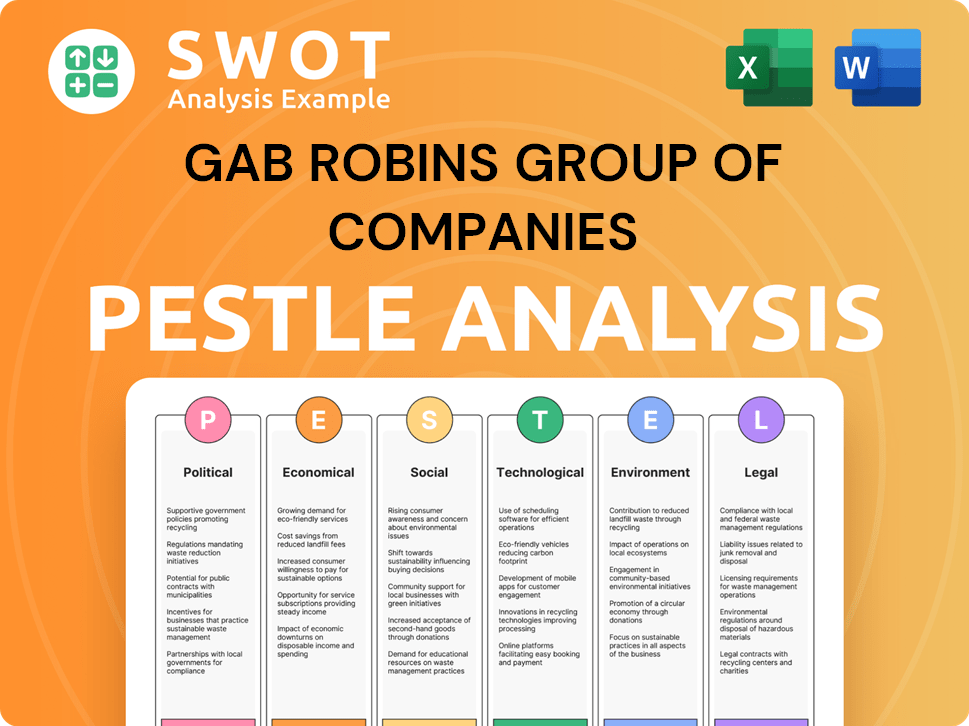

GAB Robins Group of Companies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped GAB Robins Group of Companies’s Business Model?

The Brief History of GAB Robins Group of Companies shows that it was a significant player in the insurance claims and loss adjusting sector. A key strategic move was its acquisition by Crawford & Company in December 2014. This acquisition was valued at £45.8 million (US$73.3 million), marking a pivotal moment in the company's history.

Before the acquisition, the GAB Robins Group of Companies underwent internal restructuring. These changes aimed to improve profitability and enhance service delivery. The company invested in technological infrastructure to support remote workers, adapting to the evolving business landscape.

The operational challenges included adapting to a remote workforce and ensuring consistent service delivery. The company also faced financial issues related to its defined benefits pension scheme, which was later closed. These factors shaped the company's trajectory.

The acquisition by Crawford & Company in December 2014 for £45.8 million (US$73.3 million) was a major milestone for GAB Robins. This move significantly expanded Crawford's claims handling business in the UK. Internal restructuring and technological investments also played crucial roles.

The primary strategic move was the acquisition by Crawford & Company. This allowed for expansion and enhancement of claims services. Other strategic moves included internal restructuring to improve profitability and service delivery.

Sedgwick, as the successor, maintains a competitive edge through global reach, technology, and industry expertise. Sedgwick operates in 80 countries with over 33,000 colleagues. Technological innovations, such as AI-powered applications, differentiate it in the market.

Adapting to remote work and ensuring consistent service delivery were key operational challenges. Financial issues related to the defined benefits pension scheme also presented difficulties. These issues impacted the company's operations.

Sedgwick, which incorporated GAB Robins' legacy, has a strong competitive position. This is supported by its global presence, technological advancements, and comprehensive service offerings. The launch of Sidekick, an AI-powered application, in April 2023, demonstrates its commitment to innovation.

- Global Reach: Operates in 80 countries.

- Technology: Utilizes AI and data analytics.

- Service Offerings: Includes claims handling, benefits administration, and brand protection.

- Industry Expertise: Provides comprehensive service delivery.

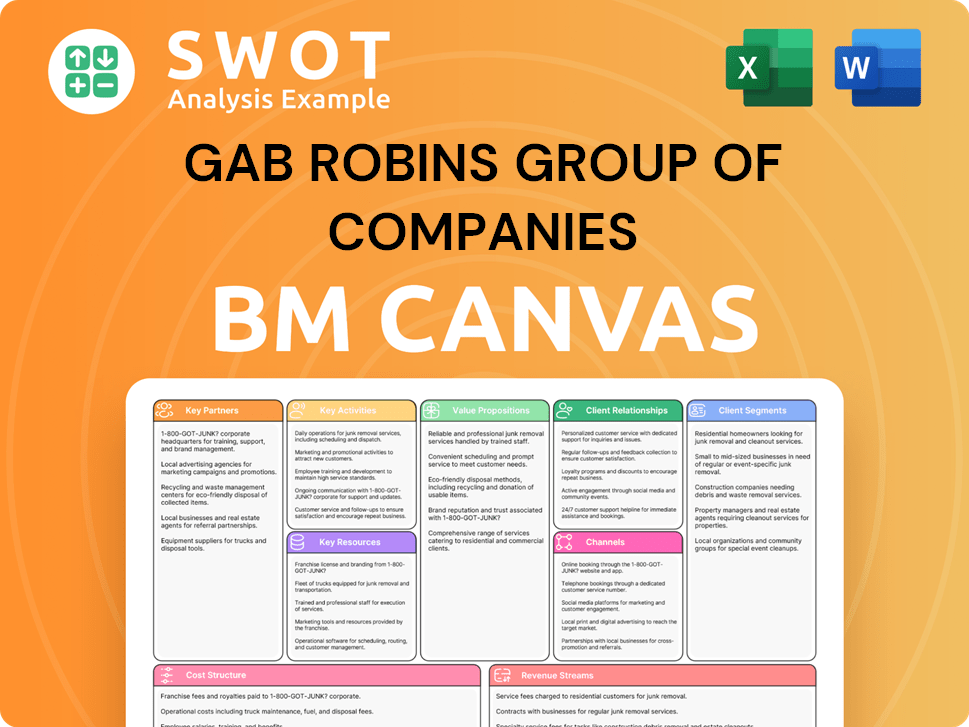

GAB Robins Group of Companies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is GAB Robins Group of Companies Positioning Itself for Continued Success?

Sedgwick, the current entity operating the former GAB Robins Group of Companies, holds a significant industry position in the claims management sector. As of 2024, the claims management market was valued at approximately $17 billion, with Sedgwick managing over $24 billion in claims. The company's extensive global reach, with operations in 80 countries and over 33,000 employees, underscores its competitive advantage. Key competitors include Crawford & Company and Gallagher Bassett.

Despite its robust market presence, Sedgwick faces several risks. Economic downturns, technological advancements, cybersecurity threats, and talent acquisition challenges represent significant hurdles. Regulatory changes and increased competition also pose consistent challenges. The company's ability to adapt to evolving work environments and manage risks from new technologies will be critical for its future success.

Sedgwick, through its acquisition of Growth Strategy of GAB Robins Group of Companies, is a leading provider of technology-enabled claims and productivity management solutions. It has a substantial market share in the $17 billion claims management market. The company's global presence and deep industry expertise contribute to its customer loyalty and competitive advantage.

Economic downturns can decrease demand for insurance and claims volume. Rapid technological advancements, cybersecurity threats, and the need to attract top talent pose significant risks. Regulatory changes and increased competition are also consistent challenges that Sedgwick must navigate.

Sedgwick is focused on maintaining market leadership through exceptional execution and customer satisfaction. The company is targeting ambitious growth, including expanding propositions in legal services, resource solutions, and commercial repairs. Leveraging AI and innovation to streamline processes and enhance services is a key focus.

Sedgwick plans to leverage AI and innovation to streamline processes and enhance services. The company's 'Forecasting 2025' report highlights key trends and risks, including evolving work environments and natural catastrophes. The company is adapting to new trends and continuing to invest in technology and its workforce.

Sedgwick's strategic focus includes expanding its service offerings and leveraging technology to improve efficiency. The company aims to capitalize on emerging trends and mitigate risks through proactive measures.

- Focus on exceptional execution and customer satisfaction.

- Expand propositions in legal services, resource solutions, and commercial repairs.

- Continue leveraging AI and innovation to streamline processes and enhance services.

- Adapt to new trends and invest in technology and its workforce.

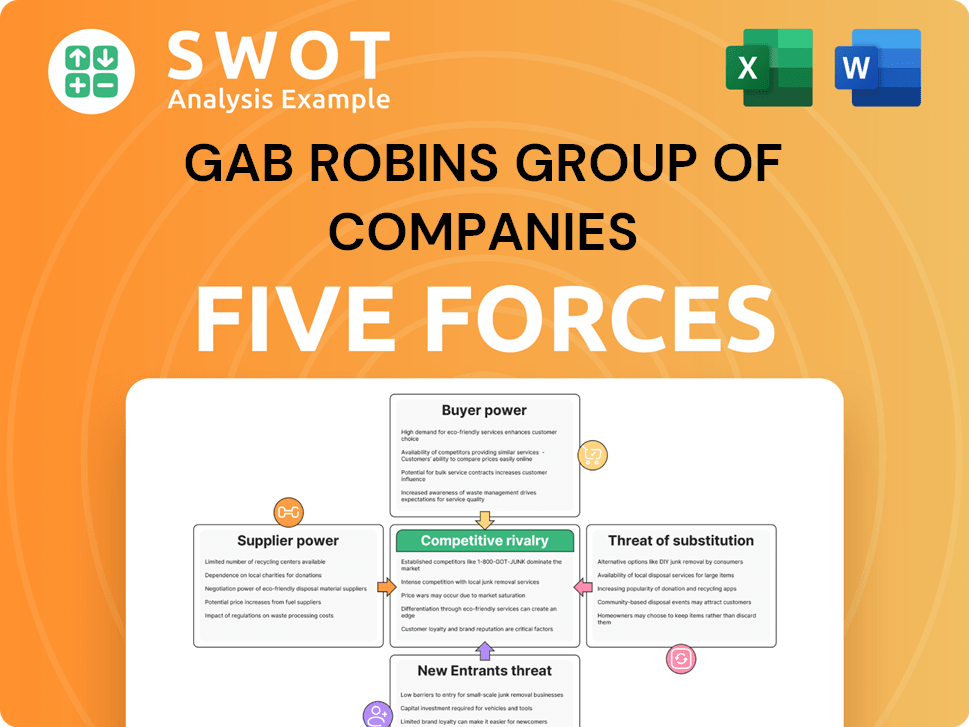

GAB Robins Group of Companies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GAB Robins Group of Companies Company?

- What is Competitive Landscape of GAB Robins Group of Companies Company?

- What is Growth Strategy and Future Prospects of GAB Robins Group of Companies Company?

- What is Sales and Marketing Strategy of GAB Robins Group of Companies Company?

- What is Brief History of GAB Robins Group of Companies Company?

- Who Owns GAB Robins Group of Companies Company?

- What is Customer Demographics and Target Market of GAB Robins Group of Companies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.