GAB Robins Group of Companies Bundle

How does Sedgwick navigate the complex competitive landscape?

In the ever-evolving world of insurance claims and risk management, understanding the competitive dynamics is crucial. Sedgwick, a global leader, has carved a significant niche for itself. But who are its main rivals, and what strategies does Sedgwick employ to maintain its market position? This analysis dives deep into the GAB Robins Group of Companies SWOT Analysis to uncover the competitive landscape.

This exploration of the GAB Robins Group's competitive landscape provides a comprehensive overview of the key players in the industry. We'll examine the company's strengths and weaknesses, and analyze the competitive advantages that shape its strategic direction. By understanding the competitive forces at play, stakeholders can make informed decisions regarding investment and strategic planning within the insurance claims and loss adjusting sector, gaining insights into GAB Robins Group's industry position and how it compares to its competitors.

Where Does GAB Robins Group of Companies’ Stand in the Current Market?

Sedgwick is a leading entity in the global claims management and loss adjusting sector, characterized by its extensive service portfolio and broad geographic reach. While specific market share figures for 2024 or 2025 are proprietary, Sedgwick is widely recognized as one of the largest third-party administrators (TPAs) globally. Their primary offerings include property and casualty claims, workers' compensation, disability, and managed care, serving a diverse clientele that includes corporations, insurers, and governmental entities.

The company operates in over 80 countries, demonstrating a significant global presence. Sedgwick's operations span North America, Europe, Asia Pacific, and Latin America, providing services to a vast network of clients. Over time, Sedgwick has strategically expanded its market position through both organic growth and significant acquisitions, such as the acquisition of Crawford & Company's U.S. property and casualty claims operations in 2024, further solidifying its market dominance.

This expansion has allowed Sedgwick to deepen its expertise in specialized claims areas and enhance its digital transformation initiatives, offering more integrated and technologically advanced solutions to its clients. The company's financial health and scale are robust, reflecting its substantial revenue generation and consistent growth in a highly competitive industry. Sedgwick's strong position is particularly evident in the North American market, where it maintains a significant share in workers' compensation and property claims. For more information on the ownership structure, you can explore Owners & Shareholders of GAB Robins Group of Companies.

Sedgwick's service offerings are comprehensive, covering various aspects of insurance claims and risk management. They provide solutions for property and casualty claims, workers' compensation, disability, and managed care. Their services are designed to meet the diverse needs of corporations, insurers, and governmental entities.

Sedgwick has a significant global footprint, operating in over 80 countries. Their presence spans North America, Europe, Asia Pacific, and Latin America, allowing them to serve clients worldwide. This extensive reach enables them to provide localized expertise and support.

Sedgwick holds a leading position in the global claims management and loss adjusting industry. They are recognized as one of the largest TPAs globally. Their market position is strengthened by strategic acquisitions and consistent growth.

Sedgwick's financial health is robust, with substantial revenue generation and consistent growth in a competitive industry. Their strong financial performance supports their ability to invest in technology and expand their service offerings. Further financial data is proprietary.

Sedgwick's key strengths include its extensive service portfolio, broad geographic reach, and strategic acquisitions. These factors contribute to its strong market position and ability to serve a diverse clientele. They have also enhanced their digital transformation initiatives.

- Extensive service portfolio covering various insurance claims.

- Broad geographic reach with operations in over 80 countries.

- Strategic acquisitions to expand market dominance, such as the Crawford & Company acquisition in 2024.

- Strong financial performance, reflecting substantial revenue and consistent growth.

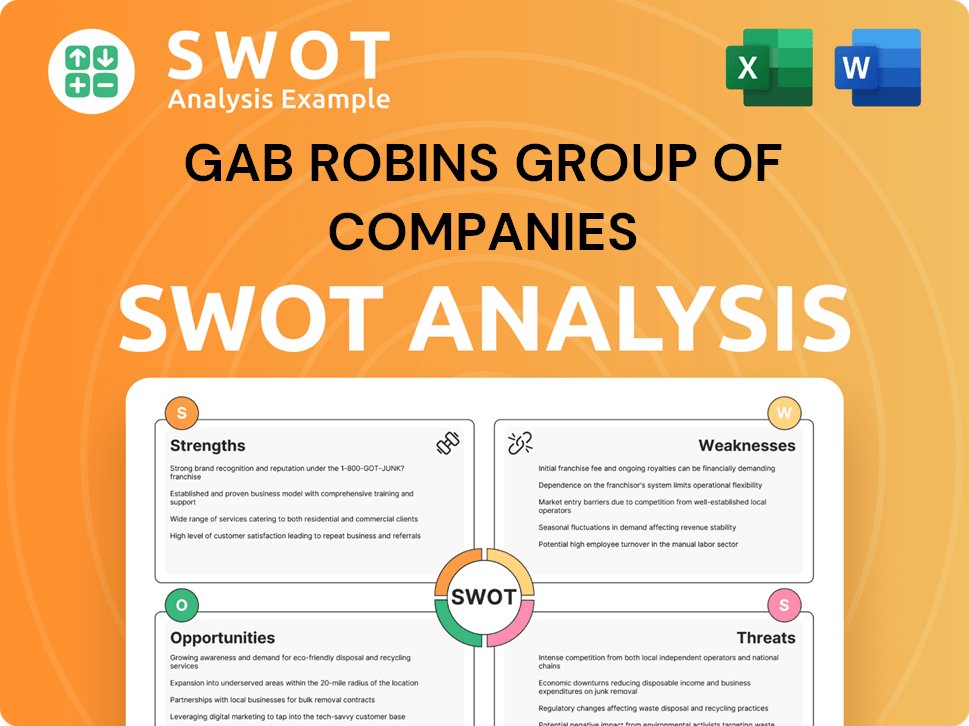

GAB Robins Group of Companies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging GAB Robins Group of Companies?

The competitive landscape for GAB Robins Group of Companies is shaped by a complex interplay of direct and indirect rivals. The company, operating within the insurance claims and risk management sectors, faces competition from a variety of firms offering similar services. Understanding this competitive environment is crucial for assessing GAB Robins Group's market position and strategic direction.

The market is characterized by firms specializing in insurance claims, loss adjusting, and risk management. These competitors vie for market share through service differentiation, technological innovation, and strategic partnerships. The dynamic nature of the industry, including mergers, acquisitions, and the adoption of new technologies, constantly reshapes the competitive environment.

Direct competitors of GAB Robins Group include major players in claims management and loss adjusting. These firms offer similar services, competing directly for client contracts and market share. The competitive intensity is high, driven by the need to provide efficient, cost-effective solutions.

Indirect competitors include smaller, specialized firms, internal claims departments of large corporations, and technology providers. These entities may offer niche services or leverage technology to streamline claims processes. The indirect competition can be significant, particularly with the rise of insurtech solutions.

Crawford & Company is a global provider of claims management solutions. It competes directly with GAB Robins Group across various service lines, including property, casualty, and catastrophe claims. The company's broad service offerings and global presence make it a significant competitor.

Verisk Analytics, while offering a broader range of data analytics and risk assessment services, also competes in claims management through its Xactware solutions. Xactware provides estimating and analytical tools for property claims, making Verisk a competitor in this segment.

Gallagher Bassett, a subsidiary of Arthur J. Gallagher & Co., is a major third-party administrator (TPA) offering risk management consulting, claims administration, and managed care services. It directly challenges GAB Robins Group in the workers' compensation and liability claims segments.

The ongoing push for digital transformation in claims management has led to increased competition in developing AI-driven solutions and predictive analytics for claims processing. This includes the use of data analytics to improve claims accuracy and efficiency.

The competitive landscape of GAB Robins Group is dynamic, with firms constantly adapting to market changes. Recent acquisitions and the rise of insurtech solutions are reshaping the industry. For example, the acquisition of Crawford & Company’s U.S. property and casualty claims operations by Sedgwick, a competitor, demonstrates how the market is consolidating. Furthermore, emerging players focusing on insurtech solutions introduce disruptive technologies that aim to streamline claims processes and reduce costs, intensifying the competition within the insurance claims and risk management sectors. To gain further insights, consider reading an article on GAB Robins Group of Companies, which provides additional context on the company's operations and market position.

Several factors drive competition in the insurance claims and risk management industry, influencing GAB Robins Group's competitive position.

- Service Differentiation: Offering specialized services and expertise in niche areas.

- Technological Innovation: Implementing advanced technologies such as AI and data analytics.

- Cost Efficiency: Providing cost-effective solutions to clients.

- Client Relationships: Building and maintaining strong relationships with clients.

- Geographical Presence: Having a broad geographical footprint to serve clients globally.

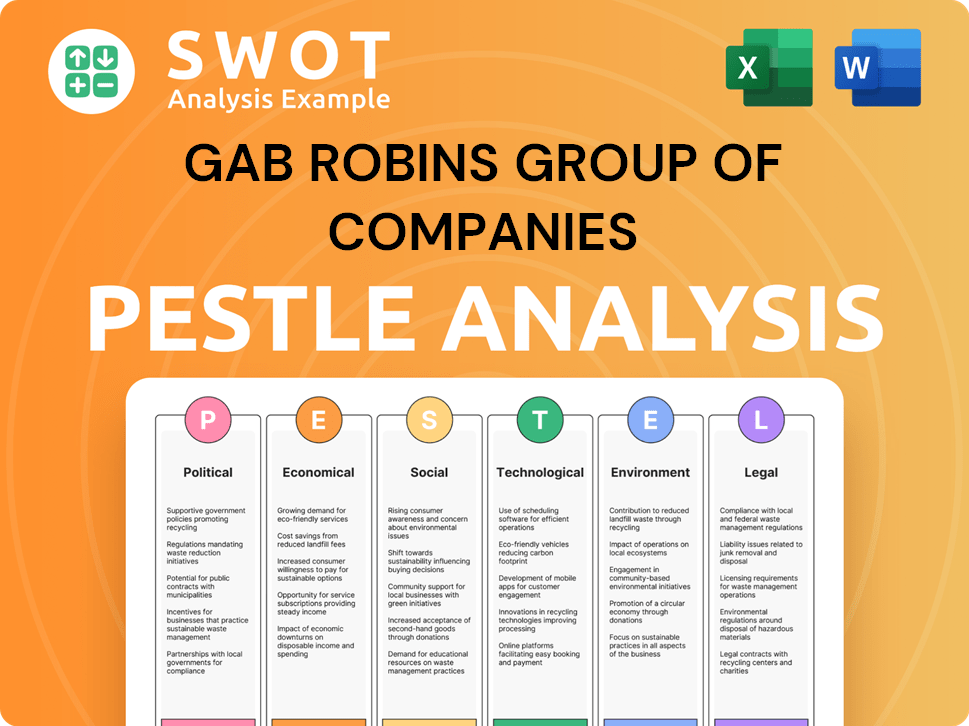

GAB Robins Group of Companies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives GAB Robins Group of Companies a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of the GAB Robins Group is crucial for assessing its position within the insurance claims and risk management sector. The Brief History of GAB Robins Group of Companies provides context for analyzing its strengths. This analysis focuses on the core competencies that have enabled GAB Robins to compete effectively, considering its service offerings, market presence, and strategic initiatives.

GAB Robins Group's ability to provide comprehensive services is a key differentiator. The company's expertise in insurance claims, risk management, and loss adjusting allows it to serve a diverse client base. This broad service portfolio, coupled with a focus on technological advancements, positions GAB Robins favorably in the competitive landscape.

The competitive landscape of GAB Robins Company is shaped by its global reach and specialized services. The company's strategic moves, including acquisitions and technological integrations, have enhanced its competitive edge. These advantages are critical for understanding its market share and overall industry position.

GAB Robins Group's extensive global presence is a significant advantage. Serving clients across multiple countries allows the company to handle complex, multinational claims. This broad geographical reach provides a competitive edge in attracting and retaining large clients with international operations, differentiating it from competitors with more limited footprints.

The company's wide range of services, including insurance claims, risk management, and loss adjusting, is another key advantage. This comprehensive approach allows GAB Robins to offer end-to-end solutions, attracting clients seeking integrated services. This diversified service portfolio enhances its ability to meet various client needs.

GAB Robins' investment in technology and data analytics is a significant competitive advantage. Utilizing advanced technologies for claims processing, fraud detection, and risk assessment improves efficiency and outcomes. This focus on digital transformation helps the company stay ahead of competitors that may lag in technological infrastructure.

The company's strong brand equity, built over years of reliable service, fosters significant customer loyalty. This loyalty translates into repeat business and positive word-of-mouth referrals. A solid reputation is crucial in the insurance claims industry, where trust and reliability are paramount.

GAB Robins Group's competitive advantages are rooted in its global reach, comprehensive service offerings, and technological innovation. These strengths enable the company to attract and retain a diverse client base while maintaining a strong market position. The company's strategic focus on these areas has been critical for its success.

- Extensive global presence across more than 80 countries.

- Comprehensive service offerings covering insurance claims, risk management, and loss adjusting.

- Investment in advanced technologies and data analytics.

- Strong brand equity and customer loyalty.

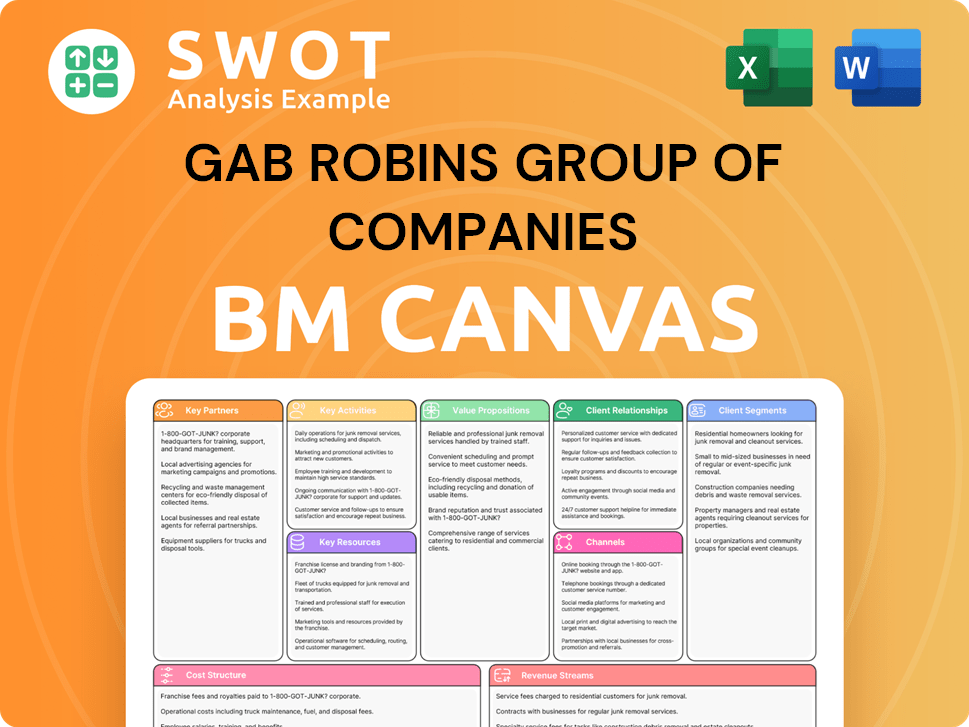

GAB Robins Group of Companies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping GAB Robins Group of Companies’s Competitive Landscape?

The competitive landscape for the GAB Robins Group of Companies is dynamic, shaped by industry trends, future challenges, and emerging opportunities. Understanding these factors is crucial for assessing the company's position in the insurance claims and risk management sectors. The industry is undergoing significant changes, driven by technological advancements and evolving customer expectations, which impact the strategies and performance of all players, including GAB Robins.

Analyzing the GAB Robins Company's competitive position requires examining its strengths and weaknesses in light of these trends. The company must navigate challenges such as technological adoption and regulatory changes while capitalizing on opportunities for growth and innovation. This analysis provides insights into how the GAB Robins Group can maintain its competitive edge and adapt to the changing market dynamics. For a deeper dive, consider reviewing the Marketing Strategy of GAB Robins Group of Companies.

The insurance claims industry is experiencing increased adoption of artificial intelligence (AI) and machine learning. Regulatory scrutiny is also growing, with a focus on data privacy and consumer protection. Customer expectations are evolving, demanding faster and more transparent claims processing, impacting the GAB Robins Group and its competitors.

Key challenges include integrating acquired businesses and maintaining a competitive edge against agile insurtech startups. Navigating global economic uncertainties that could affect claims volumes and client budgets also poses a risk. The need to invest in new technologies and manage cybersecurity risks is also significant for the GAB Robins Group.

There are significant growth opportunities in emerging markets and specialized claims segments, such as cyber and climate-related claims. Expanding integrated solutions that combine claims management with risk consulting and data analytics is another avenue. Strategic partnerships and digital transformation initiatives can further solidify the GAB Robins Group's position.

The focus on technology and global presence positions the GAB Robins Group to capitalize on opportunities. Continued investment in digital transformation and strategic partnerships is essential. The company is likely to adapt to evolving market dynamics and maintain its competitive position in the risk and claims management sector.

The claims management industry is influenced by technological advancements, regulatory changes, and evolving customer expectations. The GAB Robins Group must adapt to these dynamics to stay competitive. The company's strategic focus on technology and its global presence are key to its future success.

- AI Adoption: The use of AI in claims processing is projected to grow by 25% by 2025, offering opportunities for efficiency.

- Regulatory Compliance: Regulatory changes, particularly concerning data privacy, require continuous adaptation.

- Market Expansion: Opportunities exist in emerging markets and specialized claims, such as cyber claims, which are expected to increase by 18% annually.

- Strategic Partnerships: Collaborations can enhance service offerings and market reach.

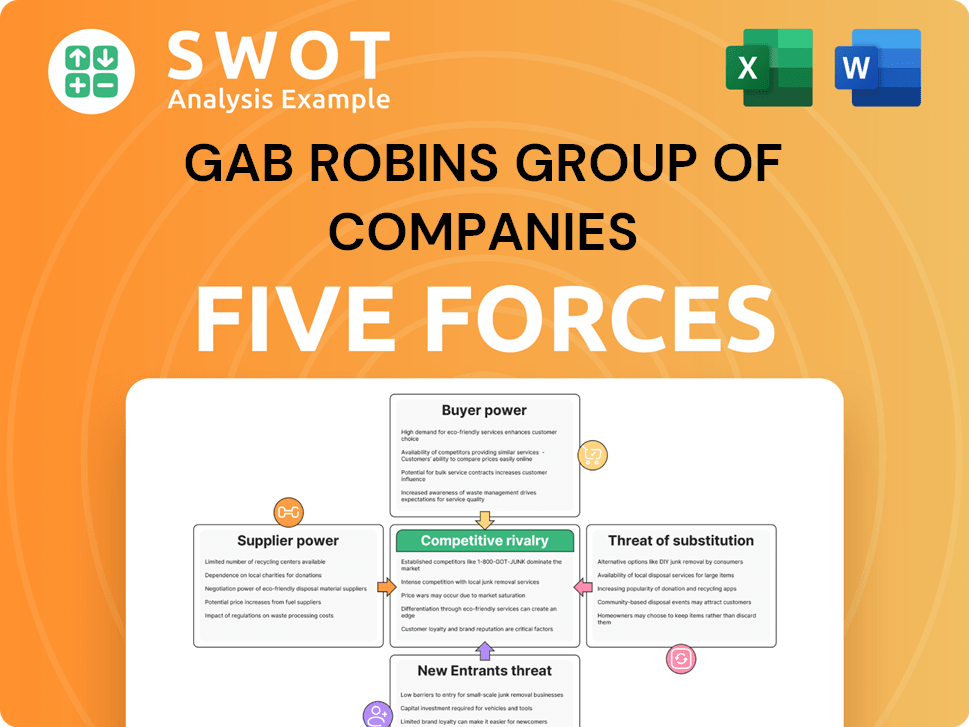

GAB Robins Group of Companies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GAB Robins Group of Companies Company?

- What is Growth Strategy and Future Prospects of GAB Robins Group of Companies Company?

- How Does GAB Robins Group of Companies Company Work?

- What is Sales and Marketing Strategy of GAB Robins Group of Companies Company?

- What is Brief History of GAB Robins Group of Companies Company?

- Who Owns GAB Robins Group of Companies Company?

- What is Customer Demographics and Target Market of GAB Robins Group of Companies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.