GAB Robins Group of Companies Bundle

Who Really Owns GAB Robins?

Understanding a company's ownership is crucial for grasping its trajectory and potential. The evolution of GAB Robins Group of Companies SWOT Analysis, a pivotal player in loss adjusting and claims management, reveals a fascinating story of strategic shifts and market positioning. From its origins in 1872 as General Adjustment Bureau to its current form, the ownership of GAB Robins has undergone significant transformations.

The journey of GAB Robins ownership, now integrated within Sedgwick, highlights the dynamic nature of the insurance industry. Knowing who owns GAB Robins gives insights into its operational priorities and strategic direction. This article will explore the GAB Robins owner, tracing the company's ownership history and the key stakeholders that influence its present-day operations. We'll examine the significant changes in GAB Robins's ownership structure and the implications for its future.

Who Founded GAB Robins Group of Companies?

The GAB Robins Group of Companies, initially known as General Adjustment Bureau, was established in 1872. The company's initial focus was on loss adjusting and claims management services.

While the exact details of the founders, their backgrounds, and the initial equity distribution are not widely available, the company's early operations centered on providing insurance claims services. This established a solid foundation for its future in the insurance sector.

Over time, GAB Robins underwent several ownership changes, transitioning from its original founding ownership to structures involving private equity and corporate holdings. This evolution reflects the dynamic nature of the insurance claims industry and the company's adaptation to market changes.

GAB Robins began by offering loss adjusting and claims management services.

The company has experienced multiple ownership transitions over the years.

In 2000, Brera Capital Partners LP acquired a significant stake in GAB Robins.

In 2009, GAB Robins sold its international subsidiaries and forensic engineering unit, EFI Global, Inc., to Cunningham Lindsey.

The UK business was potentially subject to a management buyout.

SGS Societe Generale de Surveillance Holding S.A. retained a 9.5% common stock interest after the Brera Capital Partners LP acquisition.

The Brief History of GAB Robins Group of Companies shows that the company has a complex ownership history. In 2000, Brera Capital Partners LP acquired a majority stake, illustrating a shift in the GAB Robins ownership structure. This shift from its founding ownership to private equity ownership highlights the company's evolution within the insurance claims sector. The company's history shows various changes in its ownership, including acquisitions and sales of its subsidiaries. The company's ability to adapt and evolve through various ownership phases has been a key factor in its longevity and continued presence in the insurance industry.

GAB Robins Group of Companies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has GAB Robins Group of Companies’s Ownership Changed Over Time?

The evolution of GAB Robins' ownership reflects a series of strategic acquisitions and integrations. The U.S. loss adjusting business, GAB Robins North America, was acquired by Sedgwick Leif Hansen on January 4, 2011. Later, Crawford & Company acquired GAB Robins Holdings UK Limited and a majority stake in GAB Robins Aviation Limited on December 1, 2014, for £45.8 million (approximately US$73.3 million), expanding their claims handling capabilities. Before these acquisitions, Cunningham Lindsey acquired GAB Robins' international businesses (excluding UK operations) and EFI Global in 2009. Cunningham Lindsey was later acquired by Sedgwick in April 2018.

Currently, the ownership structure of the GAB Robins Group of Companies is primarily influenced by Sedgwick's ownership. The Carlyle Group holds a majority stake in Sedgwick. Other significant investors include Stone Point Capital LLC, Altas Partners, Caisse de dépôt et placement du Québec (CDPQ), and Onex. In September 2024, Altas Partners invested $1 billion of equity in Sedgwick. This investment, finalized in the fourth quarter of 2024, valued Sedgwick at approximately $13.2 billion, a substantial increase from its $6.7 billion valuation when Carlyle initially invested in 2018. This structure allows Sedgwick to operate as an independent, private company.

| Event | Date | Details |

|---|---|---|

| Sedgwick Acquisition of GAB Robins North America | January 4, 2011 | Sedgwick acquired the U.S. loss adjusting business. |

| Crawford & Company Acquisition | December 1, 2014 | Crawford acquired GAB Robins Holdings UK Limited and a majority stake in GAB Robins Aviation Limited for £45.8 million. |

| Cunningham Lindsey Acquisition | 2009 | Cunningham Lindsey acquired GAB Robins' international businesses (excluding UK operations) and EFI Global. |

| Sedgwick Acquisition of Cunningham Lindsey | April 2018 | Sedgwick acquired Cunningham Lindsey. |

| Altas Partners Investment in Sedgwick | September 2024 | Altas Partners invested $1 billion, valuing Sedgwick at approximately $13.2 billion. |

The changes in ownership of the GAB Robins Group of Companies highlight the dynamic nature of the insurance and claims management industries. To understand the strategic shifts and growth of the company, you can explore the Growth Strategy of GAB Robins Group of Companies. These acquisitions and investments have shaped the company's current structure and market position.

The ownership of GAB Robins has evolved significantly through acquisitions and strategic investments.

- Sedgwick is the current parent company, with The Carlyle Group as the majority shareholder.

- Crawford & Company acquired parts of GAB Robins in the UK.

- Altas Partners' recent investment valued Sedgwick at approximately $13.2 billion.

- These changes reflect the consolidation and growth strategies within the insurance claims sector.

GAB Robins Group of Companies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on GAB Robins Group of Companies’s Board?

Determining the exact current board of directors for the GAB Robins Group of Companies requires an understanding of its parent company, Sedgwick. While specific equity representation for each board member isn't fully detailed in public records, the ownership structure of Sedgwick provides insights into the board's composition and influence. As of late 2024 and early 2025, The Carlyle Group's majority ownership suggests significant influence over board appointments and strategic decisions for Sedgwick, the parent company of GAB Robins. This impacts the overall governance and direction of the GAB Robins company.

Minority shareholders, including Stone Point Capital LLC, Altas Partners, CDPQ, and Onex, also hold substantial investments. The presence of these investors likely translates into board representation or observer rights. For instance, Altas Partners' $1 billion equity investment in 2024 indicates their active role in the company's value creation. Dave North, who retired as Executive Chairman on June 30, 2024, remains on the board, ensuring institutional knowledge continuity. This ownership structure directly influences who owns GAB Robins and the decisions made within the company.

| Shareholder | Ownership Type | Influence |

|---|---|---|

| The Carlyle Group | Majority | Significant board influence and strategic direction |

| Stone Point Capital LLC, Altas Partners, CDPQ, Onex | Minority | Board representation or observer rights |

| Dave North | Board Member | Institutional knowledge and continuity |

The voting structure of Sedgwick, and therefore the GAB Robins Group of Companies, likely aligns with the equity stakes, with Carlyle holding the most substantial voting power. Recent executive appointments, such as Veronica Grigg as CEO in Asia and Andrea Buhl as President of the casualty group in late 2024, suggest internal representation and influence on governance. For more insights into the financial aspects of the company, consider reading about the Revenue Streams & Business Model of GAB Robins Group of Companies.

Ownership of GAB Robins is largely determined by the ownership of its parent company, Sedgwick.

- The Carlyle Group is the majority shareholder.

- Minority shareholders include Stone Point Capital LLC, Altas Partners, CDPQ, and Onex.

- Dave North's continued presence on the board ensures institutional knowledge.

- Voting power is aligned with equity stakes.

GAB Robins Group of Companies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped GAB Robins Group of Companies’s Ownership Landscape?

Over the past few years, the ownership of the GAB Robins Group of Companies, now known as Sedgwick, has seen significant developments. A key event was the strategic investment from Altas Partners in September 2024, with Altas committing $1 billion in equity. This transaction, which closed in Q4 2024, increased Sedgwick's total enterprise value to approximately $13.2 billion, a substantial increase from $6.7 billion in 2018. This highlights a trend of continued strong private equity backing and additional strategic investments to fuel growth.

The Carlyle Group remains the majority shareholder, with Stone Point Capital LLC, Altas Partners, CDPQ, and Onex as significant minority investors. This ownership structure reflects a trend of increased institutional involvement in the claims management sector. The company has been active in mergers and acquisitions, completing 22 acquisitions as of April 2025, with the most recent being Bottomline Technologies in February 2025. These moves demonstrate a consistent strategy to expand capabilities and market reach. This demonstrates a consistent strategy of expanding capabilities and market reach through M&A.

| Key Ownership Developments | Details | Date |

|---|---|---|

| Strategic Investment from Altas Partners | $1 billion equity commitment | September 2024 |

| Enterprise Value Increase | From $6.7 billion to $13.2 billion | 2018 - Q4 2024 |

| Acquisitions Completed | 22 acquisitions | As of April 2025 |

The global claims management market was valued at $18.9 billion in 2023 and is projected to reach $25.3 billion by 2028, indicating a growing market ripe for further investment and consolidation. Dave North retired as Executive Chairman on June 30, 2024, while remaining on the board. Other executive appointments in 2024 and early 2025 include Veronica Grigg as CEO in Asia, Andrea Buhl as President of the casualty group, and Stewart Kirkpatrick as executive general adjuster in Canada. For more details on the competitive landscape of the company, you can explore the Competitors Landscape of GAB Robins Group of Companies.

The Carlyle Group holds the majority stake, with significant minority investments from Stone Point Capital LLC, Altas Partners, CDPQ, and Onex.

Sedgwick has completed 22 acquisitions, with Bottomline Technologies being the most recent in February 2025.

The claims management market is projected to grow to $25.3 billion by 2028, from $18.9 billion in 2023.

Dave North retired as Executive Chairman on June 30, 2024; Veronica Grigg became CEO in Asia.

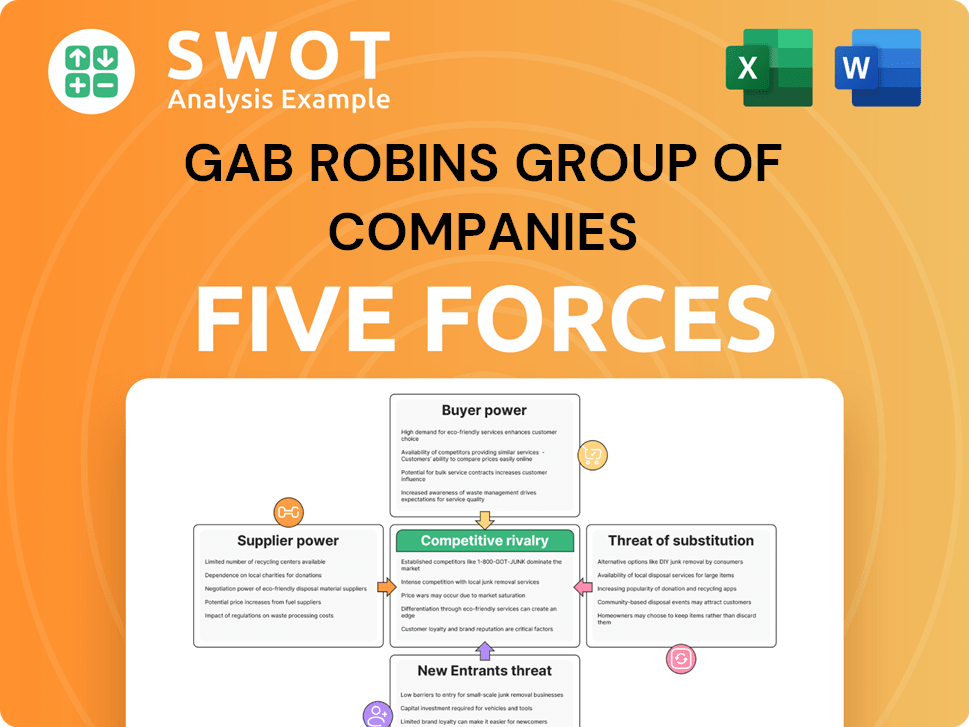

GAB Robins Group of Companies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GAB Robins Group of Companies Company?

- What is Competitive Landscape of GAB Robins Group of Companies Company?

- What is Growth Strategy and Future Prospects of GAB Robins Group of Companies Company?

- How Does GAB Robins Group of Companies Company Work?

- What is Sales and Marketing Strategy of GAB Robins Group of Companies Company?

- What is Brief History of GAB Robins Group of Companies Company?

- What is Customer Demographics and Target Market of GAB Robins Group of Companies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.