Segro Bundle

How did a UK trading company become a global industrial real estate giant?

Journey back in time to uncover the Segro SWOT Analysis, a story of strategic foresight and relentless adaptation. From its humble beginnings in 1920 as Slough Trading Company Ltd, SEGRO has transformed the industrial real estate landscape. Discover how this pioneering spirit laid the foundation for a modern logistics empire, shaping the way we move goods today.

This brief history of Segro reveals a fascinating evolution. Initially focused on redeveloping a former army base, the Segro company quickly recognized the potential of industrial parks. Today, Segro's extensive portfolio of industrial properties spans key markets, highlighting its remarkable growth and influence in the Segro real estate sector. Understanding the Segro history is crucial for anyone interested in the dynamics of industrial real estate and the rise of logistics.

What is the Segro Founding Story?

The story of the Segro company, a prominent player in the industrial real estate sector, begins in May 1920 with the incorporation of the Slough Trading Company Ltd. This marked the genesis of what would become a leading force in the development and management of industrial properties. The founders had a clear vision to transform a former military site into a modern industrial estate.

This initiative was particularly forward-thinking for its time, as the concept of integrated industrial parks was relatively novel. The company's early strategy focused on acquiring land, developing industrial units, and leasing these spaces to a variety of manufacturing and distribution businesses. This approach laid the groundwork for a comprehensive environment that supported business growth.

The establishment of the Slough Trading Estate, which eventually became the largest industrial estate in Europe, is a key milestone in the Segro history. The economic climate following World War I, with its need for industrial revival and efficient production, played a crucial role in the company's early success. This environment provided fertile ground for its innovative business model to thrive.

The Slough Trading Company Ltd. was founded in May 1920.

- The primary goal was to redevelop the Slough Depot, a former World War I site.

- The founders aimed to create a modern industrial estate.

- The business model involved developing and leasing industrial units.

- The company offered shared infrastructure and services.

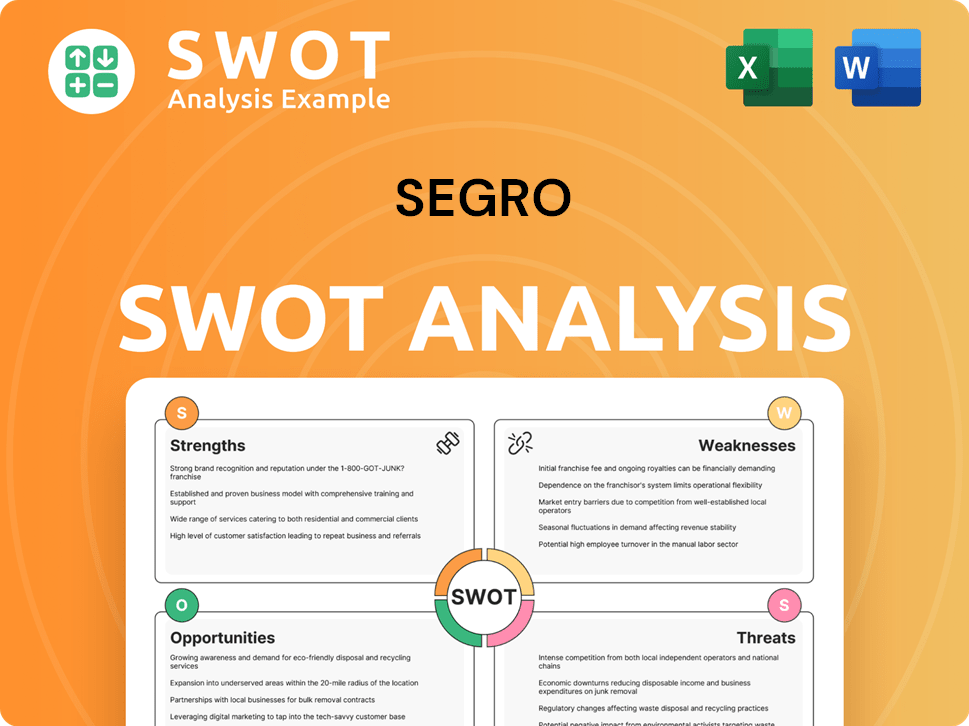

Segro SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Segro?

Following its establishment, the company, then known as Slough Trading Company Ltd., experienced significant early growth and expansion. The success of the Slough Trading Estate became a model for future developments. The company strategically expanded its portfolio by acquiring and developing additional industrial sites across the UK. This early phase focused on providing high-quality, well-managed industrial spaces, which met the changing needs of businesses.

As the UK economy industrialized, the demand for modern factory and warehouse space increased. The company was well-positioned to meet this demand, capitalizing on the growing need for industrial properties. This period saw a strategic focus on expanding its footprint to accommodate the evolving requirements of various businesses. The company's early success set the stage for its future endeavors in the industrial real estate market.

The company explored opportunities in related services to enhance the value proposition of its estates. Key acquisitions and mergers in the mid-20th century further solidified its position in the UK industrial property market. These strategic moves helped to broaden its service offerings and strengthen its market presence. This expansion laid a solid foundation for future growth and diversification.

Leadership transitions during this period often maintained the strategic vision, emphasizing long-term property ownership and development. The market reception to its integrated industrial estates was positive, as they offered efficiency and convenience to tenants. The company's focus on providing comprehensive solutions resonated well with businesses. The Growth Strategy of Segro was instrumental in shaping its early success.

The competitive landscape, while present, was less mature than today, allowing the company to establish a strong foothold. This early growth phase laid the critical foundation for its future expansion into continental Europe. This initial success was a crucial step in its transformation into a leading REIT. The company's early strategic decisions set the stage for its long-term growth and success.

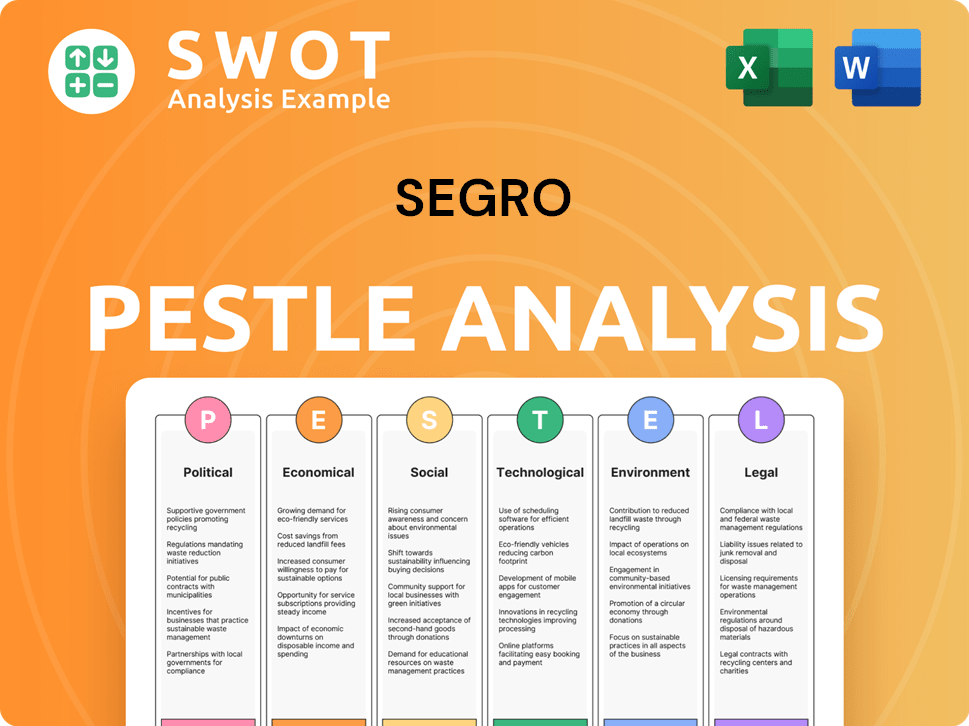

Segro PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Segro history?

The Segro company has a rich history marked by significant milestones that have shaped its trajectory in the industrial real estate sector. From its early beginnings to its present-day status as a leading player, the company's evolution reflects strategic decisions and adaptations to market dynamics.

| Year | Milestone |

|---|---|

| 1920 | Founded as Slough Estates Ltd, marking the beginning of the company's journey in industrial property. |

| 1999 | Rebranded to SEGRO plc, reflecting its expansion across Europe and a shift towards a modern corporate identity. |

| 2007 | Entered the FTSE 100 index, highlighting its significant market presence and financial performance. |

| 2023 | Capital expenditure on development projects totaled £633 million, demonstrating a strong commitment to growth and modernization. |

Innovation has been a cornerstone of the Segro company's success, driving its ability to adapt and lead in the industrial real estate market. The company has consistently embraced new technologies and sustainable practices to enhance its properties and meet evolving customer needs.

SEGRO has pioneered the use of sustainable building materials and designs, reducing the environmental impact of its properties. This includes incorporating features like solar panels, rainwater harvesting, and energy-efficient systems.

The company has integrated smart technologies into its warehouses, such as advanced building management systems and automated logistics solutions. These innovations improve operational efficiency and enhance the tenant experience.

SEGRO has focused on developing urban logistics centers and last-mile delivery hubs to support the growth of e-commerce. These strategically located properties facilitate efficient distribution within urban areas.

SEGRO actively incorporates renewable energy sources into its properties, such as solar panels, to reduce carbon emissions and operating costs. This initiative supports the company's sustainability goals and enhances property value.

The implementation of advanced building management systems allows for real-time monitoring and control of energy usage, climate control, and security. This leads to improved efficiency and tenant satisfaction.

SEGRO invests in smart infrastructure, including high-speed internet connectivity and advanced communication systems, to meet the evolving needs of its tenants. This enhances the overall functionality and appeal of its properties.

The Segro company has faced various challenges throughout its history, requiring strategic adaptation and resilience. Economic downturns and competitive pressures have tested its ability to maintain growth and profitability.

Economic recessions, such as the 2008 financial crisis and recent uncertainties, have impacted property valuations and rental income. The company has responded by focusing on prime locations and managing its portfolio strategically.

Competition from other developers and investment firms has necessitated continuous strategic adaptation. SEGRO has maintained its market leadership by focusing on high-quality, sustainable developments and strategic acquisitions.

Fluctuations in the real estate market, including changes in interest rates and investor sentiment, can affect property values and investment returns. SEGRO mitigates these risks through diversification and prudent financial management.

Evolving demands from tenants, such as the need for more flexible spaces and advanced technological infrastructure, require constant innovation. SEGRO addresses these needs by investing in modern, adaptable properties.

Changes in regulations, such as those related to environmental standards and building codes, can impact development costs and property values. SEGRO proactively adapts to these changes by incorporating sustainable practices.

Geopolitical events and uncertainties can influence investment decisions and market stability. SEGRO manages these risks through a diversified portfolio and strategic geographic focus.

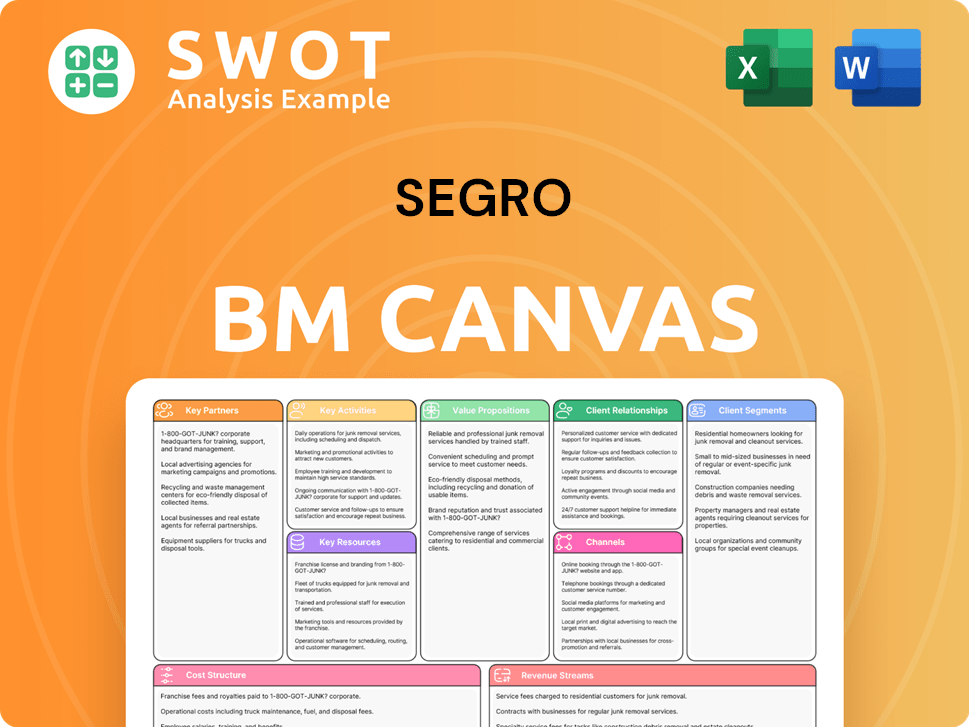

Segro Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Segro?

The Segro company has a rich history, marked by significant milestones in the industrial real estate sector. From its origins to its current status as a major player, the company's journey reflects the evolution of logistics and property development.

| Year | Key Event |

|---|---|

| 1920 | Founded as Slough Estates Ltd, initially developing industrial properties in Slough, UK. |

| 1947 | Expanded significantly after World War II, capitalizing on the need for industrial space. |

| 1990s | Underwent significant restructuring and expansion, increasing its property portfolio. |

| 2006 | Renamed as Segro, reflecting its broader European presence and focus. |

| 2010s | Focused on strategic acquisitions and development, particularly in logistics and urban warehouses. |

| 2023 | Reported strong financial results, with a focus on sustainability and expanding its portfolio. |

Segro continues to strategically expand its portfolio, focusing on key logistics hubs and urban locations. The company is actively pursuing development opportunities to meet the growing demand for modern industrial spaces. This expansion is supported by strong financial performance and a commitment to sustainable development practices.

Sustainability is a key focus for Segro, with initiatives aimed at reducing carbon emissions and promoting energy-efficient properties. The company is investing in renewable energy sources and incorporating green building practices in its new developments. These efforts are aligned with the growing importance of environmental, social, and governance (ESG) factors in real estate.

The industrial real estate market is expected to remain robust, driven by e-commerce and supply chain optimization. Segro is well-positioned to capitalize on these trends, with a portfolio concentrated in prime locations. The company's focus on modern logistics facilities and urban warehouses aligns with the evolving needs of businesses.

Segro's financial performance is expected to remain strong, supported by high occupancy rates and rental growth. The company's strategic acquisitions and development pipeline are poised to drive further revenue and profit growth. Analysts project continued positive performance, reflecting the company's strong market position and effective management.

Segro Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Segro Company?

- What is Growth Strategy and Future Prospects of Segro Company?

- How Does Segro Company Work?

- What is Sales and Marketing Strategy of Segro Company?

- What is Brief History of Segro Company?

- Who Owns Segro Company?

- What is Customer Demographics and Target Market of Segro Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.