Segro Bundle

How Does SEGRO Navigate the Cutthroat Industrial Real Estate Arena?

The industrial real estate sector is undergoing a seismic shift, fueled by e-commerce and supply chain resilience. Segro SWOT Analysis reveals how this leading REIT, specializing in modern warehousing, is positioned in this dynamic environment. From its 1920 origins, SEGRO has evolved into a major player in the UK and Continental Europe.

Understanding the Segro competitive landscape is crucial for investors and strategists alike, given its significant presence in the industrial real estate market. This analysis will explore Segro competitors, dissecting their market positions and strategies. We will also delve into Segro market analysis to uncover its competitive advantages and how it responds to the challenges and opportunities within the logistics sector.

Where Does Segro’ Stand in the Current Market?

The company, a leading player in the industrial real estate sector, focuses on owning, managing, and developing modern warehousing, light industrial, and data center properties. Its strategic focus is on prime locations within key urban and logistics markets, primarily in the UK and Continental Europe. This positioning allows the company to cater to a diverse customer base across the transport and logistics, retail, and manufacturing industries.

As of December 31, 2024, the portfolio was valued at £20.3 billion, encompassing 10.3 million square meters. Approximately two-thirds of its assets are situated in major European cities, with the remainder in logistics hubs. This strategic asset allocation underscores the company's commitment to serving the evolving needs of its customers and capitalizing on growth opportunities within the logistics sector.

In the first half of 2024, the company demonstrated robust financial performance. This included signing £48 million of new rent, which contributed to a 7% increase in net rental income, reaching £306 million. The company's adjusted pre-tax profit for the first half of 2024 was £227 million, a 14.6% increase compared to the prior year. Adjusted EPS also saw a 6.9% increase to 17.0 pence from 15.9 pence in H1 2023. The company's loan-to-value (LTV) stood at 28% as of December 31, 2024, with net debt:EBITDA at 8.6 times, reflecting a strong balance sheet. The company aims to increase passing rents by over 50% over the next three years.

The company holds a strong market position as a leading owner, asset manager, and developer of modern warehousing and industrial properties across Europe. Its focus on prime locations and high-quality assets sets it apart. This strategic approach allows it to cater to the evolving needs of various industries.

The company's financial performance in the first half of 2024 was strong, with a 7% increase in net rental income to £306 million. Adjusted pre-tax profit increased by 14.6% to £227 million. These figures highlight the company's ability to generate strong returns and maintain a healthy financial position.

The company strategically concentrates its assets in key urban and logistics markets, primarily in the UK and Continental Europe. This geographic focus allows the company to capitalize on the growth potential in these regions. This strategy is a key element in its competitive advantage.

As of December 31, 2024, the company's portfolio was valued at £20.3 billion, with 10.3 million square meters of space. Approximately two-thirds of the portfolio is located in major European cities, demonstrating a focus on high-value assets. The composition of the portfolio supports its market position.

The company's competitive advantages include its strategic location of assets, strong financial performance, and focus on high-quality properties. These factors contribute to a strong position in the industrial real estate market. For more details, you can explore the Target Market of Segro.

- The company's focus on prime locations in key urban and logistics markets.

- Strong financial performance, including growth in net rental income and adjusted pre-tax profit.

- A well-diversified portfolio with significant holdings in major European cities and logistics hubs.

- A strong balance sheet, reflected in a loan-to-value ratio of 28% as of December 31, 2024.

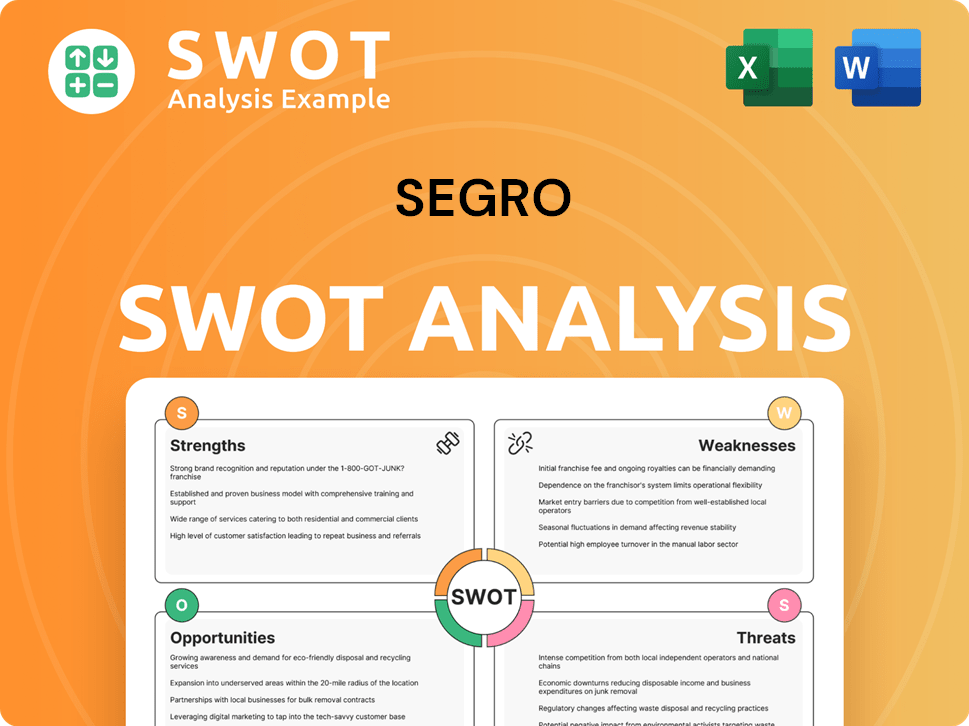

Segro SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Segro?

The industrial real estate market, where the company operates, is highly competitive. Understanding the Segro competitive landscape is crucial for evaluating its performance and strategic positioning. This analysis will explore the key players and dynamics shaping the market.

The Segro market analysis reveals a landscape characterized by both direct and indirect competitors. These competitors challenge the company through various means, including portfolio size, geographic reach, and specialized offerings. The competitive environment is dynamic, with ongoing developments and acquisitions influencing market share.

The company faces competition from a range of players in the industrial property sector across Europe. These competitors vie for market share and investment opportunities, making it essential to understand their strategies and strengths.

Key direct competitors include Prologis, GLP, and Blackstone. These companies have significant portfolios and global reach, allowing them to leverage economies of scale. Their size and resources pose a direct challenge in securing and managing industrial properties.

Other significant competitors include Stenprop, Hansteen, Tritax Big Box REIT (BBOX), Big Yellow Group (BYG), Safestore (SAFE), UK Commercial Property REIT (UKCM), Urban Logistics REIT (SHED), and Land Securities Group (LAND). These competitors have varying strategies and focus areas within the industrial and logistics sectors.

WDP, a Belgium-based REIT, is a direct competitor specializing in logistics and industrial properties. WDP's focus on long-term leases with creditworthy tenants ensures consistent cash flow, posing a challenge in securing high-quality occupiers. WDP has a portfolio of over 6 million square meters of warehouse space.

The Segro competitive landscape is dynamic, with ongoing development and acquisition activities by all major players. Emerging players and new entrants, particularly those focusing on niche areas or leveraging new technologies, could also disrupt the traditional landscape. Mergers and alliances further intensify the competitive dynamics.

For example, the company's European Logistics Partnership (SELP), a joint venture, recently exchanged contracts on the acquisition of €470 million of high-quality assets in Germany and The Netherlands. This illustrates the ongoing activity in the market.

Competitors challenge the company through various means, including portfolio size, geographic reach, and specialized offerings. The company's ability to secure high-quality occupiers is a key factor in this competitive environment.

The industrial real estate market is highly competitive, with several key players vying for market share. The company faces challenges from both direct and indirect competitors, each with its own strengths and strategies. Understanding the competitive landscape is crucial for assessing the company's performance and future prospects. For more information on the company's financial performance, consider reading the article Owners & Shareholders of Segro.

- Segro competitors include global giants like Prologis and GLP, regional players like WDP, and other REITs.

- The market is characterized by ongoing development, acquisitions, and joint ventures.

- The competitive dynamics are influenced by factors such as portfolio size, geographic reach, and specialized offerings.

- The company's ability to secure high-quality occupiers is a key factor in this competitive environment.

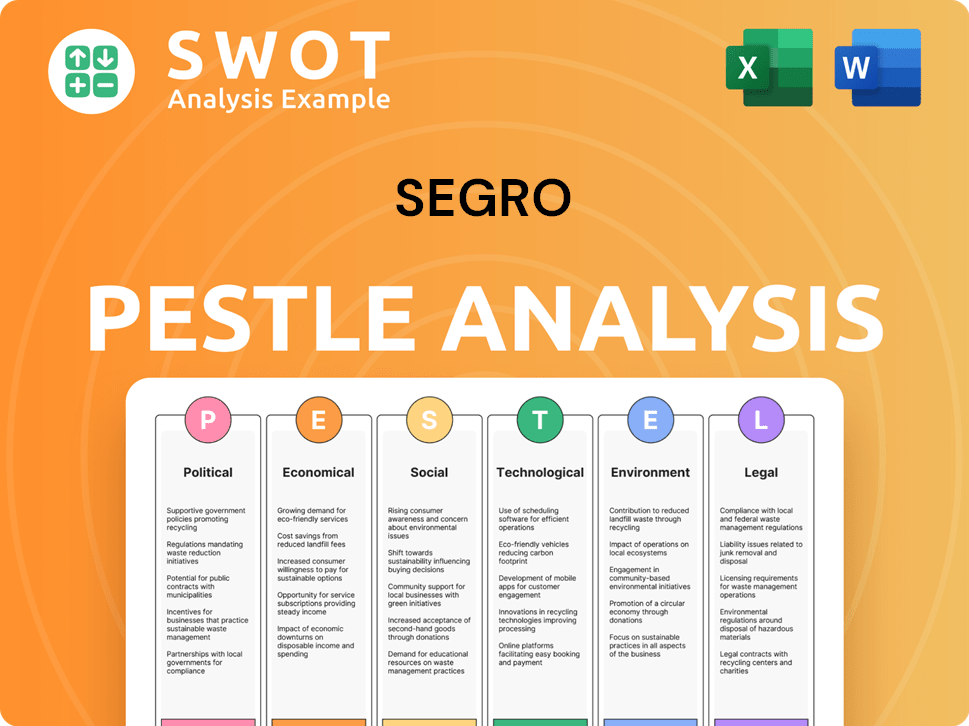

Segro PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Segro a Competitive Edge Over Its Rivals?

Understanding the Marketing Strategy of Segro is crucial for grasping its competitive advantages within the industrial real estate sector. The company, a prominent player in the industrial real estate market, has cultivated a robust competitive edge. This advantage stems from a strategic focus on prime locations, high-quality properties, and a commitment to sustainability. Analyzing these factors provides a clear view of its strengths in the competitive landscape.

One of the key strengths of the company is its strategically located portfolio, particularly in key logistics hubs and prime industrial areas across the UK and Continental Europe. This geographic focus, coupled with a commitment to modern, efficient properties, positions it well to meet the evolving needs of tenants. The company's focus on sustainable development further enhances its appeal to investors and tenants alike, aligning with broader ESG (Environmental, Social, and Governance) trends.

The company's development pipeline and financial performance also contribute to its competitive standing. The company's ability to develop new properties and its strong financial position provide a solid foundation for continued growth. These advantages have evolved over time, with the company continually adapting its offerings and development strategies to maintain its leadership in the evolving industrial real estate market. This adaptability is crucial in a dynamic market.

The company strategically positions its properties in key logistics hubs and prime industrial areas, primarily in the UK and Continental Europe. Approximately two-thirds of its portfolio is located in major European cities. This strategic placement gives the company a significant advantage in supply-constrained markets.

The company's portfolio consists of modern, high-quality properties designed to meet the evolving needs of tenants. These properties offer state-of-the-art facilities and amenities. This 'flight to quality' by occupiers, who are increasingly seeking modern, efficient spaces, plays directly into the company's strengths.

The company has a significant development pipeline with the potential to deliver over £440 million of additional rent. It anticipates developing over a third of this pipeline in the next three years. The company's development capability provides a significant competitive advantage.

The company's strong financial position and track record of consistent growth contribute to its competitive standing. The ability to consistently deliver results and maintain a strong financial foundation is a key advantage. These advantages have evolved over time, with the company continually adapting its offerings.

The company's competitive advantages are rooted in strategic portfolio locations, high-quality properties, and a strong development pipeline. The focus on prime locations, modern facilities, and sustainable development sets it apart. The company's financial strength and consistent growth further enhance its competitive position.

- Strategic Location: Properties in key logistics hubs and prime industrial areas, particularly in major European cities.

- High-Quality Properties: Modern facilities designed to meet the evolving needs of tenants, attracting occupiers seeking efficient spaces.

- Development Pipeline: A significant development pipeline with the potential to deliver substantial additional rent.

- Financial Strength: A strong financial position and consistent growth, supporting its competitive standing.

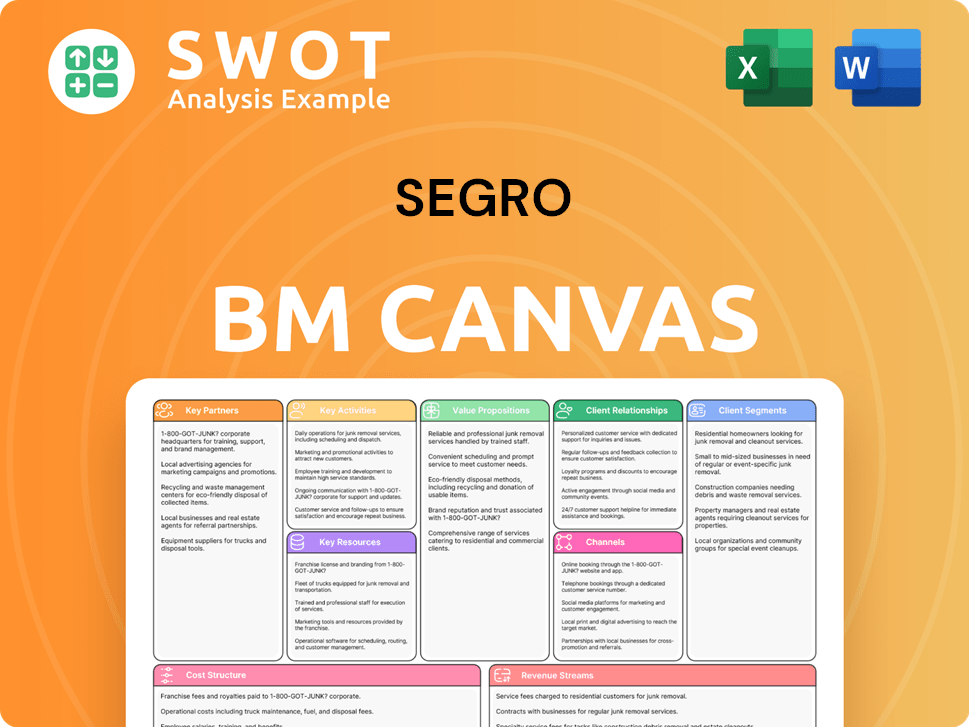

Segro Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Segro’s Competitive Landscape?

The industrial real estate sector is experiencing significant shifts, with the rise of e-commerce and technological advancements reshaping the competitive landscape. This creates both opportunities and challenges for companies like SEGRO. Understanding the current market dynamics and anticipating future trends is crucial for maintaining a strong market position.

The sector faces challenges such as slowing net absorption and rising vacancy rates in older buildings, alongside economic uncertainties and increased competition. However, strategic investments, partnerships, and a focus on sustainability can help navigate these risks and capitalize on emerging opportunities. The competitive advantages of SEGRO will be important in the coming years.

The growth of e-commerce continues to drive demand for warehouse properties and logistics space. The 'flight to quality' among occupiers, seeking modern facilities, is another key trend. Technology's impact on supply chain management is also significant, influencing warehouse design and operations.

A slowdown in net absorption and rising vacancy rates in older buildings are emerging challenges. Economic uncertainty, changing regulations, and global trade disruptions pose risks. Increased competition in the real estate sector requires continuous differentiation. Higher financing costs add to the pressure.

The continued growth of e-commerce and demand for logistics services offers significant opportunities. Expansion into new markets, such as data centers, and strategic partnerships are key. A focus on sustainable development and active asset management can enhance property value.

E-commerce's share of total retail sales, excluding autos and gasoline, reached a record-high 23.2% in Q3 2024 and is expected to reach 25.0% by year-end 2025. Annual market rent growth slowed to 2.8% in 2024 from 6.9% in 2023. SEGRO plans to invest approximately £600 million on development and infrastructure in 2024 and 2025.

SEGRO's ability to navigate the evolving industrial real estate market depends on adapting to industry trends and addressing challenges. The company is well-positioned to capitalize on opportunities, particularly through its investment in logistics infrastructure and expansion into new sectors like data centers. For more insights, explore the Growth Strategy of Segro.

- Focus on high-quality, modern facilities to attract occupiers.

- Strategic partnerships and joint ventures to expand market reach.

- Investment in sustainable development to meet environmental standards.

- Active asset management to maximize property value and rental income.

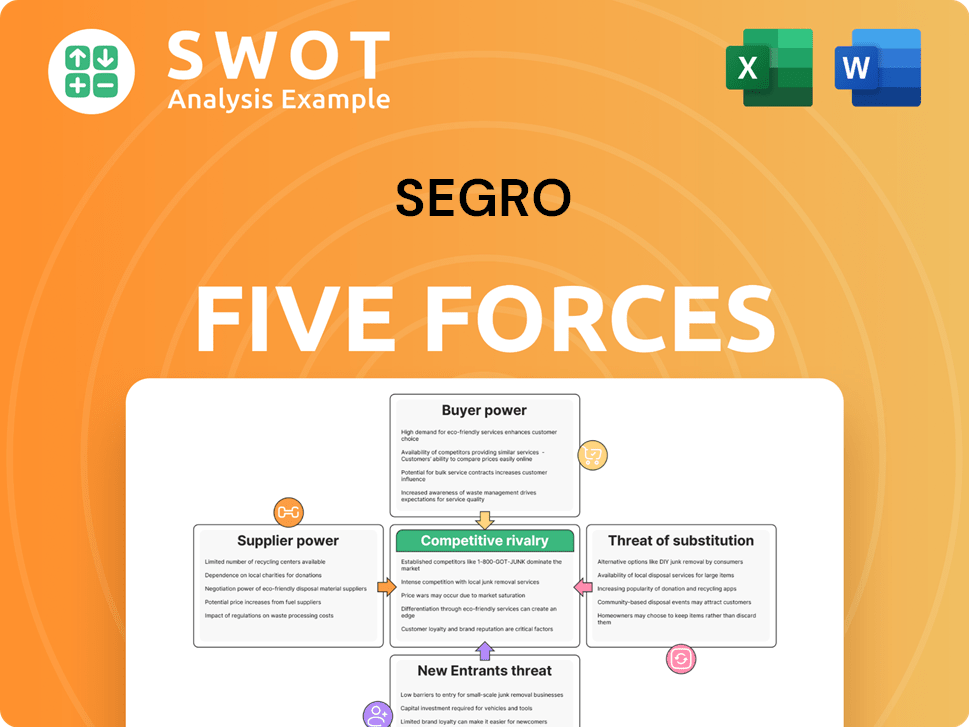

Segro Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Segro Company?

- What is Growth Strategy and Future Prospects of Segro Company?

- How Does Segro Company Work?

- What is Sales and Marketing Strategy of Segro Company?

- What is Brief History of Segro Company?

- Who Owns Segro Company?

- What is Customer Demographics and Target Market of Segro Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.