Simon Property Group Bundle

How Did Simon Property Group Become a Retail Giant?

Ever wondered how a small family business transformed into the largest owner of shopping malls in the U.S.? The Simon Property Group SWOT Analysis reveals the strategies behind this remarkable ascent. From its 1960s origins in Indianapolis, the SPG company has redefined the retail industry, adapting and innovating to meet evolving consumer demands.

This brief history of Simon Property Group explores the key milestones that shaped its journey. Discover the early acquisitions, the vision of the founders, and the strategic decisions that fueled its expansion. Understanding Simon Malls' evolution provides valuable insights into the dynamics of the real estate investment trust and the broader retail industry.

What is the Simon Property Group Founding Story?

The story of the SPG company began in 1960. Melvin Simon, a leasing agent, teamed up with his brothers Herbert and Fred Simon in Indianapolis, Indiana. Together, they formed Melvin Simon & Associates (MSA).

Melvin Simon, armed with an accounting degree, saw potential in developing retail shopping centers. Their early focus was on small, open-air plazas, often anchored by a grocery or drug store. This marked the humble beginnings of what would become a major player in the retail industry.

Their initial success was rapid. The first wholly-owned shopping plaza opened in Bloomington, Indiana, in August 1960, followed by four more in the Indianapolis area. The company's ability to manage effectively quickly attracted larger retail tenants, setting the stage for future growth.

The company's early growth was driven by strategic acquisitions and developments, with a significant milestone being its initial public offering (IPO) in December 1993.

- Melvin Simon & Associates (MSA) was founded in 1960.

- Their first shopping plaza opened in Bloomington, Indiana, in August 1960.

- The IPO in December 1993 raised $840 million.

- The IPO was the largest for a real estate investment trust at the time.

The IPO in December 1993 was a pivotal moment, raising $840 million. This was the largest IPO for a real estate investment trust at that time, providing substantial capital for expansion. The early focus on effective management and strategic growth laid the foundation for the company's future as a leading real estate investment trust.

For more insights into how the company has grown, check out the Growth Strategy of Simon Property Group.

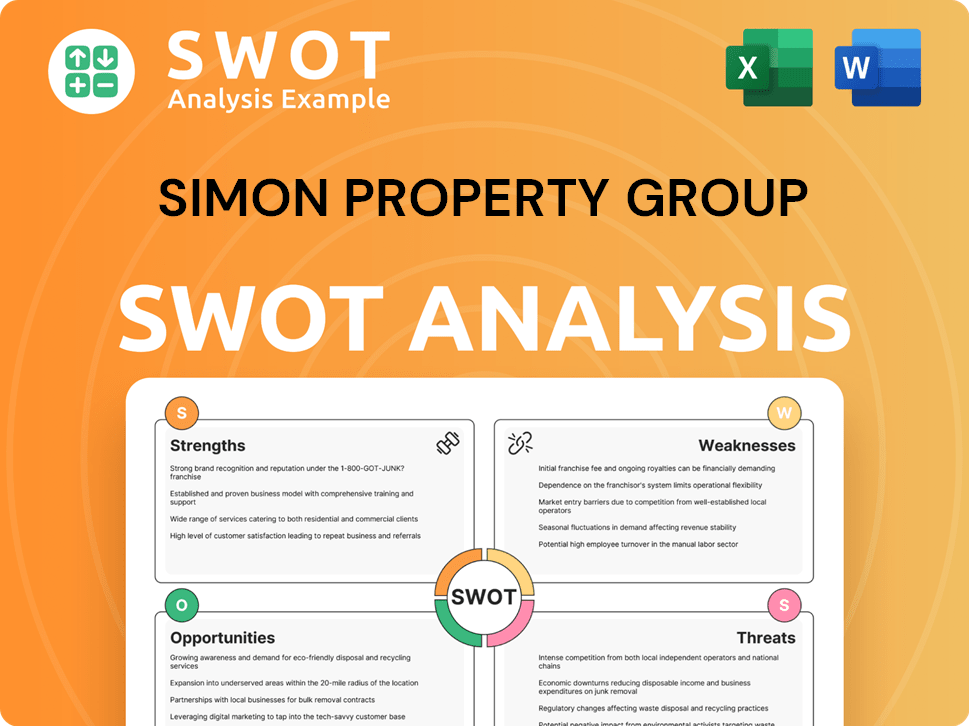

Simon Property Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Simon Property Group?

The early growth of the Simon Property Group (SPG company) involved strategic expansions and innovative concepts within the retail industry. Melvin Simon & Associates (MSA) initially focused on developing retail spaces, including partnerships with Kmart. They pioneered the enclosed mall concept, significantly influencing the shopping mall history and retail landscape.

MSA expanded beyond Indiana, securing deals to develop four of the first Kmart department stores in the Midwest, spanning Indiana, Illinois, and Michigan. This early focus on strategic partnerships helped establish a foundation for future growth. This expansion was a key step in the company's early development.

The company developed three properties in Colorado, including its first fully enclosed shopping mall, University Mall in Fort Collins, which opened in 1964. This innovative approach was then brought to Indiana with two more enclosed malls in Anderson and Bloomington. The enclosed mall concept became a hallmark of the company.

MSA consistently added approximately 1 million square feet of retail space annually, reaching over 3 million square feet by 1967. This rapid expansion demonstrates the company's commitment to growth and its ability to secure prime real estate. The company's growth trajectory was impressive.

By 1975, the company opened Towne East Square in Wichita, Kansas, its first enclosed mall exceeding 1 million square feet. The formal establishment of Simon Property Group as a publicly traded entity occurred in December 1993, through the largest IPO of a Real estate investment trust (REIT) to date. David Simon, with an MBA, became president and CEO in 1994.

A significant strategic move came in 1996 with the merger of Simon Property Group and DeBartolo Realty Corporation, forming Simon DeBartolo Group. Further expansion in the late 1990s included the hostile takeover of The Retail Property Trust for $1.2 billion in 1997. These acquisitions solidified their position as a leading REIT.

In 1998, the company acquired Corporate Property Investors and reverted its name to Simon Property Group, also gaining an ownership interest in Groupe BEG, S.A., a European shopping center operator. This marked a significant step in their international expansion strategy. These moves expanded their global footprint.

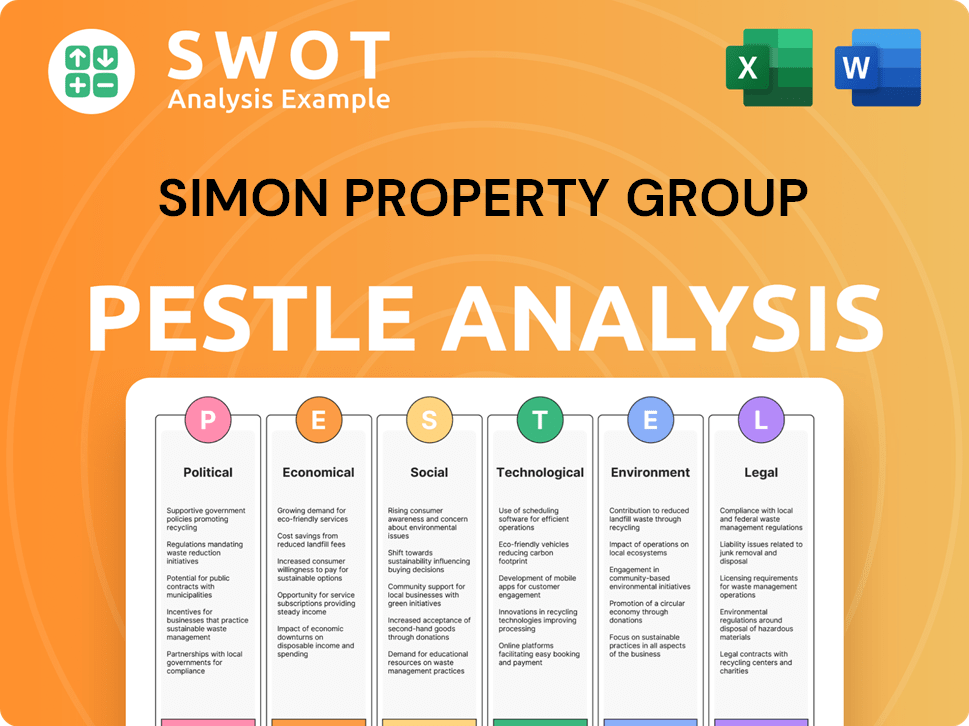

Simon Property Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Simon Property Group history?

The journey of Simon Property Group, a prominent real estate investment trust, is marked by significant milestones. From its beginnings, the SPG company has grown to become a leader in the retail industry, shaping the landscape of Simon Malls and beyond.

| Year | Milestone |

|---|---|

| 1997 | Creation of Simon Brand Ventures (SBV) to leverage economies of scale in marketing. |

| 2007 | Acquisition of Mills Corporation, diversifying its portfolio with various shopping malls and retail properties. |

| 2010 | Expansion of international footprint, including the acquisition of Prime Outlets-Puerto Rico and an additional 21 outlet malls for $2.3 billion. |

| 2020 | Completion of the acquisition of Taubman Centers, a leading owner and operator of high-end shopping centers. |

| 2024 | As of December 31, 2024, Simon Property Group owned an 88% noncontrolling interest in Taubman Realty Group L.P. |

Simon Property Group has consistently sought innovative ways to enhance its operations. A key focus has been integrating technology to improve the customer experience, particularly through digital marketing and smart building technologies.

Simon Property Group has invested heavily in digital marketing strategies to engage with customers online. This includes targeted advertising, social media campaigns, and enhanced online shopping experiences.

The company has implemented smart building technologies to improve operational efficiency and enhance the shopping experience. This includes energy management systems, smart parking solutions, and advanced security features.

Simon Property Group is transforming properties into mixed-use destinations, incorporating elements like housing, hotels, and office space. This strategy aims to create vibrant, integrated communities.

The company is integrating technology to enhance shopper engagement, including mobile apps, interactive kiosks, and personalized shopping experiences. This approach aims to improve customer satisfaction and drive sales.

Despite its successes, Simon Property Group has faced several challenges. The COVID-19 pandemic led to temporary closures of its U.S. shopping malls in March 2020, impacting operations. Macroeconomic uncertainties and the impact of tariffs on retailer inventory remain ongoing concerns for the SPG company.

The company has faced challenges from market downturns and economic fluctuations. These downturns can affect consumer spending and reduce demand for retail space.

Simon Property Group faces competition from other real estate investment trusts and evolving retail trends. The rise of e-commerce and changing consumer preferences pose significant challenges.

The impact of tariffs on retailer inventory and sourcing strategies has affected the company. These tariffs can increase costs and reduce profitability for retailers.

Macroeconomic uncertainty affects sales and overall performance. Economic downturns and fluctuations in consumer spending can impact the company's financial results.

The temporary closure of malls during the COVID-19 pandemic significantly impacted the company's operations. This led to reduced revenue and operational challenges.

Simon Property Group's strategic response includes significant investments in redevelopment projects, transforming properties into mixed-use destinations, and integrating technology for enhanced shopper engagement. This includes plans to spend between $400 million and $500 million on mall redevelopments in 2025.

To understand the competitive landscape, consider reading about the Competitors Landscape of Simon Property Group.

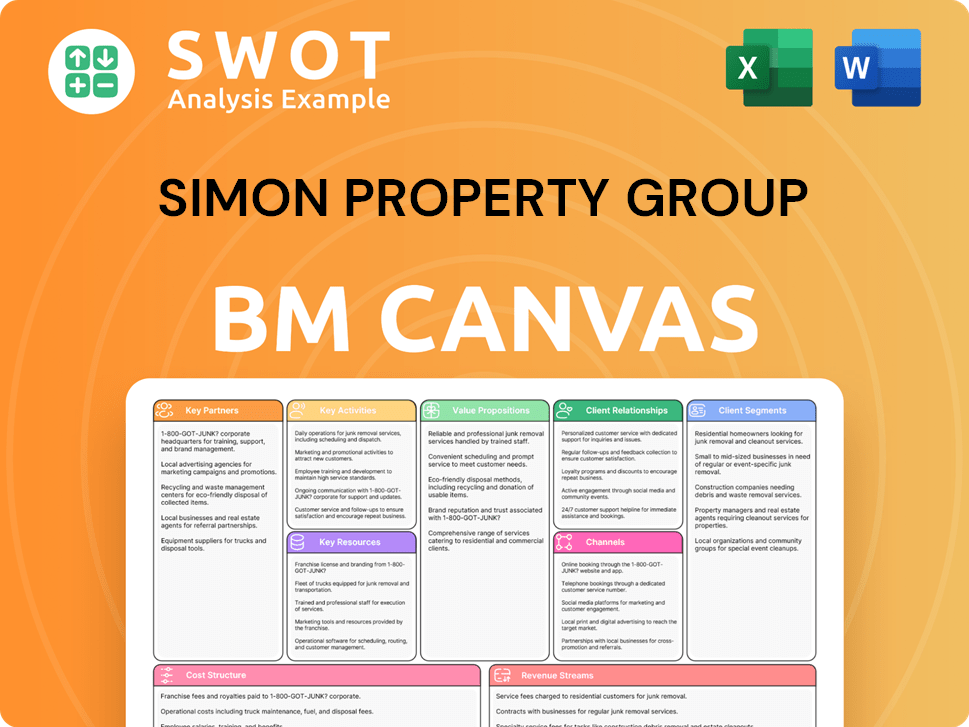

Simon Property Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Simon Property Group?

The SPG company, a leading real estate investment trust, has a rich shopping mall history. Founded by Melvin and Herbert Simon, the company has evolved significantly since its inception. This evolution includes strategic acquisitions, public offerings, and international expansions, shaping its current status in the retail industry. The Revenue Streams & Business Model of Simon Property Group article offers additional insights into the company's financial strategies.

| Year | Key Event |

|---|---|

| 1960 | Melvin Simon and Herbert Simon founded Melvin Simon & Associates (MSA) in Indianapolis, Indiana. |

| 1964 | MSA opened its first fully enclosed shopping mall, University Mall in Fort Collins, Colorado. |

| 1975 | MSA opened Towne East Square in Wichita, Kansas, its first enclosed mall over 1 million square feet. |

| 1993 | Melvin Simon & Associates went public with an $840 million IPO, forming Simon Property Group (SPG). |

| 1994 | David Simon became President and CEO of Simon Property Group. |

| 1996 | SPG merged with DeBartolo Realty Corporation, becoming Simon DeBartolo Group. |

| 1997 | Simon acquired The Retail Property Trust for $1.2 billion. |

| 1998 | The company acquired Corporate Property Investors and was renamed Simon Property Group, also beginning international expansion. |

| 2007 | Simon Property Group acquired The Mills Corporation. |

| 2010 | Simon acquired Prime Outlets-Puerto Rico and 21 additional outlet malls for $2.3 billion. |

| 2020 | Simon Property Group completed the acquisition of Taubman Centers. |

| 2024 | Simon reported record Funds From Operations (FFO) of $4.877 billion and net income of $2.368 billion ($7.26 per diluted share). Occupancy in U.S. Malls and Premium Outlets reached 96.5%, and base minimum rent per square foot grew to $58.26. |

| February 2025 | Simon Property Group announced the retirement of Herbert Simon. |

| March 2025 | Simon Property Group declared a common stock dividend of $2.10 per share for Q1 2025, a 7.7% increase from Q1 2024. |

| May 2025 | Simon Property Group reports Q1 2025 results, with revenue of $1.47 billion, exceeding forecasts. |

In 2025, Simon Malls plans to invest between $400 million and $500 million in mall redevelopments. These investments focus on enhancing existing properties to meet evolving consumer demands. This strategy includes mixed-use developments that integrate retail, residential, office, and entertainment spaces, aiming to create dynamic destinations.

Simon Property Group reaffirmed its 2025 Real Estate FFO guidance, projecting a range of $12.40 to $12.65 per diluted share. This demonstrates confidence in the company's financial performance and strategic direction. The company's strong financial position supports its growth initiatives and expansion plans.

International market expansion remains a key area of interest for Simon Property Group. The company is also focused on technological integration and diversification. The transformation of properties like Smith Haven Mall and the development of projects like Northgate Station and The Fashion Mall at Keystone highlight its commitment to market leadership.

Simon's forward-looking strategy is rooted in creating innovative retail destinations. The company is adapting to changing consumer preferences through strategic investments and developments. This approach ensures that Simon Property Group remains a leader in the retail industry, focusing on both growth and adaptability.

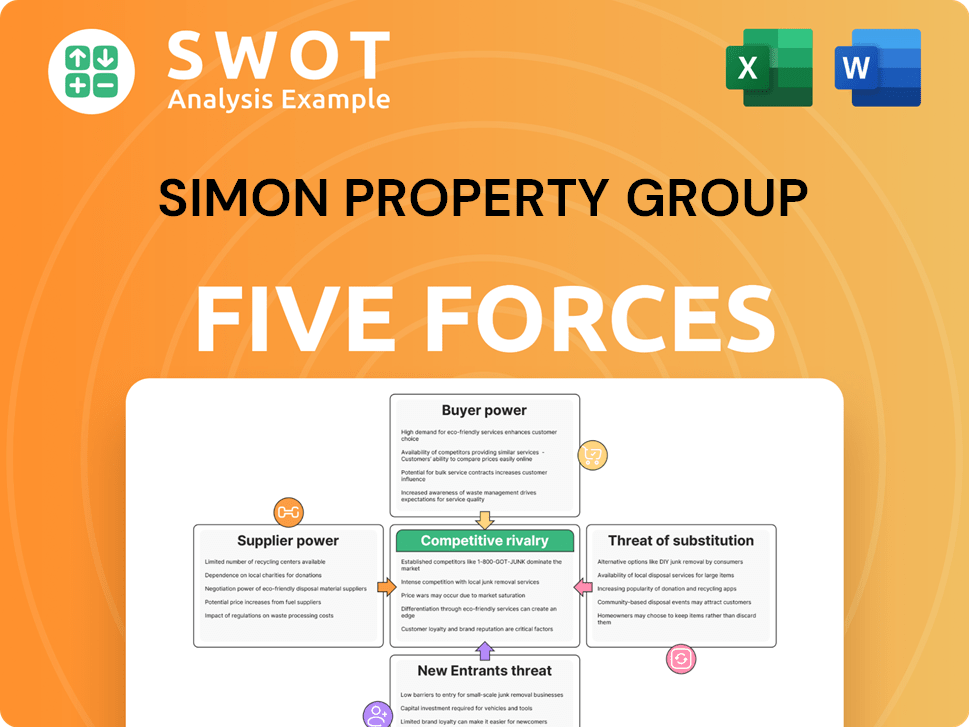

Simon Property Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Simon Property Group Company?

- What is Growth Strategy and Future Prospects of Simon Property Group Company?

- How Does Simon Property Group Company Work?

- What is Sales and Marketing Strategy of Simon Property Group Company?

- What is Brief History of Simon Property Group Company?

- Who Owns Simon Property Group Company?

- What is Customer Demographics and Target Market of Simon Property Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.