Simon Property Group Bundle

How Does Simon Property Group Thrive in the Retail Realm?

Ever wondered how a real estate giant like Simon Property Group (SPG company) navigates the ever-changing retail landscape? This powerhouse, a leading Real estate investment trust, boasts an impressive portfolio of Simon Malls and other retail properties worldwide. With billions in revenue and a strategic focus on premier destinations, understanding SPG's operations is key for anyone interested in the financial markets.

From mall ownership to international expansions, Simon Property Group's business model is a fascinating case study in adapting to evolving consumer behaviors. Its success is evident in its robust financial performance, including record Funds From Operations in 2024. For a deeper dive into the company's strengths and weaknesses, consider exploring a Simon Property Group SWOT Analysis to gain a comprehensive understanding of its strategic positioning and future prospects.

What Are the Key Operations Driving Simon Property Group’s Success?

The core operations of the SPG company revolve around the ownership, development, and management of high-quality retail real estate. This includes a diverse portfolio of properties that cater to various tenants, spanning retail, dining, and entertainment sectors. The company's focus is on creating and delivering value through premier assets, ensuring high occupancy rates and strong financial performance.

As of December 31, 2024, Simon Property Group's U.S. portfolio comprised a significant presence across multiple retail formats. This included 92 malls, 70 Premium Outlets, 14 Mills, six lifestyle centers, and 12 other retail properties spread across 37 states and Puerto Rico. The operational processes are comprehensive, involving property management, leasing, marketing, and development services.

Simon's value proposition lies in its ability to provide attractive physical spaces for retailers, supported by strategic partnerships with leading brands. This approach enhances the tenant mix and consumer experience, contributing to market differentiation. The company's proactive property enhancement and tenant retention strategies directly benefit customers by offering diverse shopping, dining, and entertainment options.

Simon Property Group emphasizes operational excellence through its comprehensive management of retail properties. This includes property management, leasing, marketing, and development services. The company's focus on premier assets results in high occupancy rates and increasing base minimum rent.

Strong tenant relationships are a cornerstone of Simon's strategy, fostering long-term partnerships with leading brands. These relationships ensure a diverse and appealing tenant mix. This approach enhances the consumer experience and drives foot traffic to its properties.

Redevelopment and repurposing of existing properties are key strategies for Simon. This includes transforming former department store spaces into higher-density or mixed-use formats. The company integrates residential units, offices, and diverse retail offerings.

The company's financial performance is a direct result of its strategic focus and operational efficiency. At the end of 2024, occupancy in its U.S. Malls and Premium Outlets reached 96.5%, with base minimum rent per square foot at $58.26. This demonstrates the effectiveness of its business model.

Simon Property Group's success is driven by its strategic focus on premier assets, strong tenant relationships, and proactive property management. These strategies translate into tangible benefits for customers, offering diverse shopping, dining, and entertainment options.

- High-Quality Retail Spaces: Providing attractive and well-maintained properties.

- Diverse Tenant Mix: Offering a wide variety of retailers and entertainment options.

- Enhanced Consumer Experience: Creating appealing environments that drive foot traffic.

- Market Differentiation: Establishing a high-quality portfolio that stands out in the retail landscape.

For more insights into how Simon Property Group approaches its marketing, consider reading about the Marketing Strategy of Simon Property Group.

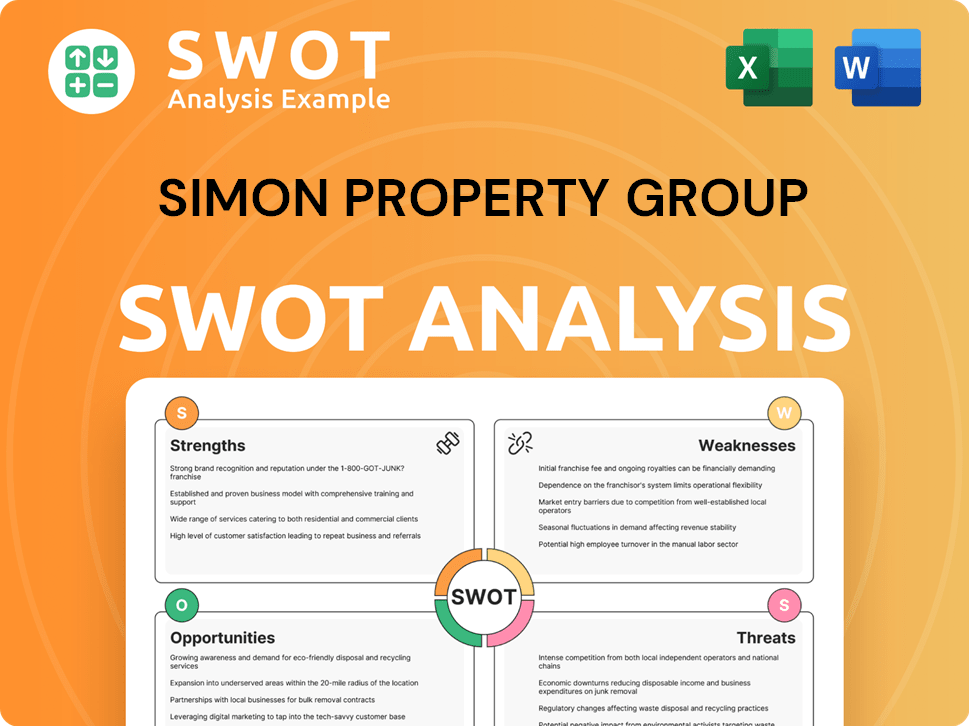

Simon Property Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Simon Property Group Make Money?

Understanding the revenue streams and monetization strategies of the SPG company is crucial for investors and anyone interested in the real estate investment sector. The company, a significant player in mall ownership, leverages its extensive portfolio to generate substantial income. This approach highlights the company's ability to adapt and thrive within the dynamic retail properties landscape.

Simon Property Group's financial success is largely driven by its ability to maximize revenue from its properties. This involves not only securing leases but also enhancing the value of its properties through strategic development and management practices. The company's diversified approach ensures resilience and sustained growth in the competitive market.

The primary revenue source for Simon Property Group comes from lease income derived from its diverse portfolio of properties, including fixed minimum lease consideration and variable lease consideration based on tenants' reported sales. For the full year ended December 31, 2024, Simon Property Group reported total revenue of $5.96 billion, a 5.4% increase from $5.66 billion in 2023.

Beyond traditional lease income, Simon Property Group employs several strategies to boost its financial performance. These include property management fees, development and redevelopment projects, and other services that enhance the shopping experience. The company's strategic approach to acquisitions and divestments also plays a key role in its financial health, as further detailed in Growth Strategy of Simon Property Group.

- Property Management Fees: Simon Property Group offers its expertise to third parties, generating revenue from management fees.

- Development and Redevelopment: Investing in new and existing properties enhances property value and attracts tenants.

- Additional Services: Revenue is generated from parking, advertising, sponsorships, and other services.

- Strategic Divestments and Acquisitions: Optimizing its portfolio through strategic moves contributes to overall financial health. In the first quarter of 2025, lease income was $1.37 billion, showing a 5% increase year-over-year, while management fees and other revenues increased by 14.7% to $33.79 million.

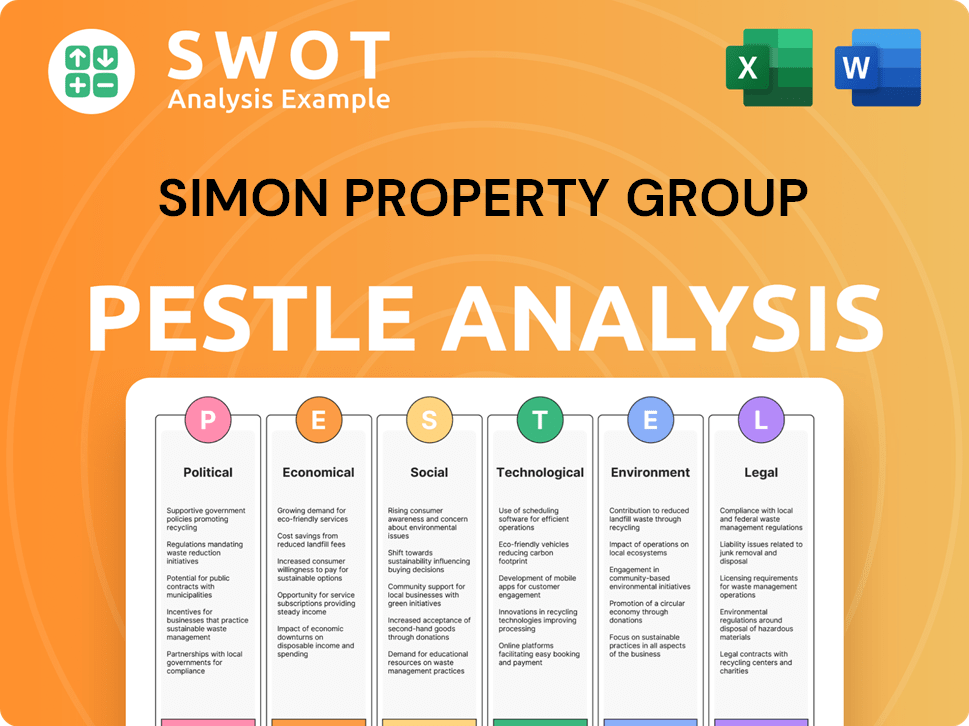

Simon Property Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Simon Property Group’s Business Model?

The evolution of Simon Property Group (SPG) showcases significant milestones and strategic shifts that have cemented its position in the real estate investment landscape. In 2024 and early 2025, the company has demonstrated a proactive approach to adapting its portfolio and expanding its global presence, emphasizing its commitment to long-term growth and value creation.

Simon Malls has consistently adapted to changing market dynamics, focusing on enhancing the shopping experience and optimizing its property portfolio. This adaptability is crucial in navigating the challenges of the retail industry and maintaining its competitive edge. Recent strategic moves include significant redevelopments, acquisitions, and expansions.

Simon Property Group's strategic initiatives and operational excellence have positioned it as a leader in the real estate investment sector, with a focus on long-term value creation and sustainable growth. The company's ability to adapt to market changes and capitalize on opportunities has been key to its success.

In 2024, Simon Property Group completed 16 significant redevelopment projects. The company opened a new Premium Outlet center in the U.S. and expanded its portfolio through strategic acquisitions. Early 2025 saw further international expansion with acquisitions in Italy and the opening of a new outlet in Indonesia.

Strategic acquisitions in 2024 included the remaining interest in Smith Haven Mall and an additional stake in Miami International Mall. The company is investing in technology for enhanced shopper engagement and omnichannel integration. Marketing campaigns like 'Meet Me @ The Mall' aim to attract a younger demographic.

Simon Property Group benefits from a high-quality portfolio of premier shopping destinations and proactive property redevelopment. The company maintains a strong financial position, with approximately $10.1 billion of liquidity as of March 31, 2025. Its ability to attract top-tier tenants and leverage data-driven insights further strengthens its competitive standing.

The rise of e-commerce and changing consumer preferences pose challenges to physical retail. Simon Property Group responds by investing in technology and omnichannel integration to enhance the shopping experience. The company also focuses on marketing campaigns to attract younger consumers and highlight the mall as a community gathering place.

Simon Property Group’s financial health is supported by its strategic investments and active management of its properties. The company's focus on adapting to market changes and enhancing the shopping experience has been critical to its financial performance. Understanding the Competitors Landscape of Simon Property Group provides further context on its market positioning.

- Strong Liquidity: Approximately $10.1 billion of liquidity as of March 31, 2025, providing financial flexibility for strategic initiatives.

- Property Redevelopment: Completed 16 significant redevelopment projects in 2024, enhancing property value and appeal.

- Strategic Acquisitions: Expanded its portfolio through acquisitions, including interests in key malls and international properties.

- Focus on Customer Experience: Investments in technology and omnichannel integration to improve shopper engagement.

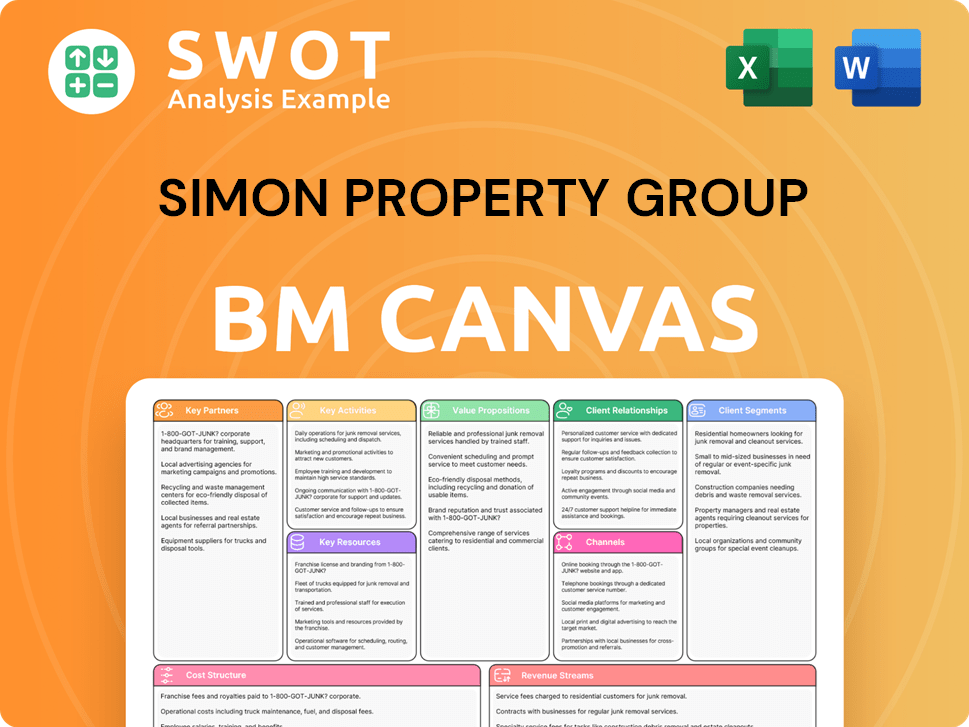

Simon Property Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Simon Property Group Positioning Itself for Continued Success?

As a leading owner of premier shopping, dining, entertainment, and mixed-use destinations, the company holds a significant position in the retail real estate sector. Its focus on high-productivity premium malls and outlets is a key factor in its success. The company's U.S. Malls and Premium Outlets reported an occupancy rate of 95.9% as of March 31, 2025, a 0.4% increase from the prior year, demonstrating its strong market position.

The company faces several risks, including adverse conditions in the general retail environment, the potential loss of anchor stores, and tenant bankruptcies. The rise of e-commerce and changing consumer preferences continue to pose competitive threats. Financial risks also exist due to its substantial debt and the impact of rising interest rates.

The company is a dominant player in the retail real estate sector. It is recognized as a leading owner of premier shopping, dining, and entertainment destinations. The company's market share in the Commercial Leasing industry is approximately 1.9% of total industry revenue.

Market risks include adverse retail conditions and tenant bankruptcies. The rise of e-commerce and shifting consumer behaviors pose challenges. Financial risks stem from its debt burden and potential interest rate impacts.

The company plans strategic acquisitions and redevelopment projects to drive growth. It expects to generate positive cash flow from operations in 2025 and maintain its investment-grade credit ratings. Strategic initiatives include focusing on high-quality real estate and exploring mixed-use developments.

The company anticipates generating positive cash flow from operations in 2025. The company's outlook for Real Estate FFO for the year ending December 31, 2025, is reaffirmed at $12.40 to $12.65 per diluted share.

The company is focused on strategic acquisitions and redevelopment projects to drive growth. It is also actively managing its capital structure and aiming to maintain its investment-grade credit ratings, as discussed in Owners & Shareholders of Simon Property Group. The company is investing in technology integration to enhance the customer experience and operational efficiency.

- Focus on high-quality real estate assets.

- Selective development of new properties in underserved markets.

- Partnerships for international investments.

- Exploring mixed-use developments.

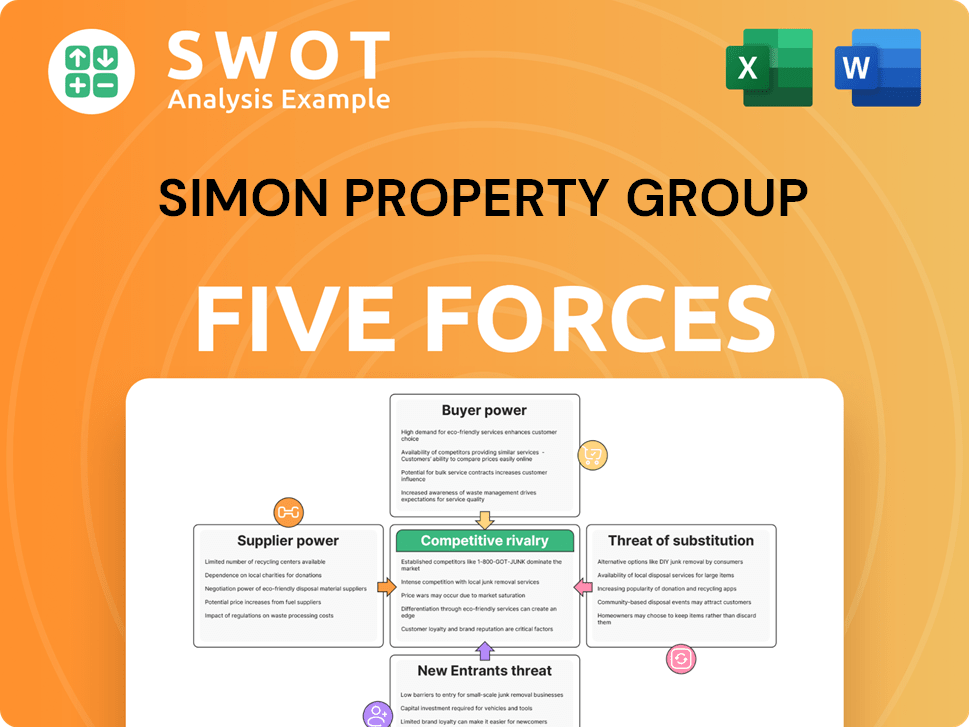

Simon Property Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simon Property Group Company?

- What is Competitive Landscape of Simon Property Group Company?

- What is Growth Strategy and Future Prospects of Simon Property Group Company?

- What is Sales and Marketing Strategy of Simon Property Group Company?

- What is Brief History of Simon Property Group Company?

- Who Owns Simon Property Group Company?

- What is Customer Demographics and Target Market of Simon Property Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.