Simon Property Group Bundle

Can Simon Property Group Maintain Its Dominance in the Evolving Retail World?

In a retail world reshaped by e-commerce, the enduring presence of Simon Property Group, a leading real estate investment trust (REIT), demands attention. From its inception in 1960, the company has evolved into a global leader by creating vibrant shopping and entertainment destinations. This article explores the Simon Property Group SWOT Analysis, uncovering the strategies and challenges shaping its future.

Understanding the competitive landscape is crucial for any investor or strategist evaluating the Simon Property Group. This real estate market analysis will dissect the mall industry and retail sector, examining Simon Property Group's market position and its key rivals. We'll explore the company's competitive advantages and strategic initiatives, providing insights into its financial performance and future outlook amidst the impact of e-commerce.

Where Does Simon Property Group’ Stand in the Current Market?

The Simon Property Group (SPG) holds a significant market position in the retail real estate sector. As of late 2024, it stands as the largest retail REIT in the U.S. by market capitalization and property holdings. This strong position is a result of its strategic focus on high-quality assets and a broad geographic footprint.

SPG's extensive portfolio includes over 200 properties, such as premium outlets, malls, and lifestyle centers. These properties are located across North America, Europe, and Asia. This diversity allows SPG to cater to a wide range of consumers, from luxury shoppers to everyday customers, supporting its strong market share.

The company's strategic shift towards upscale properties and premium outlets has been key. This move beyond traditional malls has helped SPG capture higher-spending consumer segments. This repositioning has allowed the company to maintain strong occupancy rates and rental growth, even amid broader retail challenges.

In 2024, SPG reported approximately $5.4 billion in revenue. Its net income reached around $2.0 billion. These figures show a strong financial foundation that supports continued investment and market leadership within the retail sector.

SPG maintains a particularly strong presence in major metropolitan areas across the United States. Its properties often serve as dominant retail destinations. This strategic geographic presence is a key factor in its sustained success within the competitive landscape.

SPG's market position is reinforced by its strategic focus on high-quality assets and a diverse portfolio. Its financial strength and strategic initiatives have allowed it to maintain a leading position in the real estate market analysis.

- SPG's portfolio includes premium outlets, malls, and lifestyle centers.

- The company has adapted to changing consumer preferences by focusing on upscale properties.

- Financial performance demonstrates robust health, supporting continued investment.

- SPG holds a strong position in major metropolitan areas across the United States.

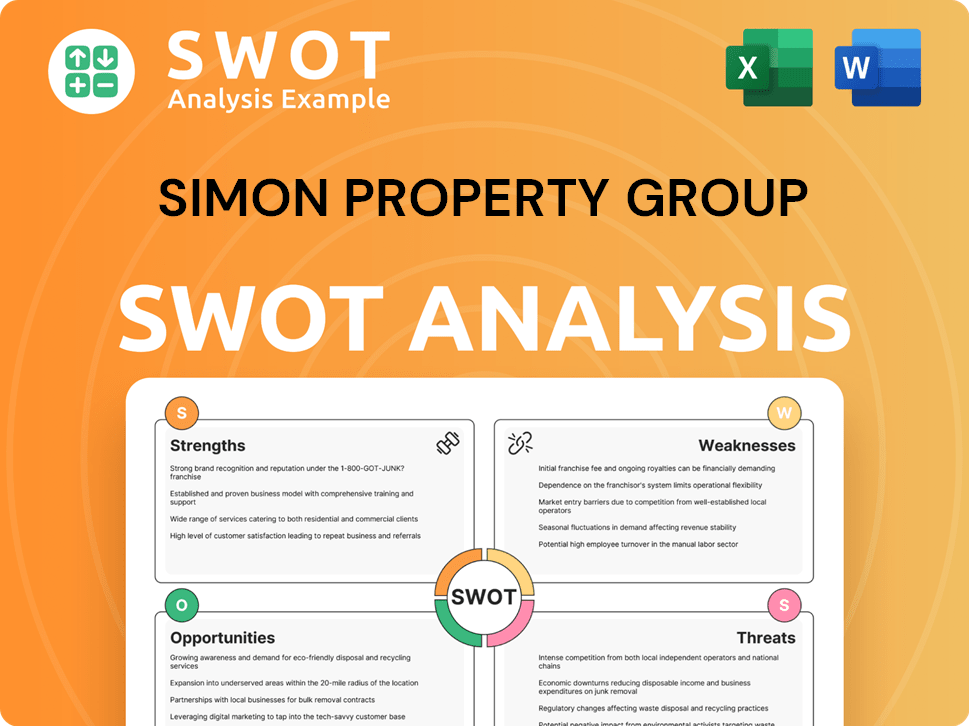

Simon Property Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Simon Property Group?

The competitive landscape for Simon Property Group is complex, shaped by both direct and indirect competitors. The company faces challenges from other major retail real estate investment trusts (REITs) and the evolving retail sector. A thorough real estate market analysis reveals the dynamics at play, influencing Simon Property Group's strategic decisions and market position.

Understanding the competitive environment is crucial for assessing Simon Property Group's financial performance and future outlook. The company's ability to maintain and grow its market share depends on how it navigates these competitive pressures and adapts to changing consumer behaviors. This includes strategic initiatives such as property redevelopment and tenant management.

The impact of e-commerce and the broader retail sector's trends on Simon Property Group is significant. Online retailers and changing consumer preferences require the company to innovate and enhance the physical retail experience. The company's brand reputation and competitive strategies are constantly tested by these forces.

Direct competitors include other large retail REITs. These companies own and manage similar properties, competing for tenants and market share. They often engage in strategic acquisitions and redevelopment projects.

Key players include Brookfield Properties Retail and Federal Realty Investment Trust. Brookfield manages a significant portfolio of shopping malls. Federal Realty focuses on high-quality retail properties in affluent markets.

Indirect competition comes from e-commerce giants like Amazon. They significantly impact brick-and-mortar sales, necessitating innovation in physical retail. This requires Simon Property Group to adapt to changing consumer habits.

Smaller, regional developers and private equity firms also pose a threat. They develop niche retail centers or acquire individual properties. This can disrupt Simon's market share in specific regions.

Emerging players focus on mixed-use developments. These integrate residential, office, and retail spaces. This presents a changing competitive dynamic as consumers seek holistic experiences.

The industry sees competition for prime retail assets and tenants. Competition for luxury brands to anchor high-end malls is fierce. This highlights the intense rivalry among top-tier REITs.

Simon Property Group's competitive strategies involve acquisitions, redevelopments, and tenant management. The company must continuously adapt to the shifts in the retail sector and the rise of e-commerce. For more insights into the company's history, you can read Brief History of Simon Property Group.

- Market Share: The company competes with other REITs for market share in the mall industry.

- Tenant Attraction: Attracting luxury brands and high-profile tenants is crucial.

- Property Redevelopment: Redeveloping properties to meet changing consumer demands is essential.

- E-commerce Adaptation: Integrating online and physical retail experiences is a key strategy.

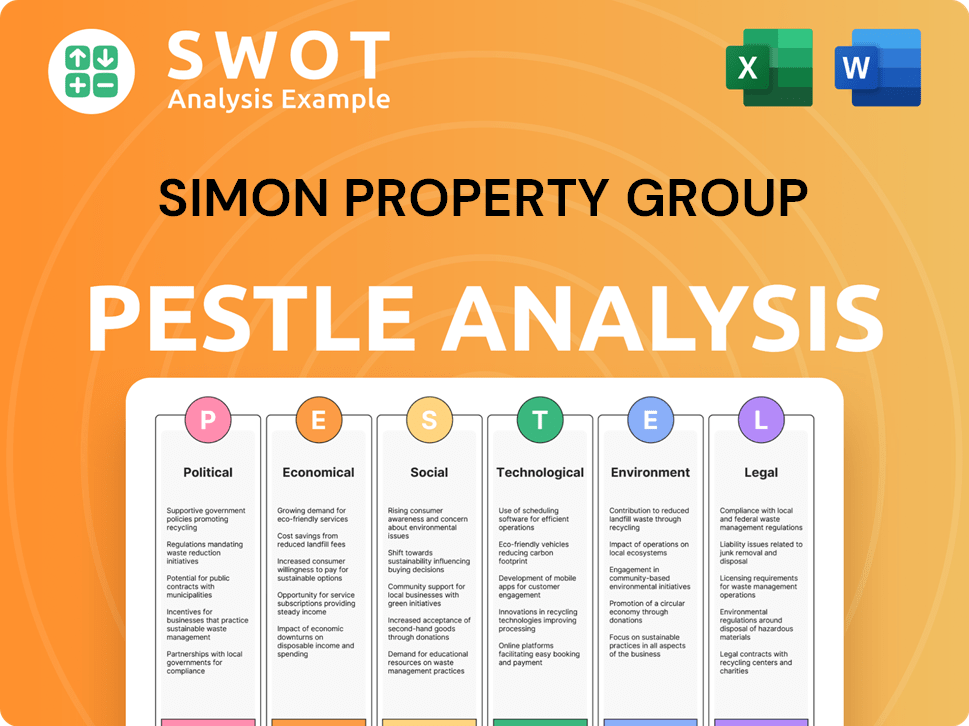

Simon Property Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Simon Property Group a Competitive Edge Over Its Rivals?

Understanding the Owners & Shareholders of Simon Property Group requires a deep dive into its competitive advantages within the real estate market analysis. The company, a major player in the mall industry, has consistently demonstrated its ability to navigate the retail sector's challenges. Its strategic initiatives and robust financial performance have solidified its market share and position, making it a key entity to analyze in the competitive landscape.

Simon Property Group's success is underpinned by several key competitive advantages. These advantages allow it to maintain a strong market position and adapt to the evolving retail environment. By examining these factors, we can better understand its resilience and strategic foresight.

The company's enduring success is built on several core competitive advantages that set it apart from its rivals. Its premium outlets and flagship malls often hold prime positions in affluent markets, attracting a desirable tenant mix and high foot traffic. This extensive and well-curated portfolio provides a significant barrier to entry for new competitors.

Simon Property Group owns a high-quality, strategically located property portfolio. This includes premium outlets and flagship malls in prime locations. The company's properties attract a desirable tenant mix, contributing to high foot traffic and strong performance.

Simon Property Group has established strong relationships with national and international retailers. These relationships allow the company to secure favorable leasing terms. The company attracts a diverse array of prominent brands, creating a synergistic environment.

The company benefits from economies of scale in property management, marketing, and operational efficiencies. This allows Simon Property Group to optimize costs and enhance profitability compared to smaller competitors. These efficiencies contribute to better financial performance.

Simon Property Group has robust financial health and access to capital, enabling it to invest in property redevelopments, expansions, and strategic acquisitions. This financial strength supports long-term growth and enhances its portfolio. The company's financial stability is a key advantage.

Simon Property Group's competitive advantages include a high-quality property portfolio, strong retailer relationships, economies of scale, and robust financial health. These factors contribute to its market position.

- Strategic Property Locations: Prime locations in affluent markets attract high foot traffic.

- Tenant Relationships: Securing favorable leasing terms and attracting prominent brands.

- Operational Efficiencies: Optimizing costs and enhancing profitability.

- Financial Strength: Investing in redevelopments and strategic acquisitions.

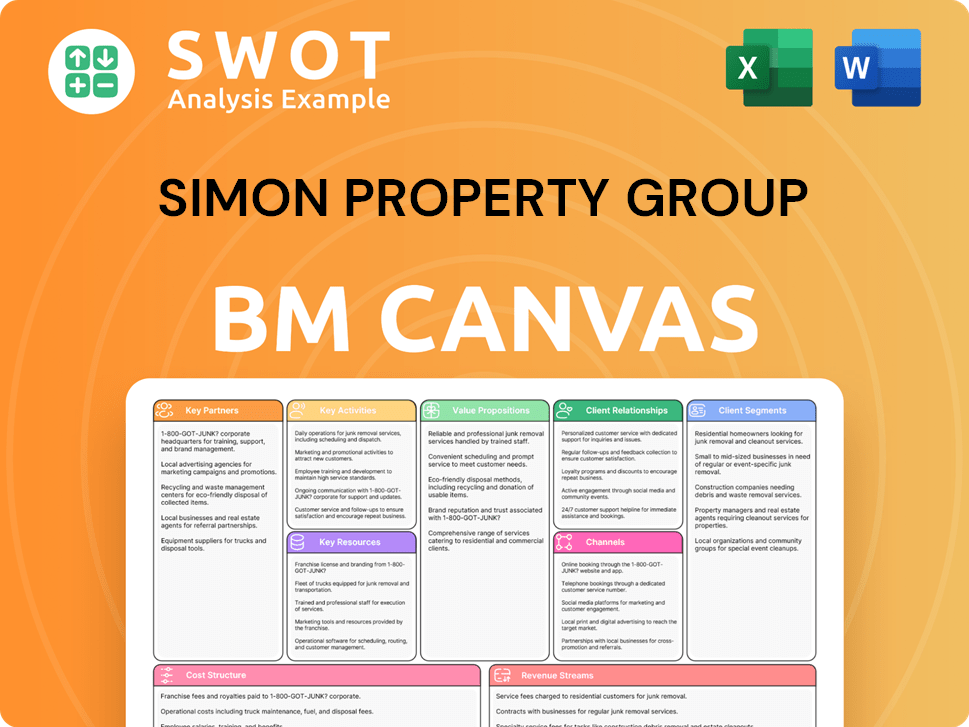

Simon Property Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Simon Property Group’s Competitive Landscape?

The retail real estate market is currently undergoing a transformation, significantly impacting the competitive landscape for companies like Simon Property Group. The rise of e-commerce and evolving consumer preferences are reshaping the industry, creating both challenges and opportunities. Understanding the current market dynamics is essential for assessing Simon Property Group's position and future prospects. A comprehensive real estate market analysis reveals the need for strategic adaptation to maintain a strong market share.

For Simon Property Group, the primary challenge lies in navigating the shift towards online shopping and changing consumer expectations. This necessitates continuous investment in enhancing the in-person shopping experience and adapting to the evolving demands of the retail sector. Simultaneously, the company must address potential risks like economic downturns and the expansion of digitally native retail concepts to maintain its competitive advantages. To learn more about their strategic initiatives, consider reading about the Growth Strategy of Simon Property Group.

E-commerce continues to grow, impacting foot traffic in traditional malls. Consumers are increasingly seeking experiential retail, convenience, and sustainability. Regulatory changes, including zoning laws and environmental regulations, also play a role.

Adapting older mall formats to meet modern demands requires significant investment. Economic downturns could impact consumer spending and tenant solvency. The expansion of digitally native retailers poses a competitive threat.

Demand for well-located, high-quality experiential retail remains strong. Diversification into mixed-use developments offers growth potential. Leveraging technology to enhance the customer journey presents new avenues for revenue.

Continuous investment in existing assets and selective redevelopment projects. Exploring new revenue streams beyond traditional retail leasing. Strategic partnerships with innovative retailers and leisure operators.

In 2024, e-commerce sales are projected to account for approximately 16% of total retail sales, highlighting the ongoing shift in consumer behavior. Simon Property Group's strategy includes investing in mixed-use developments, with a focus on integrating residential, office, and hospitality components, which can generate higher revenue per square foot. The company has been actively partnering with experiential retailers and entertainment venues to drive foot traffic and enhance the appeal of its properties. For example, in Q1 2024, Simon Property Group reported an occupancy rate of 95.2% for its portfolio, indicating strong demand for its properties despite the challenges in the retail sector.

- E-commerce growth continues to impact the mall industry.

- Emphasis on experiential retail is crucial for attracting consumers.

- Mixed-use developments offer diversification opportunities.

- Strategic partnerships are key for driving traffic and revenue.

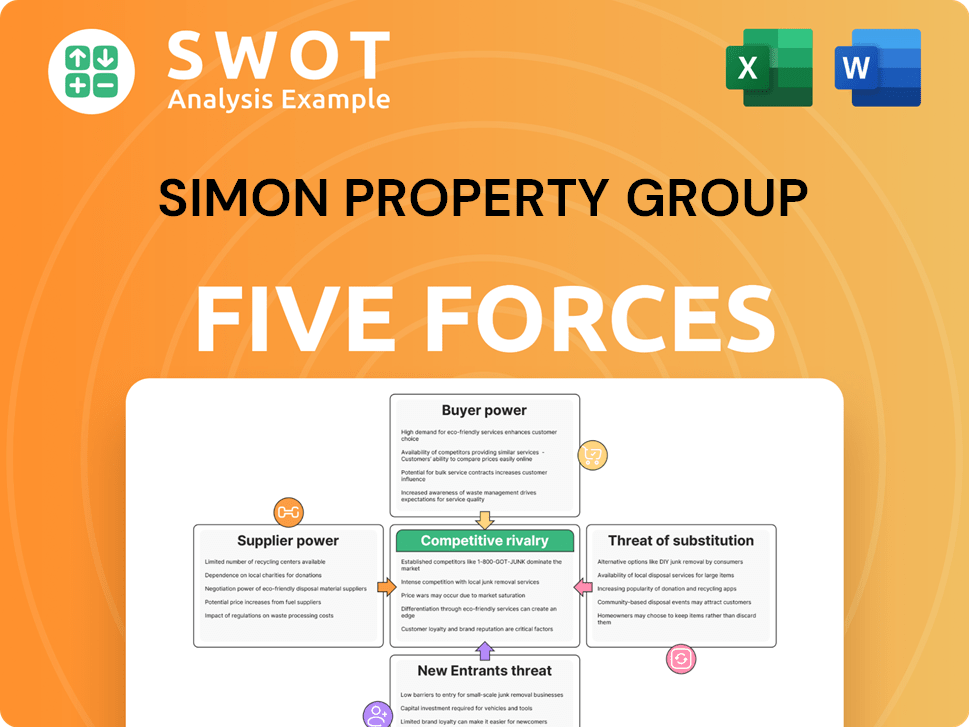

Simon Property Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simon Property Group Company?

- What is Growth Strategy and Future Prospects of Simon Property Group Company?

- How Does Simon Property Group Company Work?

- What is Sales and Marketing Strategy of Simon Property Group Company?

- What is Brief History of Simon Property Group Company?

- Who Owns Simon Property Group Company?

- What is Customer Demographics and Target Market of Simon Property Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.