Simon Property Group Bundle

Who Really Controls Simon Property Group?

Understanding the ownership structure of a major player like Simon Property Group is crucial for any investor or industry observer. From its humble beginnings to its current status as a retail real estate giant, the evolution of Simon Property Group SWOT Analysis and its ownership reveals a fascinating story of growth and adaptation. Knowing who holds the reins provides invaluable insight into its strategic direction and future prospects.

This exploration of SPG ownership will uncover the key players shaping its destiny, from the initial vision of its founders to the current landscape of shareholders and institutional investors. We'll examine the impact of its IPO and how its ownership structure influences its financial performance and its position within the retail industry. Discover the answers to questions like: Who is the CEO of Simon Property Group? Who are the Simon Property Group shareholders? Is Simon Property Group a public company? How does the mall ownership landscape look today?

Who Founded Simon Property Group?

The story of Simon Property Group, a major player in the real estate investment trust (REIT) sector, began in 1960. It was founded by Melvin Simon and Herbert Simon, with Fred Simon later joining the venture. Their initial focus was on developing shopping centers, marking the beginning of what would become a vast portfolio of mall ownership.

Initially, Simon Enterprises operated as a privately held company, fully owned by the Simon family. While the exact ownership percentages at the start are not publicly available, the founders' vision and entrepreneurial drive were key to the company's early growth. This private structure allowed for long-term strategic planning without the immediate pressures of the public market.

Early financial backing likely came from a mix of personal capital, traditional bank loans, and potentially local investors who saw the potential in their retail development projects. This private phase was critical for building the foundation of the company's expertise in real estate development and management before its public debut.

Melvin Simon and Herbert Simon founded the company in 1960.

The company's initial focus was on developing shopping centers.

For over three decades, the company operated privately, controlled by the Simon family.

Private ownership allowed for long-term strategic decisions.

Early funding came from personal capital, bank financing, and local investors.

The private phase was crucial before the company's public debut.

The founders' vision and strategic decisions during this private phase were instrumental in shaping the company's future. The company's evolution from a private entity to a publicly traded REIT is a testament to the founders' foresight and the company's ability to adapt to the changing retail landscape. For further insights into the company's strategic moves, consider reading about the Growth Strategy of Simon Property Group.

The early years of Simon Property Group were marked by private ownership and strategic development. The founders, Melvin and Herbert Simon, laid the groundwork for the company's success in the retail sector.

- Founded in 1960 by Melvin and Herbert Simon.

- Focused initially on shopping center development.

- Operated privately for over three decades.

- Early funding from personal capital and bank financing.

- Private ownership allowed for long-term strategic planning.

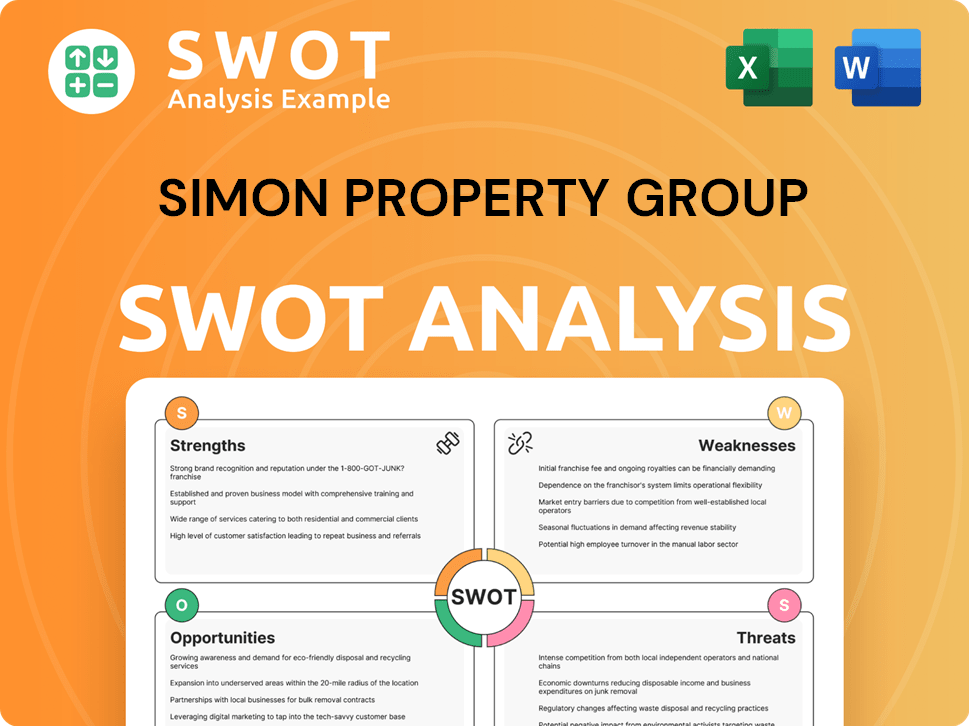

Simon Property Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Simon Property Group’s Ownership Changed Over Time?

The evolution of Simon Property Group's ownership is a story of transformation from a private entity to a publicly traded real estate investment trust (REIT). The pivotal moment arrived on December 17, 1993, with its initial public offering (IPO), which opened the door to a diverse shareholder base. This shift marked a significant change, as the company moved from being a family-run operation to one influenced by public market dynamics and institutional investors.

Post-IPO, the ownership structure of Simon Property Group diversified considerably. Institutional investors, mutual funds, and index funds became major players. This transformation has shaped the company's strategic direction, influencing its focus on acquiring and developing high-quality retail properties and adapting to the changing retail landscape. The inclusion in various exchange-traded funds (ETFs) and index funds has further broadened its investor base, reflecting its status as a stable, dividend-paying REIT.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | December 17, 1993 | Transitioned from private to public ownership; introduced public shareholders. |

| Institutional Investment Growth | Ongoing | Increased influence of institutional investors like Vanguard and BlackRock. |

| Index Fund Inclusion | Ongoing | Increased exposure to passive investors through ETFs and index funds. |

As of early 2025, the major shareholders of Simon Property Group include prominent institutional investors. According to recent data, The Vanguard Group, Inc. holds approximately 12.39% of the outstanding shares, while BlackRock Inc. holds about 9.24% as of March 31, 2025. These figures highlight the significant influence of institutional investors. The Simon family, while no longer holding a majority stake, maintains a notable position, ensuring their continued influence through board representation and strategic involvement. Understanding the composition of SPG ownership is crucial for anyone interested in the company, whether as an investor or a student of the retail industry. For a deeper dive into how the company operates, consider reading about the Marketing Strategy of Simon Property Group.

The ownership of Simon Property Group has evolved significantly since its IPO, with institutional investors playing a major role.

- Vanguard and BlackRock are among the top institutional shareholders.

- The Simon family retains a significant stake and influence.

- The company's ownership structure reflects its status as a leading REIT.

- Understanding SPG ownership is key for investors and industry observers.

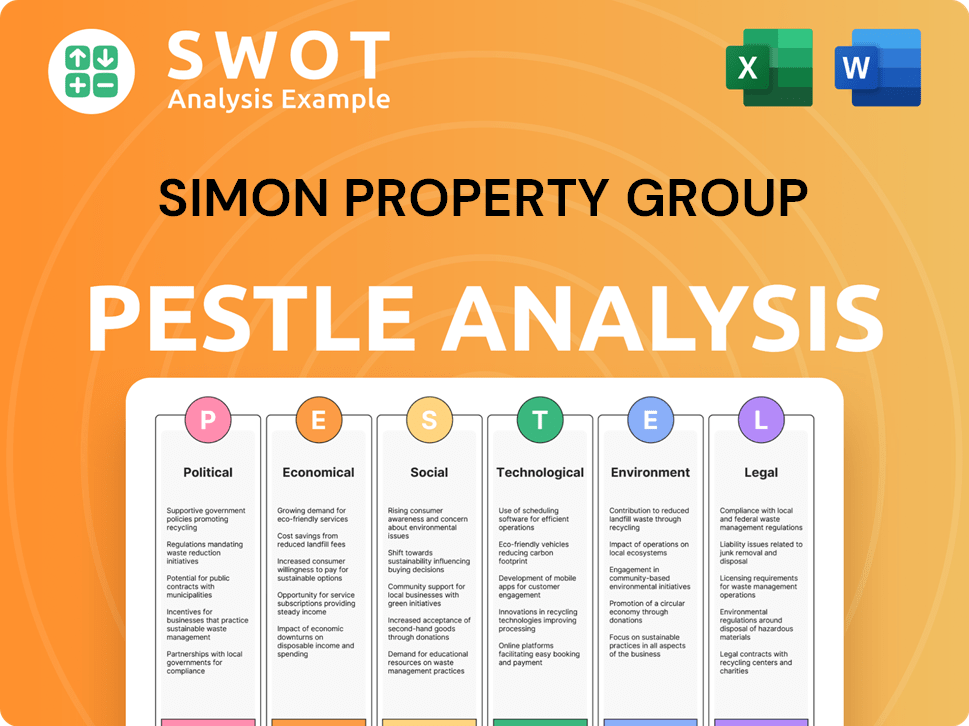

Simon Property Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Simon Property Group’s Board?

The current board of directors of Simon Property Group (SPG) is key to the company's governance. As of early 2025, the board includes independent directors and individuals connected to the founding family. David Simon, son of Herbert Simon, holds the positions of Chairman, CEO, and President, representing a direct link to the founding ownership. Other board members bring expertise in finance, real estate, and corporate governance. Understanding who owns Simon Property Group involves examining the board's composition, which reflects a balance of interests.

The board's structure ensures that major decisions consider shareholder interests alongside the leadership provided by the Simon family. The presence of independent directors provides oversight, contributing to the company's stability. The board's role is crucial in maintaining a balance, especially in a real estate investment trust (REIT) like SPG. The board's composition and the voting structure are key aspects of the company's governance, ensuring that the interests of various stakeholders are considered. For further insights, you can explore the Competitors Landscape of Simon Property Group.

| Board Member | Title | Affiliation |

|---|---|---|

| David Simon | Chairman, CEO, President | Simon Family |

| (To be updated with 2025 data) | Independent Director | Various |

| (To be updated with 2025 data) | Independent Director | Various |

The voting structure at Simon Property Group follows a one-share-one-vote principle for its common stock. This ensures that each share has equal voting power in most corporate matters. There are no publicly disclosed dual-class shares or special voting rights that would grant outsized control to specific individuals or entities. The Simon family maintains significant influence through their ownership stake and David Simon's leadership. However, major decisions require approval from the broader shareholder base and the independent oversight of the board. This structure helps maintain a balance between management, the board, and major shareholders, contributing to the company's stability within the mall ownership sector.

Simon Property Group's voting structure is straightforward, with each share of common stock carrying equal voting power. This ensures fairness among shareholders. The absence of special voting rights or dual-class shares promotes transparency.

- One-share-one-vote system.

- No dual-class shares.

- Major decisions require broader shareholder approval.

- Independent board oversight.

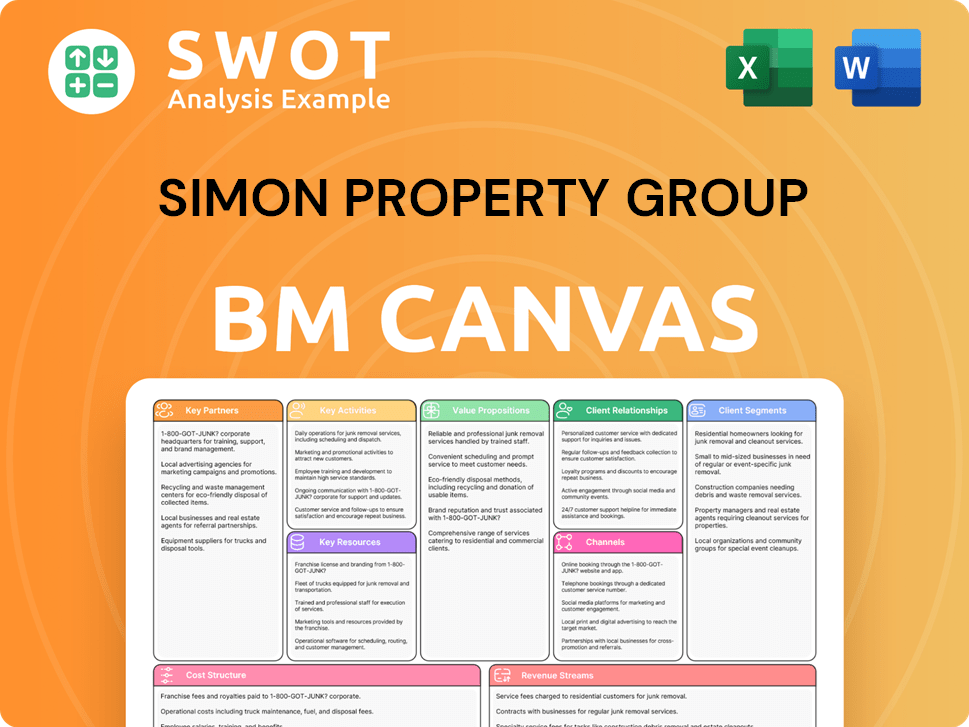

Simon Property Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Simon Property Group’s Ownership Landscape?

In the past few years, the ownership profile of Simon Property Group has shown continued evolution. This is influenced by broader industry trends and strategic initiatives. The company's focus on mixed-use developments and redevelopments of existing properties attracts investors seeking exposure to diversified real estate assets. Increased institutional ownership, particularly by passive index funds and ETFs, remains a dominant force, leading to a dispersed ownership among a large number of institutional holders. For example, as of early 2025, institutional ownership remains high, with top firms like The Vanguard Group and BlackRock maintaining significant positions.

The company has navigated the challenges and opportunities presented by the shifting retail landscape, which can influence investor sentiment and ownership dynamics. Its focus on high-quality assets and adapting to e-commerce trends aims to maintain investor confidence. Public statements from the company often emphasize its strong balance sheet and dividend policy, which are attractive to REIT investors. This signals a commitment to shareholder returns rather than major ownership overhauls or privatization plans in the near future. The company's strategies aim to maintain investor confidence and adapt to the evolving retail industry.

| Metric | Details | Data (Early 2025) |

|---|---|---|

| Institutional Ownership | Percentage of shares held by institutional investors | Approximately 90% |

| Top Institutional Holders | Key institutional investors | The Vanguard Group, BlackRock |

| Dividend Yield | Current dividend yield | Approximately 5-6% |

The company's strategic focus on high-quality assets and adapting to e-commerce trends aims to maintain investor confidence. Public statements often emphasize its strong balance sheet and dividend policy, signaling a commitment to shareholder returns. This is particularly attractive to REIT investors.

Continued high institutional ownership, driven by passive investment strategies. Focus on adapting to e-commerce and mixed-use developments. Emphasis on shareholder returns through dividends and a strong balance sheet.

Positive, supported by the company's performance and strategic initiatives. Stability in leadership, with no recent significant founder departures. Focus on maintaining investor confidence through consistent financial performance and strategic asset management.

The company's ownership is primarily institutional, with a dispersed base. The shift towards mixed-use developments attracts diversified investors. The focus remains on long-term value creation and shareholder returns.

Expectations of continued institutional ownership and strategic asset management. The company is positioned to adapt to the evolving retail landscape. Focus on maintaining a strong financial position to support investor confidence.

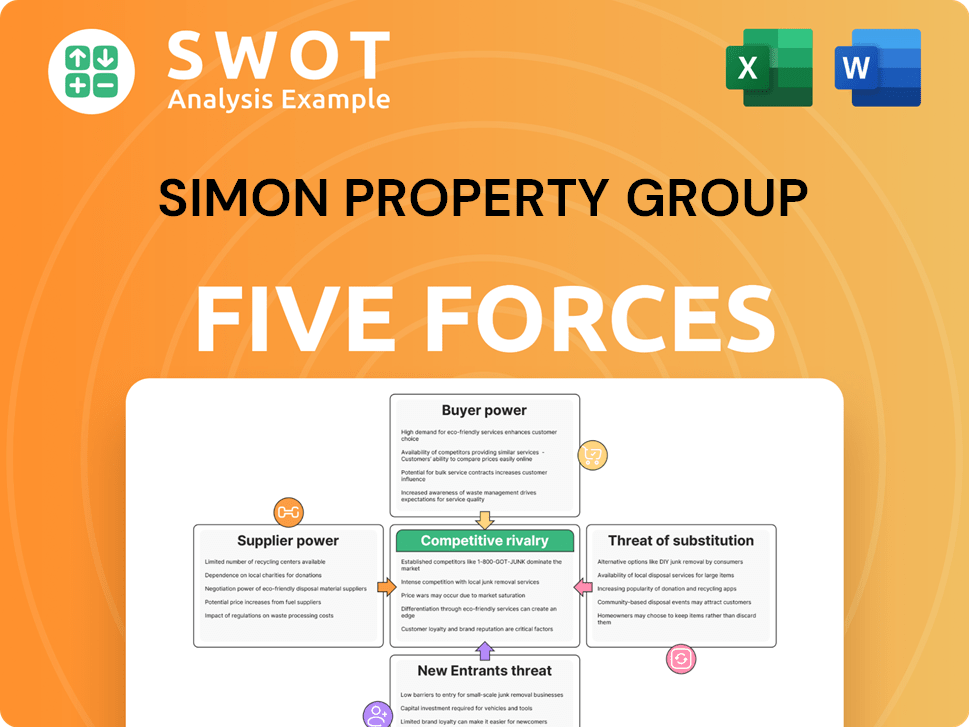

Simon Property Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simon Property Group Company?

- What is Competitive Landscape of Simon Property Group Company?

- What is Growth Strategy and Future Prospects of Simon Property Group Company?

- How Does Simon Property Group Company Work?

- What is Sales and Marketing Strategy of Simon Property Group Company?

- What is Brief History of Simon Property Group Company?

- What is Customer Demographics and Target Market of Simon Property Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.