Simon Property Group Bundle

Can Simon Property Group Continue Its Reign in Retail Real Estate?

Simon Property Group (SPG), a Real Estate Investment Trust (REIT) titan, has masterfully navigated the complexities of the retail industry. From its humble beginnings in 1993, the company has evolved into the largest retail REIT in the United States, a testament to its strategic acumen. Their acquisition of The Taubman Company in 2020 is a prime example of their commitment to growth.

This exploration delves into the Simon Property Group SWOT Analysis, examining its growth strategy, market position, and future prospects. With a vast portfolio including malls, premium outlets, and lifestyle centers, SPG's ability to adapt to changing consumer behaviors and the evolving retail landscape is crucial. Understanding the company's strategic initiatives and expansion plans provides valuable insights for investors and industry observers alike, as they look for investment opportunities.

How Is Simon Property Group Expanding Its Reach?

The expansion initiatives of Simon Property Group (SPG) are primarily focused on enhancing its existing portfolio and pursuing strategic acquisitions. This approach aims to diversify revenue streams and adapt to evolving consumer preferences. SPG's strategy involves significant investments in redeveloping and densifying properties, transforming traditional retail spaces into mixed-use destinations.

A key element of the Growth Strategy involves selective acquisitions and partnerships. The company also explores international opportunities, particularly in markets with strong growth potential. SPG's product pipeline includes initiatives to integrate more diverse tenants, creating comprehensive destinations.

In 2023, Simon spent $569.2 million on redevelopment and expansion projects, demonstrating its commitment to optimizing its assets. The company aims to generate free cash flow in the range of $1.5 billion to $1.6 billion in 2024, which will support further growth and expansion.

Simon Property Group actively redevelops its properties to include residential, office, and hospitality components. This strategy aims to create vibrant mixed-use destinations, attracting a broader customer base and increasing foot traffic. These transformations are crucial for adapting to changing consumer behaviors and market trends.

SPG focuses on selective acquisitions and partnerships to enhance its portfolio. This includes both large-scale acquisitions and smaller, targeted investments. These strategic moves help to maintain a high-quality, dominant property portfolio and drive future growth.

The company explores international opportunities, especially in markets with strong growth potential. This expansion focuses on premium outlet and mall concepts, extending SPG's brand reach and revenue streams. This strategic move is a key part of the long-term growth plan.

SPG integrates more diverse tenants, including fitness centers, entertainment venues, and healthcare providers. This diversification creates more comprehensive and resilient destinations. This strategy helps to attract a wider customer base and increase overall property value.

Simon Property Group's growth strategy includes redevelopment, strategic acquisitions, international expansion, and tenant diversification. These initiatives are designed to enhance the company's portfolio and adapt to evolving market demands. These strategies are crucial for the Real Estate Investment Trust's (REIT) future success.

- Focus on mixed-use developments to attract diverse customer segments.

- Selective acquisitions to maintain a high-quality property portfolio.

- Expansion into international markets with strong growth potential.

- Integration of diverse tenants to create comprehensive destinations.

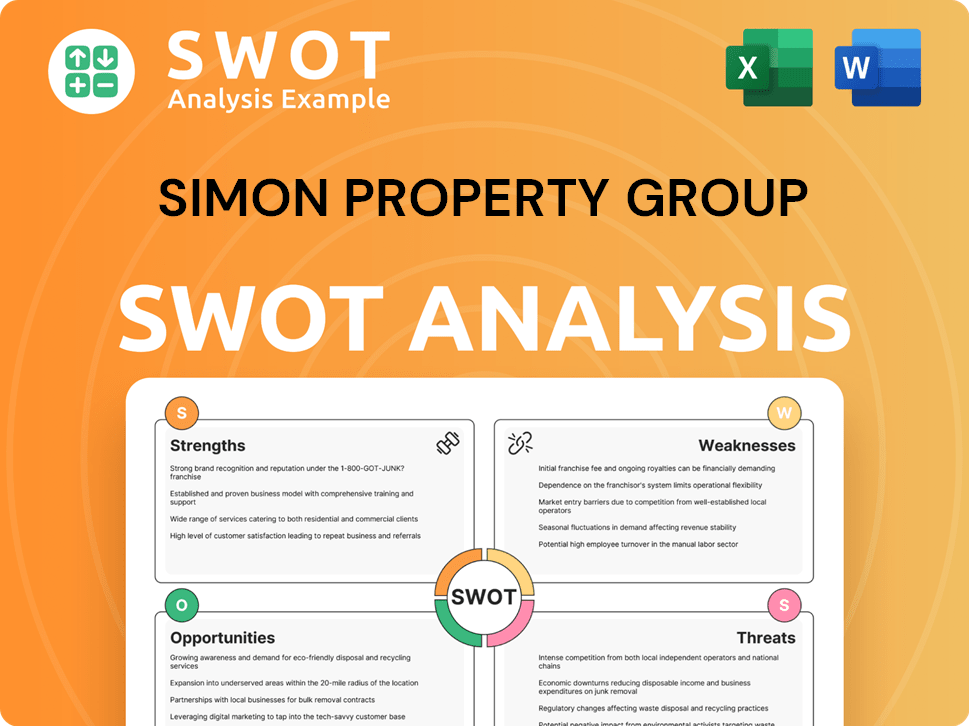

Simon Property Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Simon Property Group Invest in Innovation?

In today's dynamic retail landscape, understanding and adapting to customer needs is critical for any Real Estate Investment Trust (REIT), including Simon Property Group (SPG). The company constantly monitors consumer preferences and shopping behaviors. This allows them to refine their strategies and maintain a competitive edge in the Retail Industry.

Simon Property Group (SPG) focuses on enhancing the shopping experience by integrating digital and physical retail. This approach aims to meet the evolving expectations of consumers who want convenience, personalization, and seamless interactions across all channels. By leveraging data analytics, SPG can tailor its offerings and improve customer satisfaction.

The company's commitment to innovation is evident in its investments in digital transformation and technology integration. These efforts are designed to attract and retain customers, ultimately driving growth and ensuring long-term success in the real estate market. This strategic focus helps SPG maintain its leadership position.

Simon Property Group (SPG) actively invests in digital transformation to enhance the customer experience. This includes developing mobile applications and integrating e-commerce platforms. The goal is to create a seamless shopping experience across all channels.

SPG utilizes sophisticated data analytics to understand consumer behavior. This data-driven approach allows for personalized marketing strategies. The company aims to tailor its offerings to meet individual customer preferences.

Simon Property Group explores cutting-edge technologies like AI and IoT. These technologies are used to enhance property management, security, and energy efficiency. This includes predictive maintenance and optimizing staffing levels.

Sustainability is a core part of SPG's innovation strategy. The company invests in renewable energy sources and energy-efficient building systems. These efforts contribute to environmental responsibility and operational cost savings.

SPG focuses on integrating e-commerce seamlessly with its brick-and-mortar retail operations. This includes partnerships with online retailers and the development of omnichannel shopping experiences. The aim is to provide customers with convenient shopping options.

The integration of new platforms and technical capabilities aims to create more efficient shopping environments. This includes optimizing staffing levels and streamlining property management. These improvements contribute to increased foot traffic and sales.

The company's strategic initiatives are designed to create more engaging and efficient shopping environments. These efforts contribute to increased foot traffic and sales, driving growth objectives. To learn more about the company's history, you can read a brief history of Simon Property Group.

Simon Property Group's (SPG) innovation strategy includes several key technologies and strategies aimed at enhancing its market position and driving future growth. These initiatives are crucial for navigating the evolving retail landscape and maintaining a competitive edge.

- Mobile Applications: Developing advanced mobile applications to improve the shopping experience.

- Data Analytics: Implementing sophisticated data analytics to understand consumer behavior.

- Personalized Marketing: Deploying personalized marketing strategies to engage customers.

- AI and IoT: Exploring AI and IoT for property management, security, and energy efficiency.

- Sustainability: Investing in renewable energy and energy-efficient systems.

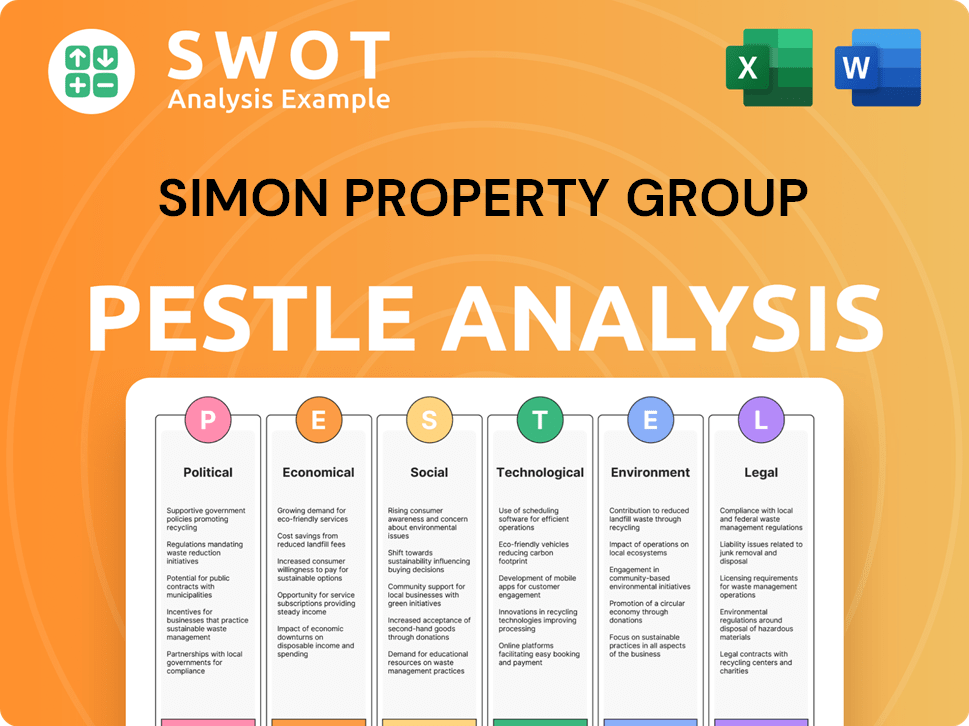

Simon Property Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Simon Property Group’s Growth Forecast?

The financial outlook for Simon Property Group (SPG) is positive, driven by strategic initiatives and a robust portfolio. The company's growth strategy focuses on maintaining high occupancy rates, increasing rental income, and successfully executing redevelopment projects. This approach is designed to enhance shareholder value and ensure long-term sustainability within the Real Estate Investment Trust (REIT) sector.

SPG's financial performance is expected to be strong, supported by a well-diversified portfolio of high-quality assets. The company's ability to generate significant free cash flow and maintain a strong balance sheet provides flexibility for future investments. This financial strength allows Simon Property Group to adapt to changing market conditions and capitalize on growth opportunities within the Retail Industry.

For the full year 2024, Simon Property Group projects Funds From Operations (FFO) to be in a range of $11.85 to $12.10 per diluted share. This projection indicates a stable to slightly increasing FFO. The company's strategic initiatives are designed to drive revenue growth and maintain healthy profit margins, ensuring continued financial success. The company's commitment to its growth strategy is evident in its financial targets and operational performance.

Simon Property Group's financial health is reflected in key metrics. The projected FFO for 2024, ranging from $11.85 to $12.10 per diluted share, demonstrates a consistent financial outlook. The company's ability to maintain a strong balance sheet with approximately $9.2 billion of liquidity as of December 31, 2023, underscores its financial stability.

The Growth Strategy of SPG includes a focus on high occupancy rates and rental increases. Occupancy for U.S. Malls and Premium Outlets was 95.9% as of December 31, 2023. Redevelopment and expansion projects are also key drivers. These initiatives are designed to enhance the value of its property portfolio and generate strong returns.

Simon Property Group maintains a strong position in the Retail Industry. The company's diverse portfolio and proven management team contribute to its success. The company's ability to adapt to market changes and capitalize on opportunities is crucial for its continued growth. The company's strategic focus on high-quality assets and operational efficiency is key to maintaining its market share.

Analysts generally hold a positive Future Outlook for SPG, citing its strong portfolio and management. The company's financial goals are aligned with its historical performance. The company's ability to generate strong returns for shareholders is a key factor in its positive outlook, demonstrating its commitment to long-term value creation. To understand the customer base, consider the Target Market of Simon Property Group.

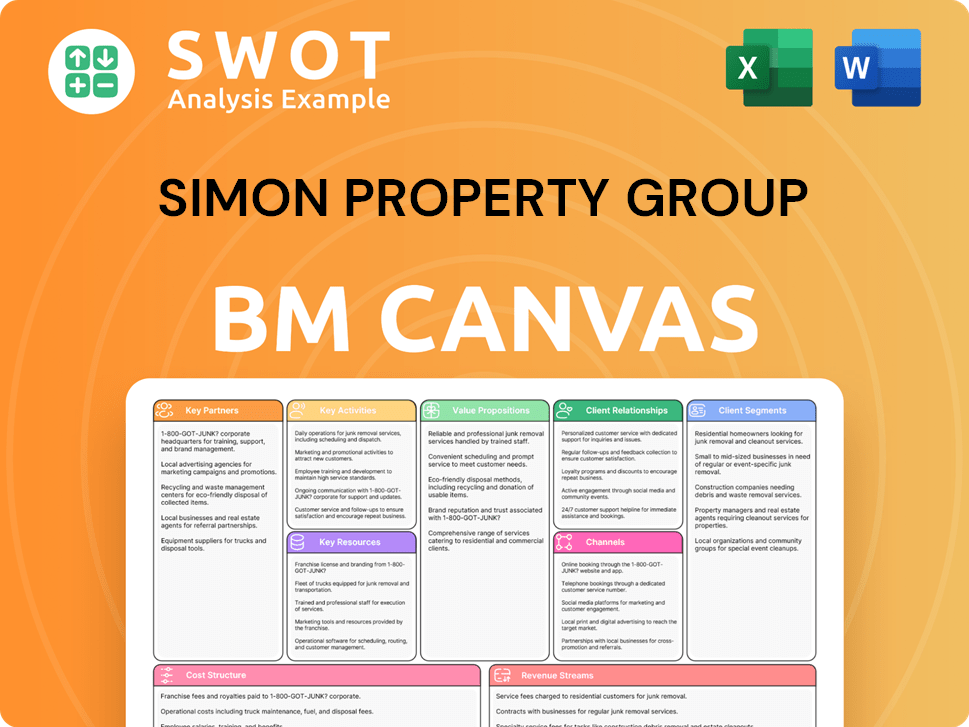

Simon Property Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Simon Property Group’s Growth?

The growth strategy of Simon Property Group (SPG) faces several potential risks and obstacles. The evolving retail landscape, including the rise of e-commerce and changing consumer preferences, presents ongoing challenges. Regulatory changes and supply chain disruptions can also impact operations and financial performance.

Market competition remains a significant hurdle, requiring continuous adaptation to maintain occupancy rates and rental income. Internal resource constraints, such as access to skilled labor or capital for projects, may also pose challenges. SPG must proactively address these risks to sustain its growth trajectory and maintain its position in the Real Estate Investment Trust (REIT) market.

To mitigate these risks, Simon Property Group employs diversification, a robust risk management framework, and scenario planning. The company's strong financial position and experienced management team provide a buffer against unforeseen challenges. For instance, the company successfully navigated the challenges posed by the COVID-19 pandemic through proactive measures and tenant support programs, demonstrating its resilience in overcoming significant obstacles. For more insights into the company, consider exploring Owners & Shareholders of Simon Property Group.

Competition from other REITs and evolving retail formats, including e-commerce, is a major risk. SPG must continuously innovate to attract and retain tenants. Maintaining competitive occupancy rates and rental growth is critical for financial health.

Changes in zoning laws, environmental regulations, or tax policies can increase costs. These changes can also restrict development opportunities. Compliance with evolving regulations is crucial.

Disruptions in supply chains can affect tenant performance and rental income. Retailers facing operational disruptions may struggle to meet their obligations. SPG is somewhat protected but still indirectly affected.

The rapid evolution of online shopping and digital interactions requires continuous investment. Adapting to changing consumer preferences is essential for staying competitive. Failing to innovate can lead to declining foot traffic.

Access to skilled labor and capital can pose obstacles to development projects. Managing resources effectively is crucial for executing expansion plans. Efficient capital allocation is key.

Economic recessions can lead to decreased consumer spending and lower demand for retail space. SPG’s performance is tied to overall economic conditions. Diversification helps to mitigate these risks.

In Q1 2024, Simon Property Group reported a net income of $486.1 million. Occupancy rates remained strong, indicating resilience in the face of market challenges. The company's strategic investments in mixed-use properties and experiential retail are crucial for adapting to changing consumer behaviors, as e-commerce continues to grow, influencing the retail landscape. These strategies help to maintain and enhance the value of their properties.

Simon Property Group actively manages its risks through diversification and a strong financial position. The company's proactive approach includes tenant support programs and strategic investments. These initiatives help to improve its resilience. Scenario planning and proactive risk management are essential for navigating the complexities of the retail market and safeguarding long-term value.

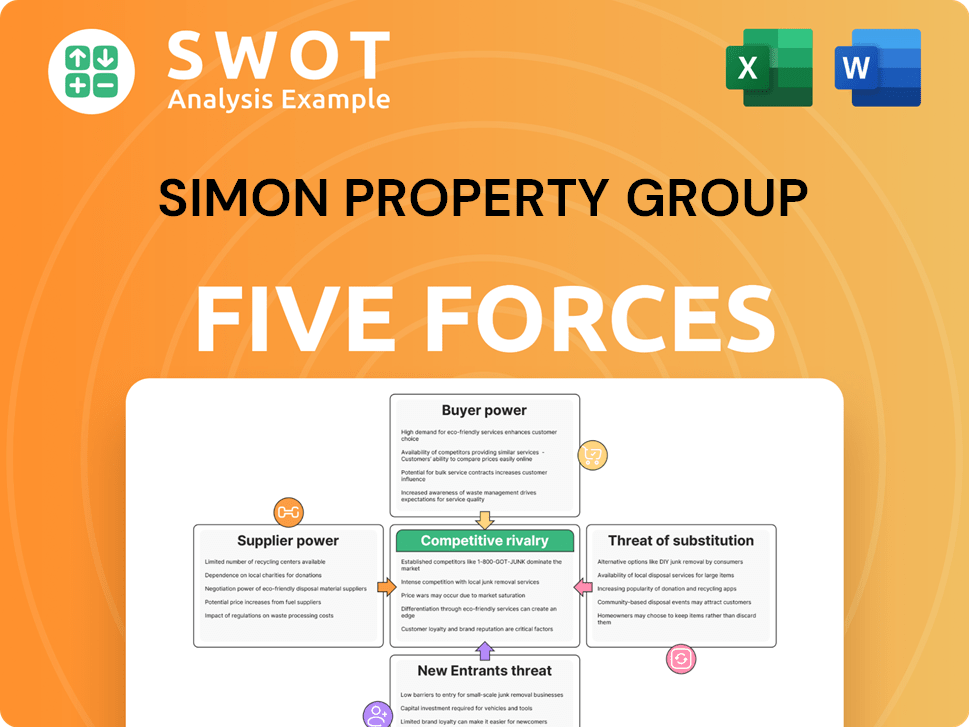

Simon Property Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simon Property Group Company?

- What is Competitive Landscape of Simon Property Group Company?

- How Does Simon Property Group Company Work?

- What is Sales and Marketing Strategy of Simon Property Group Company?

- What is Brief History of Simon Property Group Company?

- Who Owns Simon Property Group Company?

- What is Customer Demographics and Target Market of Simon Property Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.