SunPower Bundle

How has SunPower Reshaped the Solar Energy Landscape?

Born from a Stanford professor's vision, SunPower has etched its name into the annals of solar innovation. From its inception, the SunPower SWOT Analysis reveals a company driven by groundbreaking efficiency and a commitment to renewable energy. Its journey, marked by both triumphs and tribulations, offers a compelling narrative of technological advancement and strategic adaptation within the dynamic solar industry.

This exploration of the SunPower company will uncover the key milestones in its history, from its early years as a solar panel manufacturer to its current status as a leading residential solar installer. We'll examine the technological advancements that set SunPower apart, its strategic shifts, and the financial challenges it has overcome. Understanding the SunPower timeline provides valuable insights into the evolution of solar energy and the forces shaping the future of renewable power.

What is the SunPower Founding Story?

The SunPower company, a prominent player in the solar industry, has a compelling founding story. It began with a vision to enhance solar power efficiency, leading to a company that has significantly impacted the renewable energy sector. This section delves into the origins of SunPower, exploring its inception and early development.

SunPower's journey started in 1985. The company's foundation was built on groundbreaking research. This research laid the groundwork for SunPower's future innovations.

SunPower was officially founded on April 24, 1985, by Dr. Richard Swanson, an electrical engineering professor from Stanford University. His research focused on improving solar power efficiency, which led him to commercialize this technology.

- Initially named Eos, the company began with a modest $2,000 in capital from Swanson and his friend, Richard Crane.

- In 1989, Robert Lorenzini invested in the company and became its chairman, leading to the name change to SunPower.

- Early revenue came from research grants and the production of silicon wafers for semiconductor companies.

- A key early product was the A-300 solar cell, which achieved a 20% efficiency, attracting attention from investors.

- Swanson dedicated himself full-time to SunPower in 1991, leaving his academic position.

For more information about the target market of SunPower, you can read the article about the Target Market of SunPower.

SunPower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of SunPower?

The early years of the SunPower company were marked by significant growth, driven by strategic investments and advancements in solar technology. This period saw the company transform from a startup to a major player in the solar industry. Key financial moves and technological breakthroughs fueled its expansion, setting the stage for its future in the solar energy market.

In 2002, Cypress Semiconductor invested in SunPower, with initial funding of $8 million, eventually totaling approximately $150 million. This investment was crucial, and Cypress appointed Tom Werner as CEO in 2003. This strategic move provided the financial backing and leadership necessary for SunPower to scale its operations and advance its technological capabilities.

Demand for SunPower's products increased in the early 2000s, leading to substantial revenue growth. Revenues grew from $5 million in 2003 to $78.7 million in 2005. The company filed for an initial public offering (IPO) in 2005, raising $138.6 million, and achieved profitability for the first time in 2006, reporting revenues of $236.5 million.

During its expansion phase, SunPower relocated its headquarters to San Jose, California, and secured contracts with major retailers for solar panel installations. In 2007, the company announced plans to expand its manufacturing facility significantly. By 2007, SunPower's contribution accounted for half of Cypress Semiconductor's revenues, reaching $775 million.

In 2008, SunPower was spun off as an independent company from Cypress. Further expansion included the 2010 acquisition of Sunray Renewable Energy for $277 million. Despite a temporary market decline in 2011, revenues rebounded by 2013, leading to further manufacturing expansions. In 2014, SunPower secured $220 million from Bank of America and Merrill Lynch to support customer financing options, demonstrating continued growth and financial stability. For more information on the company's ownership, you can read about Owners & Shareholders of SunPower.

SunPower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in SunPower history?

The SunPower company has a significant history marked by numerous achievements and strategic shifts. This SunPower history reflects its evolution in the solar energy sector. The SunPower timeline showcases its adaptability and innovation within a dynamic market.

| Year | Milestone |

|---|---|

| 2015 | Completed the 579-megawatt Solar Star Projects in Southern California, one of the world's largest solar photovoltaic power plants. |

| 2019 | Announced a major strategic shift, spinning off its manufacturing division into Maxeon Solar Technologies. |

| 2022 | Sold its commercial and industrial solutions business to TotalEnergies. |

| 2024 | Filed for Chapter 11 bankruptcy protection in August due to financial difficulties. |

| 2025 | Complete Solaria Inc. rebranded as SunPower in April, reporting its first profitable quarter in Q1. |

SunPower is known for its innovative Maxeon solar cell technology, which enhances efficiency and durability. These panels are recognized for high efficiency, reaching up to 22.8%, and maintaining performance in extreme weather conditions.

The Maxeon solar cell technology is a key innovation, offering superior efficiency and durability.

SunPower panels are known for their high efficiency, reaching up to 22.8%, making them a leader in the solar panel manufacturer industry.

The unique cell design minimizes degradation, ensuring performance in extreme weather conditions.

SunPower secured over 450 patents, with some receiving the U.S. Patent and Trademark Office's Patents for Humanity award.

SunPower faced challenges, including market downturns and strategic missteps. A significant challenge was the acquisition of SolarBridge Technologies, which led to increased failure rates in AC modules. For more information on SunPower's position in the market, consider exploring the Competitors Landscape of SunPower.

The company experienced market declines in solar power purchases, leading to production cuts in 2011.

The acquisition of SolarBridge Technologies resulted in a significant increase in AC module failure rates, approximately reaching 20%.

The company filed for Chapter 11 bankruptcy protection in August 2024 due to financial difficulties and market pressures.

The 'new' SunPower reported its first profitable quarter in four years in Q1 2025, with $80.2 million in revenue and a $1.3 million profit.

SunPower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for SunPower?

The SunPower company has a rich history marked by innovation, strategic shifts, and financial challenges. From its inception in 1985 to its recent restructuring, the SunPower has navigated the evolving solar energy landscape, experiencing periods of growth, acquisitions, and significant transformations. The following timeline highlights key milestones in SunPower's journey, including pivotal moments in its development as a leading solar panel manufacturer.

| Year | Key Event |

|---|---|

| April 24, 1985 | Dr. Richard Swanson founded the company, initially named Eos. |

| 1989 | Robert Lorenzini invested and changed the company name to SunPower. |

| 2001 | T.J. Rodgers invested $750,000 to address the company's financial issues. |

| 2002 | Cypress Semiconductor acquired a controlling interest in SunPower. |

| 2003 | Tom Werner was appointed CEO. |

| 2005 | SunPower went public, raising $138.6 million through an IPO. |

| 2006 | The company achieved its first profitable year with $236.5 million in revenues. |

| 2007 | Acquired PowerLight for $332 million, expanding into large-scale solar installations. |

| 2008 | SunPower became an independent company after being spun off from Cypress. |

| 2010 | Acquired Sunray Renewable Energy for $277 million to expand in Europe. |

| 2011 | TotalEnergies acquired a controlling interest in SunPower for $1.37 billion. |

| 2012 | Founder Richard Swanson retired. |

| 2014 | Acquired SolarBridge Technologies and raised $220 million for customer financing. |

| 2019 | Announced the spin-off of its manufacturing division into Maxeon Solar Technologies. |

| 2020 | Maxeon Solar Technologies officially spun off. |

| February 2022 | Sold its commercial and industrial solutions business to TotalEnergies. |

| August 5, 2024 | SunPower filed for Chapter 11 bankruptcy protection. |

| September 30, 2024 | Complete Solaria acquired key assets for $45 million. |

| April 21, 2025 | Complete Solaria officially rebrands as SunPower, changing its Nasdaq ticker to SPWR. |

| Q1 2025 | The rebranded SunPower reported its first profitable quarter in four years, with $80.2 million in revenue and $1.3 million in profit. |

The 'new' SunPower, under T.J. Rodgers, aims to significantly increase its revenue. The goal is to grow the current annualized revenue run rate of over $300 million to more than $1 billion as quickly as possible. This ambitious target demonstrates a strong focus on expansion and market penetration.

Alongside revenue growth, the company is concentrating on sustained profitability. The strategy involves growing expenses at a much slower rate than revenue, aiming to achieve positive operating income. This approach is crucial for long-term financial health and investor confidence.

SunPower plans to regain its high technical standards by partnering with leading suppliers. Collaborations with companies like REC for solar panels and Enphase Energy for energy storage systems are key. These partnerships will help SunPower to offer cutting-edge products.

Now the fifth-largest residential solar installer in the U.S., SunPower intends to leverage its strong financial performance and partnerships. The aim is to differentiate itself in the market. This will enhance its position and drive further growth in the solar energy sector.

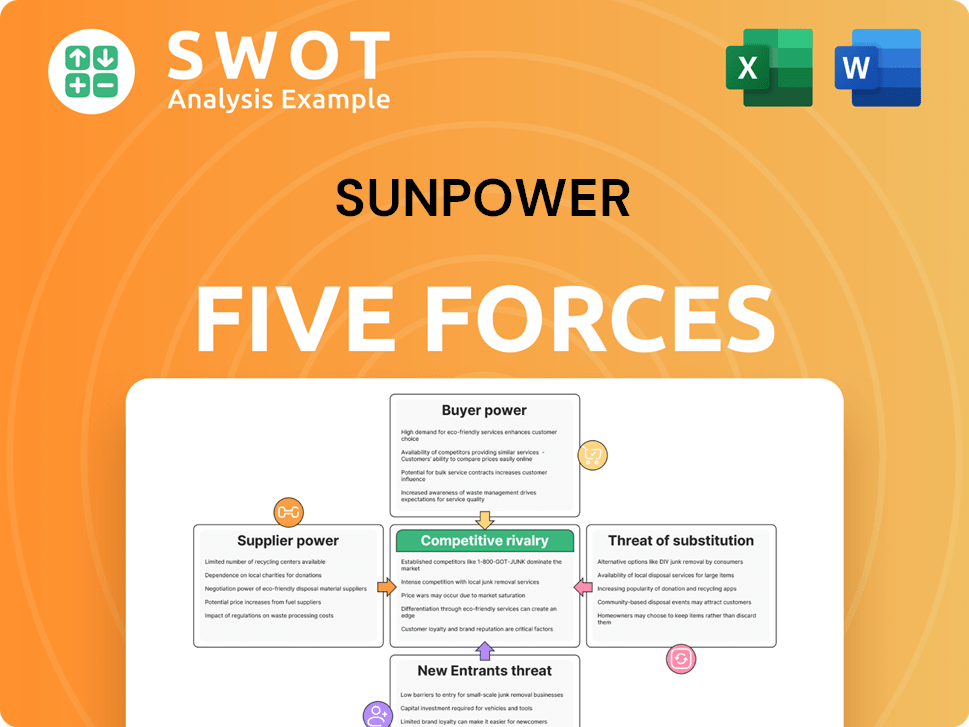

SunPower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of SunPower Company?

- What is Growth Strategy and Future Prospects of SunPower Company?

- How Does SunPower Company Work?

- What is Sales and Marketing Strategy of SunPower Company?

- What is Brief History of SunPower Company?

- Who Owns SunPower Company?

- What is Customer Demographics and Target Market of SunPower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.