SunPower Bundle

How Does SunPower Power the Future?

SunPower, a leading SunPower SWOT Analysis, has revolutionized the solar energy landscape, particularly in the residential sector. Its focus on high-efficiency

This exploration delves into the core of this

What Are the Key Operations Driving SunPower’s Success?

SunPower is a Solar power company that delivers value by offering integrated solar energy solutions, primarily to the residential sector. They focus on providing homeowners with solar panels, energy storage, and comprehensive services. This includes system design, installation, and ongoing maintenance, aiming to reduce electricity bills and increase energy independence.

The company's value proposition centers on helping customers lower their carbon footprint while also potentially increasing their home's value. They differentiate themselves in the competitive market through a seamless customer experience, from initial consultation to post-installation support. This approach, combined with a strong brand reputation, translates into optimized energy savings and a reliable power supply for their customers.

The operational processes behind SunPower's offerings are multifaceted. While historically involved in manufacturing its own solar cells and panels, the company has shifted towards a fabless model. This involves leveraging third-party manufacturers for panel production while concentrating on design, engineering, and system integration. This allows SunPower to focus on technology development, particularly in energy management software and battery storage integration. Their supply chain involves sourcing components globally and working with a network of certified dealers and installers for distribution and customer service.

SunPower offers high-efficiency solar panels, known for their aesthetic appeal and performance. They also provide the SunVault energy storage system for storing excess solar energy. Furthermore, the company offers complete services including system design, installation, monitoring, and maintenance to support homeowners.

SunPower uses a fabless manufacturing model, focusing on design and system integration. They emphasize a seamless customer experience, from initial consultation to post-installation support. The company also employs a proprietary energy management platform that integrates solar generation, storage, and home energy consumption.

Customers benefit from optimized energy savings and enhanced home value. They gain increased energy independence and a reduced carbon footprint. SunPower systems provide a reliable power supply, differentiating the company in the Residential solar market.

SunPower has a strong brand reputation for quality and efficiency in the solar energy market. They compete with other Solar power company providers by offering integrated solutions. Their focus on customer experience and technology sets them apart.

In Q1 2024, SunPower reported $304.9 million in revenue, demonstrating continued market presence. The company is focused on expanding its residential customer base. They are also investing in technology to improve SunPower solar panel efficiency ratings.

- SunPower's focus on high-efficiency panels and energy storage solutions aims to increase energy savings for homeowners.

- The company's strategic partnerships and dealer network are key to its distribution and customer service model.

- SunPower continues to innovate in energy management software to offer integrated solutions for home energy needs.

- The company's financial performance in 2024 reflects its efforts to adapt to market dynamics and enhance customer value.

SunPower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SunPower Make Money?

The core of the company's revenue generation revolves around the sale and installation of residential solar energy systems. This includes the direct sale of high-efficiency Solar panels, inverters, and energy storage solutions like the SunVault battery. Installation services also contribute significantly to their revenue streams.

Beyond direct sales, the company generates recurring revenue through monitoring and maintenance services for its installed systems. This provides a stable income stream, complementing the initial sales and installation revenue. The company focuses on offering comprehensive, integrated solutions to its customers.

The company's monetization strategies involve offering comprehensive, integrated solutions rather than just individual components. This often involves bundled services where the cost of equipment, installation, and software is presented as a single package. The company also utilizes tiered pricing models for its Solar panels and storage solutions, allowing customers to choose systems that align with their energy needs and budget.

The primary source of revenue comes from selling and installing Solar panels and associated equipment. This includes the sale of inverters and battery storage systems.

Recurring revenue is generated through monitoring and maintenance services. This provides a steady income stream after the initial installation.

Offering bundled services, including equipment, installation, and software, simplifies the purchasing process for customers.

Tiered pricing models allow customers to select systems that match their energy needs and financial constraints.

Financing options like solar leases and power purchase agreements (PPAs) make Solar energy accessible with little to no upfront cost.

Exploring participation in virtual power plant initiatives to generate revenue through grid services.

The company has explored various financing options, including solar leases and power purchase agreements (PPAs) through third-party financial partners. These options enable homeowners to adopt Solar energy with minimal upfront costs. This approach broadens the customer base and accelerates the adoption of Solar power company solutions. The expansion in revenue sources is notable, with an increased emphasis on energy storage solutions and potential future involvement in virtual power plant initiatives. To understand more about the company's strategic growth, consider reading about the Growth Strategy of SunPower.

The company's success hinges on a multi-faceted approach to revenue generation and customer acquisition.

- Direct sales and installation of Solar panels and related equipment.

- Recurring revenue from monitoring and maintenance services.

- Bundled service offerings that combine equipment, installation, and software.

- Tiered pricing models to cater to various customer budgets.

- Innovative financing options, such as leases and PPAs, to reduce upfront costs.

- Exploration of virtual power plant initiatives for future revenue streams.

SunPower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped SunPower’s Business Model?

The journey of Owners & Shareholders of SunPower has been marked by significant milestones that have shaped its operations and financial performance. A pivotal strategic move was its decision to divest its commercial and industrial solutions business in 2020 and its international residential and light commercial business in 2021, allowing it to focus almost exclusively on the North American residential solar market. This sharpened its operational focus and streamlined its business model.

The launch and continuous development of its SunVault energy storage system represent a key product milestone, addressing the growing demand for energy resilience and independence among homeowners. The company has navigated operational challenges such as supply chain disruptions, particularly impacting the availability and cost of components in recent years. SunPower has responded by diversifying its supplier base and optimizing logistics to mitigate these impacts.

Its competitive advantages are multifaceted: a strong brand reputation built on high-efficiency, aesthetically pleasing solar panels, a robust network of certified dealers and installers ensuring quality installations, and proprietary energy management software that integrates solar and storage seamlessly. SunPower's continuous adaptation to new trends is evident in its embrace of smart home energy management and its exploration of virtual power plant capabilities. Its focus on a premium, integrated offering for the residential market allows it to differentiate itself from competitors that may focus solely on component sales or large-scale projects.

SunPower's key milestones include strategic shifts like divesting from commercial and international markets to concentrate on the North American residential sector. The introduction of the SunVault energy storage system is another critical achievement, enhancing its product offerings and market position. These moves have been instrumental in shaping its operational strategy and market focus.

Strategic moves include a focused approach on the residential solar market, streamlining operations and enhancing its ability to cater to homeowner needs. The company has also actively worked on managing supply chain challenges by diversifying suppliers and improving logistics. These steps have been crucial in maintaining its competitive edge in the SunPower industry.

SunPower's competitive advantages include a strong brand reputation, high-efficiency solar panels, and a network of certified installers. Its proprietary energy management software and focus on premium, integrated offerings further differentiate it. Continuous innovation in smart home energy management and virtual power plant capabilities also contribute to its market strength.

In recent years, SunPower has shown resilience by adapting to supply chain issues, diversifying its supplier base, and optimizing logistics. The company continues to innovate in energy management software and explore virtual power plant technologies. These efforts are aimed at maintaining its leadership in the residential solar market.

SunPower distinguishes itself through its high-efficiency solar panels and integrated energy solutions, focusing on premium offerings for the residential market. The company's strong brand reputation and a network of certified installers ensure quality and customer satisfaction. Their strategic focus on the residential sector allows for a more tailored approach compared to competitors.

- High-Efficiency Solar Panels: Provides superior energy production compared to standard panels.

- Integrated Energy Solutions: Offers a complete system including solar panels, storage, and energy management.

- Strong Dealer Network: Ensures quality installation and customer service through certified installers.

- Focus on Residential Market: Specializes in meeting the unique needs of homeowners.

SunPower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is SunPower Positioning Itself for Continued Success?

The company holds a significant position in the North American residential solar energy market, known for premium products and integrated solutions. It often operates at a higher price point due to its efficiency and comprehensive service offerings. Strong customer loyalty is a key strength, driven by the perceived quality and reliability of its systems and its extensive dealer network. Understanding the Target Market of SunPower is crucial to understanding its industry position.

However, the company faces several risks. Regulatory changes, such as shifts in net metering policies or solar incentives, can significantly impact demand and profitability. Intense competition from other solar power company installers and panel manufacturers poses an ongoing threat. Technological disruption could render existing products less competitive if not continually innovated upon. Macroeconomic factors like interest rate fluctuations and changing consumer preferences could also impact its operations and revenue.

The company is a key player in the residential solar market. It is recognized for premium products, often commanding a higher price. Its strong dealer network contributes to its market presence.

Regulatory changes and competition pose significant challenges. Technological advancements require continuous innovation. Macroeconomic factors, such as interest rates, can impact the solar panels industry.

The company's future is tied to energy storage, software platforms, and dealer network expansion. It aims to deliver a superior customer experience. Focus is on recurring revenue and integration into the smart home ecosystem.

Expanding energy storage solutions is a key focus. Enhancing software for energy management is a priority. Strengthening the dealer network is crucial for growth.

The company is strategically positioned in the premium residential solar market. It faces risks from regulatory changes, competition, and technological disruption. Its future outlook depends on strategic initiatives in energy storage and software.

- Continued innovation in solar panel technology is essential.

- Expansion of energy storage solutions is a key growth area.

- Strengthening the dealer network is crucial for market reach.

- Adapting to changing consumer preferences and market dynamics is vital.

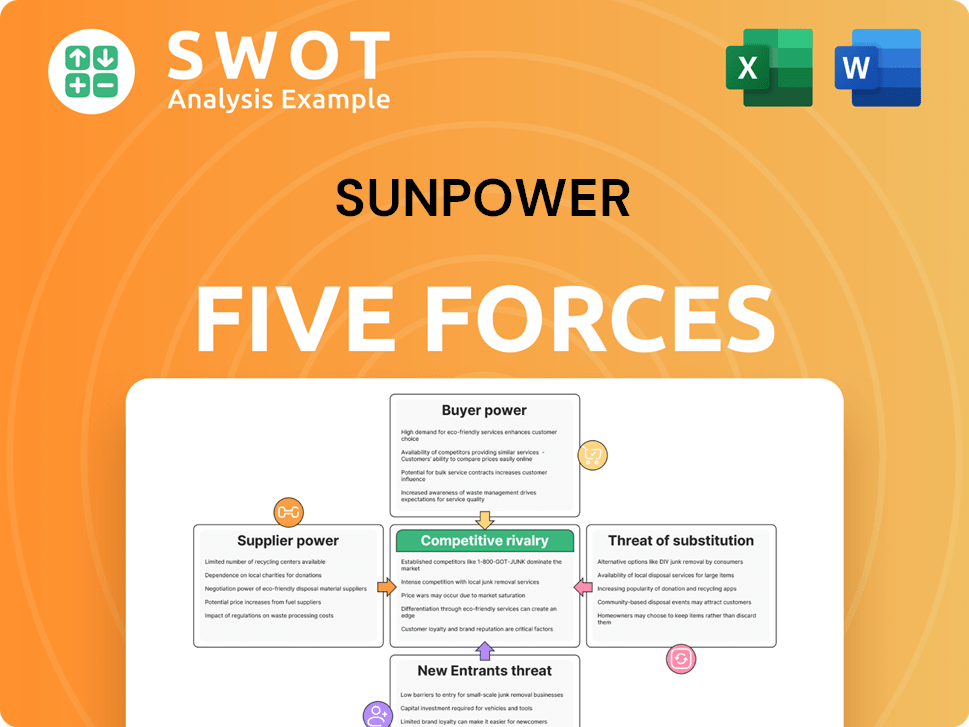

SunPower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SunPower Company?

- What is Competitive Landscape of SunPower Company?

- What is Growth Strategy and Future Prospects of SunPower Company?

- What is Sales and Marketing Strategy of SunPower Company?

- What is Brief History of SunPower Company?

- Who Owns SunPower Company?

- What is Customer Demographics and Target Market of SunPower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.