SunPower Bundle

Can SunPower Reclaim Its Solar Power Throne?

The solar energy market is booming, with projections indicating massive growth by the end of the decade. Amidst this expansion, SunPower, a company synonymous with solar innovation, is charting a new course. This SunPower SWOT Analysis delves into the company's strategic repositioning and future outlook in the dynamic renewable energy industry.

Having navigated significant challenges, including a recent acquisition and rebranding, the 'new' SunPower is poised to leverage its brand recognition and market position. This SunPower company analysis explores how the company plans to capitalize on the expanding solar energy market, focusing on its growth strategy and innovative solar technologies to secure a sustainable future. Understanding SunPower's business model and strategy is crucial for investors considering the long-term investment outlook of this key player in the solar sector.

How Is SunPower Expanding Its Reach?

The SunPower growth strategy is primarily focused on expanding its presence within the U.S. residential solar market. This involves several strategic initiatives aimed at increasing market share and enhancing customer offerings. The company is leveraging partnerships, product diversification, and strategic market entries to capitalize on the growing demand for solar energy solutions.

A key aspect of SunPower's expansion involves deepening relationships with established solar sales firms. This approach allows SunPower to reach a broader customer base and improve sales efficiency. Furthermore, the company is actively targeting new regional markets across the United States, bolstering its dealer networks and customer support capabilities to facilitate local-level growth. The company's strategy also includes expanding its product portfolio beyond solar panels.

SunPower is positioning itself as a comprehensive clean energy provider. This includes offering battery storage systems, smart energy management tools, and upcoming EV charging integration. This diversification aims to cater to the evolving energy needs of modern homeowners and create new revenue streams.

SunPower is collaborating with leading solar sales firms, such as Sunder Energy, to enhance customer acquisition and sales processes. This partnership strategy is expected to boost performance in the second half of 2025. These collaborations are essential for streamlining operations and expanding market reach within the competitive solar energy market.

The company is actively entering new regional markets across the U.S. by establishing and strengthening its dealer networks. This localized approach is supported by enhanced customer support capabilities. This expansion strategy is crucial for capturing growth opportunities and increasing SunPower's presence in key solar markets.

SunPower is expanding its product lineup to offer more holistic energy solutions. This includes battery storage systems, smart energy management tools, and upcoming EV charging integration. This diversification aims to position SunPower as a comprehensive clean energy provider, catering to the evolving energy needs of modern homeowners.

A significant area of expansion is the company's New Homes division. This division partners with national homebuilders like KB Home and Lennar to pre-install solar systems in new properties. This initiative aligns with a key growth segment in the solar industry, as over 70% of new single-family homes in solar-friendly states like California now include pre-wired solar systems.

SunPower's expansion initiatives are designed to capitalize on the growing demand for solar energy solutions. The company is focusing on strategic partnerships, market diversification, and product innovation to drive growth and increase market share. These strategies are essential for navigating the competitive renewable energy industry.

- Deepening partnerships with solar sales firms to enhance customer acquisition.

- Entering new regional markets through dealer network expansion and improved customer support.

- Diversifying product offerings to include battery storage, smart energy management, and EV charging solutions.

- Focusing on the New Homes division, partnering with homebuilders to pre-install solar systems.

SunPower SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SunPower Invest in Innovation?

The company's growth strategy centers on innovation and technology, particularly its high-efficiency solar solutions. This approach targets customers who prioritize performance and longevity in their solar investments. The focus on advanced technology and comprehensive energy solutions positions the company to meet evolving customer needs in the renewable energy industry.

SunPower's strategy is designed to provide greater energy independence and efficiency to its customers. This is achieved through a combination of high-efficiency solar panels, battery storage systems, and smart energy management tools. The company's commitment to innovation is supported by significant investments in research and development.

The company's focus on premium customers who value high efficiency is a key aspect of its business model. The company's panels are designed to offer 20-30% greater energy output per square foot compared to standard models. The company's ability to simplify the buying process through a new digital platform introduced in 2025 further enhances its customer-centric approach.

The company's core innovation lies in its high-efficiency solar panels. These panels are designed to maximize energy output, appealing to customers who prioritize performance and space efficiency. This technology is central to their market strategy.

Ongoing investments in research and development (R&D) are crucial. These investments drive the development and commercialization of advanced solar technologies. The company continues to explore new advancements.

The company is expanding its offerings to include battery storage systems and smart energy management tools. Future plans include integrating EV charging solutions. This expansion aims to provide comprehensive energy solutions.

The introduction of a new digital platform in 2025 simplifies the buying journey. This platform provides personalized solar quotes in minutes. This enhances the customer experience.

The leadership team includes individuals with strong technical backgrounds. Richard Swanson, the founder and a technical advisor, and Dr. Mehran Sedigh, the new CTO, bring expertise in technology and storage. Their expertise supports innovation.

The company extends its supply agreements for advanced panel technologies, such as the Maxeon 6 interdigitated back contact (IBC) panels, through 2025. This ensures supply to meet residential solar demand in the US.

The company's innovation and technology strategy is multifaceted, encompassing advanced solar panels, energy solutions, and customer experience enhancements. These elements are critical to the company's long-term growth and competitive advantage in the solar energy market. For more details, you can read about the Mission, Vision & Core Values of SunPower.

- High-Efficiency Panels: Continued development and deployment of high-efficiency solar panels to meet premium customer demand.

- Energy Storage and Management: Expansion into battery storage and smart energy management to provide comprehensive energy solutions.

- Digital Platform: Use of a digital platform to streamline the customer buying experience and offer personalized quotes.

- R&D Investments: Ongoing investment in research and development to drive innovation and commercialization of new technologies.

- Strategic Partnerships: Collaboration with technology and supply chain partners to ensure access to the latest advancements.

SunPower PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is SunPower’s Growth Forecast?

The financial outlook for SunPower demonstrates a significant turnaround, with the company achieving its first profitable quarter in four years. This positive shift is a direct result of strategic cost-cutting measures and a focus on operational efficiency. The company's ability to achieve profitability in a traditionally slow quarter highlights the effectiveness of its restructuring efforts and its potential for sustained growth in the solar energy market.

SunPower's revenue for Q1 2025 reached $80.2 million, aligning with expectations despite the seasonal challenges. This performance, coupled with the company's strategic initiatives, positions it favorably within the competitive landscape of the renewable energy industry. The company's focus on residential solar solutions and commercial solar installations is key to its future prospects.

The company's financial health is further supported by a cash balance of $14.0 million at the end of Q1 2025, a slight increase from the previous quarter. This financial stability provides a solid foundation for continued investment in innovative solar technologies and expansion plans. For a deeper understanding of the company's origins, you can explore the Brief History of SunPower.

SunPower reported an operating profit of $1.3 million in Q1 2025, marking a significant financial milestone. The company's revenue for the same period was $80.2 million.

Significant cost reductions were implemented, including a workforce reduction from nearly 3,499 employees to 906 by Q1 2025, with a target of 881. Management anticipates that two-thirds of the $100 million in operating expense and cost of goods sold reductions will recur annually.

The company projects steady revenue and positive operating income for the next quarter. SunPower aims to achieve operating income breakeven in Q2 2025.

With an annualized revenue run rate exceeding $300 million, SunPower is the fifth-largest U.S. residential solar installer. Analysts expect a reduction in loss per share, from $0.91 in 2023 to $0.04 in 2025.

The company's focus on reducing costs and improving operational efficiency is evident in its financial performance. The company's strategic initiatives are aimed at improving profit margins and achieving sustainable growth within the renewable energy industry.

- Operating profit of $1.3 million in Q1 2025.

- Revenue of $80.2 million in Q1 2025.

- Cash balance of $14.0 million at the end of Q1 2025.

- Anticipated up to a 37% decline in overall equipment expense.

- Aim to grow cash from operations during 2025.

SunPower Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow SunPower’s Growth?

The path for the company, despite its strategic initiatives, is fraught with potential risks. The solar energy market is intensely competitive, with established players vying for market share. The company's focus on high-efficiency panels must effectively differentiate it within a crowded field to ensure sustainable growth.

External factors such as regulatory changes and macroeconomic conditions, including rising interest rates, present significant challenges. Geopolitical risks and trade policies add further uncertainty, potentially impacting the company's expansion plans and overall financial health. These external elements require careful navigation to mitigate their adverse effects.

Supply chain vulnerabilities and the need to maintain profitability are key considerations for the company. The company's past struggles, including a liquidity crisis and bankruptcy filing in August 2024, underscore its sensitivity to market demand and access to capital. The company must demonstrate consistent positive cash flow to secure its future.

The solar energy market is highly competitive, with major players like SunRun and Freedom Forever holding significant market share in the U.S. residential sector. Intense competition can pressure pricing and margins, impacting the company's financial performance. Differentiating through high-efficiency panels is crucial, but it requires effective marketing and customer acquisition strategies.

Changes in net metering rules and other solar incentives can significantly impact the renewable energy industry. Policy shifts can affect demand and profitability, as seen in the company's past financial difficulties. Monitoring and adapting to evolving regulatory landscapes are essential for sustained growth and market share.

Rising interest rates increase the cost of solar investments for homeowners, potentially dampening demand. Geopolitical risks and protectionist tariffs can disrupt supply chains and increase costs. These factors can introduce volatility and uncertainty, affecting the company's SunPower future prospects and overall financial stability.

Global supply chain disruptions and component shortages can impact the production and delivery of solar panels. While the company has diversified its supply chain, ongoing disruptions pose risks to profitability. Maintaining a resilient supply chain is critical for meeting customer demand and managing costs effectively.

The company's past liquidity crisis and bankruptcy filing in August 2024 highlight its sensitivity to market demand and access to capital. Maintaining profitability and consistent positive cash flow is crucial. The recent deficiency notice from Nasdaq underscores the importance of timely financial reporting and operational efficiency.

The company must demonstrate consistent positive cash flow to secure its future and reassure investors. The focus on high-efficiency panels aims to attract premium customers and improve profitability. The SunPower company analysis must include cost management and operational efficiency.

The solar energy market is dominated by competitors like SunRun and Freedom Forever, who have a strong hold on the U.S. residential solar market. The company's success depends on its ability to differentiate itself and capture market share from these established players. Effective marketing and competitive pricing are essential for success.

The company's financial performance is critical for its long-term viability. The company must maintain profitability and positive cash flow to avoid future financial distress. The company's restructuring efforts and cost-cutting measures must yield positive results to ensure financial stability and SunPower growth strategy.

Efficient operations, including supply chain management and cost control, are essential for profitability. Disruptions in the supply chain can impact production and increase costs, affecting the company's ability to meet customer demand. Streamlining operations and managing costs are critical for success.

External factors, such as regulatory changes and macroeconomic conditions, can significantly impact the SunPower stock and the company's financial performance. The company must be prepared to adapt to these changes and mitigate their effects. Understanding and responding to external factors are key to long-term success. For more details, consider exploring the Revenue Streams & Business Model of SunPower.

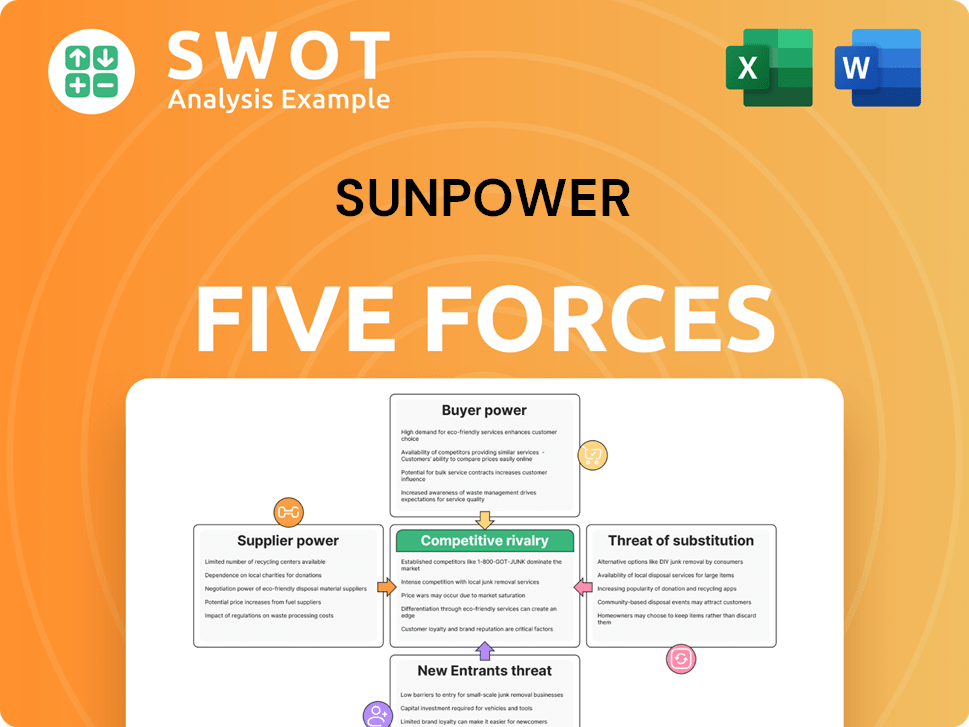

SunPower Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SunPower Company?

- What is Competitive Landscape of SunPower Company?

- How Does SunPower Company Work?

- What is Sales and Marketing Strategy of SunPower Company?

- What is Brief History of SunPower Company?

- Who Owns SunPower Company?

- What is Customer Demographics and Target Market of SunPower Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.