Target Bundle

How Did Target Become a Retail Powerhouse?

Target Corporation's story is one of remarkable transformation, from its roots to its current standing as a retail giant. The company's journey began in 1902 with George Draper Dayton's vision in Minneapolis, Minnesota. This brief history of Target company's founding reveals the strategic decisions that shaped its evolution.

Understanding Target's business background is crucial for investors and strategists alike. Over the years, Target's growth and expansion over time have been marked by key milestones, solidifying its place in the market. For a deeper dive into its strategic positioning, consider exploring a comprehensive Target SWOT Analysis.

What is the Target Founding Story?

The story of Target Corporation, a prominent retail giant, began in the early 20th century. Its roots trace back to George Draper Dayton, who established the Dayton Dry Goods Company in Minneapolis, Minnesota.

This foundation set the stage for the emergence of Target, an innovative concept in the retail landscape. The vision was to offer quality products at affordable prices, coupled with an exceptional customer experience.

The Owners & Shareholders of Target have played a significant role in shaping the company's trajectory.

The Target history began in 1902 when George Draper Dayton acquired the Goodfellow Dry Goods store in Minneapolis, Minnesota.

- In 1903, the company was renamed the Dayton Dry Goods Company.

- The name was later shortened to the Dayton Company in 1910.

- John F. Geisse developed the concept for Target.

- The first Target store opened on May 1, 1962, in Roseville, Minnesota.

- The name 'Target' and the bullseye logo were created by Stewart K. Widdess.

- Douglas Dayton was the first president of Target.

- The initial business model was 'Upscale Discount'.

- At the end of its first year, Target had four stores, all in Minnesota.

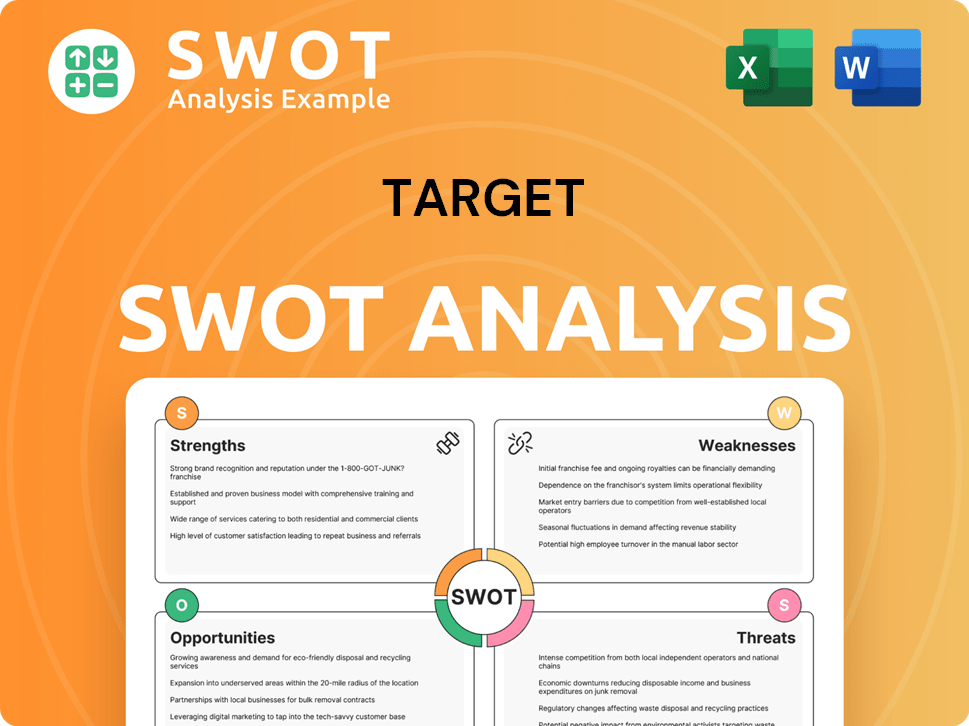

Target SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Target?

The early growth and expansion of the company, now known as Target Corporation, marked a pivotal phase in its history. The company's strategy from the outset was to differentiate itself by emphasizing high quality alongside low prices. This approach helped the discount chain grow rapidly, establishing it as a significant player in the retail industry. Understanding the Growth Strategy of Target provides further insights into its development.

In 1956, the Dayton Company, the parent of Target, opened Southdale Mall in Minneapolis, the nation's first fully enclosed shopping center. This innovative move redefined retail by consolidating competitors under one roof. This early venture set the stage for future expansion and success, showcasing the company's forward-thinking approach to business.

Following the successful launch of the first Target store in 1962, the discount chain expanded quickly. Within eight years, Target had grown to include 24 stores. This rapid growth demonstrated the effectiveness of its business model and its appeal to consumers seeking quality products at affordable prices.

In 1966, Target expanded beyond Minnesota, opening two stores in Denver, with sales exceeding $60 million. The Dayton Company also launched the B. Dalton Bookseller specialty chain in the same year. The parent company was reorganized as Dayton Corporation in 1967, going public with its first offering of common stock.

Further expansion occurred in 1968 with the acquisition of department stores in Oregon and Arizona, and the merger of Pickwick Book Shops with B. Dalton. In 1969, Dayton Corporation merged with the J.L. Hudson Company of Detroit, forming the Dayton-Hudson Corporation. This entity acquired other national brands, including Shoppers Mart, Marshall Field's, and Mervyn's.

By 1970, the company had four Dayton Company stores and four discount Target Stores. By 1975, Target had become the leading revenue producer for Dayton-Hudson. Annual sales reached $1 billion by 1979. The company continued its nationwide expansion throughout the 1980s, solidifying its position as a major retail giant.

The early years of Target Corporation were characterized by strategic decisions and rapid expansion. The company's focus on quality and value, combined with innovative moves like the Southdale Mall, set the stage for long-term success. This approach helped establish Target's strong market position.

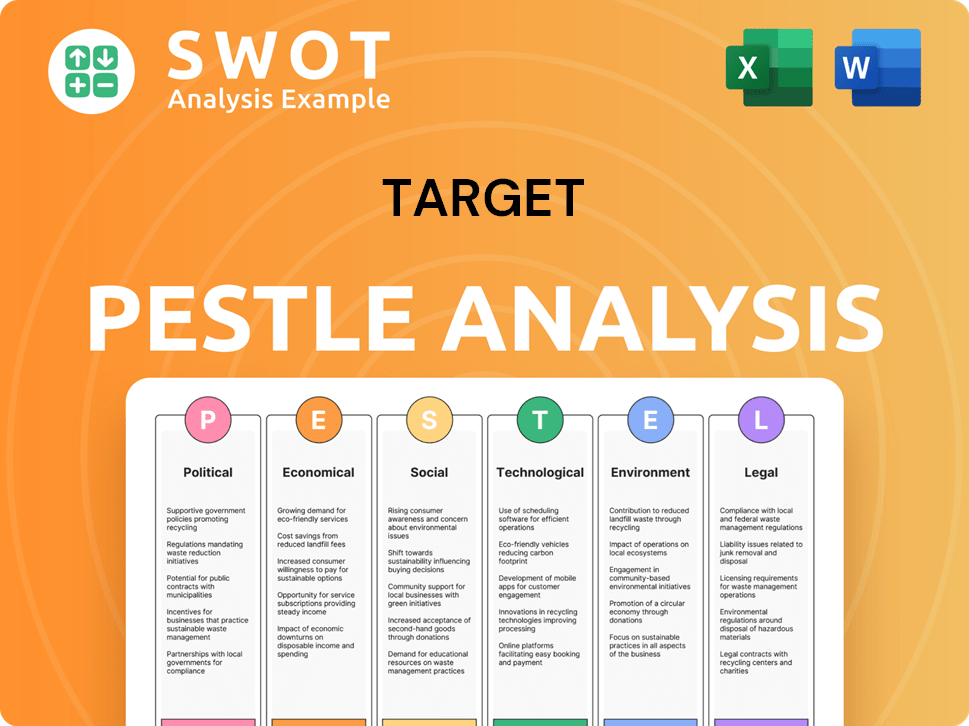

Target PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Target history?

The Target Corporation has a rich Target history, marked by significant growth and strategic shifts. The Target store has evolved from its early days to become a leading retail giant. Understanding the Target history provides valuable insights into its current market position and future prospects, offering a comprehensive view of its journey.

| Year | Milestone |

|---|---|

| 1902 | The company was founded as the Dayton Dry Goods Company in Minneapolis, Minnesota, by George Dayton. |

| 1962 | The first Target store opened in Roseville, Minnesota, introducing the 'upscale discount' concept. |

| 1990s | Expanded nationally, establishing a significant presence across the United States. |

| 2000s | Focused on private-label brands and design collaborations, enhancing its brand appeal. |

| 2010s | Launched its expansion into Canada, later withdrawing due to financial challenges. |

| 2024 | Lowered prices on over 10,000 items and continued to invest in its data foundation and architecture. |

Target Corporation has consistently pursued innovation to differentiate itself in the competitive retail market. A key innovation was its 'upscale discount' strategy, which combined low prices with stylish merchandise, setting a new standard in the industry.

The introduction of the 'upscale discount' strategy was a major innovation, offering chic appeal at low prices. This approach set the Target store apart from competitors by providing a unique value proposition.

The development of private label brands, with 48 private brands like Good & Gather and Threshold, enhanced differentiation. This strategy allowed Target Corporation to control quality and pricing, boosting customer loyalty.

Partnerships with fashion designers for limited-edition clothing lines made design accessible and affordable. These collaborations attracted a broader customer base and strengthened Target's brand image.

In 2024, Target lowered prices on over 10,000 items, emphasizing affordability within its owned brand portfolio. This initiative aimed to attract value-conscious consumers and boost sales.

Investing heavily in its data foundation and architecture to effectively deploy AI is another key area of innovation. This focus allows for improved digital experiences and more efficient operations.

Despite its successes, Target Corporation has faced several challenges throughout its Target history. Operating profitability has declined over the past decade, influenced by inventory shrink and increased digital penetration. In 2013, a major data breach significantly impacted the company's reputation and customer trust.

Operating profitability has faced headwinds due to inventory challenges and increased digital shopping trends. These factors have put pressure on profit margins in recent years.

The 2013 credit and debit card data breach was a major setback, impacting customer trust and brand reputation. This incident highlighted the importance of data security in the retail sector.

The expansion into Canada proved unprofitable due to supply chain issues and consumer shopping behaviors. This venture resulted in significant financial losses and operational difficulties.

The rollback of Diversity, Equity, and Inclusion (DEI) initiatives in early 2025 led to criticism and a consumer boycott, resulting in a $12.4 billion drop in market value by the end of February 2025. This situation highlighted the importance of aligning business practices with consumer values.

Target is aiming for $2 billion to $3 billion in cost savings over the next few years. This focus on efficiency is crucial for maintaining profitability and navigating economic challenges.

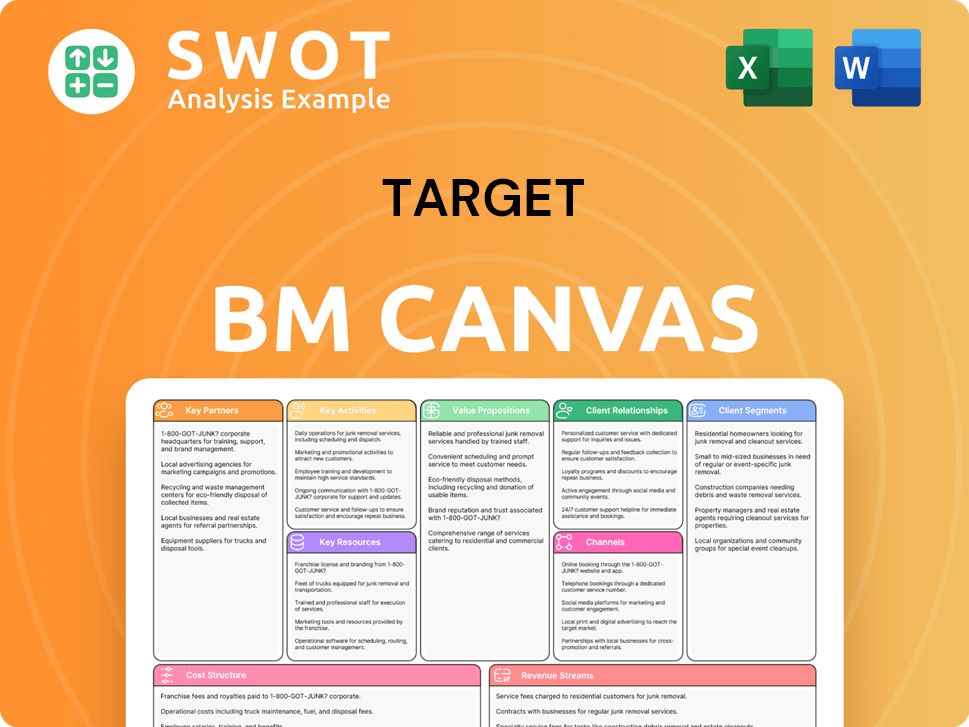

Target Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Target?

The Target history is marked by significant milestones, from its early days as the Dayton Dry Goods Company to its current status as a leading retail giant. This evolution showcases the Target Corporation's adaptability and commitment to growth. The Target store has become a household name through strategic expansions, innovative offerings, and a focus on customer experience.

| Year | Key Event |

|---|---|

| 1902 | George Draper Dayton founded the Dayton Dry Goods Company in Minneapolis, marking the beginning of the company's journey. |

| 1962 | The first Target discount store opened in Roseville, Minnesota, introducing the Target brand to consumers. |

| 1979 | Target's annual sales reached $1 billion, demonstrating significant growth and market penetration. |

| 1995 | The first SuperTarget store, including a full-service grocery, opened in Omaha, Nebraska, expanding its offerings. |

| 2000 | Dayton-Hudson Corporation was renamed Target Corporation, reflecting its core business focus. |

| 2014 | Brian Cornell became CEO, steering the company through strategic initiatives and expansions. |

| 2024 | Target opened 23 new stores and achieved 0.1% comparable sales growth, showing continued expansion. |

Target aims to drive over $15 billion in sales growth by 2030 through multi-channel business investments. The company plans to open over 300 new stores in the next decade, with approximately 20 new stores planned for 2025. Investments between $4 billion and $5 billion are planned for 2025 in stores, supply chain, and technology.

Target is expanding on-trend and affordable assortments, enhancing the Target Plus marketplace to over $5 billion by 2030. It plans to double the size of its in-house media company, Roundel, by 2030 and invest in AI-driven personalization. The company is also modernizing inventory management with AI-powered technology.

The revamped Target Circle loyalty program, Target Circle 360, launched on April 7, 2024, to enhance the customer experience. For full-year 2025, the company anticipates GAAP and Adjusted EPS between $8.80 and $9.80. The company's focus remains on leveraging stores as fulfillment hubs, with over 96% of total sales fulfilled by stores.

Target projects net sales growth around 1% and comparable sales growth around flat for 2025. This outlook reflects the company's strategic investments and initiatives aimed at driving long-term growth and enhancing its market position. The company continues to build on its legacy of value and customer focus.

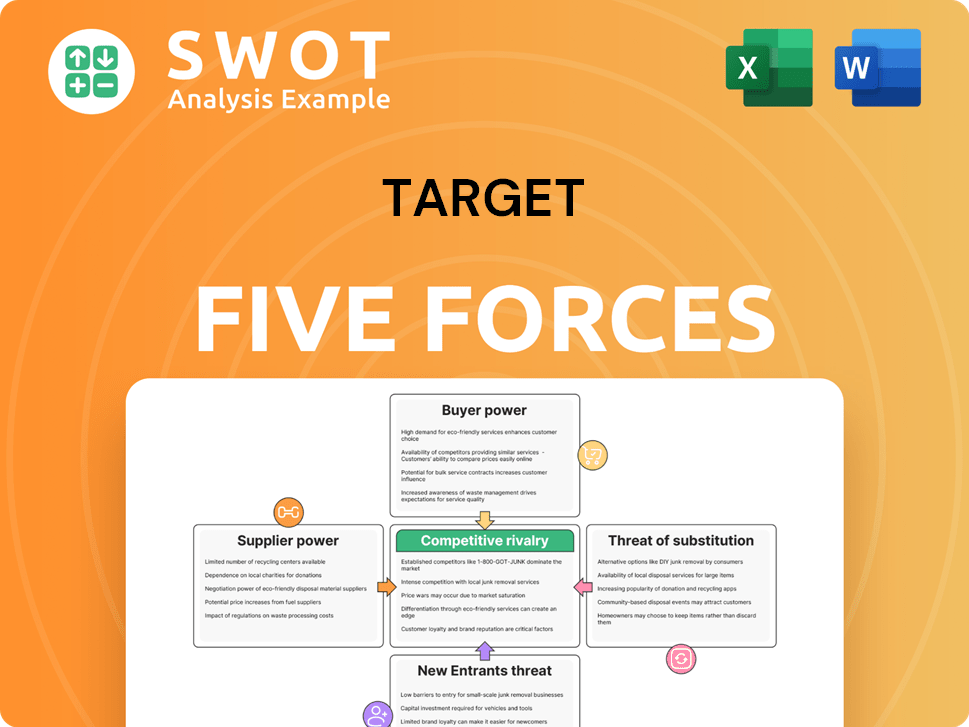

Target Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Target Company?

- What is Growth Strategy and Future Prospects of Target Company?

- How Does Target Company Work?

- What is Sales and Marketing Strategy of Target Company?

- What is Brief History of Target Company?

- Who Owns Target Company?

- What is Customer Demographics and Target Market of Target Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.