Target Bundle

How Does Target Stack Up in Today's Retail Arena?

Target, a retail giant since 1902, has consistently adapted to remain a top player in the U.S. market. From its humble beginnings as the Dayton Dry Goods Company to its current nationwide presence, Target's journey is a testament to its strategic evolution. But how does this iconic brand navigate the complex world of market competition?

To truly understand Target's success, we must delve into its competitive landscape. This analysis will explore Target's market position, identifying key competitors and evaluating its competitive advantage. For a deeper dive into Target's strategic positioning, consider exploring a comprehensive Target SWOT Analysis. We'll examine how Target differentiates itself and what strategies it employs to maintain its market share in the face of industry rivals and evolving consumer preferences.

Where Does Target’ Stand in the Current Market?

Target Corporation maintains a robust market position within the U.S. general merchandise retail sector. It competes with other major retailers, consistently ranking among the top players in the United States. Its operations are streamlined under a single segment, focusing on its extensive network of physical stores and its growing digital presence. This structure allows for a unified approach to its market strategy.

The company's product offerings are diverse, including apparel, home goods, electronics, beauty products, and a significant food and beverage selection. Target's geographic reach spans all 50 U.S. states and the District of Columbia, ensuring broad accessibility for its customer base. It primarily serves a diverse customer segment, often targeting families and individuals looking for a blend of quality, style, and value. Understanding the Target Market of Target is essential for analyzing its competitive strategy.

Target has strategically differentiated itself by focusing on private label brands and exclusive designer collaborations, positioning itself as a curated and design-forward discount retailer. This approach sets it apart from more traditional discount retailers. Furthermore, the company has invested heavily in digital transformation, enhancing its e-commerce capabilities and integrating online and in-store experiences to meet evolving consumer preferences. Target's financial health is demonstrated by its total revenue, which was $107.4 billion for fiscal year 2023, ending February 3, 2024.

Target consistently ranks among the top general merchandise retailers in the United States. While specific market share figures fluctuate by product category, the company maintains a significant presence. Its growth potential is tied to its ability to adapt to market trends and consumer demands.

Target's competitive strategy emphasizes private label brands and exclusive collaborations. This approach helps differentiate it from competitors and attract a specific customer base. Digital transformation is also a key focus, enhancing its e-commerce capabilities.

Target operates in all 50 U.S. states and the District of Columbia, providing broad accessibility to its customer base. The company's nationwide presence supports its overall market position. It continues to optimize its store footprint and supply chain.

Target primarily serves a diverse customer segment, often appealing to families and individuals. The company focuses on providing a balance of quality, style, and value to meet the needs of its target demographic. This focus helps maintain customer loyalty.

Target's financial performance reflects its strong market position and operational efficiency. The company's total revenue for fiscal year 2023 was $107.4 billion. Its future outlook depends on its ability to adapt to changing market conditions and consumer preferences.

- Target's revenue demonstrates its substantial scale compared to industry averages.

- The company focuses on optimizing its store footprint and supply chain.

- Investments in digital transformation are key to its future growth.

- Target's financial health supports its competitive advantage.

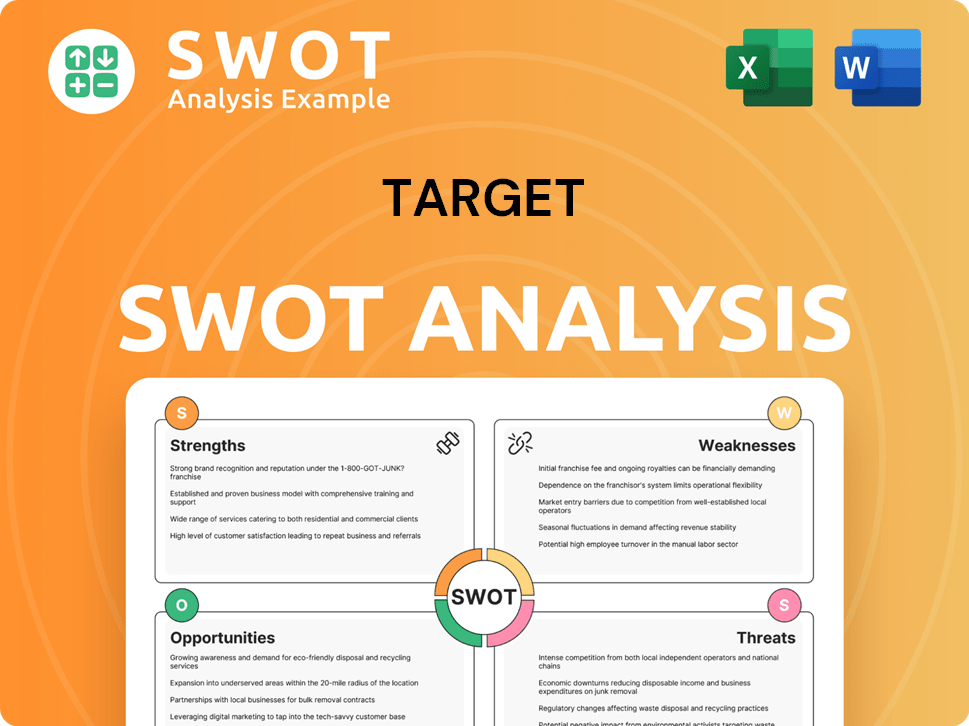

Target SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Target?

The Growth Strategy of Target involves navigating a complex competitive landscape. The company faces a diverse set of rivals, from massive retailers to specialized stores and online platforms. Understanding these competitors is crucial for assessing Target's market position and developing effective strategies for growth and sustainability.

Analyzing the competitive landscape of Target requires a deep dive into both direct and indirect competitors. Direct competitors offer similar products and services, vying for the same customer base. Indirect competitors, on the other hand, may target different niches or offer alternative solutions, still impacting Target's market share and overall performance. This competitive analysis helps to identify threats and opportunities, informing strategic decisions.

The competitive landscape for Target is dynamic, influenced by shifts in consumer behavior, technological advancements, and economic conditions. Staying informed about the strategies and performance of key competitors is essential for Target to maintain its competitive advantage and adapt to the evolving retail environment. This includes monitoring market share, pricing strategies, and customer satisfaction levels.

Walmart is a primary direct competitor, leveraging its vast store network and aggressive pricing. Amazon also poses a significant threat through its e-commerce dominance and rapid delivery capabilities. Costco, with its membership-based model, is another key player, especially in certain product categories.

Specialty retailers like TJ Maxx and Marshalls compete in apparel and home goods. Best Buy challenges Target in electronics, while various grocery chains compete for food sales. Online retailers and direct-to-consumer (DTC) brands also play a role.

Target differentiates itself through curated merchandise, store design, and customer experience. Its private-label brands and strategic partnerships also contribute to its competitive edge. Maintaining a strong brand image and customer loyalty is crucial.

Market share fluctuates based on consumer preferences, economic conditions, and competitor strategies. Walmart consistently holds a significant market share in general merchandise. Amazon's e-commerce dominance continues to grow, impacting all retailers.

Price wars, supply chain disruptions, and changing consumer habits pose significant threats. The rise of e-commerce and DTC brands challenges traditional retail models. Economic downturns can also impact consumer spending.

Expanding online presence, enhancing omnichannel capabilities, and developing innovative products offer opportunities. Strategic partnerships and acquisitions can also boost market share. Focusing on sustainability and ethical practices can attract customers.

Several factors drive competition within the retail industry, including pricing, product assortment, customer service, and convenience. Target must excel in these areas to maintain and grow its market share. These factors impact the overall competitive landscape.

- Pricing: Competitive pricing strategies are crucial for attracting and retaining customers.

- Product Assortment: Offering a diverse and appealing product range is essential.

- Customer Service: Providing excellent customer service enhances loyalty.

- Convenience: Offering convenient shopping experiences, including online and in-store options, is vital.

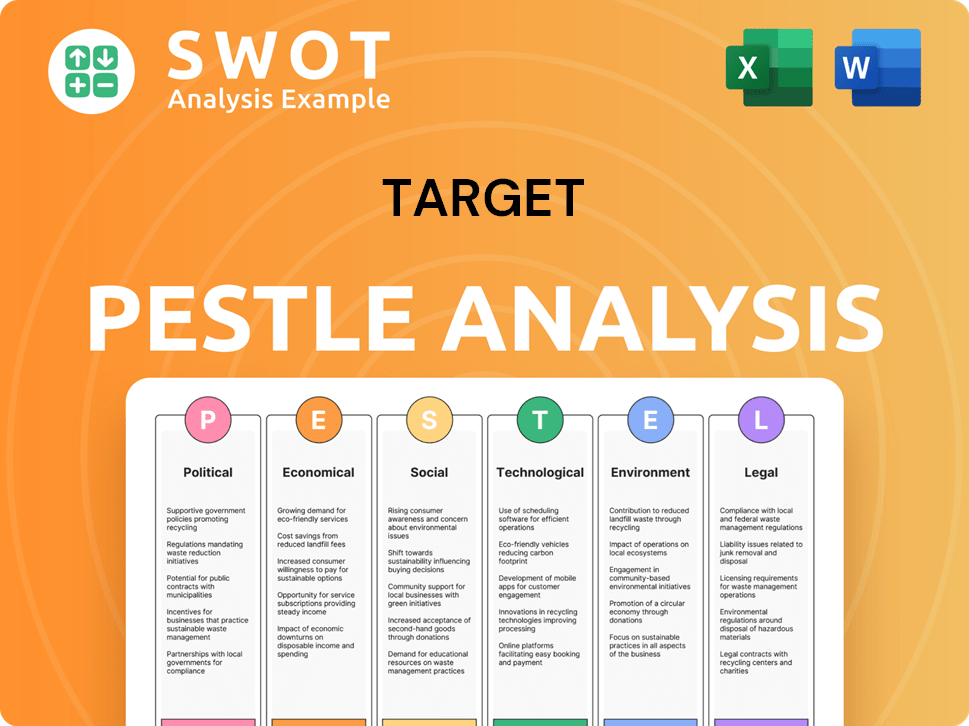

Target PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Target a Competitive Edge Over Its Rivals?

Analyzing the competitive landscape of a target company involves understanding its strengths and weaknesses relative to industry rivals. For Target Corporation, a deep dive into its competitive advantages reveals key differentiators that contribute to its market position. This analysis is crucial for investors, business strategists, and anyone conducting a Target company analysis.

Understanding Target's competitive advantage is essential for evaluating its long-term growth potential. The company's ability to maintain and enhance these advantages will determine its success in a dynamic retail environment. This article aims to explore these advantages, providing a comprehensive view of Target's competitive strategy.

Target's competitive advantages are multifaceted, encompassing brand equity, exclusive brands, and a robust operational infrastructure. These elements work together to create a unique value proposition that resonates with consumers. As you read further, you'll gain insights into how Target differentiates itself from competitors, which is vital for informed decision-making.

Target's brand equity, often referred to as the 'Tar-zhay' effect, is a significant competitive advantage. This brand image combines affordability with a perception of style and quality. This unique positioning cultivates customer loyalty, drawing in a demographic that appreciates design-forward products at accessible prices. The company's brand strength is a key factor in its ability to maintain market share.

Target's portfolio of owned and exclusive brands is a major differentiator. These brands, such as Cat & Jack for children's apparel and Good & Gather for food, offer high-quality products at competitive prices. This strategy drives customer traffic and contributes to higher profit margins compared to national brands. The focus on exclusive brands strengthens Target's market position.

Target's robust supply chain and distribution network are continually optimized for efficiency. This enables effective inventory management and product availability across its extensive store footprint and growing e-commerce operations. The company's investments in technology, particularly in its digital platforms and fulfillment options, provide a seamless omnichannel shopping experience. Efficient operations are crucial for meeting customer demand.

Target's omnichannel capabilities, including Drive Up and Shipt, provide a seamless shopping experience. Its extensive physical store presence, often in prime retail locations, serves as a convenient shopping destination and a hub for online order fulfillment. These investments in technology and infrastructure enhance customer convenience and drive sales. This approach is critical for competing in today's market.

In 2024, Target reported a net sales increase, demonstrating its continued growth. The company's strategic investments in its owned brands and omnichannel capabilities have contributed to its financial success. For example, in Q1 2024, comparable sales increased by 0.9%, driven by growth in digital channels and store traffic. This growth indicates the effectiveness of Target's competitive strategies.

- Target's market share in key categories remains strong, reflecting its brand loyalty and competitive pricing.

- The company’s focus on owned brands has led to higher profit margins compared to national brands.

- Investments in supply chain and fulfillment have improved operational efficiency and customer satisfaction.

- The company’s ability to adapt to changing consumer preferences and market trends is a key factor in its success. For more information, you can read about Owners & Shareholders of Target.

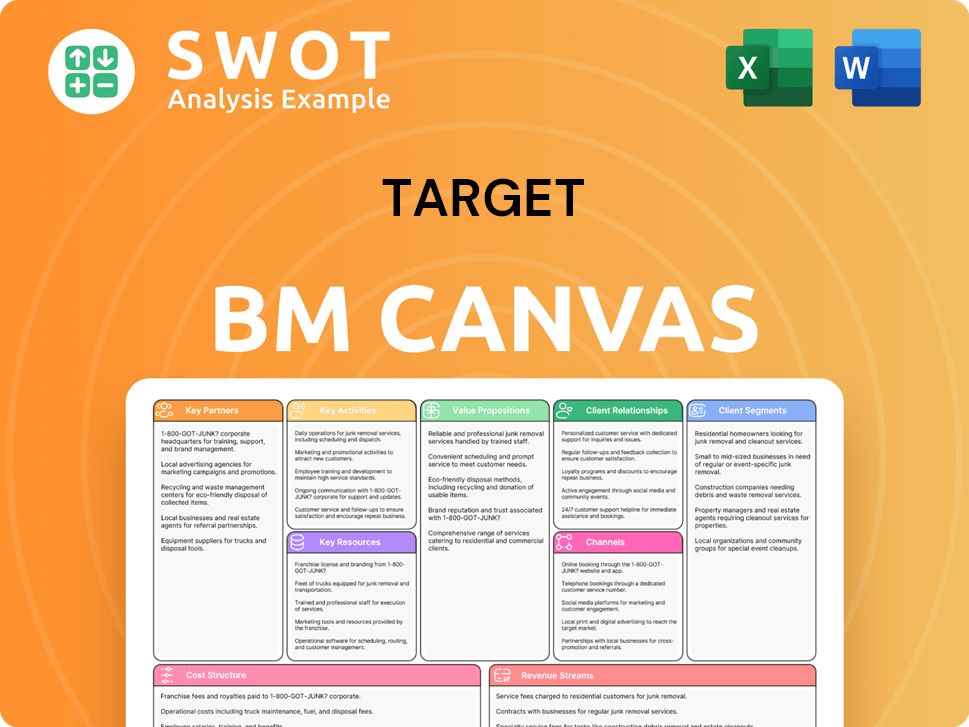

Target Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Target’s Competitive Landscape?

The retail sector is experiencing significant shifts, driven by technological advancements, changing consumer preferences, and global economic factors. This dynamic environment presents both challenges and opportunities for companies like Target, influencing its competitive landscape and strategic direction. A thorough competitive landscape analysis is essential for understanding the current market dynamics and anticipating future trends.

Understanding the market competition and how the Target company analysis is positioned is crucial for making informed decisions. Factors such as the rise of e-commerce, inflationary pressures, and the need for sustainable practices are reshaping the industry. As a result, companies must adapt to maintain their competitive advantage and secure their market share.

Several trends are influencing the retail sector. The increasing use of AI and data analytics is transforming supply chains and customer engagement. Consumers are prioritizing convenience, personalization, and sustainability. Economic factors, like inflation and supply chain disruptions, also play a significant role. Furthermore, the expansion of e-commerce continues to grow, with online retail sales in the U.S. reaching over $1 trillion in 2023, according to the U.S. Census Bureau.

Target faces challenges such as the need for continuous investment in digital infrastructure to compete with online retailers. Inflationary pressures and economic slowdowns could impact discretionary spending. Increased competition from both established players and new entrants demands constant innovation. According to a 2024 report by Deloitte, rising operational costs and supply chain complexities will continue to pressure profit margins in the retail sector.

Target can leverage its brand and omnichannel capabilities to enhance personalized shopping experiences. Expanding private label offerings in sustainable products and health and wellness presents a clear opportunity. Further investment in supply chain automation and last-mile delivery can improve efficiency. Strategic partnerships with emerging brands or technology providers can also unlock new growth avenues. The company can also focus on improving its customer experience, which, according to a 2024 study by Bain & Company, is a key differentiator in the retail industry.

To remain competitive, Target needs to adapt its strategies to these shifts. This includes digital innovation, supply chain resilience, and a differentiated product assortment. Focusing on sustainability and ethical sourcing can also enhance brand appeal. As discussed in Growth Strategy of Target, a strong emphasis on these areas will be crucial for future success.

Target should concentrate on several key areas to navigate the competitive landscape and capitalize on opportunities. These include enhancing its digital presence, optimizing supply chain efficiency, and expanding its private label offerings.

- Digital Transformation: Investing in e-commerce platforms and data analytics to personalize customer experiences.

- Supply Chain Optimization: Implementing automation and improving last-mile delivery to reduce costs and improve efficiency.

- Product Differentiation: Expanding private label brands in high-growth categories like sustainable products.

- Strategic Partnerships: Collaborating with emerging brands and technology providers to drive innovation.

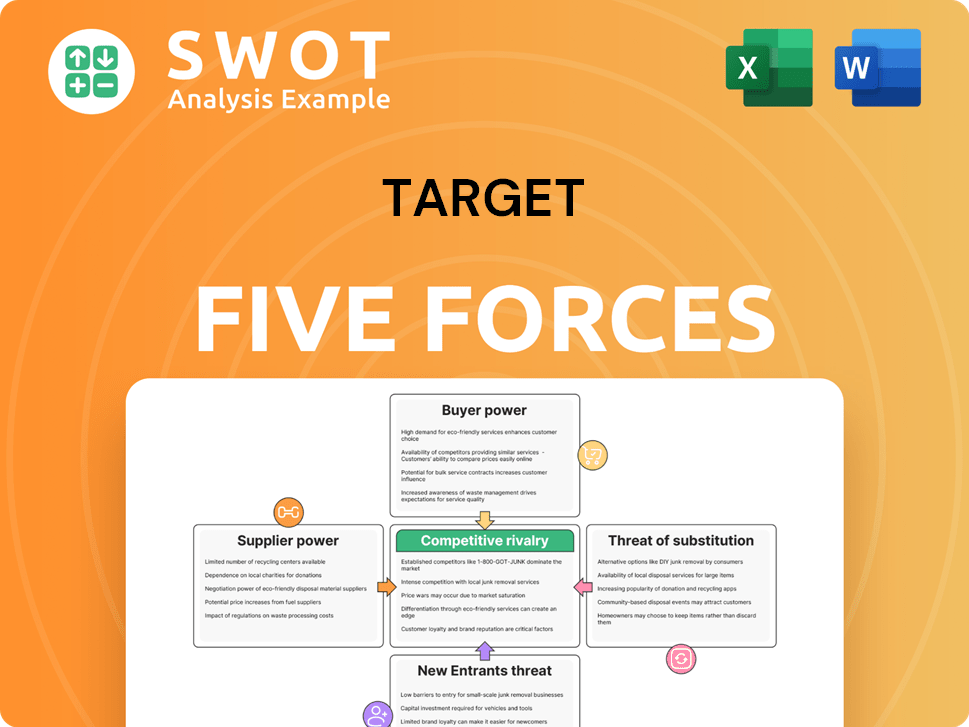

Target Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Target Company?

- What is Growth Strategy and Future Prospects of Target Company?

- How Does Target Company Work?

- What is Sales and Marketing Strategy of Target Company?

- What is Brief History of Target Company?

- Who Owns Target Company?

- What is Customer Demographics and Target Market of Target Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.