ThredUp Bundle

How Did ThredUp Revolutionize the Fashion Industry?

Dive into the fascinating ThredUp SWOT Analysis and discover how a simple idea blossomed into a leader in the sustainable fashion movement. From its humble beginnings in Boston, MA, to becoming a global online consignment powerhouse, ThredUp's journey is a compelling case study in innovation. Explore how this thredUp company transformed the clothing resale landscape.

Founded in 2009, the thredUp history illustrates a remarkable evolution, driven by a vision to make secondhand apparel accessible and appealing. The introduction of the 'Clean Out Bag' was a game-changer, significantly impacting the thredUp business model and accelerating its growth. Today, as the online consignment market continues to surge, understanding ThredUp's trajectory provides valuable insights into the future of sustainable fashion.

What is the ThredUp Founding Story?

The story of the thredUp company began in 2009. It was founded by James Reinhart, Chris Homer, and Oliver Lubin. The initial idea came from James Reinhart's personal experience with selling his lightly worn shirts at local thrift stores. He realized that there was a common issue: people struggled to efficiently get rid of gently used clothes.

Reinhart, then a business student at Harvard, saw an opportunity. He aimed to unlock the potential of the 'hundreds of millions of dollars in people's closets that weren't being accessed.' The initial concept, funded by the founders and later by seed funding, was a peer-to-peer marketplace for swapping men's attire. The company was initially located in Boston, MA.

The name 'thredUp' was chosen to reflect the idea of clothing 'threads' being passed from one person to another, emphasizing sustainability and giving new life to pre-owned items. In its early stages, thredUp pivoted its focus in 2010 to children's clothing due to higher demand, and later expanded to include women's clothing in 2013, which proved to be a significant turning point. This shift from a direct swapping model to a consignment service, where thredUp handles the sorting, evaluating, and selling of items, was crucial in defining its business model. This approach made it convenient for sellers to clean out their closets and for buyers to access quality secondhand items.

thredUp was founded in 2009 by James Reinhart, Chris Homer, and Oliver Lubin.

- The initial concept was a peer-to-peer marketplace for swapping men's clothing.

- The company pivoted to children's clothing in 2010 and women's clothing in 2013.

- The business model shifted to a consignment service, handling the sale of items.

- The name 'thredUp' reflects the idea of clothing threads being passed on.

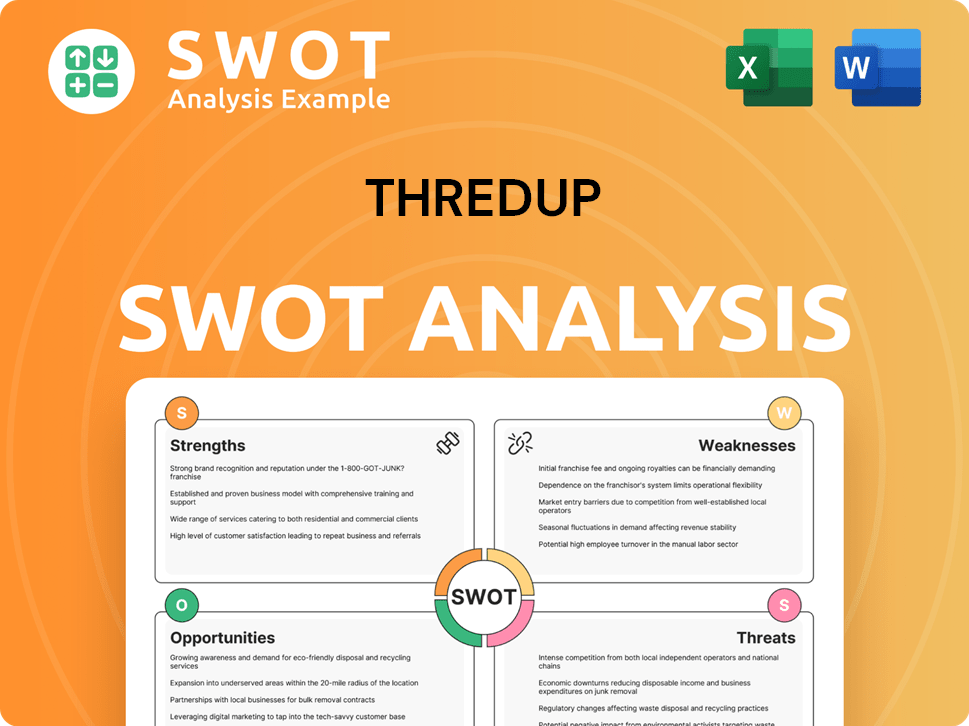

ThredUp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ThredUp?

The early growth of the thredUp company was marked by strategic decisions that broadened its market appeal and operational efficiency. From swapping shirts initially, the company expanded into children's clothing in 2010, recognizing a significant opportunity in the resale market. Relocating to Silicon Valley in 2011 provided access to technology and venture capital, which fueled innovation and expansion for thredUp.

A key turning point for thredUp history was the 2012 launch of the 'Clean Out Bag' program, which simplified the selling process, boosting inventory and user engagement. By 2015, after processing over 13 million articles of clothing, thredUp secured an $81 million investment from Goldman Sachs, valuing the enterprise at approximately $400 million. This period was characterized by an emphasis on improving the user experience through technology and data analytics.

ThredUp successfully tapped into the growing consumer interest in sustainable fashion and clothing resale. The online platform offered a convenient way to shop for secondhand clothing, a trend accelerated by the shift towards online consignment. The company expanded its reach by establishing 'Resale-as-a-Service' (RaaS) partnerships with fashion brands and retailers, further expanding its reach and inventory. For more insights, check out the Competitors Landscape of ThredUp.

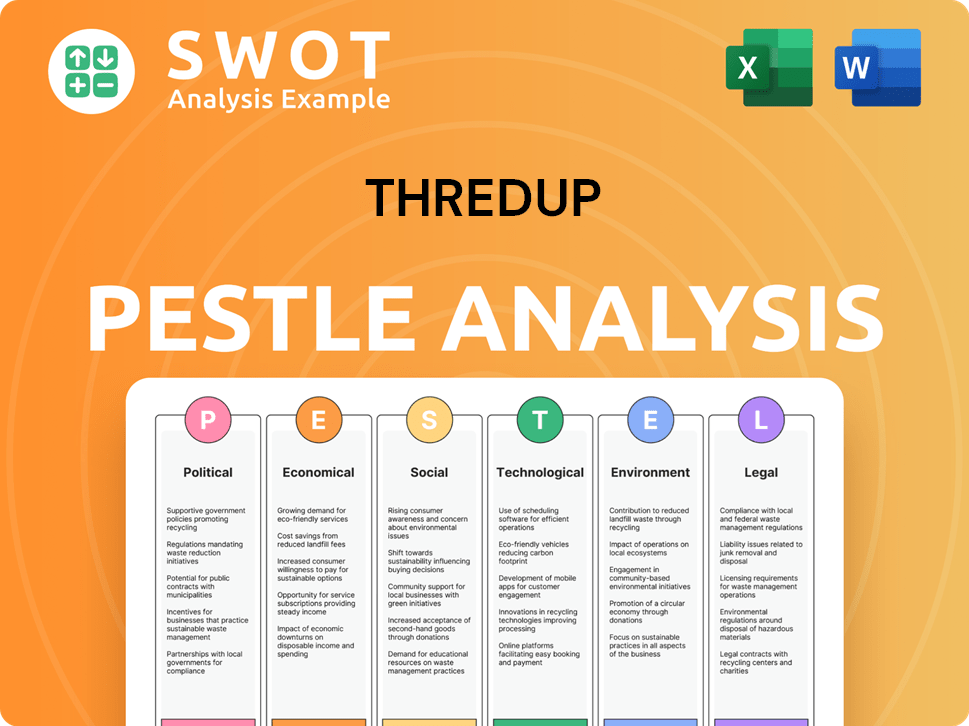

ThredUp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ThredUp history?

The journey of thredUp, a leading online consignment platform, is marked by significant milestones. From its inception, the thredUp company has continually evolved, adapting to market dynamics and consumer preferences within the clothing resale sector.

| Year | Milestone |

|---|---|

| 2012 | Launched the 'Clean Out Bag' program, simplifying the consignment process and scaling inventory. |

| 2019 | Introduced 'Thrift Cards,' integrating thrifting into mainstream gift-giving. |

| 2021 | Achieved an initial public offering (IPO) on Nasdaq, with a valuation of $1.3 billion, and later dual-listed on the Long-Term Stock Exchange (LTSE). |

| 2023 | Processed over 137 million secondhand items from approximately 55,000 different brands. |

ThredUp has consistently innovated to enhance user experience and operational efficiency. These innovations have played a crucial role in shaping the thredUp history and its position in the market.

The 'Clean Out Bag' program, launched in 2012, revolutionized the consignment process. This simplified approach made it easier for users to send in their clothes, significantly boosting inventory.

In 2019, thredUp launched 'Thrift Cards,' integrating thrifting into mainstream gift-giving. This move expanded the platform's appeal and introduced new customers to the concept of clothing resale.

ThredUp developed AI-powered search tools, including natural language, image, and chat search capabilities. These tools significantly improved product discoverability and increased conversion rates.

The company's investment in technology, particularly in AI, has enhanced its operational efficiency. These advancements have contributed to a 95% increase in new buyer acquisition in Q1 2025 compared to Q1 2024.

Despite its successes, thredUp has faced challenges, including market fluctuations and financial pressures. The company has responded strategically to maintain its growth trajectory.

While Q4 2024 saw a 9% year-over-year increase in revenue to $67.3 million, active buyers decreased by 6% year-over-year. This indicates a need for strategic adjustments to retain and attract customers.

ThredUp reported a net loss from continuing operations of $40.0 million for the full year 2024. This financial performance underscores the challenges in the competitive online consignment market.

To focus on its core U.S. operations, thredUp divested 91% of its European business, Remix Global EAD, in Q4 2024, retaining a minority interest. This strategic move allows the company to concentrate on its most profitable markets.

The competitive landscape and evolving consumer preferences require continuous adaptation. These experiences have reinforced thredUp's commitment to innovation and strategic adaptation in a competitive and evolving market.

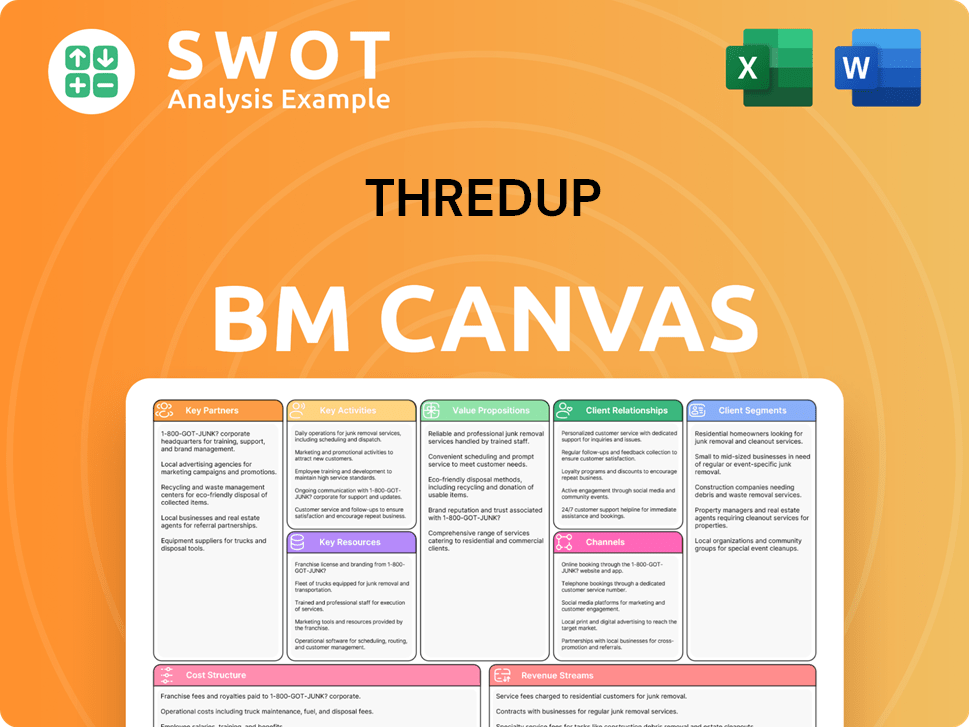

ThredUp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ThredUp?

The story of thredUp, a leading online consignment and clothing resale platform, is marked by strategic pivots and significant growth. Founded in 2009 by James Reinhart, Chris Homer, and Oliver Lubin, the company initially focused on peer-to-peer clothing swaps, evolving into a major player in the sustainable fashion market. This evolution, from its inception in Boston to its current status, showcases a commitment to innovation and adaptation within the rapidly changing retail landscape. Understanding the thredUp history is key to grasping its current position and future potential.

| Year | Key Event |

|---|---|

| 2009 | Founded in Boston, MA, initially focusing on peer-to-peer clothing swaps. |

| 2010 | Expanded focus to include children's clothing due to higher demand. |

| 2011 | Relocated headquarters to San Francisco, CA. |

| 2012 | Launched the 'Clean Out Bag' program, simplifying the selling process and boosting inventory. |

| 2013 | Began reselling women's clothing, significantly broadening its market. |

| 2015 | Raised $81 million in a Series E funding round led by Goldman Sachs. |

| 2017 | Acquired Remix Global, a European online resale company, marking initial international expansion. |

| 2019 | Launched Thrift Cards and raised $175 million in a new funding round, bringing total funding to over $300 million. |

| 2021 | Went public, listing on the Nasdaq with a valuation of $1.3 billion. Also dual-listed on the Long-Term Stock Exchange. |

| 2023 | Increased sales by 4% to €99.8 million in the first half, reducing negative results. |

| 2024 | U.S. secondhand apparel market grew 14%, five times faster than the broader retail clothing market. thredUp's AI-powered search tools named among TIME Magazine's 'Best Inventions of 2024'. |

| Q4 2024 | Divested 91% of its European business, Remix Global EAD, to focus on U.S. operations. Reported full-year revenue of $260.0 million, a 1% growth year-over-year. |

| Q1 2025 | Achieved 10% year-over-year revenue growth, reaching $71 million, with active buyers increasing to 1.4 million. |

thredUp is strategically focusing on the U.S. market after divesting its European business. The U.S. secondhand apparel market is experiencing rapid growth, expanding by 14% in 2024. Online resale is expected to nearly double, reaching $40 billion by 2029, with an average annual growth of 13%.

For the full fiscal year 2025, thredUp anticipates revenue between $270.0 million and $280.0 million, indicating a 6% year-over-year increase. The company expects to maintain a gross margin of 77.0% to 79.0% and a stable Adjusted EBITDA margin. This financial outlook reflects confidence in its growth trajectory.

thredUp is investing in technology and user experience, particularly leveraging AI algorithms for personalized recommendations. The company plans to expand into new markets and diversify product offerings beyond women's and children's clothing. Their AI-powered tools were recognized as one of TIME Magazine's 'Best Inventions of 2024'.

thredUp is committed to eco-friendly practices and promoting the benefits of the circular economy. The company's current infrastructure supports up to $600 million in revenue, with potential expansion to $1 billion with additional capital expenditure. Read more about the Growth Strategy of ThredUp.

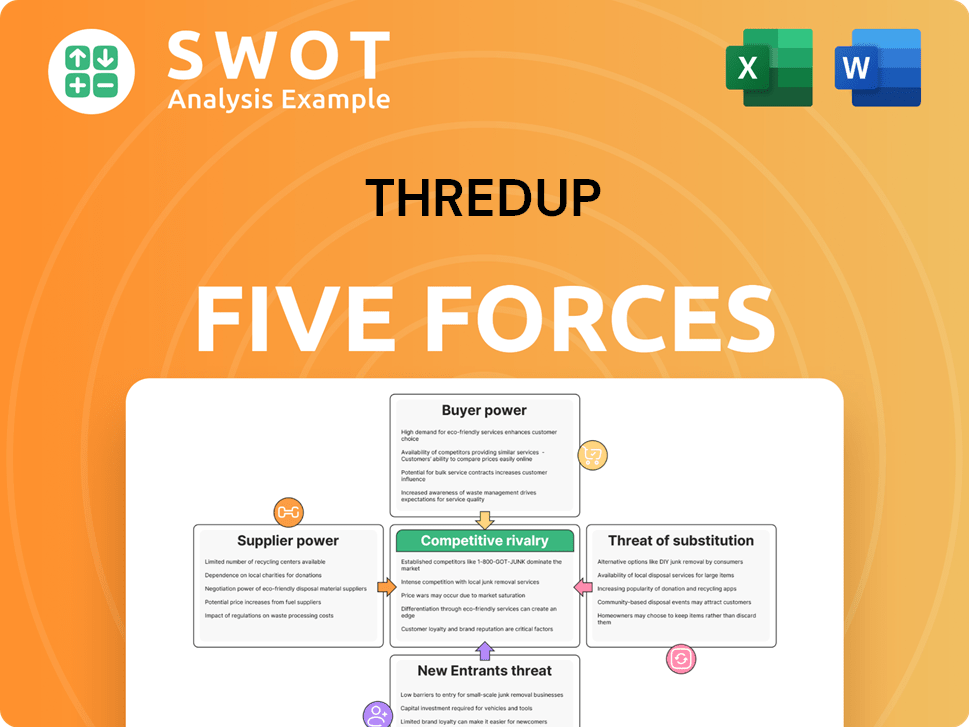

ThredUp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ThredUp Company?

- What is Growth Strategy and Future Prospects of ThredUp Company?

- How Does ThredUp Company Work?

- What is Sales and Marketing Strategy of ThredUp Company?

- What is Brief History of ThredUp Company?

- Who Owns ThredUp Company?

- What is Customer Demographics and Target Market of ThredUp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.