ThredUp Bundle

Can ThredUp Conquer the Resale Revolution?

The fashion industry is undergoing a seismic shift, with consumers increasingly prioritizing sustainability and value. This creates a dynamic environment where companies like ThredUp are redefining how we interact with clothing. Founded in 2009, ThredUp has emerged as a key player in the online consignment and thrift market, offering a convenient platform for buying and selling pre-owned apparel.

ThredUp's journey from a startup to a major player in the ThredUp SWOT Analysis market highlights the growing importance of sustainable fashion and the resale market. Understanding the ThredUp competitive landscape is crucial for investors and businesses alike. This analysis will delve into ThredUp's competitors, its market share, and the challenges and opportunities that shape its growth strategy, offering a comprehensive market analysis of this innovative company.

Where Does ThredUp’ Stand in the Current Market?

In the dynamic ThredUp competitive landscape, the company holds a significant position within the rapidly expanding online resale market for apparel. As one of the largest online consignment and thrift stores in the United States, it primarily focuses on secondhand women's, men's, and children's clothing, shoes, handbags, and accessories. This positioning caters to a broad customer base, including environmentally conscious consumers and budget-minded shoppers.

The company's core operations revolve around facilitating the buying and selling of used clothing and accessories. ThredUp's value proposition centers on convenience, affordability, and sustainability, differentiating it from traditional brick-and-mortar thrift stores. This is achieved through its user-friendly platform and services like 'Clean Out Kits,' which streamline the selling process for consumers.

ThredUp's geographic presence is mainly concentrated in the United States, with an expanding international footprint, notably in Europe through its acquisition of Remix. ThredUp's commitment to sustainability and its focus on a seamless experience have been key in shaping its market position. The company has been working towards profitability, making significant investments in technology and logistics to support its growth.

While precise market share figures for 2024-2025 are subject to change, ThredUp consistently ranks as a leading player in the online consignment segment. Its established brand and operational infrastructure provide a competitive edge. The company's large active buyer base and the millions of unique items processed annually underscore its scale and influence within the resale market.

For the first quarter of 2024, ThredUp reported revenues of $79.7 million, exceeding expectations and indicating continued growth. This financial performance reflects the company's ability to attract and retain customers in a competitive market. The company's financial strategy focuses on balancing growth with profitability.

ThredUp distinguishes itself through its focus on convenience, sustainability, and a user-friendly platform. Its 'Clean Out Kits' and seamless selling and buying experience set it apart from traditional thrift stores. The company's commitment to sustainable fashion resonates with a growing consumer base.

- Established Brand Recognition: ThredUp has built a strong brand reputation in the online resale market.

- Technological Infrastructure: Investments in technology and logistics enhance operational efficiency.

- Customer-Centric Approach: Focus on convenience and a positive user experience drives customer loyalty.

- Sustainability Initiatives: Commitment to eco-friendly practices attracts environmentally conscious consumers.

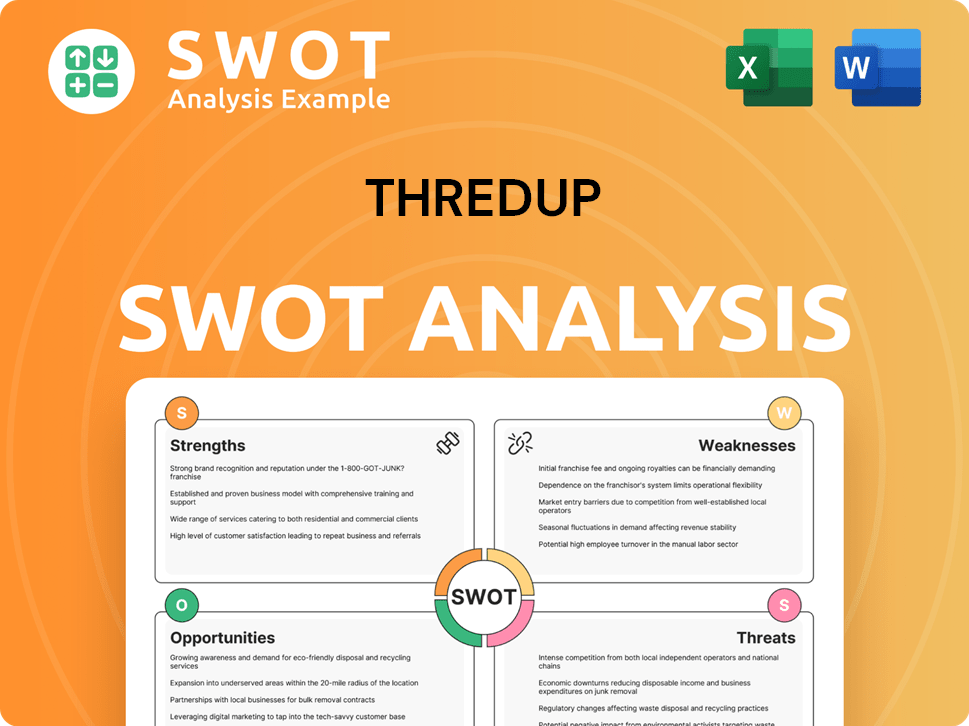

ThredUp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ThredUp?

The ThredUp competitive landscape is dynamic, encompassing both direct and indirect rivals in the rapidly expanding resale market. Understanding these competitors is crucial for assessing ThredUp's market analysis and strategic positioning. The company faces challenges from online platforms, luxury resale specialists, traditional brick-and-mortar stores, and even major e-commerce retailers.

ThredUp's competitors vary in their business models and target audiences. Some focus on peer-to-peer transactions, while others specialize in high-end goods or offer the convenience of a curated online experience. The growth of the secondhand market has intensified competition, requiring ThredUp to continually adapt and innovate to maintain its market share.

The re-commerce sector is experiencing significant growth. According to a 2024 report by GlobalData, the secondhand apparel market is expected to reach $218 billion by 2027, indicating substantial opportunities for players like ThredUp. This growth underscores the importance of understanding the competitive environment and the strategies employed by key rivals.

ThredUp's primary direct competitor is Poshmark. This platform operates as a social marketplace, where individuals directly list and sell their items. This peer-to-peer model offers a different experience compared to ThredUp's consignment-based approach. Poshmark's focus on community and direct seller interaction differentiates it in the online consignment space.

Platforms such as The RealReal and Vestiaire Collective target a different segment of the market, specializing in high-end designer goods. These platforms focus on authentication and cater to a more affluent customer base. Their business models are centered around luxury resale, offering a curated selection of authenticated items.

Traditional brick-and-mortar thrift stores like Goodwill and Salvation Army offer deeply discounted items, representing indirect competition. While these stores lack the convenience and curated selection of online platforms, they cater to budget-conscious consumers. Additionally, brand-specific resale programs, such as those offered by Patagonia and Levi's, are emerging as significant players.

Large e-commerce retailers like Amazon and eBay also pose indirect competition. Their vast marketplaces for new and used goods provide a broad selection, potentially drawing customers away from specialized platforms. These retailers leverage their scale and reach to compete in the secondhand market.

The competitive dynamics are constantly evolving, with new entrants leveraging technology and shifting consumer preferences. Established players must adapt their strategies to capture a larger share of the growing secondhand market. Understanding these dynamics is crucial for ThredUp's long-term success.

The rise of sustainable fashion and consumer interest in reducing waste are driving growth in the resale market. ThredUp and its competitors are benefiting from these trends, but they must also address challenges such as supply chain management and customer acquisition. The demand for secondhand clothing is increasing, as evidenced by the fact that the global secondhand apparel market is projected to grow at a CAGR of 12.5% from 2024 to 2030, according to a report by Grand View Research.

ThredUp's ability to compete effectively hinges on several factors. These include its ability to differentiate its services, manage operational costs, and adapt to changing consumer preferences. The company must also consider its pricing strategy and customer service to maintain its competitive edge. For more insights, explore the Revenue Streams & Business Model of ThredUp.

- Focus on curated selection and quality control.

- Enhance the customer experience through user-friendly interfaces and efficient processes.

- Invest in marketing and brand building to attract and retain customers.

- Explore strategic partnerships and collaborations.

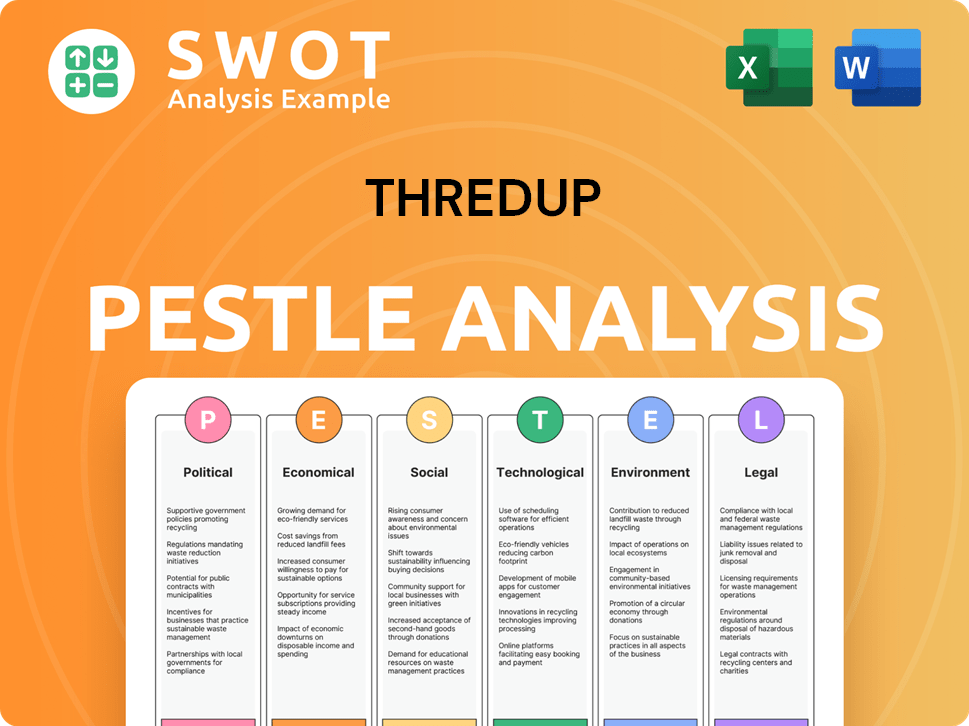

ThredUp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ThredUp a Competitive Edge Over Its Rivals?

The Owners & Shareholders of ThredUp company has carved out a significant niche in the online consignment and resale market. Its success is built on a foundation of operational efficiency, brand recognition, and a strong commitment to sustainability. Understanding the competitive landscape requires examining the company's core strengths and how they contribute to its market position. This analysis is crucial for investors, analysts, and business strategists looking to assess its long-term viability and growth potential.

One of the primary competitive advantages of the company is its streamlined operational model, particularly its 'Clean Out Kit' and comprehensive consignment process. This approach simplifies the selling experience for consumers, handling photography, listing, pricing, and shipping. This efficiency is backed by sophisticated logistics and data analytics, allowing for the effective processing of millions of unique items. The company's focus on technology, including its proprietary software for inventory management and pricing algorithms, further enhances its operational edge.

Brand equity and consumer trust are also key factors. The company has cultivated a strong brand image associated with convenience, affordability, and sustainability, resonating with a growing segment of environmentally conscious consumers. Its established customer base and high repeat purchase rates demonstrate strong customer loyalty. Furthermore, the company's commitment to promoting sustainable fashion also differentiates it, appealing to a demographic increasingly prioritizing eco-friendly consumption. These advantages have evolved as the company has scaled, allowing it to leverage economies of scale in processing and shipping, further solidifying its position.

The company's 'Clean Out Kit' and streamlined consignment process simplify selling. This includes handling photography, listing, pricing, and shipping. Data analytics and logistics enable efficient processing of millions of items.

The company has a strong brand image associated with convenience and sustainability. High repeat purchase rates demonstrate strong customer loyalty. Focus on sustainable fashion appeals to eco-conscious consumers.

Proprietary software for inventory management and pricing algorithms provides an operational edge. Technology allows for efficient sorting, processing, and pricing of a vast inventory. Continuous investment in technology creates barriers to entry.

The company leverages economies of scale in processing and shipping. Established infrastructure supports efficient operations. Scalability allows for growth and market expansion.

The company's competitive advantages are multifaceted, including operational efficiency, brand recognition, and technological innovation. These factors contribute to its strong market position in the resale market. Understanding these advantages is crucial for evaluating its long-term growth potential.

- Proprietary 'Clean Out Kit' and streamlined consignment process.

- Strong brand image associated with convenience and sustainability.

- Proprietary software for inventory management and pricing algorithms.

- Focus on sustainable fashion and eco-friendly consumption.

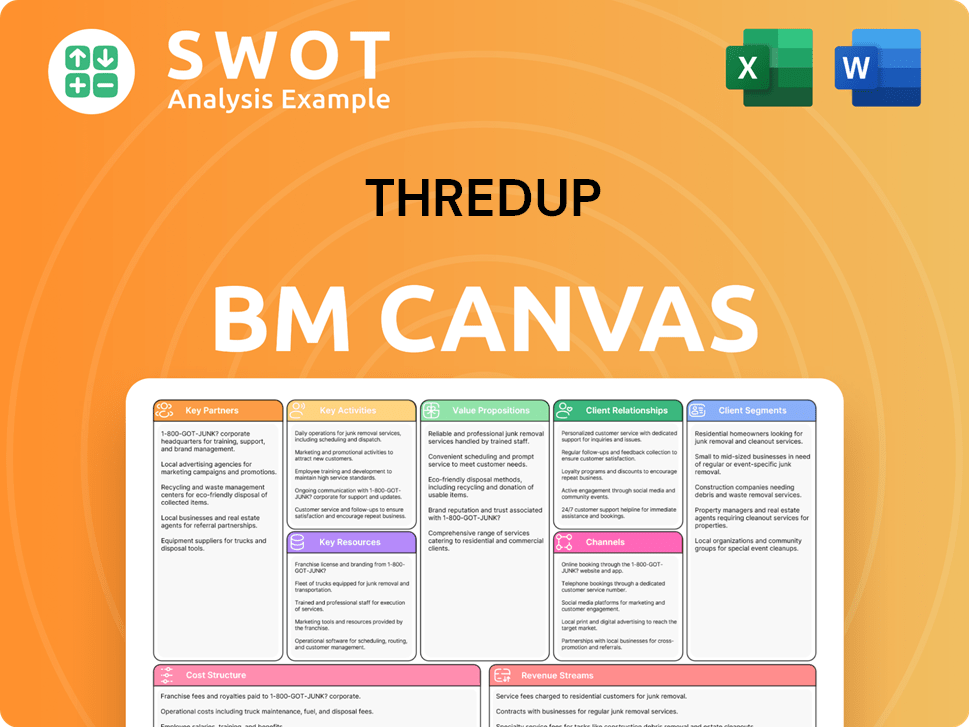

ThredUp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ThredUp’s Competitive Landscape?

The re-commerce sector, where online consignment platforms like ThredUp operate, is experiencing considerable growth, propelled by shifts in consumer behavior and technological advancements. This creates both opportunities and challenges for companies competing within the ThredUp competitive landscape. Understanding the market dynamics and the strategies of ThredUp competitors is crucial for navigating this evolving environment.

Analyzing the ThredUp market analysis reveals a complex interplay of factors. The rise of sustainable fashion and the demand for online consignment are key drivers. However, the industry faces pressures from increased competition and economic fluctuations. The future outlook depends on strategic adaptation and leveraging emerging trends.

The resale market is expanding rapidly, fueled by consumer interest in sustainability and circular fashion. Technological advancements, including AI and data analytics, are enhancing platform efficiency and customer experience. Social commerce and influencer marketing are also playing a significant role in shaping consumer behavior.

Increased competition from new entrants and traditional retailers entering the re-commerce space could intensify pricing pressures. Economic downturns and supply chain disruptions can affect inventory flow and consumer spending. Maintaining quality control and efficient inventory management remain operational challenges.

Expanding into new international markets, particularly in regions with growing middle classes, presents a substantial growth avenue. Diversifying product categories beyond apparel could unlock new revenue streams. Strategic partnerships with brands and retailers to facilitate their resale programs offer another promising opportunity.

ThredUp's growth strategy likely involves leveraging its brand, optimizing operational efficiencies, and exploring new strategic collaborations. Continued investment in technology to enhance the platform, improve personalization, and streamline operations will be critical. The company aims to capitalize on the sustained growth of the circular economy.

To succeed, ThredUp must navigate several critical areas. Addressing challenges faced by ThredUp, such as increased competition and supply chain issues, is essential. Focusing on ThredUp's competitive advantages, like its established brand and technology, will be crucial.

- Focus on expanding into international markets, such as Europe and Asia, where the secondhand market is growing.

- Continue to invest in technology, particularly in AI and data analytics, to improve inventory management and personalize the customer experience.

- Explore strategic partnerships with brands and retailers to integrate deeper into the fashion ecosystem.

- Enhance ThredUp's supply chain to improve efficiency and reduce costs.

For a deeper dive into the strategic initiatives, consider reading about the Growth Strategy of ThredUp. The success of ThredUp hinges on its ability to adapt to market changes and capitalize on the expanding resale market. By focusing on sustainability, technology, and strategic partnerships, ThredUp can strengthen its position in the ThredUp competitive landscape.

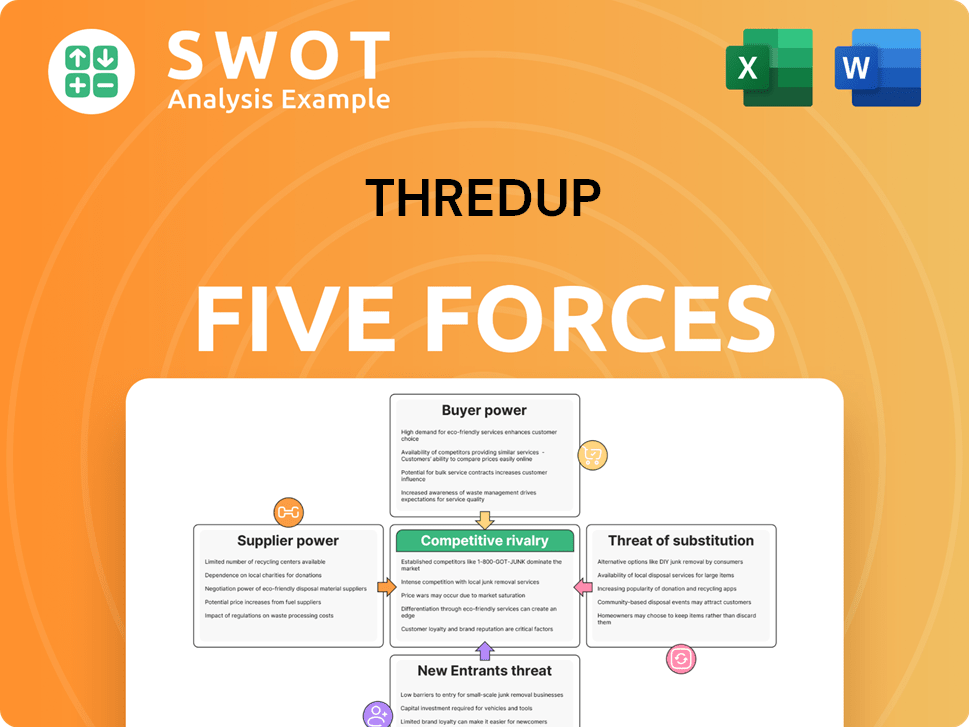

ThredUp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ThredUp Company?

- What is Growth Strategy and Future Prospects of ThredUp Company?

- How Does ThredUp Company Work?

- What is Sales and Marketing Strategy of ThredUp Company?

- What is Brief History of ThredUp Company?

- Who Owns ThredUp Company?

- What is Customer Demographics and Target Market of ThredUp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.