ThredUp Bundle

Can ThredUp Revolutionize Fashion's Future?

The fashion industry is at a crossroads, grappling with environmental concerns and consumer demand for sustainable solutions. ThredUp, a pioneer in the online consignment space, has emerged as a key player in the shift towards a circular economy. Founded in 2009, ThredUp has transformed how we buy and sell clothes, making secondhand fashion accessible and appealing.

As the resale market explodes, with projections reaching $70 billion by 2027, understanding ThredUp's ThredUp SWOT Analysis and its strategic vision is crucial. This comprehensive analysis will explore ThredUp's growth strategy, examining its innovative business model, financial performance, and competitive landscape. We'll delve into ThredUp's future prospects, assessing its expansion plans, technological advancements, and the challenges it faces in the dynamic world of online consignment and sustainable fashion.

How Is ThredUp Expanding Its Reach?

The growth strategy of the company is built on a multi-faceted approach, focusing on both expanding its market reach and diversifying its offerings. A key element of this strategy involves scaling its Resale-as-a-Service (RaaS) platform. This platform enables brands and retailers to integrate secondhand selling directly into their operations, aiming to become a foundational technology for circular fashion within the retail sector.

As of early 2024, the company's RaaS had partnered with over 140 brands, including well-known names, demonstrating a strong push to establish itself as a key player in the circular economy. This strategic move not only diversifies revenue streams beyond direct-to-consumer sales but also strengthens its position as a crucial enabler of the circular economy for other businesses. The company's financial performance review, as highlighted in various reports, indicates a focus on sustainable growth through these initiatives.

Geographically, while the company's primary focus has been the U.S. market, international expansion remains a long-term goal. The company is also exploring new product categories and service offerings to attract a wider customer base. This includes expanding its luxury segment and potentially venturing into other secondhand goods beyond apparel. The strategic rationale behind these initiatives is to tap into new customer segments and capture a larger share of the growing secondhand market.

The company is aggressively scaling its Resale-as-a-Service (RaaS) platform. This expansion involves partnering with more brands and retailers to integrate secondhand selling into their operations. The goal is to solidify its position as a key technology provider for the circular fashion model.

While primarily focused on the U.S., the company has plans for international expansion. This includes assessing market opportunities and building the technological infrastructure needed for global reach. The company's future prospects include entering new markets.

The company is exploring expansion into new product categories. This includes growing its luxury segment and potentially offering other secondhand goods beyond apparel. The aim is to attract a wider customer base and increase revenue streams.

The company is focusing on forming strategic partnerships to enhance its market position. Collaborations with brands and retailers are crucial for expanding its RaaS platform. These partnerships support the company's growth strategy.

The company's expansion initiatives are designed to capitalize on the rising demand for sustainable fashion and the resale market. These initiatives are supported by investments in technology and infrastructure to ensure scalability and efficiency.

- Scaling RaaS platform to onboard more brands.

- Expanding geographically to tap into new markets.

- Diversifying product offerings to attract a broader customer base.

- Forming strategic partnerships to strengthen market position.

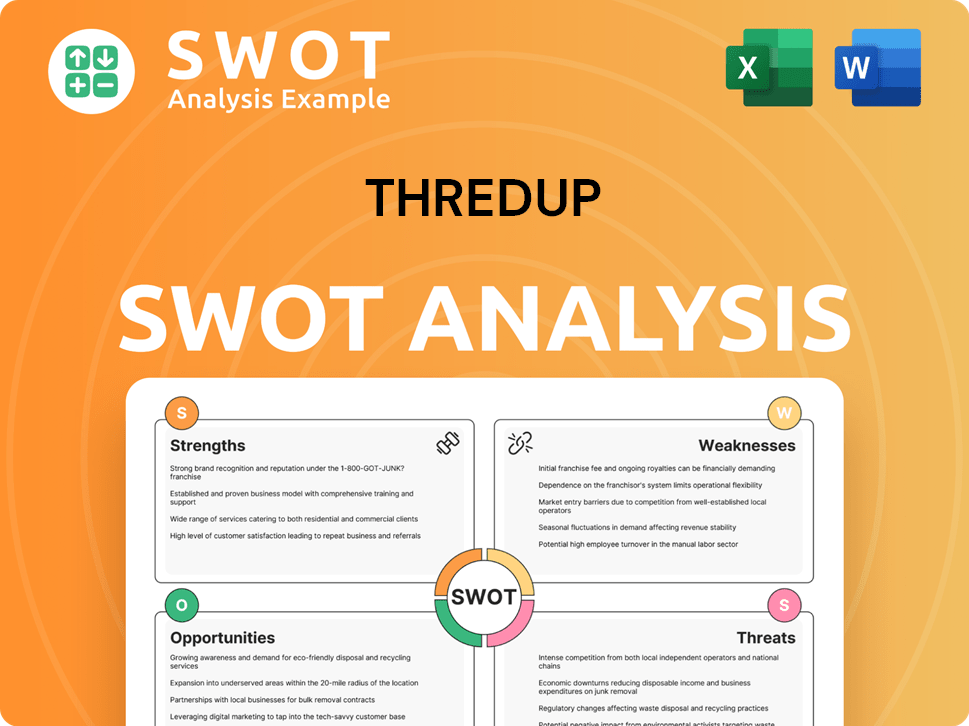

ThredUp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ThredUp Invest in Innovation?

The sustained growth of the company is significantly driven by its innovation and technology strategy. This strategy centers on automating and streamlining the complex processes of authenticating, pricing, and listing secondhand items. This technological focus is crucial for maintaining a competitive edge in the resale market.

The company invests heavily in in-house development to enhance its proprietary operating platform. This platform uses data science and machine learning to efficiently process millions of unique items. This includes improvements in computer vision for item recognition and condition assessment, as well as sophisticated algorithms for dynamic pricing.

A key aspect of the company's technological advancement is its commitment to digital transformation within the re-commerce space. Continuous refinement of the user experience on both buying and selling platforms is a priority. Automation plays a critical role in its distribution centers, boosting processing efficiency and reducing operational costs. These technological capabilities directly contribute to growth objectives by improving efficiency, reducing turnaround times, and enhancing the overall customer experience, thereby attracting and retaining more users.

The company utilizes computer vision to automate the process of identifying and assessing the condition of items. This technology is crucial for efficiently processing the large volume of inventory.

Sophisticated algorithms are used for dynamic pricing to maximize both seller payouts and buyer value. These algorithms adjust prices based on various factors, including brand, condition, and demand.

The company continually refines its user experience on both buying and selling platforms. This includes making the process of sending in 'Clean Out Kits' and browsing inventory as seamless as possible.

Automation is a key element in the company's distribution centers, where items are sorted, inspected, and prepared for sale. This increases processing efficiency and reduces operational costs.

The company continuously refines its proprietary systems and algorithms. This ongoing development demonstrates its leadership in applying technology to the unique challenges of the secondhand market.

These technological capabilities directly contribute to growth objectives by improving efficiency, reducing turnaround times, and enhancing the overall customer experience. This attracts and retains more users.

The company's approach to technology is central to its mission and core values. By focusing on innovation, the company aims to maintain its leadership in the online consignment and sustainable fashion sectors. The company's investment in technology is a key factor in its ThredUp growth strategy and future prospects, enabling it to adapt to the evolving demands of the resale market and maintain a competitive edge. This commitment to technological advancement is crucial for the company's long-term success and its ability to capitalize on the growing consumer interest in sustainable fashion.

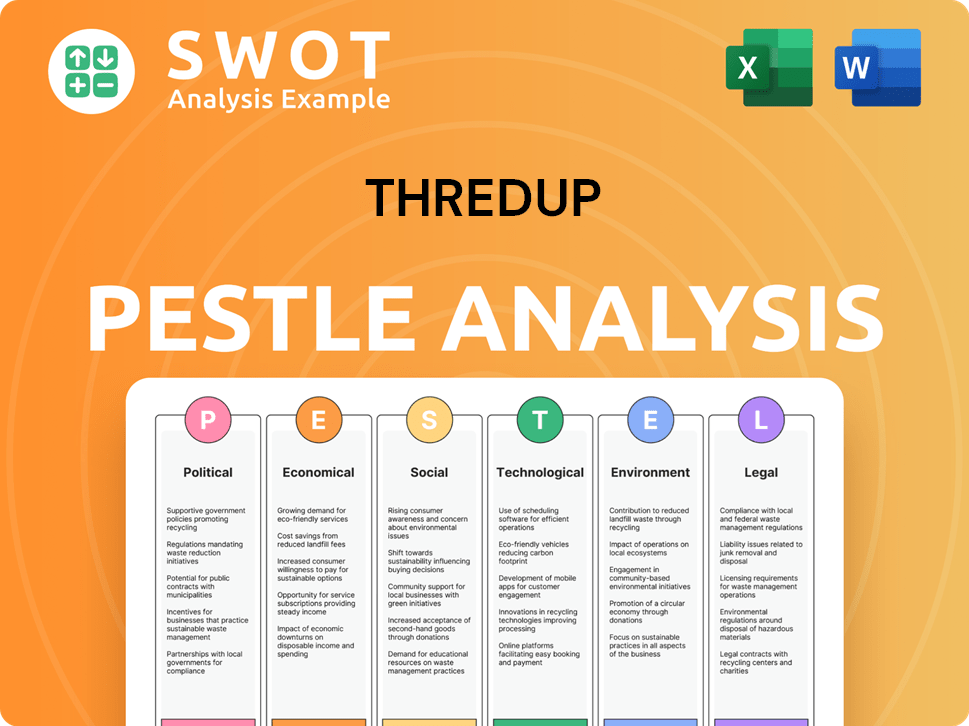

ThredUp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ThredUp’s Growth Forecast?

The financial outlook for ThredUp reflects its strategy to capitalize on the expanding secondhand market. The company's ThredUp growth strategy focuses on increasing revenue while improving profitability. This involves managing operating expenses and investing in technology and infrastructure to support its scaling operations. The company's performance in the resale market is closely watched by investors and analysts.

For the full year 2023, ThredUp reported revenues of $322.2 million, marking a 12% increase year-over-year. The company anticipates continued revenue growth, although specific long-term targets beyond short-term guidance are not consistently provided. For the first quarter of 2024, ThredUp projected revenue to be between $80.0 million and $82.0 million, representing a year-over-year increase of 1% to 4%. This growth is crucial for the company's ThredUp future prospects.

ThredUp is also focused on enhancing its profitability. The net loss for the full year 2023 was $71.1 million, an improvement compared to the previous year. A key financial goal is achieving sustained profitability. The company's ability to reduce its net loss and move towards positive adjusted EBITDA, which was $0.2 million for the fourth quarter of 2023, indicates a strategic shift towards financial efficiency alongside growth. This approach is vital for long-term sustainability in the competitive online consignment market.

ThredUp's revenue for 2023 was $322.2 million, a 12% increase year-over-year. This indicates a steady expansion in the resale market, driven by increasing consumer adoption of secondhand fashion. The projected revenue for Q1 2024 is between $80.0 million and $82.0 million, showing continued growth.

The net loss for 2023 was $71.1 million, an improvement from the previous year. This improvement reflects the company's efforts to manage costs and enhance operational efficiency. The focus is on achieving positive adjusted EBITDA, which was $0.2 million in Q4 2023.

ThredUp's financial strategy involves managing operating expenses and investing in technology and infrastructure. This supports the scaling of operations and enhances the customer experience. The company aims to balance aggressive market capture with a disciplined approach to profitability.

The company is leveraging the increasing consumer adoption of secondhand fashion. This trend is a key driver for ThredUp's growth. The company's ability to capitalize on this trend is crucial for its ThredUp company analysis and future success.

ThredUp's financial performance is characterized by revenue growth and a focus on improving profitability. The company's strategic investments and operational efficiencies are aimed at achieving sustainable financial results. The company's performance is closely tied to the broader trends in sustainable fashion.

- Revenue for 2023: $322.2 million

- Year-over-year revenue growth: 12%

- Projected Q1 2024 revenue: $80.0 - $82.0 million

- Net loss for 2023: $71.1 million

- Adjusted EBITDA (Q4 2023): $0.2 million

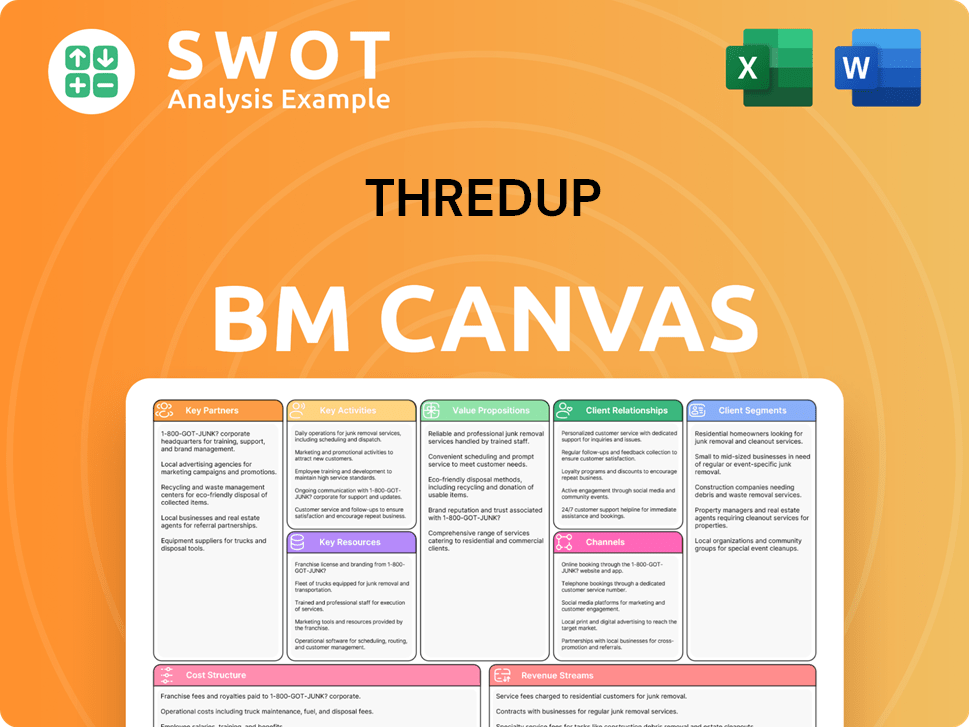

ThredUp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ThredUp’s Growth?

The future of ThredUp, like any company in the dynamic resale market, faces several potential risks and obstacles. These challenges range from intense competition to the need for constant adaptation to technological advancements and evolving consumer preferences. Understanding these hurdles is crucial for assessing the company's long-term viability and growth potential within the sustainable fashion and online consignment sectors.

Market dynamics, regulatory shifts, and internal operational efficiencies all play a significant role in influencing ThredUp's trajectory. The company's ability to navigate these complexities will be a key determinant of its success. While ThredUp has demonstrated resilience and innovation, continuous monitoring and strategic adjustments are essential to mitigate potential negative impacts.

ThredUp's growth strategy and future prospects are intricately linked to its capacity to overcome these challenges. This includes effectively managing supply chain logistics, maintaining a competitive edge, and ensuring compliance with evolving industry standards. The following sections detail specific risks and the strategies the company employs to address them.

The resale market is becoming increasingly crowded. The rise of competitors, including large retailers entering the re-commerce space and direct-to-consumer platforms, intensifies the competition. This can impact market share and pricing power for ThredUp.

Changes in regulations, particularly those related to consumer protection, environmental standards, or data privacy, could necessitate operational adjustments. Compliance with new regulations can lead to increased costs and complexities.

Although less pronounced than in traditional retail, vulnerabilities in the supply chain can still affect ThredUp. The logistics of collecting, processing, and distributing items are critical, and any disruptions could impact operations.

New technologies and business models could disrupt ThredUp's current advantages. While technology is also an area of innovation, the rapid pace of change presents risks. Adapting to new trends is crucial.

Attracting and retaining skilled talent in a competitive job market is essential. Internal resource constraints could hinder growth if the company cannot maintain a strong team. This is a key factor for the future.

Economic downturns can impact consumer spending, potentially affecting demand for secondhand clothing. Reduced consumer spending may lead to lower sales volumes and revenue.

ThredUp addresses these risks through diversification, particularly with its RaaS platform, which reduces reliance on direct consumer sales. The company also employs robust risk management frameworks, including ongoing monitoring of market trends and technological advancements. Investing in automation and data analytics demonstrates a proactive approach to enhancing operational resilience.

As of Q1 2024, ThredUp reported a revenue of $79.5 million, marking a 5% increase year-over-year. The company's active buyers reached 1.7 million. Despite these positive indicators, the company continues to face challenges in achieving consistent profitability. The competitive landscape includes both online and offline retailers, impacting ThredUp's market share and pricing strategies. For more insights into the company's financials, you can read about Owners & Shareholders of ThredUp.

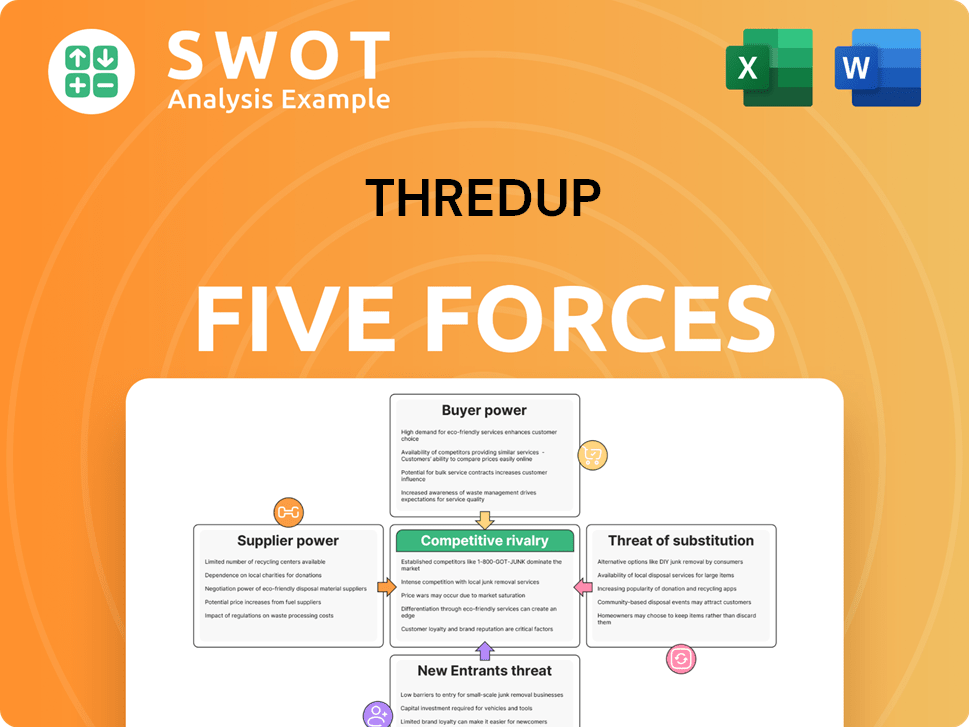

ThredUp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ThredUp Company?

- What is Competitive Landscape of ThredUp Company?

- How Does ThredUp Company Work?

- What is Sales and Marketing Strategy of ThredUp Company?

- What is Brief History of ThredUp Company?

- Who Owns ThredUp Company?

- What is Customer Demographics and Target Market of ThredUp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.