ThredUp Bundle

Who Really Controls ThredUp?

The ownership structure of a company is a fundamental aspect, directly influencing its strategic decisions and market performance. ThredUp, a pioneer in the online secondhand clothing market, has seen its ownership evolve significantly since its inception. Understanding the ThredUp SWOT Analysis is crucial for any investor or stakeholder seeking to understand the company's competitive positioning.

From its initial funding rounds to its IPO, the ThredUp company has attracted a diverse group of ThredUp investors, each with their own objectives. Unraveling Who owns ThredUp provides critical insights into its operational strategies and future prospects. This analysis will explore the ThredUp ownership structure, examining the influence of the ThredUp founder and major shareholders, and how these factors shape the company's trajectory in the competitive resale market, including details about the ThredUp business model.

Who Founded ThredUp?

The online consignment platform, was founded in 2009. The company's inception was spearheaded by James Reinhart, along with co-founders Oliver Lubin and Chris Homer. James Reinhart, currently serving as CEO, played a critical role in shaping the platform's business model.

The initial ownership structure of the company involved the founders, but specific equity splits are not publicly available. The early vision focused on creating a convenient way for consumers to sell and buy secondhand clothing, addressing both environmental sustainability and economic value. This approach formed the core of the company's business model.

Early financial backing for the company came from a mix of angel investors and venture capital firms. These investments were crucial for the initial development and scaling of the platform. The company's journey reflects the typical path of a venture-backed startup, with multiple funding rounds fueling its growth.

Early investors in the company included Redpoint Ventures and WTI (Western Technology Investment). These firms recognized the potential of the re-commerce market. The company's ability to secure funding allowed it to expand its inventory processing capabilities and reach a wider customer base. The company's financial backers played a significant role in shaping its early trajectory.

- Early funding rounds were essential for the company's expansion.

- Vesting schedules were likely in place to ensure founder commitment.

- There were no widely reported initial ownership disputes.

- The early development phase was driven by a shared vision for sustainable fashion.

The company's early success and expansion are detailed in an article about the Growth Strategy of ThredUp. The company's evolution from its founding to its current status as a publicly traded company reflects the dynamic nature of the fashion re-commerce market. Understanding the company's ownership structure provides insights into its strategic decisions and future direction. As of 2024, the company continues to innovate within the secondhand clothing market, with its ownership structure evolving alongside its business strategies.

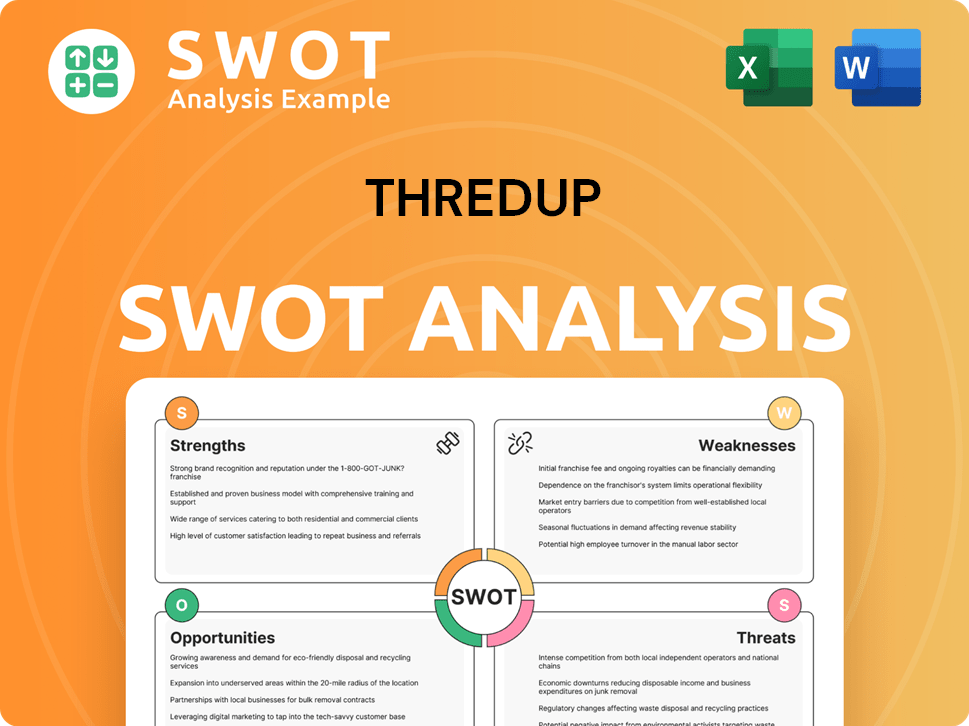

ThredUp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ThredUp’s Ownership Changed Over Time?

The ThredUp company underwent a significant transformation with its Initial Public Offering (IPO) on March 26, 2021. The IPO, priced at $14 per share, generated approximately $168 million and gave the company an initial market capitalization of around $1.3 billion. This transition from a private to a public entity introduced a wide array of public shareholders, altering the ThredUp ownership structure substantially.

Prior to the IPO, ThredUp secured funding through multiple rounds, involving venture capital firms. Post-IPO, these early investors, along with the ThredUp founder and other insiders, saw their stakes evolve. The move to public ownership brought increased scrutiny and reporting demands, including detailed ownership disclosures through SEC filings, such as 13F reports for institutional investors. This shift has influenced the company's strategy, emphasizing quarterly performance, shareholder value, and enhanced corporate governance.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | March 26, 2021 | Transitioned from private to public company; introduced public shareholders. |

| Subsequent SEC Filings | Ongoing | Provided detailed ownership information, including institutional holdings. |

| Market Activity | Ongoing | Fluctuated institutional and insider ownership percentages. |

As of early 2024, major shareholders include institutional investors like Vanguard Group Inc. and BlackRock Inc. ThredUp's founder, James Reinhart, continues to hold a notable stake, aligning his interests with public shareholders. The evolution of the ThredUp business model and its financial performance are closely watched by these significant stakeholders. For more details on how the company generates revenue, you can read about the Revenue Streams & Business Model of ThredUp.

The IPO marked a crucial change, transforming who owns ThredUp. Institutional investors now play a significant role, with the ThredUp company's founder still holding a key position.

- Institutional investors like Vanguard and BlackRock hold substantial shares.

- Founder James Reinhart maintains a notable stake.

- Public filings provide detailed ownership information.

- The shift to public ownership influences company strategy.

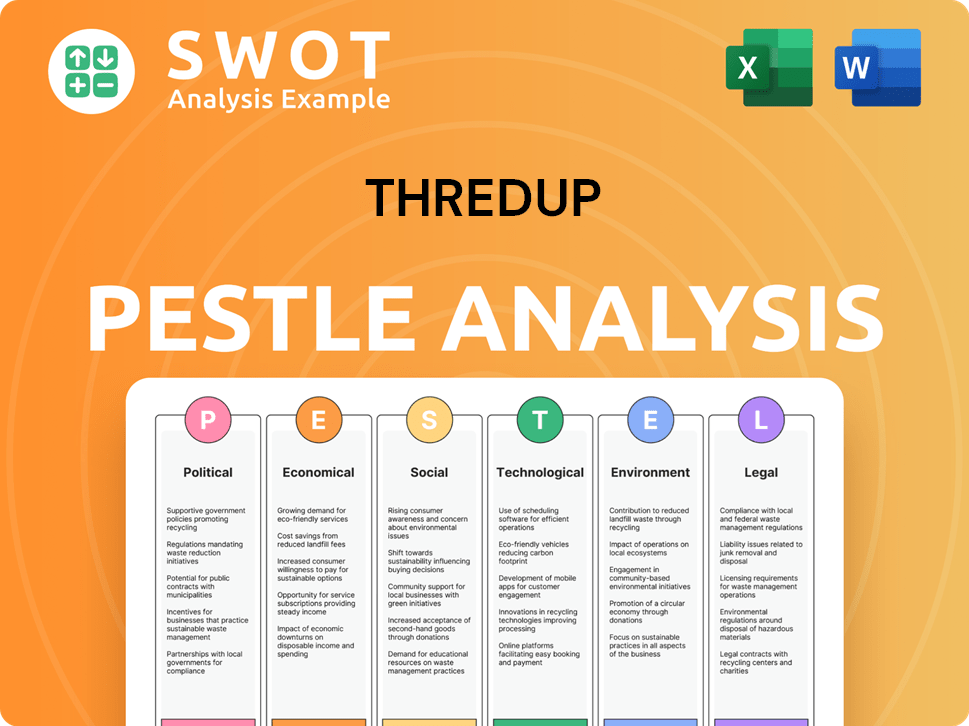

ThredUp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ThredUp’s Board?

The current Board of Directors of the company plays a key role in its governance and strategic direction. As of early 2025, the board includes James Reinhart, the CEO and co-founder, ensuring founder representation. Other board members include representatives from venture capital firms that were early investors, such as partners from Redpoint Ventures or Trinity Ventures, indicating their continued influence. Independent directors also bring experience and provide impartial oversight, crucial for corporate governance.

This structure aims to balance insider knowledge with independent perspectives to ensure robust decision-making. This balance is crucial as the company navigates the e-commerce and sustainable fashion market. Understanding the Competitors Landscape of ThredUp is also important for assessing the company's strategic positioning.

| Board Member | Title | Affiliation |

|---|---|---|

| James Reinhart | CEO & Co-founder | |

| Representative | Board Member | Redpoint Ventures |

| Representative | Board Member | Trinity Ventures |

The company operates under a one-share-one-vote structure. This standard voting structure ensures that voting power is proportional to ownership stake. While the CEO and other insiders may hold significant individual stakes, their voting power reflects their shareholdings. There are no public indications of dual-class shares or special voting rights that would grant outsized control to specific individuals or entities. This structure is typical for publicly traded companies, promoting shareholder equality.

The board includes the CEO and representatives from early investors. The company uses a one-share-one-vote structure.

- The board ensures a balance of insider and independent perspectives.

- Voting power is generally proportional to ownership.

- The governance structure supports the company's strategic goals.

- Who owns ThredUp is a mix of founders, venture capital, and public shareholders.

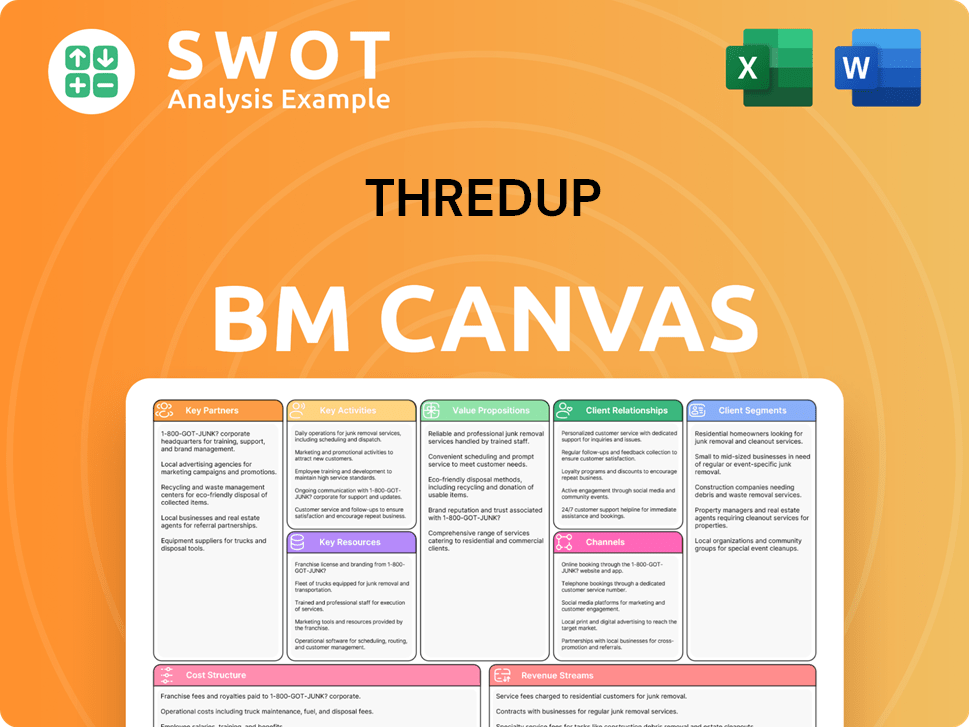

ThredUp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ThredUp’s Ownership Landscape?

Over the past few years (2022-2025), the ThredUp ownership landscape has seen interesting shifts. A key trend is the increasing presence of institutional investors. These include large asset management firms and mutual funds, which continuously assess the company's performance and future prospects in the growing re-commerce sector. While specific figures fluctuate, the general direction points toward a broader institutional investor base. Understanding who owns ThredUp is crucial for investors.

The company has not announced major share buybacks or secondary offerings that would significantly alter its ownership structure. Mergers and acquisitions within the secondhand market could influence ownership, but no such transactions have been announced recently. Leadership continuity, with James Reinhart remaining as CEO, suggests stability in founder involvement. The ThredUp company structure has remained consistent, reflecting its status as a publicly traded entity.

| Ownership Trend | Details | Impact |

|---|---|---|

| Institutional Investment | Increased participation from asset management firms and mutual funds. | Reflects confidence in the re-commerce market and ThredUp's potential. |

| Share Structure | No significant share buybacks or secondary offerings. | Maintains the existing ownership distribution without major dilution. |

| Leadership | James Reinhart continues as CEO. | Ensures continuity in strategic direction and founder involvement. |

Industry trends, such as the focus on ESG factors, may influence ThredUp's investors, attracting funds focused on sustainable and ethical investments. Analyst reports highlight the growth potential of the re-commerce market, which could attract new investors. There are no public statements suggesting a planned privatization or a change in its public listing status, indicating a continued commitment to its current ownership structure. For a deeper dive into the company's strategic approach, consider reading about the Growth Strategy of ThredUp.

James Reinhart is the co-founder and CEO. He has been instrumental in shaping the company's vision and strategy since its inception. His continued leadership provides stability.

The business model focuses on reselling secondhand clothing and accessories. It involves a consignment model where sellers send items, and ThredUp handles the listing, selling, and shipping.

Yes, ThredUp is a publicly traded company. It went public in March 2021. This has opened up the company to a wider range of investors.

James Reinhart is the current CEO of ThredUp. He is also the co-founder of the company.

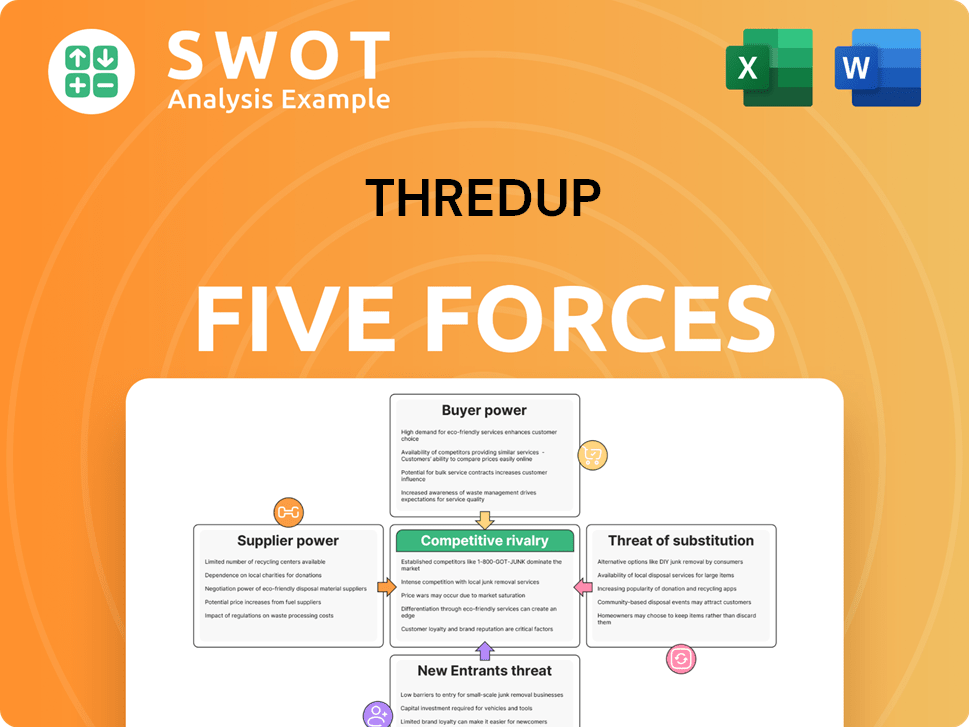

ThredUp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ThredUp Company?

- What is Competitive Landscape of ThredUp Company?

- What is Growth Strategy and Future Prospects of ThredUp Company?

- How Does ThredUp Company Work?

- What is Sales and Marketing Strategy of ThredUp Company?

- What is Brief History of ThredUp Company?

- What is Customer Demographics and Target Market of ThredUp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.