Tronox Holdings Bundle

What's the Story Behind Tronox Holdings?

Ever wondered about the journey of a global leader in titanium dioxide production? Tronox Holdings, a pivotal player in the chemicals industry, has a fascinating history. From its roots as a spin-off, the Tronox Holdings SWOT Analysis unveils a compelling narrative of growth and strategic evolution. Explore how this mining company transformed into a titan in the industry.

Tronox Holdings' story is a testament to strategic vision and adaptability. This brief history of Tronox Holdings Company details its evolution from a 2005 public offering to its current position, highlighting key milestones and challenges. Understanding the Tronox history provides valuable insights into the company's operations, its impact on the titanium dioxide market, and its future prospects within the competitive landscape of the chemicals industry.

What is the Tronox Holdings Founding Story?

The Tronox Holdings story began as a strategic move by its former parent company, Kerr-McGee. The company's journey to independence started with an initial public offering (IPO) on November 21, 2005. It officially became an independent entity in March 2006.

The spin-off was driven by pressure from corporate raider Carl Icahn, a significant Kerr-McGee shareholder. It also served to separate Kerr-McGee's substantial environmental liabilities. These liabilities included issues like polluting Lake Mead and leaving radioactive waste in Navajo Nation territory.

Initially based in Oklahoma City, Tronox inherited several radioactive waste sites from Kerr-McGee. The original business model focused on producing titanium dioxide pigment, a key material for various applications. The transition aimed to establish Tronox as a dedicated player in the chemicals sector, concentrating on titanium products. Early challenges included managing the significant environmental debts inherited from its parent company.

Tronox was spun off from Kerr-McGee in 2006.

- The IPO occurred in 2005.

- The spin-off addressed significant environmental liabilities.

- The company's initial focus was on titanium dioxide production.

- The company inherited radioactive waste sites.

Tronox Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Tronox Holdings?

The early years of Tronox Holdings saw a mix of rapid growth and significant challenges. Following its spin-off, the company quickly joined the S&P SmallCap 600 index. However, the 2008 financial crisis led to a sharp decline in its stock price, culminating in a Chapter 11 bankruptcy filing in early 2009.

Tronox emerged as an independent entity in March 2006. In the first quarter of 2006, it replaced Meade Instruments on the S&P SmallCap 600 index. This early inclusion in the index highlighted its initial market presence within the chemicals industry.

The 2008 financial crisis significantly impacted Tronox. The company's stock price plummeted, leading to its classification as a penny stock. Consequently, Tronox filed for Chapter 11 bankruptcy on January 14, 2009, although its non-U.S. operations were not included in the filing.

Tronox successfully emerged from Chapter 11 bankruptcy on February 14, 2011. Tom Casey became the CEO in October 2011, marking a new phase for the

A key expansion move was the acquisition of Exxaro Mineral Sands on June 15, 2012. This led to the combination under Tronox Limited, an Australian holding company. This acquisition enhanced vertical integration, securing a supply of titanium feedstock for its titanium dioxide operations.

Tronox's operations include mines and beneficiation plants in Australia and South Africa and nine TiO2 pigment production facilities worldwide. In 2024, Tronox reported total revenue of $3,074 million, an 8% increase year-over-year, and an adjusted EBITDA of $564 million. In Q1 2025, revenue was $738 million, a 9% increase compared to the prior quarter.

Tronox Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Tronox Holdings history?

The Tronox Holdings has achieved several significant milestones, particularly through strategic acquisitions and operational advancements, solidifying its position in the chemicals industry.

| Year | Milestone |

|---|---|

| 2012 | Acquired Exxaro Mineral Sands, enhancing vertical integration and TiO2 feedstock supply. |

| 2024 | Launched a new global coatings product, responding to regulatory changes in TiO2 manufacturing. |

| 2024 | Invested $135 million in two South African mining projects, Namakwa East OFS and Fairbreeze extension, to secure high-grade ilmenite sources. |

Innovations at Tronox include the launch of new products and strategic investments in mining projects to ensure a reliable supply of essential materials. The company's focus on sustainability, such as the solar project in 2024, also demonstrates its commitment to reducing environmental impact.

Tronox introduced a new global coatings product in 2024, adapting to evolving regulatory standards within the chemicals industry.

The company invested in mining projects to secure a consistent supply of high-grade ilmenite, essential for titanium dioxide production. These investments aim to replace aging mines and maintain operational efficiency.

Tronox is committed to sustainability, as shown by its solar project in 2024, which supports its Scope 1 and 2 emissions reduction targets.

Despite these advancements, Tronox has faced challenges, including financial burdens from legacy environmental issues and market pressures. In 2025, the company reported a net loss, which included restructuring charges related to the closure of a pigment plant.

The company filed for Chapter 11 bankruptcy in January 2009, primarily due to environmental liabilities inherited from its former parent, Kerr-McGee.

Market downturns and competition, particularly from Chinese exports, have posed ongoing challenges. In the first quarter of 2025, Tronox reported a net loss of $111 million.

The decision to idle the Botlek pigment plant in the Netherlands, announced in March 2025, is expected to improve free cash flow and save over $30 million annually from 2026 onwards.

Tronox is focused on cost reduction programs, targeting $125-$175 million in sustainable cost savings by the end of 2026 to overcome financial challenges.

Tronox Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Tronox Holdings?

The Tronox Holdings journey has seen significant shifts and strategic moves. From its initial public offering to navigating bankruptcy and emerging as a key player in the chemicals industry, the company's history is marked by both challenges and strategic expansions. Key events include forming as an independent company, acquiring Exxaro Mineral Sands, and settling environmental contamination issues. More recently, the company has focused on cost improvements and strategic initiatives to drive future growth.

| Year | Key Event |

|---|---|

| 2005 | Tronox goes public through an IPO by Kerr-McGee. |

| 2006 | Becomes an independent company in March. |

| 2008 | Stock price declines significantly; moves from NYSE to OTC. |

| 2009 | Files for Chapter 11 bankruptcy. |

| 2011 | Emerges from Chapter 11 bankruptcy in February; Tom Casey becomes CEO in October. |

| 2012 | Headquarters moves to Stamford, CT in June; acquires Exxaro Mineral Sands. |

| 2014 | U.S. government reaches $5 billion settlement with Anadarko (Kerr-McGee successor) for environmental contamination. |

| 2024 | Launches new global coatings product; invests $135 million in South African mining projects. Reports full-year revenue of $3.074 billion and net loss of $54 million. |

| 2025 (Q1) | Reports revenue of $738 million and a net loss of $111 million, including restructuring charges for idling the Botlek plant. |

| 2025 (May) | JP Morgan upgrades Tronox Holdings outlook from Neutral to Overweight. |

Tronox is concentrating on strategic initiatives to boost growth and profitability. This includes a strong emphasis on vertical integration to ensure self-sufficiency in titanium dioxide (TiO2) production. The company is also aiming to become a significant supplier of rare earth oxides.

The company maintains its 2025 revenue guidance of $3.0-$3.4 billion and adjusted EBITDA guidance of $525-$625 million. Capital expenditures for 2025 are projected to be less than $365 million, with free cash flow expected to be greater than $50 million. Tronox is implementing a cost improvement program targeting significant savings by the end of 2026.

A key element of Tronox's strategy is a cost improvement program, targeting $125-$175 million in sustainable, run-rate cost improvements by the end of 2026. Approximately $25-$35 million of these savings are expected by the end of 2025. The idling of the Botlek plant is contributing to these cost savings.

Despite macroeconomic uncertainties and competitive pressures, Tronox is positioned to capitalize on an anticipated industry recovery in the TiO2 market. This recovery is expected to be driven by improvements in key end-markets like coatings and housing, as well as tightening supply-demand dynamics. This positions the company well within the chemicals industry.

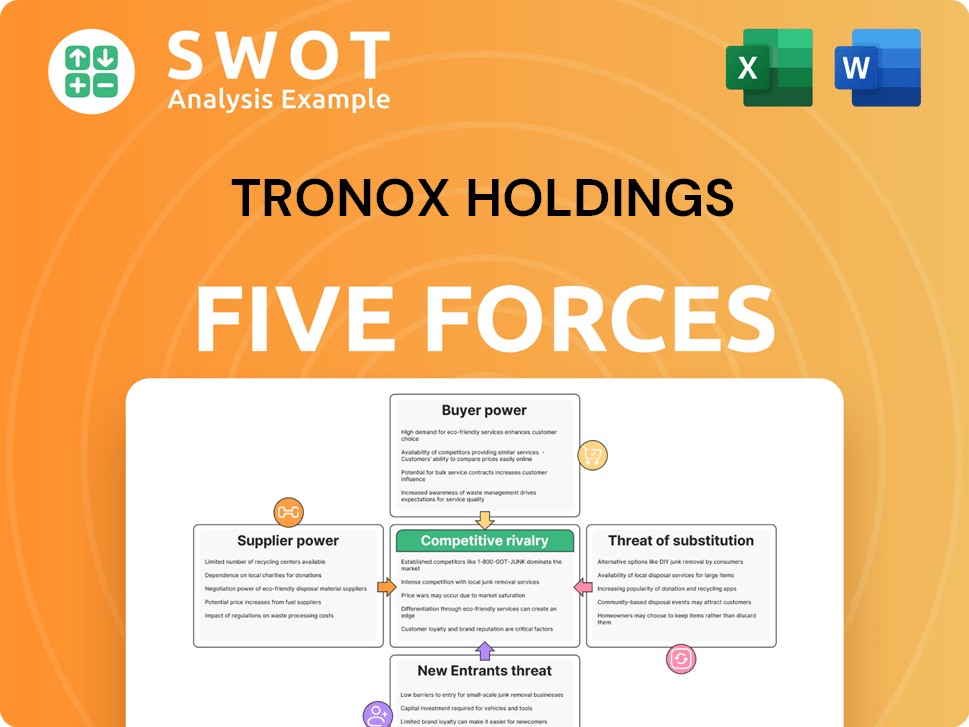

Tronox Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Tronox Holdings Company?

- What is Growth Strategy and Future Prospects of Tronox Holdings Company?

- How Does Tronox Holdings Company Work?

- What is Sales and Marketing Strategy of Tronox Holdings Company?

- What is Brief History of Tronox Holdings Company?

- Who Owns Tronox Holdings Company?

- What is Customer Demographics and Target Market of Tronox Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.