Tronox Holdings Bundle

How Does Tronox Holdings Company Stack Up in the TiO2 Arena?

The global titanium dioxide (TiO2) market is a battleground, and Tronox Holdings SWOT Analysis is a key player. This essential pigment is crucial across a wide range of industries. Founded in 2005, Tronox has strategically positioned itself in this competitive landscape, evolving through acquisitions and expansions.

To truly understand Tronox's market position, we must conduct a thorough competitive landscape analysis. Examining Tronox's financial performance alongside its key competitors is crucial in the titanium dioxide industry. This exploration will reveal Tronox's competitive advantages and disadvantages, as well as its future outlook within the global TiO2 market.

Where Does Tronox Holdings’ Stand in the Current Market?

Tronox Holdings plc holds a prominent position in the global titanium dioxide (TiO2) market. It is the only fully integrated producer of TiO2 pigment, controlling the entire value chain from mining to pigment production. This integration provides a significant competitive edge, ensuring supply chain stability and cost control. In Q1 2024, the company reported a net income of $26 million, demonstrating strong operational performance.

The company's core operations revolve around its diverse grades of TiO2 pigment, catering to various applications, including paints and coatings, plastics, paper, and specialty chemicals. Its geographic presence spans across North America, South America, Europe, Africa, and Asia, allowing it to serve a global customer base. Tronox serves a broad spectrum of customer segments, from large multinational corporations to specialized manufacturers. The company's strategic focus emphasizes its integrated model and sustainable practices, aligning with growing industry demands. The company's financial health is robust, with net sales of $817 million in Q1 2024, reflecting its significant scale within the industry.

Tronox's market position is particularly strong in regions where its integrated operations provide a cost advantage and reliable supply. The company's ability to control the entire production process, from raw materials to finished product, is a key differentiator. This integrated model helps in managing costs and ensuring a consistent supply of high-quality TiO2 pigment to its global customer base. For a deeper dive into the company's strategic initiatives, consider exploring the Growth Strategy of Tronox Holdings.

Tronox consistently ranks among the top global TiO2 producers. While specific market share figures fluctuate, the company's scale and integrated operations ensure a significant presence. Its strong performance in Q1 2024, with net sales of $817 million, highlights its substantial market share.

The primary competitive advantage of Tronox is its fully integrated model. This allows for better control over costs, supply chain, and product quality. The company's geographic diversification and focus on sustainable practices also contribute to its competitive edge. These factors are crucial in the titanium dioxide industry.

Tronox serves a diverse customer base, including large multinational corporations and specialized manufacturers. Its products are used in paints, coatings, plastics, and other industries. The company's ability to meet the needs of various customer segments contributes to its market position.

Tronox's financial performance is a key indicator of its market position. The company's net sales of $817 million in Q1 2024 demonstrate its significant scale. The net income of $26 million in the same period reflects strong operational efficiency and market demand.

Tronox's strengths include its integrated model, global presence, and diverse product portfolio. The company's weaknesses might include dependence on raw material prices and economic fluctuations. Understanding these aspects is crucial for a thorough competitive landscape analysis.

- Integrated production model ensures supply chain control.

- Global presence allows access to diverse markets.

- Strong financial performance, with $817 million in net sales in Q1 2024.

- Dependence on raw material prices can impact profitability.

Tronox Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Tronox Holdings?

The competitive landscape for Tronox Holdings Company is primarily defined by the titanium dioxide (TiO2) market, a sector characterized by a few major players. A thorough competitive landscape analysis reveals that Tronox's market position is significantly influenced by its direct competitors and the broader industry dynamics. Understanding these factors is crucial for assessing Tronox's financial performance and strategic positioning.

The TiO2 industry is highly concentrated, with a few key companies controlling a significant portion of the global market share. This concentration leads to intense competition, where companies vie for market share through various strategies, including pricing, product innovation, and geographical expansion. Analyzing Tronox's competitive advantages and disadvantages requires a deep understanding of these competitive dynamics.

Tronox's main rivals include established industry leaders and emerging players, each employing different strategies to gain a competitive edge. Evaluating how Tronox compares to its competitors involves assessing their respective strengths and weaknesses, market reach, and financial health. For a deeper dive into the company's financial aspects, consider exploring Revenue Streams & Business Model of Tronox Holdings.

The primary competitors of Tronox Holdings Company include Chemours Company, Venator Materials PLC, and Lomon Billions Group.

Chemours, a major producer of TiO2, competes with Tronox through its established brand, extensive product portfolio, and strong presence in key end-use markets. Chemours often challenges Tronox on product quality and customer relationships.

Venator Materials PLC competes through product innovation and specialized applications, often targeting niche markets. Venator focuses on high-performance pigments and technical service.

Lomon Billions Group, a Chinese company, is a formidable competitor, primarily leveraging its significant production capacity and competitive pricing. Lomon Billions has expanded its global reach, particularly in Asian markets.

Chemours and Venator often compete on product quality and technical service, while Lomon Billions leverages scale and cost efficiency. These strategies drive shifts in market share.

Indirect competitors include companies producing alternative white pigments or materials that can substitute TiO2 in certain applications. However, TiO2 remains dominant due to its superior opacity and brightness.

The titanium dioxide industry faces various challenges, including fluctuating raw material costs, environmental regulations, and global economic conditions. These factors can impact Tronox's financial results and competitive landscape.

- Pricing Pressure: Increased capacity from Asian producers like Lomon Billions has put pressure on global TiO2 prices.

- Consolidation: Mergers and acquisitions impact competitive dynamics by creating larger, more integrated entities.

- Supply Chain Disruptions: Global events and logistical challenges can lead to supply chain disruptions, affecting all major players.

- Environmental Regulations: Stricter environmental standards can increase production costs and influence market strategies.

Tronox Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Tronox Holdings a Competitive Edge Over Its Rivals?

The competitive landscape of Tronox Holdings Company is shaped by its unique position and strategic moves within the titanium dioxide (TiO2) industry. A comprehensive competitive landscape analysis reveals how Tronox leverages its strengths to maintain a leading market position. Key milestones and strategic decisions have been instrumental in shaping the company's competitive edge, particularly its ability to control the entire value chain.

Tronox's journey has been marked by significant acquisitions and expansions, notably the acquisition of Cristal's TiO2 business in 2019. This move dramatically increased its integrated capabilities and global reach. The company's focus on sustainability and ESG initiatives also plays a critical role in its competitive strategy, attracting environmentally conscious customers. These factors, combined with proprietary technology, contribute to a strong competitive advantage.

Understanding the Tronox market position requires an examination of its core competencies. The company's vertical integration, from mining mineral sands to producing TiO2 pigment, provides significant advantages. This control over the supply chain helps mitigate price volatility and ensures a consistent supply, which is a key differentiator in the titanium dioxide industry. Further insights can be found in an analysis of the Target Market of Tronox Holdings.

Tronox is the only fully integrated TiO2 producer globally, controlling the entire value chain from mining to pigment production. This ensures supply reliability and cost efficiencies. This integration is a significant barrier to entry for competitors and provides a stable supply of raw materials.

Tronox utilizes proprietary technologies in mineral processing and pigment production. This leads to high-quality and consistent product offerings. These technologies are key to maintaining its competitive edge in the market.

Tronox has a global footprint with mining and processing operations across multiple continents. This provides a resilient supply chain and optimized logistics. The company's global presence allows it to serve diverse customer bases efficiently.

Tronox focuses on ESG initiatives, including reducing its carbon footprint and improving water management. This enhances brand equity and customer loyalty, especially among environmentally conscious buyers. These initiatives are increasingly important in the market.

Tronox's competitive advantages are multifaceted, providing a robust defense against Tronox competitors. These advantages include vertical integration, proprietary technologies, a global footprint, and a focus on sustainability. These factors contribute to Tronox's strong market position and financial performance.

- Vertical Integration: Controls the entire value chain.

- Proprietary Technology: Ensures high-quality products.

- Global Footprint: Provides supply chain resilience.

- Sustainability: Enhances brand equity.

Tronox Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Tronox Holdings’s Competitive Landscape?

An examination of the Growth Strategy of Tronox Holdings reveals a company navigating a dynamic titanium dioxide (TiO2) industry. The competitive landscape for Tronox Holdings Company is shaped by evolving industry trends, including technological advancements, regulatory changes, and shifting consumer preferences. Understanding these factors is crucial for assessing Tronox's market position and future outlook.

The Tronox market position is influenced by both internal strengths and external pressures. The company faces risks such as potential disruptions from new production methods and increased competition. However, opportunities exist in emerging markets and product innovations. A comprehensive competitive landscape analysis is essential for understanding how Tronox can maintain and improve its position.

Technological advancements drive demand for higher-performance TiO2 grades. Regulatory changes push for more sustainable manufacturing, impacting production costs. Consumer preferences increasingly favor environmentally friendly products, influencing material choices. Global economic shifts, particularly in emerging markets, impact TiO2 demand.

Potential disruptions include new, cost-effective production methods or alternative pigments. New market entrants from low-cost regions could intensify price competition. Changing business models, such as circular economy principles, require adaptation. Declining demand in mature markets and increased regulatory scrutiny pose threats.

Emerging markets with expanding industrial bases offer significant growth potential. Product innovations can lead to new applications for TiO2. Strategic partnerships can enhance research and development and market access. Sustainable practices and cleaner technologies can provide a competitive advantage.

Tronox focuses on optimizing integrated operations for cost efficiency. The company invests in sustainable practices to meet regulatory demands. It explores opportunities in high-growth application areas and geographies. These strategies aim to maintain and evolve its competitive position.

The titanium dioxide industry is currently influenced by factors such as the rising demand in the Asia-Pacific region, which is expected to continue driving growth. Environmental regulations are becoming stricter, pushing companies to adopt sustainable practices. Price volatility in raw materials like titanium ore can significantly impact production costs.

- Technological innovation is crucial for developing higher-performance TiO2 grades.

- Geopolitical events and trade policies can affect supply chains and market access.

- Competition from both established players and new entrants is increasing.

- The shift towards more sustainable products is reshaping consumer preferences.

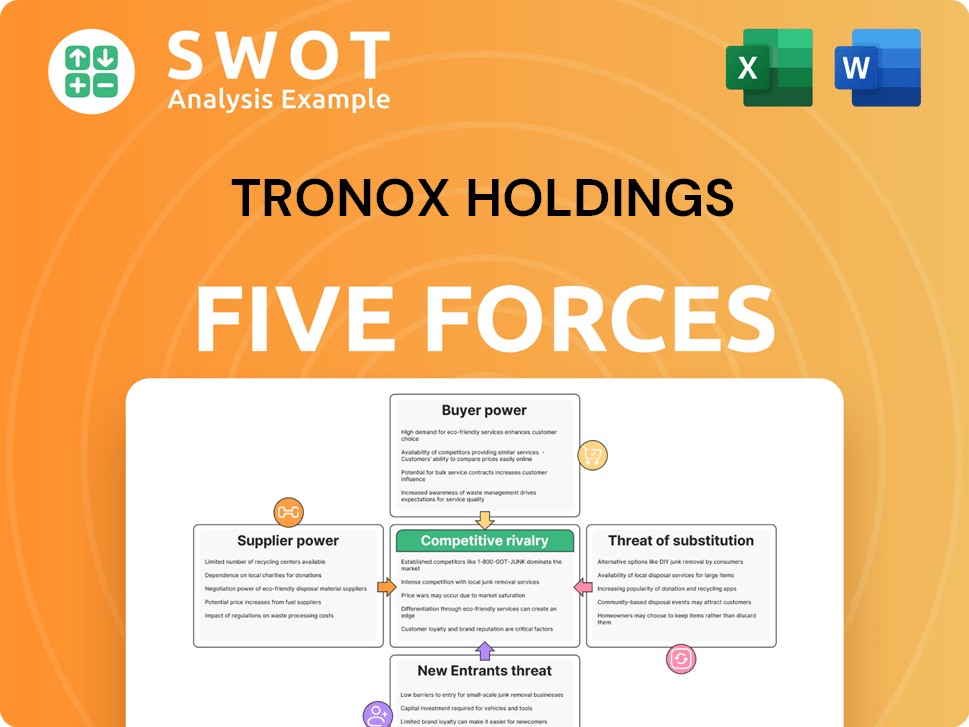

Tronox Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tronox Holdings Company?

- What is Growth Strategy and Future Prospects of Tronox Holdings Company?

- How Does Tronox Holdings Company Work?

- What is Sales and Marketing Strategy of Tronox Holdings Company?

- What is Brief History of Tronox Holdings Company?

- Who Owns Tronox Holdings Company?

- What is Customer Demographics and Target Market of Tronox Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.