Tronox Holdings Bundle

How Does Tronox Holdings Shape Industries Worldwide?

Tronox Holdings, a global titan in titanium dioxide (TiO2) production, fuels essential industries from paints to plastics. With a vertically integrated model spanning mining to manufacturing, Tronox controls its supply chain, setting it apart in the chemicals sector. In 2024, Tronox reported $3.074 billion in revenue, highlighting its significant market presence and operational prowess.

This deep dive into Tronox Holdings SWOT Analysis will explore the core of the

What Are the Key Operations Driving Tronox Holdings’s Success?

Tronox Holdings plc is a vertically integrated company that creates and delivers value through its core operations. The company focuses on the mining and processing of titanium-bearing mineral sands and the manufacturing of titanium dioxide (TiO2) pigment. This integrated approach allows for greater control over the supply chain and enhances the production of high-quality products.

The company's main products include TiO2 pigment, specialty-grade TiO2 products, high-purity titanium chemicals, and zircon. These products are essential for various industries, such as paints, coatings, plastics, and paper, where TiO2 is used to add brightness and durability. Tronox's commitment to quality and its diverse product portfolio serve a wide range of customer needs.

Tronox's operational processes are comprehensive, involving mining operations in resource-rich regions like Australia and South Africa. The company also operates upgrading facilities to produce high-grade titanium feedstock, pig iron, and other minerals. This vertical integration supports self-sufficiency in TiO2 production, allowing Tronox to deliver low-cost, high-quality pigment globally. The company's operational capacity includes producing approximately 832,000 metric tons of titanium feedstock annually.

Tronox mines titanium-bearing mineral sands in regions like Australia and South Africa. These operations are crucial for securing the raw materials needed for TiO2 production. The company's mining activities are a fundamental part of its integrated business model.

Tronox manufactures TiO2 pigment, a key ingredient in many products. This process involves converting titanium feedstock into high-quality pigment. The company's manufacturing facilities are strategically located to serve global markets.

Tronox offers a diverse range of products, including TiO2 pigment, specialty-grade TiO2 products, and titanium chemicals. These products cater to various industries, such as paints, coatings, and plastics. The company's product offerings are designed to meet specific customer needs.

With a global footprint, Tronox operates nine pigment facilities worldwide and employs approximately 6,500 people across six continents. The company's global presence supports its ability to serve customers worldwide. Tronox's extensive network enhances its operational efficiency and market reach.

Tronox's value proposition centers on its vertically integrated operations, which provide a consistent supply of high-quality products. The company's strategic partnerships and global distribution network enhance its ability to serve customers efficiently. Tronox's integrated approach minimizes disruptions and maximizes quality control.

- Consistent Supply: Tronox ensures a reliable supply of TiO2 pigment and other products.

- High-Quality Products: The company is committed to producing high-quality products that meet industry standards.

- Diversified Portfolio: Tronox offers a wide range of products to serve various industrial applications.

- Strategic Partnerships: The company engages in strategic manufacturing partnerships across the Asia-Pacific region.

Tronox's supply chain is robust, supported by its global footprint. The company is also expanding its distribution network, with plans to establish 12 new distribution centers in emerging markets in 2024. This extensive network and integrated approach minimize operational disruptions and maximize quality control, making Tronox's operations unique and effective compared to competitors. For more insights, you can read about the Owners & Shareholders of Tronox Holdings.

Tronox Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tronox Holdings Make Money?

The primary revenue streams for Tronox Holdings plc, often referred to as Tronox Company, stem from the sale of its key products. These include titanium dioxide (TiO2), zircon, and other mineral products. The company leverages its integrated business model to control costs and optimize its product mix, enhancing profitability. Understanding the financial performance of Tronox is crucial for investors and stakeholders.

In 2024, Tronox reported a total revenue of $3.074 billion, marking an 8% increase from the previous year. This growth was driven by increased sales volumes, particularly in the TiO2 and zircon segments. Tronox's ability to adapt to market demands and optimize its operations is key to its financial success.

For Q1 2025, TiO2 revenue was $584 million, and zircon revenue was $69 million. Revenue from other products in Q1 2025 was $85 million, an increase of 5% year-over-year.

Tronox's monetization strategies are centered on its integrated business model, which allows it to control costs from raw material extraction to finished product. This approach enhances profitability and provides a competitive advantage. The company's financial performance is also influenced by its ability to respond to market demand and optimize its product mix.

- Titanium Dioxide (TiO2): In 2024, TiO2 revenue increased by 7% to $2.41 billion, driven by a 13% increase in sales volumes, though partially offset by a 6% decline in average selling prices. In Q1 2025, TiO2 revenue was $584 million. This product is crucial, as it is a key ingredient in paints, plastics, and paper.

- Zircon: Zircon revenue rose by 25% to $322 million in 2024, with volumes increasing by 41% but average prices falling by 16%. In Q1 2025, zircon revenue was $69 million. Zircon is used in ceramics, foundries, and the chemical industry.

- Other Products: Revenue from other products in Q1 2025 was $85 million, an increase of 5% year-over-year. These include ilmenite and heavy mineral concentrate tailings.

- Cost Improvements: Tronox aims to achieve $125-175 million of sustainable, run-rate cost improvements by the end of 2026, which will further enhance its monetization efforts.

For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Tronox Holdings.

Tronox Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Tronox Holdings’s Business Model?

Tronox Holdings plc has strategically navigated the titanium dioxide (TiO2) market, focusing on vertical integration and cost optimization. The company's moves reflect a commitment to operational efficiency and sustainable practices. These strategies are crucial for maintaining a competitive edge in the global chemicals and mining industries.

Key milestones include significant investments in mining projects and the launch of new products. These initiatives are designed to enhance production capacity and adapt to regulatory changes. Tronox's focus on cost-saving measures and sustainability further solidifies its position in the market.

The company's recent actions, such as the intent to idle the Botlek pigment plant, demonstrate its proactive approach to financial management. These moves aim to improve free cash flow and reduce operational costs, ensuring long-term profitability and resilience in a dynamic market environment. For more insights, check out the Growth Strategy of Tronox Holdings.

In 2024, Tronox launched a new global coatings product. The company invested $135 million in two key mining projects in South Africa, Namakwa East OFS and Fairbreeze extension, to replace existing mines. Fairbreeze Expansion is scheduled for commissioning in July 2025, and Namakwa East OFS in November 2025.

Tronox focuses on vertical integration, operating its own titanium-bearing mineral sand mines. In March 2025, the company announced the intent to idle its Botlek pigment plant in the Netherlands. This move is expected to improve free cash flow in 2025 and deliver over $30 million in cost improvements from 2026 onwards.

Tronox has a global scale, operating a network of TiO2 plants and mines worldwide. The company emphasizes product innovation, developing differentiated TiO2 products. Tronox is investing in sustainability, with two renewable energy contracts in South Africa converting 70% of its electricity in the region to renewable sources by 2027.

Tronox launched a cost improvement plan in 2024 targeting $125-175 million in sustainable savings by the end of 2026. The Botlek plant idling is expected to improve free cash flow. The company is also working towards achieving its Scope 1 and 2 emissions reduction target for 2025 of 25%.

Tronox's strategic moves focus on vertical integration, ensuring self-sufficiency in TiO2 feedstock production. The company is investing in mining projects and implementing cost-saving measures to enhance its competitive position in the market. These initiatives are designed to improve financial performance and adapt to market challenges.

- Vertical Integration: Operating mines and beneficiation operations in Australia and South Africa.

- Cost Reduction: Aiming for $125-175 million in sustainable savings by the end of 2026.

- Sustainability: Converting 70% of electricity in South Africa to renewable sources by 2027.

- Emissions Reduction: Achieving a 25% reduction in Scope 1 and 2 emissions by 2025.

Tronox Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Tronox Holdings Positioning Itself for Continued Success?

The Tronox Holdings Company holds a strong position as a leading integrated manufacturer of titanium dioxide (TiO2) pigment globally. They have a worldwide presence, with operations across six continents and a customer base of approximately 1,200 clients. Their business model includes vertical integration, which allows them to control their raw materials supply, supporting their competitive edge in the market.

However, the company faces a number of risks. These include the impact of macroeconomic conditions, policy changes impacting international trade, and inflationary pressures. Market fluctuations, the volatility of TiO2 prices, and production disruptions at their facilities can also affect profitability. In early 2025, Moody's changed Tronox's credit rating to a negative outlook, indicating potential financial challenges.

Tronox is a leading global producer of titanium dioxide (TiO2) pigment. They have a significant presence in the market due to their global operations and integrated business model. The company's ability to control its raw materials supply is a key factor in its competitive standing.

The company faces risks from macroeconomic conditions, policy changes, and inflationary pressures. Market volatility, price fluctuations, and disruptions in production can also affect profitability. Moody's has assigned a negative outlook, indicating potential financial challenges.

Tronox has strategic initiatives to maintain and increase profitability. They anticipate sufficient cash flow for operational needs, capital expenditures, and debt payments. The company is focused on cost improvements and investing in new mining projects.

For 2025, Tronox projects revenue between $3.0-3.4 billion and adjusted EBITDA between $525-625 million. Capital expenditures are expected to be less than $365 million. The company aims for $125-175 million in sustainable cost savings by the end of 2026.

Tronox is focused on several key initiatives to improve its financial performance and market position. These include cost reduction programs, investments in new mining projects, and leveraging existing operations to become a significant supplier of rare earth oxides.

- Cost Improvement Plan: Targeting $125-175 million in sustainable savings by the end of 2026.

- Mining Projects: Enhancing mining cost profile by $50-60 million from 2025 to 2026 through projects like Fairbreeze Expansion and Namakwa East OFS.

- Rare Earth Oxides: Aiming to become a significant supplier by utilizing existing mining operations and processing monazite.

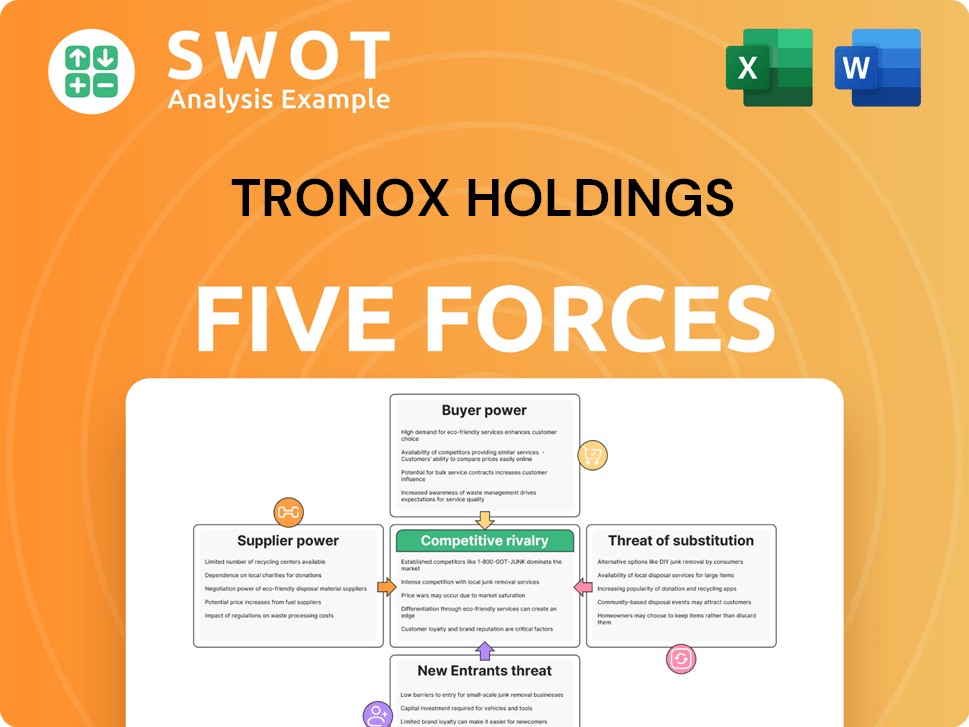

Tronox Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tronox Holdings Company?

- What is Competitive Landscape of Tronox Holdings Company?

- What is Growth Strategy and Future Prospects of Tronox Holdings Company?

- What is Sales and Marketing Strategy of Tronox Holdings Company?

- What is Brief History of Tronox Holdings Company?

- Who Owns Tronox Holdings Company?

- What is Customer Demographics and Target Market of Tronox Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.