TTM Technologies Bundle

How has TTM Technologies Shaped the Tech World?

In a world powered by cutting-edge electronics, understanding the TTM Technologies SWOT Analysis is crucial. This global leader in engineered systems and printed circuit board (PCB) manufacturing has a fascinating story. From its inception in 1998, TTM Technologies, or TTM company, has become a pivotal player, providing essential components across various sectors.

This brief history of TTM Technologies details the company's evolution, highlighting its strategic growth and adaptation within a dynamic technological landscape. Explore TTM history, including TTM acquisitions, TTM products, and TTM financials to understand its journey. The article will also touch on TTM Technologies manufacturing processes, key milestones, and expansion, providing a comprehensive TTM Technologies company profile.

What is the TTM Technologies Founding Story?

The story of TTM Technologies began in 1998. This was a time of rapid technological change, where the demand for advanced electronic components was growing quickly. The company saw an opportunity to provide specialized manufacturing services, focusing on printed circuit boards (PCBs).

While specific details about the founders are not widely available, the company's quick growth suggests a team with strong expertise in electronics manufacturing. They also had a good understanding of what the market needed. This understanding was key to the early success of TTM Technologies.

The initial business model focused on providing high-quality, advanced PCB solutions. This included early offerings of high-density interconnect (HDI) PCBs. These were essential for making electronic devices smaller and more powerful. The name, TTM, stands for 'Time-To-Market'. This reflects the company's commitment to delivering products quickly to meet customer needs in a fast-paced industry. Initial funding likely came from a mix of private investment and strategic partnerships, which was common for capital-intensive manufacturing businesses.

Here are some important points in the brief history of TTM Technologies.

- Founded in 1998, focusing on advanced PCB manufacturing.

- Early focus on HDI PCBs, crucial for miniaturization.

- Name 'Time-To-Market' reflects commitment to fast delivery.

- Rapid growth driven by expertise in electronics and market understanding.

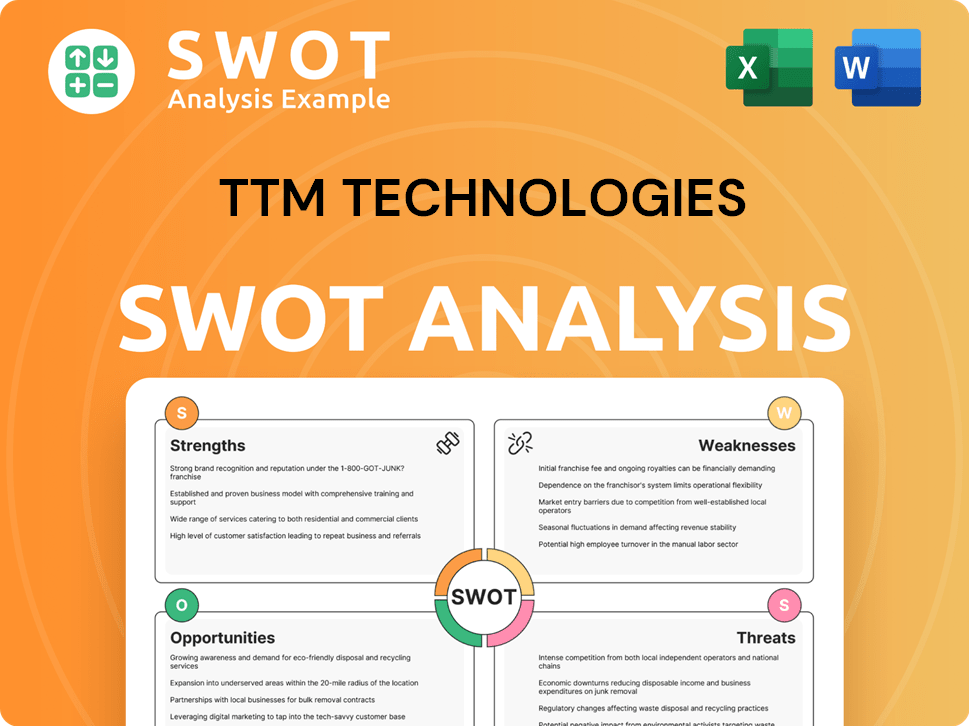

TTM Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of TTM Technologies?

The early years of TTM Technologies were marked by rapid growth and strategic moves. This expansion was fueled by a focus on high-growth markets and key acquisitions. A pivotal moment was the initial public offering (IPO) in 2000, which provided capital for significant growth.

The IPO on NASDAQ in 2000 was a crucial step, giving the company resources for expansion. Early PCB product launches targeted the growing telecommunications and computing industries. This early focus helped establish the TTM company as a key player.

To meet growing demand, TTM quickly expanded its manufacturing facilities. These facilities were strategically located to serve a growing client base. This expansion was critical for supporting the company's early success and growth.

The acquisition of Honeywell’s Advanced Circuits business in 2006 was a significant move, broadening TTM's capabilities. This acquisition strengthened its position in the aerospace and defense sectors. The 2010 acquisition of Tyco Electronics' Printed Circuit Group further solidified its market leadership.

These TTM acquisitions allowed entry into new markets and product categories, diversifying its portfolio. The company consistently focused on technological advancements, investing in research and development. Leadership transitions during this period aimed to improve operational efficiency.

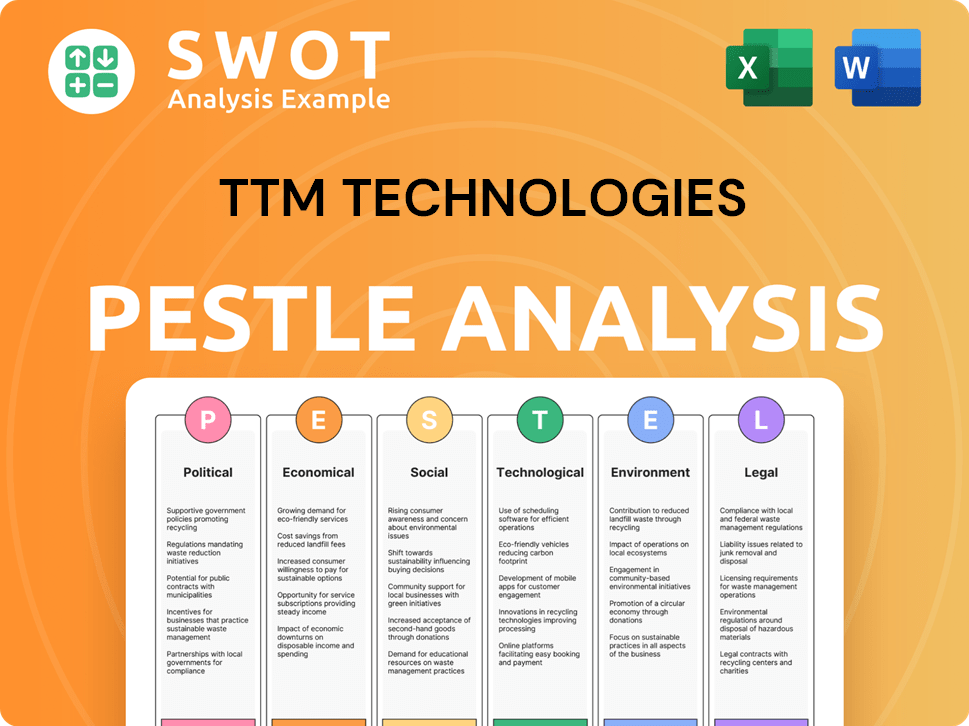

TTM Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in TTM Technologies history?

The TTM Technologies has a rich TTM history, marked by significant milestones in the electronics manufacturing sector. The company's journey reflects its evolution and strategic adaptations over time, demonstrating its resilience and commitment to innovation in a competitive market.

| Year | Milestone |

|---|---|

| 1998 | Founded through the merger of three printed circuit board (PCB) manufacturers. |

| 2000 | Completed its initial public offering (IPO), marking a significant step in its growth. |

| 2006 | Acquired Tyco Printed Circuit Group, expanding its manufacturing capabilities. |

| 2010 | Acquired Viasystems Group, Inc., further strengthening its market position. |

| 2015 | Acquired the PCB business of Sanmina Corporation, increasing its market share. |

| 2021 | Acquired Telephonics Corporation, diversifying its product offerings. |

TTM Technologies has consistently focused on innovation, particularly in PCB manufacturing. This commitment has allowed the company to meet the evolving needs of the electronics industry.

TTM has continuously advanced its HDI PCB technology, which is essential for compact and complex electronic devices. These advancements have improved performance and reliability.

The company has invested in advanced materials for PCBs, enhancing their thermal management and signal integrity. This has led to improved product performance and durability.

TTM has secured numerous patents related to PCB manufacturing processes and materials. This protects its innovations and competitive edge.

Major partnerships with leading technology companies have further cemented its role in the supply chain for cutting-edge electronics. These collaborations enhance its market position.

TTM has expanded into engineered systems, providing integrated solutions for various applications. This diversification has broadened its revenue streams.

The company has invested in RF components, catering to the growing demand for wireless communication technologies. This expansion has enhanced its product portfolio.

Despite its successes, TTM Technologies has faced various challenges. These challenges have driven the company to adapt and innovate.

Economic recessions have impacted demand for electronic components, affecting TTM's financial performance. The company has had to adjust its strategies to navigate these downturns.

Competition from lower-cost manufacturers, particularly in Asia, has required TTM to focus on efficiency and differentiation. This has led to strategic adjustments.

Although rare, product failures have prompted rigorous quality control enhancements. These improvements have strengthened its reputation.

Integrating large acquisitions has presented challenges in terms of cultural alignment and operational harmonization. Careful planning has been essential for success.

Geopolitical tensions and trade restrictions have created uncertainties. TTM has had to adapt its supply chain and market strategies.

Global supply chain disruptions have impacted the availability of raw materials and components. TTM has had to manage its supply chain proactively.

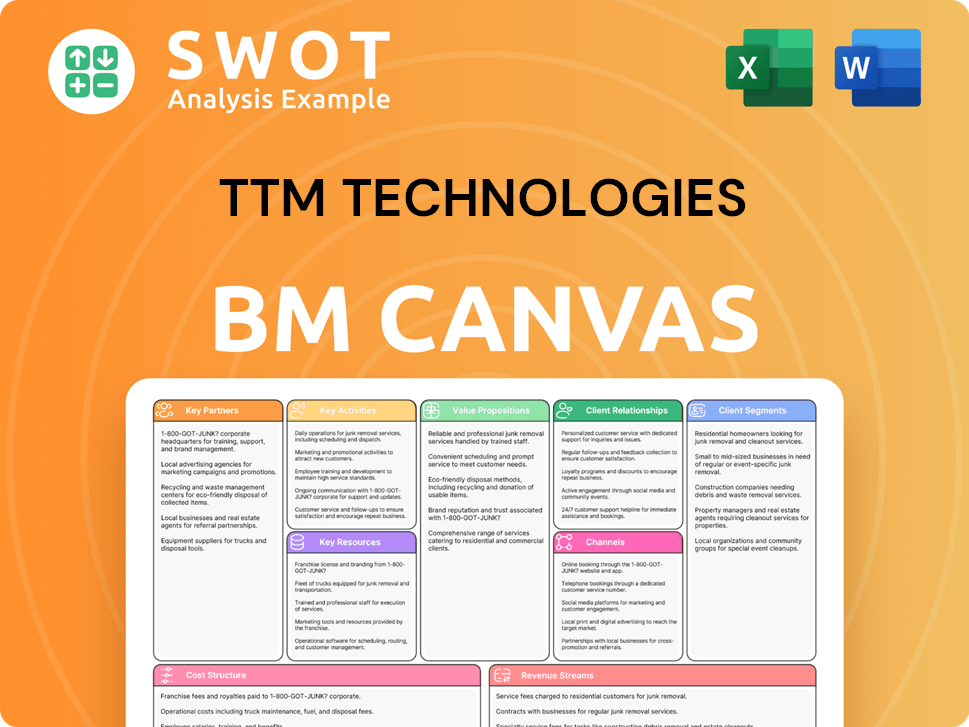

TTM Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for TTM Technologies?

The TTM Technologies company has a rich history, marked by strategic acquisitions and adaptation to evolving market demands. Starting in 1998, with its founding, the company quickly expanded its operations and capabilities, solidifying its position in the electronics manufacturing services sector. Through a series of key acquisitions and strategic initiatives, TTM has consistently broadened its market reach and technological expertise, positioning itself as a key player in the industry.

| Year | Key Event |

|---|---|

| 1998 | Founded. |

| 2000 | Initial Public Offering (IPO) on NASDAQ. |

| 2006 | Acquired Honeywell’s Advanced Circuits business. |

| 2010 | Acquired Tyco Electronics' Printed Circuit Group. |

| 2015 | Completed the acquisition of Viasystems Group, Inc., significantly expanding its global footprint and capabilities. |

| 2018 | Acquired Anaren, Inc., diversifying into custom RF and microwave solutions for aerospace and defense. |

| 2020 | Navigated the challenges of the global pandemic, adapting manufacturing and supply chain strategies. |

| 2023 | Continued focus on high-growth segments like aerospace and defense, and data center computing. |

| 2024 | Investing in advanced manufacturing technologies to enhance capabilities for next-generation electronics. |

| 2025 | Expected to continue expanding its market share in specialized technology solutions, particularly in high-reliability applications. |

The company is focused on expanding into high-growth areas. These include advanced packaging, autonomous driving, and 5G infrastructure. TTM Technologies aims to increase its market share in these sectors. This expansion is supported by strategic investments and partnerships.

TTM Technologies is committed to innovation. It invests in research and development for next-generation materials and manufacturing processes. This includes exploring new technologies to enhance its product offerings. The company’s focus on innovation supports its long-term growth strategy.

Industry trends significantly impact TTM Technologies’ future. The increasing demand for artificial intelligence (AI) hardware is a key factor. The ongoing digitalization across all sectors also drives growth. These trends create opportunities for TTM's specialized technology solutions.

Leadership emphasizes being a leading global provider of highly engineered technology solutions. This vision builds on its founding mission to deliver critical components. Operational excellence and strategic acquisitions remain key to TTM's strategy. These initiatives aim to solidify its position in the evolving technological landscape.

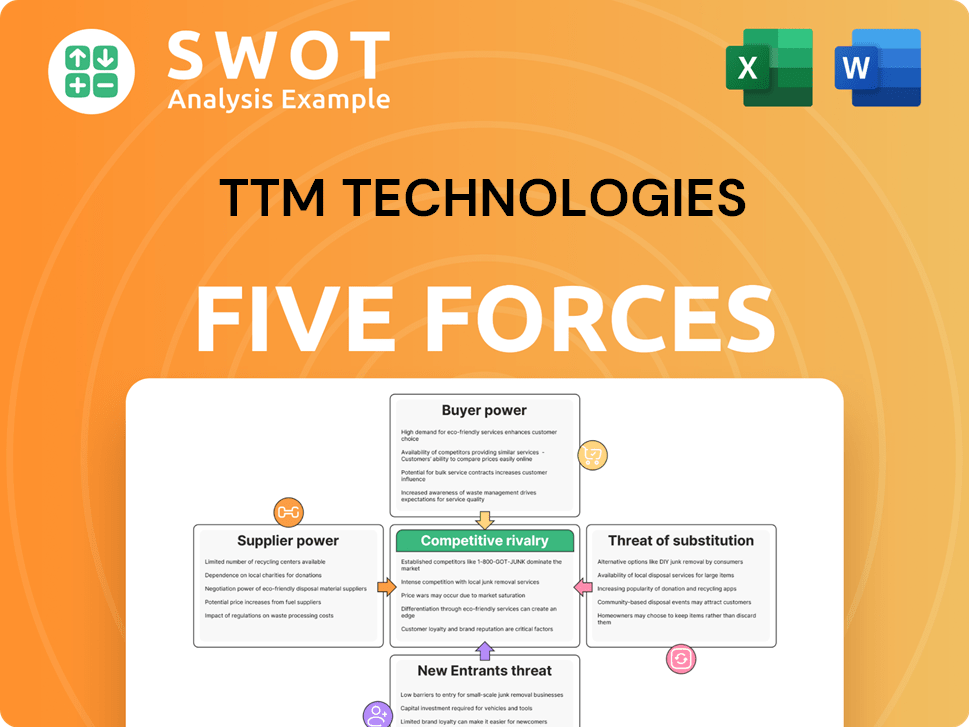

TTM Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of TTM Technologies Company?

- What is Growth Strategy and Future Prospects of TTM Technologies Company?

- How Does TTM Technologies Company Work?

- What is Sales and Marketing Strategy of TTM Technologies Company?

- What is Brief History of TTM Technologies Company?

- Who Owns TTM Technologies Company?

- What is Customer Demographics and Target Market of TTM Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.