TTM Technologies Bundle

Can TTM Technologies Maintain Its Edge in the Electronics Manufacturing Arena?

The electronics manufacturing sector is a battlefield of innovation and competition, and at the forefront is TTM Technologies. Founded on the principle of 'Time-To-Market,' TTM has rapidly evolved into a global leader. Understanding the TTM Technologies SWOT Analysis is crucial to grasping its standing in this dynamic environment.

This analysis delves into the TTM Technologies competitive landscape, exploring its market position and the strategies it employs to stay ahead. We'll examine TTM competitors, dissecting their strengths and weaknesses, and assessing TTM market share within the broader TTM industry analysis. Ultimately, this report aims to provide actionable insights into TTM Technologies' competitive advantages and its potential for future growth, considering its financial performance and navigating TTM Technologies industry trends.

Where Does TTM Technologies’ Stand in the Current Market?

TTM Technologies holds a significant market position within the global electronics manufacturing services (EMS) and printed circuit board (PCB) industries. It is recognized as one of the largest manufacturers of PCBs globally, especially in the high-end, complex board categories critical for aerospace and defense and high-performance computing. The company focuses on specialized and advanced technology segments, including high-density interconnect (HDI) PCBs, rigid-flex PCBs, RF components, and engineered systems.

Geographically, TTM has a substantial global footprint with manufacturing facilities and sales offices across North America, Asia, and Europe. This widespread presence allows the company to serve a diverse international customer base and adapt to regional market demands. TTM's customer segments are highly diversified, encompassing critical industries such as aerospace and defense, data center computing, automotive, medical, industrial, and instrumentation. This diversification helps mitigate risks associated with reliance on any single market.

Over time, TTM has strategically shifted its positioning to focus more on higher-value, lower-volume, and technologically advanced solutions, moving beyond basic PCB manufacturing to provide more integrated and complex engineered systems. For an in-depth look at their strategies, consider reading about the Marketing Strategy of TTM Technologies.

While specific market share figures for 2024 or 2025 are subject to ongoing market analysis, TTM Technologies is a major player in the PCB market, particularly in high-end segments. The company's strong presence in the aerospace and defense sector contributes significantly to its market position.

TTM Technologies reported net sales of $2.23 billion for the full year 2023, with an adjusted EBITDA of $309.0 million. The company projects net sales for the first quarter of 2024 to be between $510 million and $550 million. These figures demonstrate significant scale, especially for companies specializing in advanced electronic components.

TTM's customer segments are highly diversified, including aerospace and defense (approximately 46% of its revenue in 2023), data center computing, automotive, medical, industrial, and instrumentation. This diversification mitigates risks associated with reliance on any single market. The company's focus on high-value solutions attracts a diverse clientele.

TTM's primary product lines include high-density interconnect (HDI) PCBs, rigid-flex PCBs, RF components, and a growing portfolio of engineered systems and custom assemblies. The company is moving beyond basic PCB manufacturing to provide more integrated and complex engineered systems, focusing on technologically advanced solutions.

TTM's competitive advantages include its strong presence in the aerospace and defense sector, specialized capabilities, and global manufacturing footprint. However, competitive pressures in high-volume, lower-margin segments of the PCB market may present areas of relative weakness compared to Asian manufacturers.

- Strong in Aerospace and Defense: TTM holds a particularly strong position in the aerospace and defense sector.

- Global Presence: TTM has manufacturing facilities and sales offices across North America, Asia, and Europe.

- Diversified Customer Base: TTM serves a diverse customer base, reducing reliance on any single market.

- Focus on High-Value Solutions: The company is shifting towards higher-value, technologically advanced solutions.

TTM Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging TTM Technologies?

The competitive landscape for TTM Technologies is complex, encompassing both direct and indirect rivals across the globe. The company faces challenges from well-established players in the printed circuit board (PCB) manufacturing sector, as well as from a fragmented market of smaller, specialized manufacturers and larger electronics manufacturing services (EMS) providers. Understanding the dynamics of these competitors is crucial for assessing TTM's market position and future prospects.

The competition is shaped by factors such as technological advancements, pricing strategies, and the ability to meet stringent quality and delivery requirements. The industry has also seen consolidation through mergers and acquisitions, which can alter competitive dynamics by creating larger, more diversified entities. Emerging players, particularly those focused on new materials or additive manufacturing techniques for electronics, could disrupt traditional manufacturing processes, posing a future challenge to established players like TTM.

The competitive environment is particularly intense in securing contracts for next-generation defense programs or high-performance computing platforms, where TTM's expertise in complex, high-reliability PCBs is critical. Market share shifts can occur based on technological advancements, pricing strategies, and the ability to meet stringent quality and delivery requirements. The industry has also seen consolidation through mergers and acquisitions, which can alter competitive dynamics by creating larger, more diversified entities.

Key direct competitors include Kinwong Electronic (China), AT&S (Austria), and Tripod Technology (Taiwan). These companies compete directly with TTM in the advanced PCB and engineered systems space.

Kinwong, a major PCB manufacturer, competes across various segments with a strong focus on high-volume production and cost efficiency. They are a significant player in the Chinese market.

AT&S is a significant rival, particularly in high-end interconnect solutions and substrates for semiconductors, often challenging TTM in technologically advanced applications for industries like automotive and industrial.

Tripod Technology competes on scale and breadth of product offerings, particularly in the computing and consumer electronics sectors. They are another large Taiwanese PCB manufacturer.

Indirect competition comes from smaller, specialized PCB manufacturers and larger EMS providers. These companies may offer integrated solutions that include PCB fabrication.

Electronics manufacturing services (EMS) providers can be indirect competitors by offering integrated solutions that might reduce the need for standalone PCB services from TTM.

The TTM Technologies competitive landscape is also influenced by regional players, especially in Asia, where numerous manufacturers compete on price and volume. Companies like Amphenol and TE Connectivity, while primarily connector and sensor manufacturers, can be indirect competitors by offering integrated solutions. The TTM market share and TTM industry analysis are constantly evolving due to these factors.

Several factors influence the competitive dynamics within the PCB manufacturing industry, impacting TTM financial performance. These include technological advancements, pricing strategies, and the ability to meet stringent quality and delivery requirements.

- Technological Advancements: The ability to innovate and adopt new technologies is crucial.

- Pricing Strategies: Competitive pricing is essential, especially in high-volume markets.

- Quality and Delivery: Meeting stringent quality standards and timely delivery are critical for securing contracts.

- Mergers and Acquisitions: Consolidation can alter the competitive landscape.

- Emerging Players: New entrants, particularly those focused on new materials or additive manufacturing, could disrupt the market.

TTM Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives TTM Technologies a Competitive Edge Over Its Rivals?

Understanding the competitive landscape for TTM Technologies involves analyzing its key strengths and how it differentiates itself in the electronics manufacturing services (EMS) sector. The company's success is closely tied to its ability to deliver complex, high-reliability printed circuit boards (PCBs) and engineered systems, particularly for demanding industries like aerospace and defense.

A crucial aspect of TTM's competitive edge is its expertise in specialized PCB technologies, including High-Density Interconnect (HDI) and rigid-flex PCBs. These technologies are essential for applications requiring high performance and reliability, which are common in the aerospace and defense sectors. Furthermore, TTM's strategic global manufacturing footprint and focus on continuous innovation contribute significantly to its market position.

To evaluate TTM Technologies' position, it's essential to consider its financial performance and market share relative to competitors. While specific market share figures fluctuate, TTM's revenue and profitability provide insights into its competitive standing. For example, in recent financial reports, TTM has demonstrated its ability to secure significant contracts within its core markets, reflecting its strong customer relationships and technical capabilities. You can learn more about the company's journey in this Brief History of TTM Technologies.

TTM Technologies possesses advanced capabilities in High-Density Interconnect (HDI) PCBs, rigid-flex PCBs, and specialized RF components. These are critical for demanding applications in aerospace and defense, medical, and high-performance computing. This expertise creates a barrier to entry for competitors.

TTM holds key certifications and is a qualified supplier for numerous defense programs. These certifications provide a stable revenue stream, particularly in the aerospace and defense sectors, which require stringent quality control. The company's 'one-stop solution' approach streamlines supply chains.

TTM's global presence includes facilities in North America, Asia, and Europe. This provides supply chain resilience and proximity to key customers. It also allows for diversified manufacturing capabilities and risk mitigation. This global reach enhances responsiveness and reduces logistical complexities.

The company focuses on continuous innovation, particularly in advanced materials and miniaturization. This helps TTM stay ahead of technological curves. Continuous investment in R&D and talent is essential to maintain these advantages.

TTM Technologies' competitive advantages include its specialized technical expertise, strong customer relationships, and strategic global presence. These advantages are crucial for maintaining its market position. The company's ability to produce complex, high-reliability PCBs and engineered systems is a significant differentiator.

- Proprietary technologies in HDI and rigid-flex PCBs.

- Strong relationships and certifications in the aerospace and defense industry.

- Global manufacturing footprint for supply chain resilience.

- Focus on continuous innovation in advanced materials and miniaturization.

TTM Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping TTM Technologies’s Competitive Landscape?

The competitive environment for TTM Technologies is shaped by industry trends, future challenges, and opportunities. Advancements in technology drive demand for complex electronic components, benefiting TTM's focus on advanced PCBs and engineered systems. The increasing adoption of 5G technology, artificial intelligence (AI), and autonomous systems will fuel demand for sophisticated hardware. Regulatory changes in defense and medical industries impose stricter compliance requirements, which can be an advantage for established players like TTM.

Global economic shifts, including supply chain reconfigurations and inflationary pressures, present ongoing challenges and opportunities. For TTM, disruptions include new manufacturing techniques and increased competition from Asian manufacturers. Geopolitical tensions and trade policies could also impact global supply chains and raw material costs. Potential threats include a slowdown in key end-markets or aggressive pricing strategies from competitors. The company also faces the challenge of managing a complex global supply chain and ensuring cybersecurity.

Technological advancements, particularly in 5G, AI, and autonomous systems, are driving demand for sophisticated electronic hardware. Regulatory changes in the defense and medical sectors impose stricter compliance requirements. Global economic shifts, including supply chain reconfigurations and inflationary pressures, create both challenges and opportunities for TTM Technologies.

Anticipated disruptions include the rise of new manufacturing techniques like additive electronics, which could alter traditional PCB fabrication. Increased competition from Asian manufacturers expanding into higher-value segments is also a concern. Geopolitical tensions and trade policies could impact global supply chains and raw material costs. Managing a complex global supply chain and ensuring cybersecurity are crucial challenges.

The ongoing modernization of aerospace and defense platforms represents a stable and growing market for high-reliability products. The expansion of EVs and ADAS in the automotive sector presents strong demand. Increasing complexity in medical devices and industrial automation offers avenues for TTM to leverage its expertise. Strategic investments in advanced manufacturing and a focus on key segments are vital.

TTM is deploying investments in advanced manufacturing technologies and focusing on key aerospace, defense, and medical segments. The divestiture of its mobility business in 2023 highlights a strategic shift towards higher-growth, higher-margin specialized markets. Continuous innovation and strong customer relationships are crucial for evolving its competitive position. Learn more about TTM's business model in this article: Revenue Streams & Business Model of TTM Technologies.

TTM's ability to navigate industry trends, address future challenges, and capitalize on opportunities will determine its success. Strategic focus on high-growth markets, continuous innovation, and strong customer relationships are critical. The company's financial performance and stock performance will be influenced by these factors, alongside global market dynamics.

- Focus on high-margin markets like aerospace and defense.

- Invest in advanced manufacturing technologies.

- Maintain strong customer relationships.

- Adapt to evolving industry regulations.

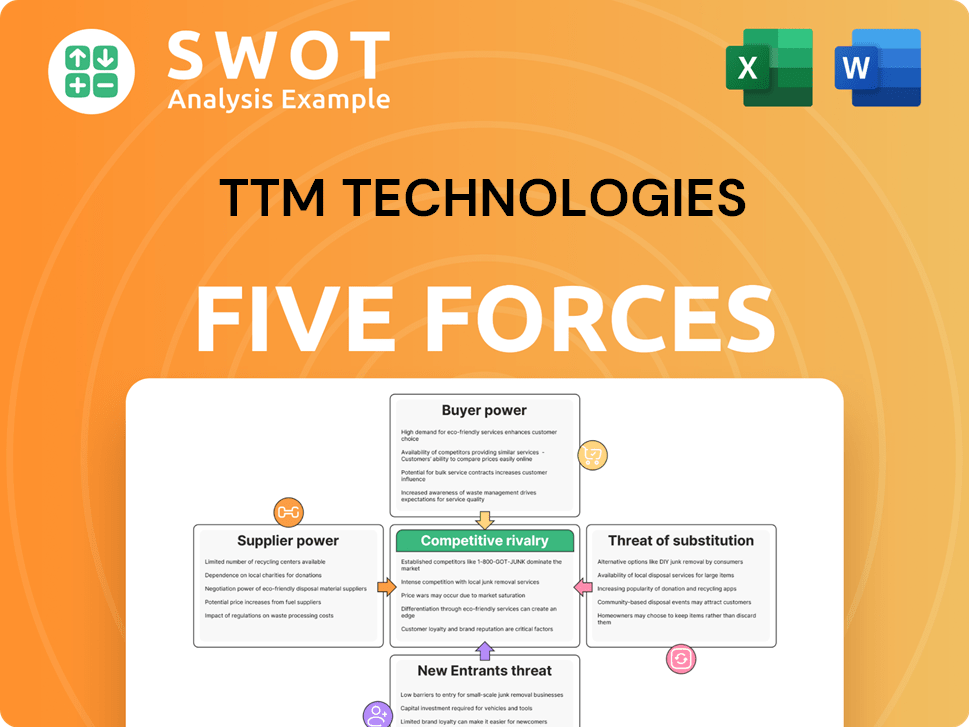

TTM Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TTM Technologies Company?

- What is Growth Strategy and Future Prospects of TTM Technologies Company?

- How Does TTM Technologies Company Work?

- What is Sales and Marketing Strategy of TTM Technologies Company?

- What is Brief History of TTM Technologies Company?

- Who Owns TTM Technologies Company?

- What is Customer Demographics and Target Market of TTM Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.