TTM Technologies Bundle

How is TTM Technologies Navigating the Tech Revolution?

In the fast-paced world of technology, understanding the inner workings of key players is crucial. TTM Technologies (TTM), a global leader in advanced electronic components, recently showcased impressive Q1 2025 results, driven by surging demand in sectors like Aerospace & Defense. But how does this TTM Technologies SWOT Analysis help investors?

This deep dive into TTM will explore its operational strategies, revealing how the TTM company generates revenue and sustains its competitive edge. From its diverse TTM products to its global presence, we'll uncover the core elements that define TTM's success, providing valuable insights for anyone interested in TTM's financial performance and future prospects. Whether you're curious about TTM's business model or the latest news, this analysis offers a comprehensive overview.

What Are the Key Operations Driving TTM Technologies’s Success?

TTM Technologies (TTM) creates value through its comprehensive technology solutions, specializing in printed circuit boards (PCBs) and radio frequency (RF) components. These offerings serve diverse sectors, including aerospace, defense, data center computing, and automotive. The company's operations are vertically integrated, covering design, engineering, manufacturing, and assembly, providing a 'one-stop solution' for customers.

The TTM business model focuses on high-reliability, high-performance solutions, particularly in the aerospace and defense sectors. The company's ability to provide quick-turn and technologically advanced PCBs allows customers to accelerate product development cycles. This comprehensive capability translates into significant customer benefits and market differentiation, supported by strategic investments and a robust supply chain.

TTM operates across North America and Asia, with 23 specialized facilities. These facilities enable both time-to-market and volume production of advanced technology products. Supply chain resilience is a key focus, with investments in new facilities like the ultra-HDI manufacturing facility in Syracuse, New York, and a new manufacturing facility in Penang, Malaysia. These investments are designed to meet the growing demand for cutting-edge technology, especially in defense programs.

TTM's manufacturing processes are vertically integrated. They encompass design, engineering, manufacturing, and assembly. This vertical integration allows for greater control over quality and efficiency. This approach enables TTM to offer a comprehensive solution to its customers, reducing the need to work with multiple suppliers.

TTM serves a broad customer base. This includes major players in the technology and defense sectors. The company's focus on high-reliability solutions makes it a key supplier for critical applications. TTM's diverse customer base helps mitigate risk and provides stability.

TTM strategically invests in new facilities. These investments enhance domestic production capabilities. The new facilities in Syracuse, New York, and Penang, Malaysia, support customer supply chain resiliency. These investments are crucial for meeting growing demand.

As of Q4 2024, TTM held a record backlog of $1.56 billion, primarily driven by the aerospace and defense sector. This robust backlog indicates strong demand for its products. TTM's financial performance is closely tied to its ability to fulfill these orders efficiently.

TTM Technologies distinguishes itself through its focus on high-reliability solutions for complex applications, particularly in the aerospace and defense sectors. Its ability to provide quick-turn and technologically advanced PCBs, along with mission systems and RF microwave/microelectronic assemblies, allows customers to shorten product development cycles and accelerate time-to-market. This comprehensive capability and commitment to advanced technology contribute to significant customer benefits and market differentiation.

- Vertically Integrated Operations: Design, engineering, manufacturing, and assembly under one roof.

- Global Manufacturing Footprint: 23 facilities across North America and Asia.

- Strategic Investments: Focus on advanced technology and supply chain resilience.

- Strong Customer Relationships: Serving major players in technology and defense.

TTM Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TTM Technologies Make Money?

The revenue streams and monetization strategies of TTM Technologies (TTM) are primarily centered around the sale of its manufactured technology solutions. These solutions are mainly categorized into Printed Circuit Boards (PCB) and RF & Specialty Components (RF&S Components). The PCB segment is the major contributor to the company's financial performance.

TTM's financial success is driven by its ability to serve a diverse customer base with high-value, technologically advanced products. The company's approach includes offering comprehensive solutions, from design and engineering to manufacturing, which allows for bundled service offerings and deeper customer integration. This positions TTM to capitalize on emerging market trends and maintain a competitive edge.

For the full year 2024, TTM's net sales reached $2.44 billion, a notable increase from $2.23 billion in 2023. In the first quarter of 2025, net sales were $648.7 million, up 14% year-over-year from $570.1 million in Q1 2024. The Printed Circuit Board segment significantly contributed to this Q1 2025 growth, generating $639.85 million, while the RF&S Components segment brought in $8.82 million.

The company's monetization strategies are significantly influenced by its diverse customer base and the high-value, technologically advanced products it provides. The Aerospace and Defense sector accounted for 46% of net sales in FY 2024 and had a record backlog of $1.56 billion. Data Center Computing also saw record revenues, representing 22% of total company revenues in FY 2024, driven by generative AI applications. Learn more about the Target Market of TTM Technologies.

- Aerospace and Defense: This sector is a major revenue driver, accounting for a significant portion of sales.

- Data Center Computing: Driven by the growth of generative AI, this sector represents a substantial and growing market for TTM.

- Automotive: A key market, representing 13% of total revenue in FY 2024.

- Medical/Industrial/Instrumentation: This segment contributed 14% of total revenue in FY 2024.

- Networking/Communications: This sector accounted for 6% of total revenue in FY 2024.

TTM Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TTM Technologies’s Business Model?

The evolution of TTM Technologies has been marked by strategic initiatives and key milestones that have solidified its position in the market. A significant move includes the construction of a new ultra-HDI manufacturing facility in Syracuse, New York, which commenced in 2024 and is slated for low-rate production in 2026. This project, backed by a $30 million award from the Department of Defense, is designed to boost domestic production of advanced PCBs and strengthen supply chain resilience, crucial aspects of the TTM business model.

In addition to this, TTM company opened a new manufacturing facility in Penang, Malaysia, in 2024, which aims to support customer supply chain needs. Operationally, the company has navigated challenges, such as goodwill impairment charges related to its RF&S Components segment, which impacted GAAP operating income in both Q4 2024 and the full year 2024. Despite these setbacks, TTM has demonstrated strong operational performance, with non-GAAP net income for Q4 2024 increasing to $62.8 million from $43.0 million in Q4 2023.

The company's financial performance in Q1 2025 saw non-GAAP net income reaching a record high for a first quarter at $52.4 million, showcasing its resilience and strategic focus. These strategic moves, combined with a commitment to technological advancement and customer service, highlight TTM's ongoing efforts to enhance its market position and operational efficiency. A deeper dive into the company's approach can be found in this article about Marketing Strategy of TTM Technologies.

The opening of a new manufacturing facility in Penang, Malaysia, in 2024, and the ongoing construction of an ultra-HDI manufacturing facility in Syracuse, New York, are significant milestones. These initiatives demonstrate TTM's commitment to expanding its global footprint and enhancing its manufacturing capabilities. The Syracuse facility, with its anticipated low-rate production in 2026, is particularly important for bolstering domestic PCB production.

Strategic moves include investments in advanced manufacturing facilities and technology. The focus on ultra-HDI technology and the expansion of global manufacturing sites are key strategies. These moves support the company's ability to meet the evolving needs of its customer base and capitalize on market opportunities, such as the growing demand from generative AI in data center computing.

TTM's competitive advantages are rooted in its proven track record, advanced technology, diversified services, and global presence. The company's ability to offer a wide range of services, from engineering and design to manufacturing and assembly, provides a 'one-stop-shop' experience. Its global footprint, with 23 specialized facilities, allows it to serve customers worldwide.

In Q4 2024, non-GAAP net income increased to $62.8 million from $43.0 million in Q4 2023. Non-GAAP net income reached a record high for a first quarter at $52.4 million in Q1 2025. Despite facing challenges, such as goodwill impairment charges, the company has demonstrated strong operational performance and financial resilience.

TTM's strengths lie in its technological expertise, global presence, and comprehensive service offerings. The company's investment in research and development ensures it remains at the forefront of technological advancements. The ability to provide end-to-end solutions enhances efficiency and supports customer needs.

- Advanced Technology: Focus on high-speed digital and RF applications.

- Diversified Services: Offering engineering, design, manufacturing, and assembly.

- Global Presence: With 23 specialized facilities worldwide.

- Financial Performance: Demonstrated strong operational performance and financial resilience.

TTM Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TTM Technologies Positioning Itself for Continued Success?

As a leading global manufacturer, TTM Technologies (TTM) holds a strong position in the technology solutions sector, particularly in printed circuit boards (PCBs) and RF components. By December 2024, TTM was recognized as one of the largest PCB manufacturers worldwide based on 2023 revenue. The company serves a diverse customer base of approximately 1,400 clients globally, including key players in aerospace and defense, data center computing, automotive, medical, industrial, and networking/communications.

However, TTM faces several risks. Intense global competition from low-cost PCB manufacturers in Asia, the cyclical nature of the electronics manufacturing industry, and potential supply chain disruptions pose challenges. Furthermore, dependence on a concentrated customer base, with the top five customers accounting for 41% of total revenues in Q3 2024, also presents a risk. Looking ahead, TTM is focused on strategic initiatives to sustain and expand its profitability.

TTM Technologies is a major player in the PCB and RF components market. The company's global presence and diverse customer base contribute to its strong industry position. With a customer retention rate exceeding 90% in 2024, TTM demonstrates strong customer loyalty.

TTM faces challenges from intense competition and supply chain disruptions. Economic uncertainties and geopolitical tensions can also impact operations. The company's dependence on a concentrated customer base presents a potential risk.

TTM is focused on strategic initiatives to drive future growth. The company is investing in expanding its U.S. manufacturing capabilities. For the second quarter of 2025, TTM projects revenues to be between $650 million and $690 million.

TTM is expanding its U.S. manufacturing capabilities, including a new ultra-HDI facility. The company is also capitalizing on strong demand in high-growth markets. These initiatives are expected to drive future growth and maintain its competitive edge.

TTM is concentrating on high-growth markets such as aerospace and defense and data center computing, driven by AI-related demands. The company's commitment to operational efficiency and strategic investments are expected to drive future growth. For more insights, check out the Growth Strategy of TTM Technologies.

- Focus on Aerospace and Defense

- Expansion in Data Center Computing

- Investment in New Technologies

- Operational Efficiency Improvements

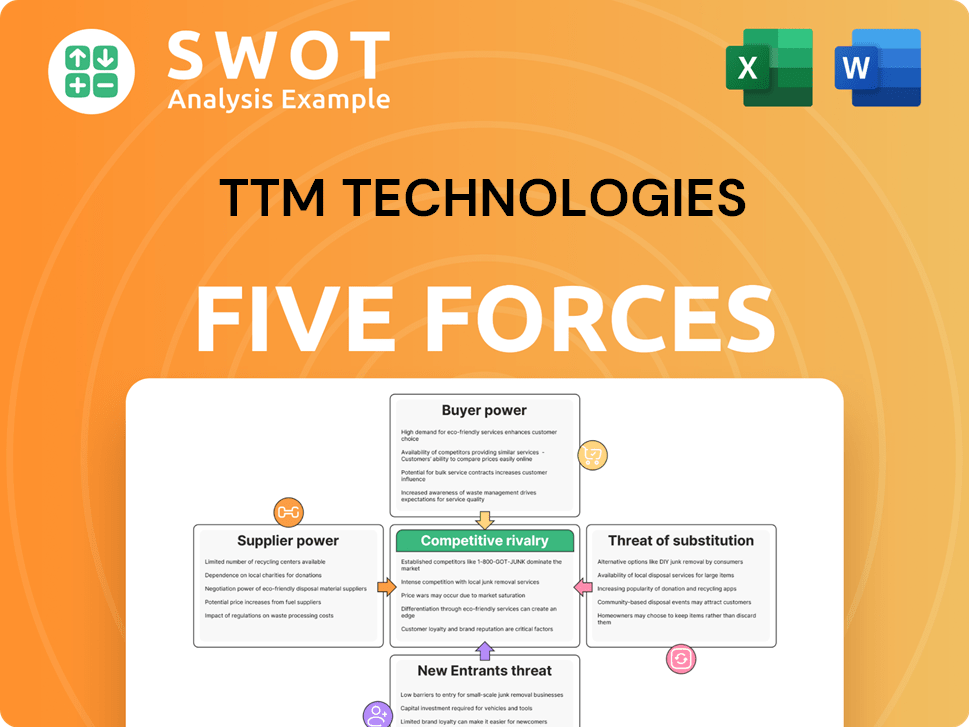

TTM Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TTM Technologies Company?

- What is Competitive Landscape of TTM Technologies Company?

- What is Growth Strategy and Future Prospects of TTM Technologies Company?

- What is Sales and Marketing Strategy of TTM Technologies Company?

- What is Brief History of TTM Technologies Company?

- Who Owns TTM Technologies Company?

- What is Customer Demographics and Target Market of TTM Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.