TTM Technologies Bundle

How is TTM Technologies Dominating the Tech Manufacturing Sector?

TTM Technologies isn't just surviving; it's thriving, with a recent 13.8% revenue surge in Q1 2025, reaching $648.7 million, fueled by strong demand in key sectors. This impressive TTM Technologies SWOT Analysis reveals the secrets behind its success. Explore how TTM's strategic focus on high-growth markets, like aerospace and defense, and its agility in adapting to tech advancements, such as generative AI, are driving its remarkable performance.

This deep dive into TTM Technologies' sales and marketing plan will dissect the company's innovative strategies. We will examine TTM Technologies' market analysis, sales process optimization, and customer acquisition strategies. Discover how TTM Technologies builds its brand awareness and navigates the competitive landscape, providing actionable insights for investors and business strategists alike. Analyzing TTM Technologies' marketing campaign examples and digital marketing initiatives will offer a comprehensive view of its business development.

How Does TTM Technologies Reach Its Customers?

The sales channels of TTM Technologies primarily rely on direct sales teams, which are crucial for engaging with a diverse customer base. These customers include original equipment manufacturers (OEMs), electronic manufacturing services (EMS) providers, original design manufacturers (ODMs), distributors, and government agencies. This direct approach is essential due to the complexity and specialized nature of TTM's technology solutions, such as high-density interconnect (HDI) PCBs and RF components.

TTM Technologies' sales and marketing strategy has evolved to focus on high-growth and mission-critical markets. This strategic shift includes significant investments in expanding domestic production capabilities, such as the new advanced technology PCB manufacturing facility in Syracuse, New York. These efforts are supported by key partnerships and government contracts, contributing significantly to growth, especially in the aerospace and defense sector.

The company serves approximately 1,400 customers globally, showcasing a broad market reach. The aerospace and defense sector accounted for 47% of total revenue in Q1 2025, demonstrating a 15% year-over-year growth. This segment benefits from longer sales cycles, providing strong visibility into future revenue growth. The company's program backlog in the aerospace and defense sector reached a record $1.56 billion in Q4 2024, highlighting strong demand and future revenue potential.

TTM Technologies utilizes direct sales teams to engage with its diverse customer base. This approach is essential for complex technology solutions. This strategy allows for personalized customer service and relationship management.

The aerospace and defense sector is a key market for TTM Technologies, contributing significantly to revenue. This sector's longer sales cycles provide strong revenue visibility. The company's investments in this sector are substantial.

TTM Technologies benefits from key partnerships and government contracts. These collaborations support the company's growth and market share. Partnerships are particularly important in the aerospace and defense sector.

TTM Technologies is expanding its domestic production capabilities. The new facility in Syracuse, New York, is a key example of this expansion. This expansion aims to enhance supply chain resilience.

The TTM Technologies sales strategy revolves around direct sales, strategic partnerships, and a focus on high-growth sectors like aerospace and defense. The company's marketing strategy supports these sales efforts through targeted initiatives and customer relationship management. For more insights, explore the Competitors Landscape of TTM Technologies.

- Direct Sales: Primary channel for engaging with OEMs, EMS providers, ODMs, distributors, and government agencies.

- Aerospace and Defense: Focus on mission-critical markets with longer sales cycles.

- Strategic Partnerships: Leveraging key alliances and government contracts for growth.

- Domestic Production: Expanding manufacturing capabilities to enhance supply chain resilience.

TTM Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does TTM Technologies Use?

The marketing tactics of TTM Technologies are carefully crafted to fit its business-to-business (B2B) model, focusing on specialized products and services. The company directs its efforts toward engineers, product developers, and procurement professionals across various industries. This targeted approach highlights the importance of content marketing, industry events, and direct engagement to reach its specific audience. The company's marketing strategy emphasizes its core value proposition: 'time-to-market' (TTM), which is a crucial factor for its customers. This message underscores its ability to deliver advanced technology products quickly, a critical factor for its customers.

Data-driven marketing and customer segmentation are implicitly vital for TTM. This is evident in its diverse end-market exposure and strong performance in specific sectors. For example, in Q1 2025, data center computing represented 21% of total revenue, experiencing a 15% year-over-year growth, largely driven by demand for generative AI applications. This suggests targeted marketing efforts towards segments with high growth potential and specific technological needs. TTM's participation in investor conferences, such as the Barclays Leveraged Conference in May 2025, also serves as a marketing tactic to engage with the financial community and communicate its strategic direction and financial health.

The company's marketing mix has evolved to highlight its role as a critical supplier for emerging technologies like AI data centers and advanced defense radar systems, aligning its messaging with current technological trends and customer demands. This approach is essential for maintaining a competitive edge and driving revenue growth. For further insights into the growth strategy, consider reading about the Growth Strategy of TTM Technologies.

TTM Technologies leverages content marketing to educate and engage its target audience. This includes technical white papers, case studies, and webinars to showcase its expertise.

Participation in industry-specific trade shows and conferences is a key tactic. These events provide opportunities to network, demonstrate products, and generate leads.

Direct engagement involves targeted outreach to key decision-makers. This includes personalized communications and direct sales efforts to build relationships.

Marketing emphasizes the company's ability to deliver products quickly. This is a critical differentiator in the fast-paced technology industry.

The company uses data analytics to understand customer segments and tailor marketing efforts. This includes analyzing revenue growth in specific sectors, such as data center computing, which represented 21% of total revenue in Q1 2025.

Engaging with the financial community through investor conferences is part of the marketing strategy. This helps communicate the company's strategic direction and financial health.

To effectively implement its marketing strategy, TTM Technologies focuses on several key areas. These strategies are crucial for achieving its sales and marketing goals.

- Targeted Content Creation: Developing technical content that addresses the specific needs of engineers, product developers, and procurement professionals.

- Strategic Event Participation: Selecting industry events that provide the best opportunities to showcase products and connect with potential customers.

- Customer Relationship Management (CRM): Utilizing CRM systems to manage customer interactions and sales processes efficiently.

- Market Analysis and Segmentation: Continuously analyzing market trends and segmenting customers to tailor marketing messages and product offerings.

- Digital Marketing Initiatives: Although not extensively disclosed, digital marketing initiatives likely include SEO optimization, social media engagement, and targeted advertising to enhance brand awareness.

TTM Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is TTM Technologies Positioned in the Market?

The brand positioning of TTM Technologies centers on its role as a leading global provider of highly engineered technology solutions. A key differentiator is its 'time-to-market' (TTM) capabilities, which enable customers to accelerate product development and market entry. This focus allows the company to target clients across various sectors, including aerospace and defense, data center computing, automotive, medical, industrial, and instrumentation markets.

TTM differentiates itself through its technical expertise, extensive global footprint, and dedication to advanced technologies. The company's brand identity is reinforced by its consistent financial performance and strategic investments. For example, a new facility in Syracuse supports national security requirements, strengthening its position in the global technology ecosystem.

The company's success in the aerospace and defense sector, which accounted for 47% of Q1 2025 revenue, highlights its reliability and innovation. TTM's brand message is consistently communicated through investor relations and its core 'time-to-market' value proposition across all touchpoints. For more insights, you can explore Owners & Shareholders of TTM Technologies.

TTM Technologies concentrates on providing advanced electronic components to key markets. These markets include aerospace and defense, data center computing, automotive, medical, industrial, and instrumentation. The company's strategic focus allows it to meet the specific needs of these demanding sectors.

The company's competitive advantages include its technical expertise, global presence with 23 specialized facilities, and focus on advanced technologies. TTM's ability to deliver high-quality products and its commitment to innovation set it apart in the market. This is a key part of the TTM Technologies marketing strategy.

TTM Technologies emphasizes its 'time-to-market' capabilities in its brand messaging. This focus helps customers accelerate their product development cycles. This message is consistently communicated across all touchpoints, reinforcing the company's value proposition. This is a core element of TTM Technologies sales strategy.

TTM Technologies' financial performance and strategic investments support its brand image. The company's consistent financial results and investments, such as the new Syracuse facility, demonstrate its commitment to growth. The aerospace and defense sector contributed significantly to revenue in Q1 2025. This is an important aspect of TTM Technologies business development.

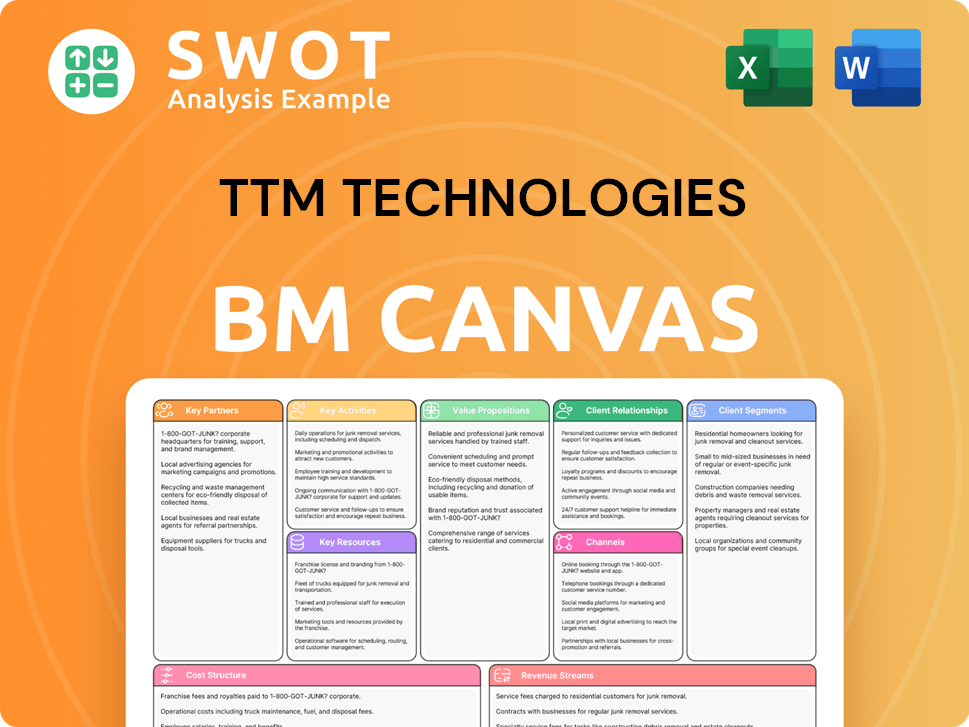

TTM Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are TTM Technologies’s Most Notable Campaigns?

For TTM Technologies, a business-to-business (B2B) manufacturer, sales and marketing strategies are less about traditional campaigns and more about strategic initiatives that drive growth. These initiatives, such as partnerships and investments in key sectors, serve as the company's primary 'campaigns'. These efforts are crucial for TTM Technologies' business development and achieving its financial objectives.

These strategic focuses are not just marketing efforts; they are fundamental to TTM Technologies' business model. They involve significant investment and are designed to position the company favorably in high-growth markets. The success of these strategic moves is carefully tracked through revenue growth and market share analysis.

The company's approach to market analysis and competitive landscape evaluation informs these strategic decisions, ensuring that resources are allocated to the most promising opportunities. This approach has been successful, as evidenced by the company's recent performance.

A key initiative is the expansion in the aerospace and defense sector. This involves a $30 million award from the Department of Defense, aimed at boosting domestic production of high-density printed circuit boards. This 'campaign' highlights the company's role in national security and strengthens the U.S. electronics supply chain. This initiative is designed to enhance capabilities for the timely delivery of cutting-edge technology for defense programs.

TTM Technologies' strategic focus on the data center computing market is another significant 'campaign', particularly driven by the growth in generative AI applications. This has led to substantial revenue growth in this segment. The company develops and supplies advanced PCBs for AI-related needs. This strategic emphasis positions the company at the forefront of this rapidly expanding technological frontier.

The success of these 'campaigns' is measured by significant revenue growth in key markets. For example, the company saw a 14% year-on-year revenue increase in Q1 2025. Record non-GAAP earnings per share of $0.50 were also achieved. Furthermore, a consistent book-to-bill ratio, with 1.09 for Q4 2024 and 1.10 for Q1 2025, indicates strong demand and future growth potential.

TTM Technologies' investments in facilities, like the new Syracuse, New York facility, are integral to its strategic initiatives. These investments are crucial for supporting the growth in key sectors. These strategic moves are designed to enhance the company's capabilities and meet the increasing demand in its target markets.

The effectiveness of TTM Technologies' sales and marketing plan is evident in its financial results. The company's customer acquisition strategies are focused on long-term partnerships and strategic alliances. These partnerships are crucial for driving revenue growth and expanding market share. The company's sales process optimization is designed to support these strategic initiatives.

- Revenue Growth: The company's revenue increased by 14% year-over-year in Q1 2025.

- Data Center Computing: This segment contributed 21% of total revenue in Q1 2025, with a 15% year-over-year increase.

- Book-to-Bill Ratio: The book-to-bill ratio was 1.09 for Q4 2024 and 1.10 for Q1 2025, indicating strong demand.

- Earnings Per Share: Non-GAAP earnings per share reached a record $0.50.

TTM Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TTM Technologies Company?

- What is Competitive Landscape of TTM Technologies Company?

- What is Growth Strategy and Future Prospects of TTM Technologies Company?

- How Does TTM Technologies Company Work?

- What is Brief History of TTM Technologies Company?

- Who Owns TTM Technologies Company?

- What is Customer Demographics and Target Market of TTM Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.