Vector Bundle

What's the Story Behind Vector Company's Success?

Ever wondered how a local power board transformed into a multi-utility powerhouse? This deep dive explores the Vector SWOT Analysis, revealing the fascinating Vector history of a company that's shaped the energy and communication landscape. From its humble beginnings to its current status as a leading player in Australasia, the Vector Company story is one of strategic evolution and innovation. Discover the key milestones that define the Vector company timeline.

The Vector Company's journey began in 1922 as the Auckland Electric Power Board, demonstrating an early commitment to community needs. Understanding the Vector Company founder's vision is key to grasping its impact. Today, Vector is a diverse entity, offering a range of Vector company products, and its Vector company achievements reflect a commitment to adapting to the ever-changing energy market, making it a compelling case study in business evolution.

What is the Vector Founding Story?

The Vector Company, a key player in New Zealand's energy sector, has a rich Vector history that began in 1999. This marked a pivotal moment, succeeding Mercury Energy Limited. The company's origins, however, trace back to the Auckland Electric Power Board (AEPB), established in 1922. This early foundation highlights a long-standing commitment to providing essential utility services to the Auckland community.

The AEPB's creation was a response to the need for a unified approach to electricity management. This involved consolidating generation, distribution, and supply functions previously managed by local councils. The transition to Vector Limited in 1999 reflects an evolution towards a more integrated and diversified utility provider. The company's structure also emphasizes community ownership, with Entrust holding a significant share of its shares.

The primary objective was to ensure the efficient and reliable delivery of electricity to the growing Auckland community. The initial business model focused on electricity distribution, later expanding to include piped gas. This expansion showcases the company's adaptability and its response to the evolving needs of its customers. For a deeper understanding of the competitive environment, you can explore the Competitors Landscape of Vector.

The Vector Company was founded in 1999, building on the legacy of the Auckland Electric Power Board (AEPB) established in 1922.

- The AEPB was created to consolidate electricity services in Auckland.

- The company's structure emphasizes community ownership, with Entrust holding a majority of shares.

- The initial focus was on electricity distribution, later expanding to include gas.

- The company's evolution reflects a commitment to innovation and digital transformation.

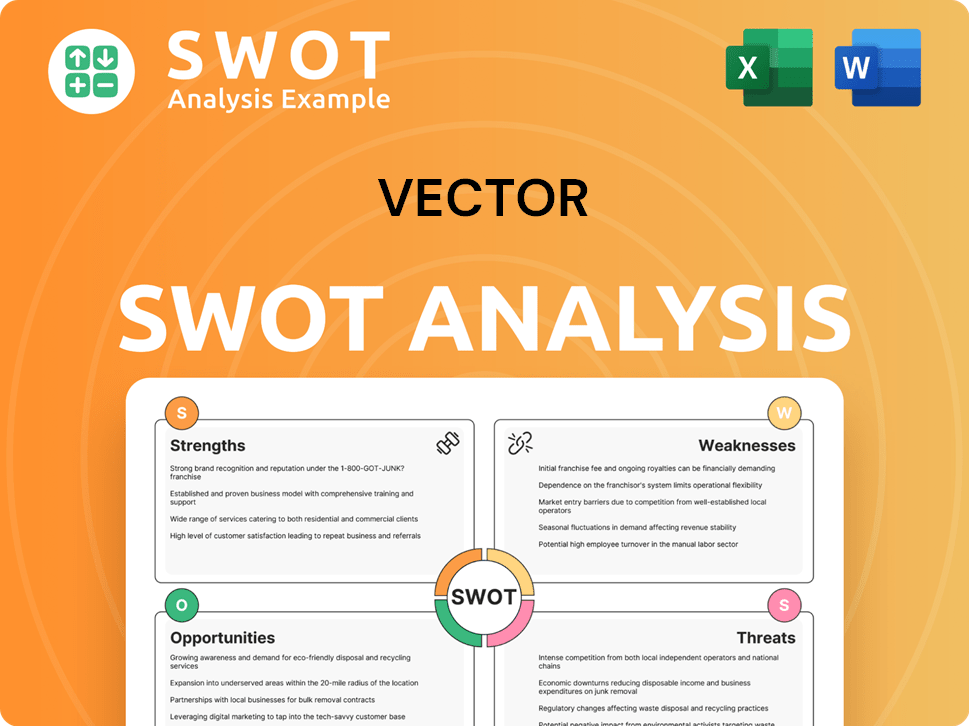

Vector SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Vector?

The early growth of the Vector Company, a key part of the Vector history, was marked by significant expansion through strategic acquisitions. These moves were crucial in shaping the company into a major player in New Zealand's energy sector. The company's evolution over time reflects a commitment to diversifying its portfolio and embracing technological advancements.

A pivotal moment in the Vector company timeline occurred in 2002 with the acquisition of UnitedNetworks. This purchase brought together Auckland's North Shore and Waitakere electricity lines, a telecommunications network, and Auckland's gas network. This made Vector the largest multi-utility company in New Zealand. Further expanding its footprint, Vector acquired two-thirds of NGC Holdings in 2004 and the remaining balance in 2005.

Vector also ventured into renewable energy and advanced metering. In 2007, the company invested in NZ Windfarms, increasing its shareholding. That same year, Advanced Metering Services was established in a joint venture with Siemens (NZ), which Vector fully acquired in 2010. In 2014, Arc Innovations was acquired, further diversifying Vector's portfolio.

In 2008, Vector sold its Wellington electricity network for $785 million. By 2024, Vector Limited reported total revenue of $1,084,875,000 and had 1,030 employees. The company's focus on digital transformation is evident through its partnerships with global tech companies, which is a key achievement for Vector company products. For more insights, check out the Marketing Strategy of Vector.

Vector leverages advanced technologies like Microsoft Azure and Kubernetes to enhance operational efficiency. These technological advancements are crucial for the company's future plans. The company's commitment to innovation is a significant aspect of its impact on the industry.

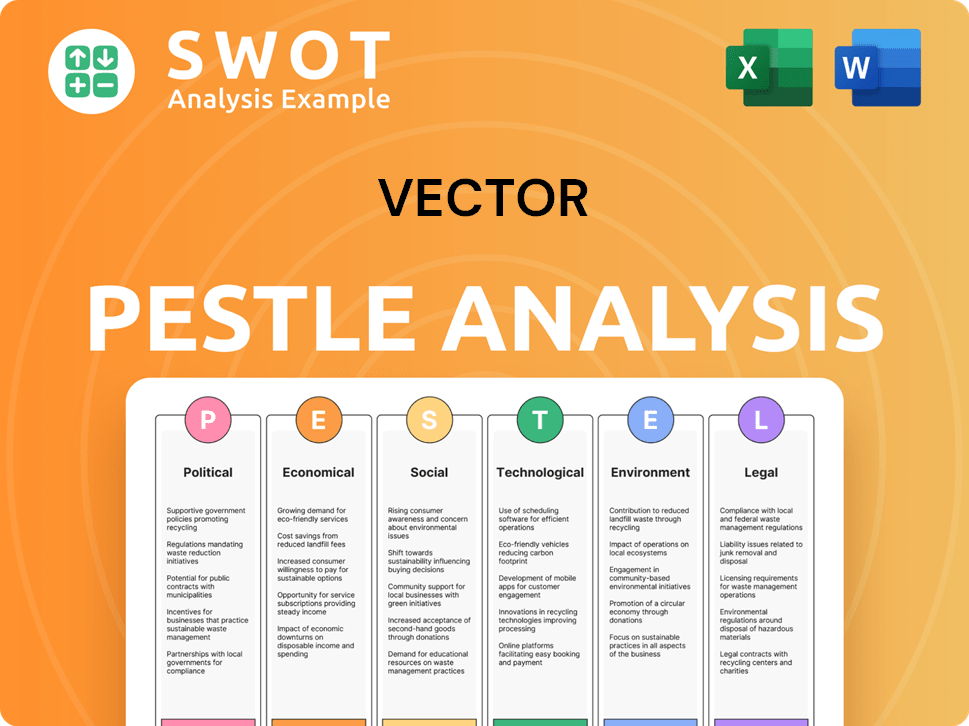

Vector PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Vector history?

The Vector Company has a rich Vector history, marked by significant achievements and a commitment to innovation in the energy sector. The Vector company timeline reflects its evolution and adaptation to the changing energy landscape, demonstrating its resilience and forward-thinking approach. The Target Market of Vector is a critical aspect of its strategic development.

| Year | Milestone |

|---|---|

| 2015 | Launched a new vision and values to address the changing energy sector and diverse workforce. |

| 2023 | BlueCurrent, a smart metering business jointly owned with QIC, secured a A$1.6 billion Climate Bonds Certified green loan in July 2023. |

| 2024 | BlueCurrent manages over 2.4 million meters across Australia and New Zealand as of March 2024. |

| 2024 | Reported a net profit after tax of $79.9 million for the full year ending June 30, 2024, recognizing a $60.0 million impairment on its gas network. |

Vector Company has focused on innovation, particularly in transforming the energy sector. This includes strategic alliances with global technology companies to develop next-generation platforms.

Vector Company is committed to creating a 'new energy future' by focusing on decarbonization and the electrification of transport.

The company is developing a digital twin initiative to simulate network behavior, especially with the increasing integration of electric vehicles (EVs), solar, and battery storage.

The smart metering business, now known as BlueCurrent, manages over 2.4 million meters across Australia and New Zealand.

Challenges faced by Vector Company include adapting to a rapidly changing energy sector and evolving customer demands. The company also navigates regulatory environments and focuses on internal digital transformation.

The company must adapt to increased renewable energy sources and evolving customer demands for lower prices and sustainable options.

Vector Company navigates regulatory environments, with the Commerce Commission's determinations impacting electricity tariffs and cash flow visibility.

Vector Company has focused on digital transformation and bringing IT service management in-house to improve efficiency and data insights.

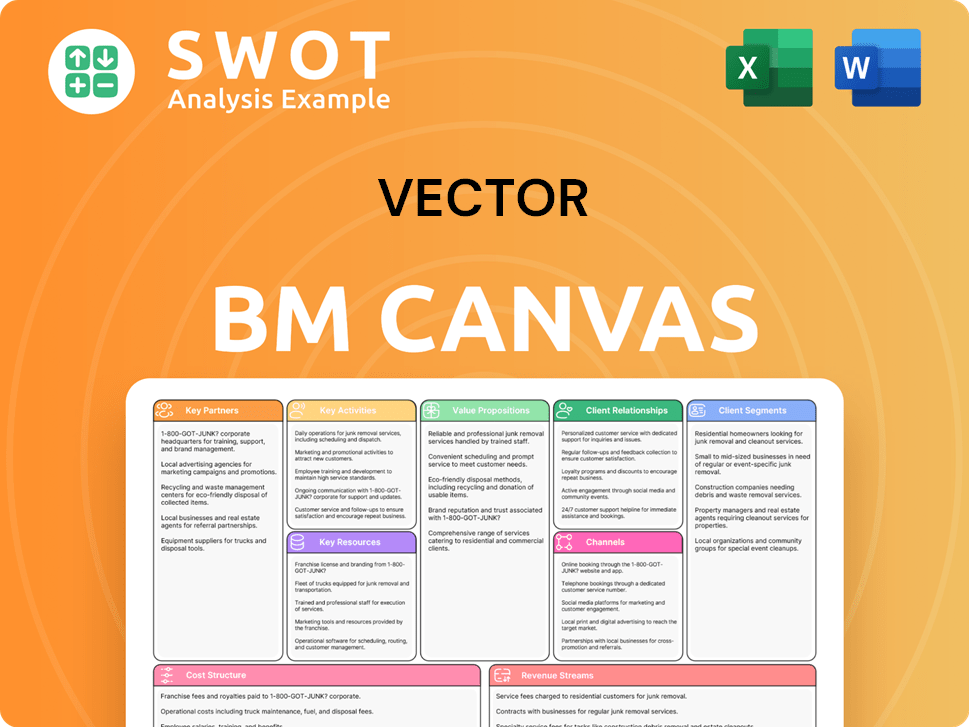

Vector Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Vector?

The Vector Company's journey, from its origins as the Auckland Electric Power Board (AEPB) in 1922, showcases a series of strategic moves and expansions. The Vector history is marked by significant acquisitions and divestitures, adapting to the evolving energy sector. These changes have positioned Vector Company as a key player in New Zealand's energy landscape.

| Year | Key Event |

|---|---|

| 1922 | Auckland Electric Power Board (AEPB) formed, taking over electricity distribution and supply, a precursor to the company. |

| 1993 | Auckland Energy Consumer Trust (Entrust) gains guardianship of Auckland's power network. |

| 1999 | Vector Limited officially founded. |

| 2002 | Acquisition of UnitedNetworks, making Vector the largest multi-utility company in New Zealand. |

| 2004-2005 | Acquisition of NGC Holdings (gas), expanding gas operations. |

| 2007 | Investment in NZ Windfarms and establishment of Advanced Metering Services. |

| 2008 | Sale of the Wellington electricity network for $785 million. |

| 2010 | Full acquisition of Advanced Metering Services. |

| 2014 | Acquisition of Arc Innovations. |

| 2015 | Launch of a new vision and values in response to the changing energy sector. |

| 2016 | Sale of the gas transmission and distribution business (now Firstgas), while retaining the Auckland gas distribution network. |

| 2020 | Strategic alliance with Amazon Web Services (AWS) to accelerate the future of energy. |

| 2023 | Sale of a 50% interest in Vector Metering to QIC, rebranded as Bluecurrent, valued at A$2.3 billion. |

| July 2023 | Bluecurrent (Vector Metering) secures a A$1.6 billion Climate Bonds Certified green loan. |

| August 2024 | Vector announces a strong full-year result with adjusted EBITDA up 14% to $365.2 million for continuing operations. |

| October 2024 | S&P Global Ratings revises Vector's long-term rating outlook to stable from positive, affirming 'BBB+' ratings. |

| January 2025 | Completion of the sale of Ongas and its shareholding in Liquigas. |

| February 2025 | Vector announces strong half-year results for FY25, with adjusted EBITDA for continuing operations up 16% to $202 million. |

Vector is focused on leading the energy transition, aiming to reduce its absolute Scope 1 & 2 GHG emissions by 53.5% by FY2030 from a FY2020 base year. This commitment aligns with science-based targets for a 1.5°C global warming limit. This is one of the many Vector company achievements.

The company anticipates adjusted EBITDA in the range of $400 million to $415 million for the full year 2025. Gross capital expenditure is projected between $495 million and $525 million. Analysts expect earnings and revenue to grow by 9.3% and 5.2% per annum respectively.

Vector is investing in digital solutions and leveraging partnerships with companies like AWS and X. These collaborations aim to enhance network capabilities and develop next-generation platforms for network management. This is key to the Vector company's future.

The dividend policy is being revised to align with the Commerce Commission's regulatory cycle. The company is committed to delivering affordable, reliable, and safe energy solutions, meeting evolving customer needs. For more details, explore this article about the Vector Company's Inception.

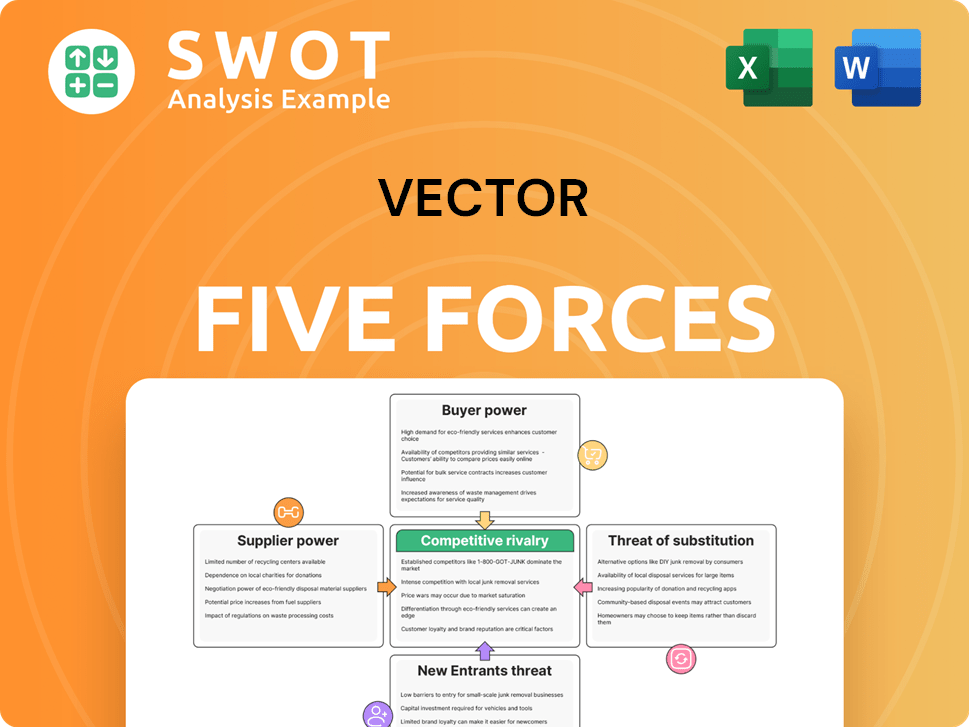

Vector Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Vector Company?

- What is Growth Strategy and Future Prospects of Vector Company?

- How Does Vector Company Work?

- What is Sales and Marketing Strategy of Vector Company?

- What is Brief History of Vector Company?

- Who Owns Vector Company?

- What is Customer Demographics and Target Market of Vector Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.