Vector Bundle

How Does Vector Company Power New Zealand?

Vector Limited, a key player in New Zealand's infrastructure, is more than just an energy provider; it's a digital solutions innovator. With a vast network spanning electricity, gas, and telecommunications, Vector serves over 620,000 customers. Understanding Vector SWOT Analysis is key to grasping its strategic position in the evolving energy landscape.

Delving into Vector operations reveals a company deeply invested in the future, driven by its 'Symphony strategy' and a commitment to smart innovation. This approach, crucial for investors and industry watchers, highlights Vector's adaptation to new trends and technological shifts. Exploring Vector calculus concepts can help analyze the complex network designs and energy flows within Vector's infrastructure. The company's financial health and strategic focus offer valuable insights into the utility sector, especially regarding decarbonization and integrated services.

What Are the Key Operations Driving Vector’s Success?

The core operations of the Vector company revolve around owning and operating essential infrastructure for electricity, gas, and telecommunications. This includes electricity distribution, gas network management, and fiber network construction. The company's value proposition centers on delivering reliable energy and digital solutions to a broad customer base.

Vector's integrated approach to energy and digital services aims to facilitate decarbonization while providing safe, reliable, and affordable energy. This is supported by the 'Symphony strategy', which emphasizes customer-centricity and leveraging smart innovation and global technology partnerships. Through strategic alliances and investments, Vector aims to improve network capabilities, leading to increased revenue and improved earnings.

The company serves over 620,000 residential and commercial customers across New Zealand, with its operational processes involving the maintenance and upgrading of extensive network infrastructure. Vector's supply chain and distribution networks are integral to its ability to deliver essential services. The Vector company's focus on integrated solutions sets it apart in the market.

Vector distributes electricity in Auckland, Wellsford, and Papakura. This involves managing approximately 18,000 kilometers of underground cables and overhead lines. The company ensures the reliable supply of electricity to homes and businesses within its service areas.

Vector manages the gas network in the wider Auckland region. Services include connections, disconnections, and leak reporting. This network is crucial for providing gas to residential and commercial customers.

Vector Fibre builds and maintains fiber networks for businesses. This provides robust data connectivity. The fiber network supports the growing demand for high-speed internet and data services.

Vector's portfolio includes new energy solutions and telecommunications services. This includes Vector Technology Solutions Ltd, which develops digital solutions for the energy infrastructure sector. HRV offers home ventilation, heating, and water filtration systems, as well as electric vehicle charging.

Vector's operations are unique due to its integrated approach to energy and digital solutions. This strategy aims to enable decarbonization while providing safe, reliable, and affordable energy. The company focuses on customer-centricity, leveraging smart innovation, and global technology partnerships to achieve its goals.

- Maintaining and upgrading extensive network infrastructure.

- Ensuring a reliable energy supply.

- Developing innovative digital platforms.

- Strategic alliances and investments for network improvements.

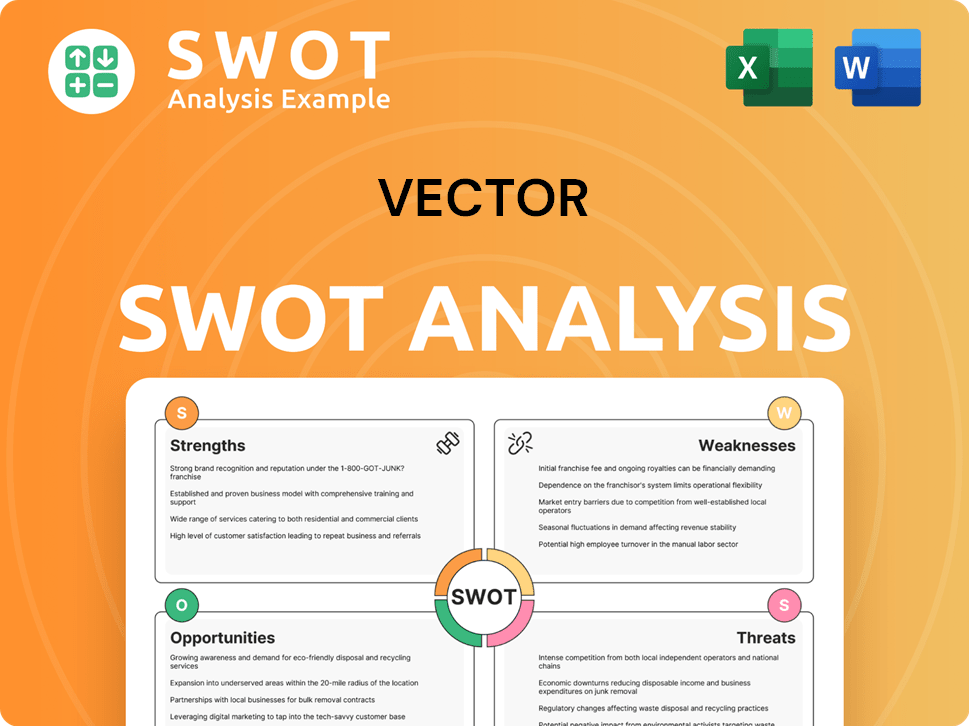

Vector SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vector Make Money?

The revenue streams and monetization strategies of Vector Limited are primarily centered around its regulated electricity and gas distribution networks. These networks are the main source of income for the company. For the year ending June 30, 2024, the company reported a total revenue of NZD 1,141.2 million.

Beyond its core networks, Vector also generates revenue from telecommunications services, specifically Vector Fibre, as well as new energy solutions and the HRV business. The company has been strategically shifting its focus by divesting from certain segments. For example, the natural gas trading business was sold on July 1, 2024, and the LPG business (Vector Ongas) and its shareholding in Liquigas Limited were sold on January 31, 2025.

These strategic shifts are expected to lead to a new segment structure for financial results, focusing on electricity, gas distribution, and other areas. Capital contributions from customers for new network connections also contribute to revenue, particularly in the electricity and gas distribution segments. Additionally, Vector receives dividends from its metering joint venture, with an estimated NZD 38 million expected in fiscal 2025.

The core revenue stream comes from regulated electricity and gas distribution networks.

Revenue is generated from telecommunications services, particularly through Vector Fibre.

Vector also generates revenue from new energy solutions.

The HRV business, which includes home ventilation, heating, water filtration, and EV charging, contributes to revenue.

Dividends from the metering joint venture are also a source of income, with an estimated NZD 38 million in fiscal 2025.

Capital contributions from customers for new network connections also contribute to revenue.

Vector's revenue streams are influenced by its strategic decisions and investments in infrastructure. The sale of the natural gas trading business in 2024 and the LPG business in early 2025 reflect a strategic shift. The company's focus remains on its core regulated networks and expanding into new energy solutions and telecommunications. Understanding the Marketing Strategy of Vector can provide further insights into how these revenue streams are managed and promoted.

- NZD 1,141.2 million: Total revenue reported for the year ended June 30, 2024.

- NZD 38 million: Estimated dividends from the metering joint venture for fiscal 2025.

- Strategic Divestments: Sale of natural gas trading and LPG businesses to streamline operations.

- Focus Areas: Electricity and gas distribution, Vector Fibre, and new energy solutions.

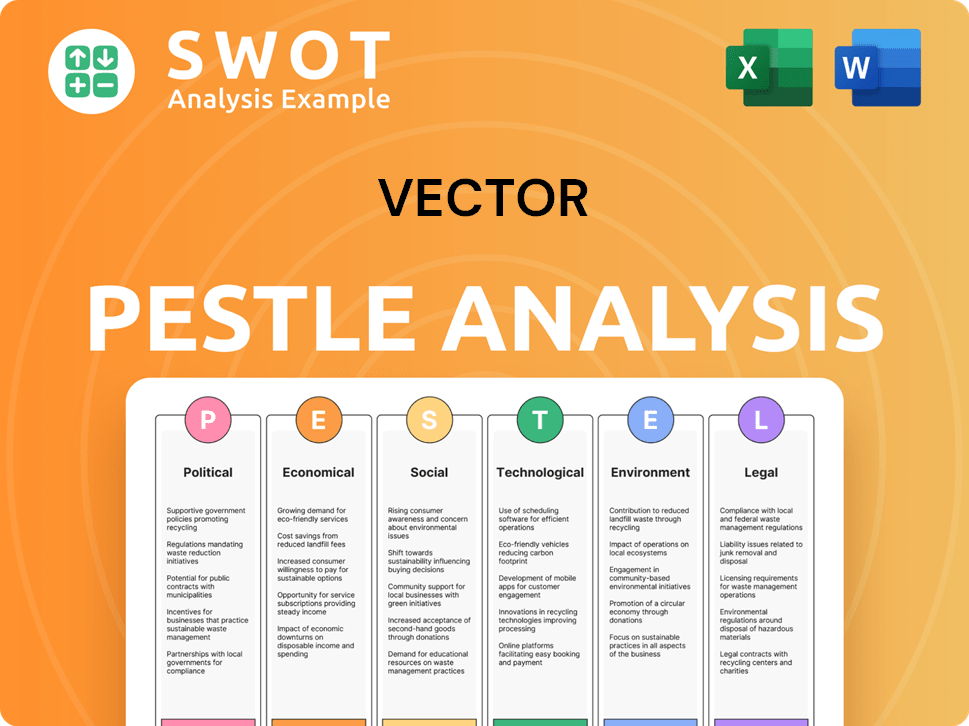

Vector PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vector’s Business Model?

The strategic evolution of Vector has been marked by significant shifts in its operational focus and financial structure. These changes aim to position the company at the forefront of the energy transition, leveraging its core strengths in network infrastructure and technological innovation. Recent divestitures and strategic partnerships underscore Vector's commitment to adapting to the changing energy landscape.

Vector's strategic moves include divesting non-core assets to concentrate on its core business. This focus is supported by investments in digital solutions and strategic alliances. These initiatives are designed to enhance network capabilities and future earnings. The company is also committed to sustainability, with ambitious targets for reducing greenhouse gas emissions.

The company faces operational challenges, including economic slowdowns, which have affected new electricity and gas connections. Despite these hurdles, Vector maintains a competitive edge through its established brand and technology leadership. Its strategic focus and commitment to innovation are key to navigating the evolving energy market.

Vector has undertaken several strategic moves to reshape its operations. A key milestone was the divestiture of a 50% stake in its unregulated metering business in April 2023. The company completed the sale of its natural gas trading business in July 2024. Vector finalized the sale of its LPG business (Vector Ongas) and its 60.25% shareholding in Liquigas Limited on January 31, 2025.

The strategic moves are designed to enable Vector to concentrate on the energy transition. These moves involve focusing on networks and technology solutions. Vector aims to improve its business risk profile and liquidity through these strategic actions. The company is investing in digital solutions and partnerships to enhance network capabilities.

Vector's competitive edge comes from its brand strength as New Zealand's largest provider and distributor. Technology leadership, including investments in digital solutions, is a key advantage. The regulated asset base provides high cash certainty. The company focuses on smart innovation and digital platforms to adapt to new trends.

Operational challenges include a broader economic slowdown. New electricity connections were down by 23.0% in the nine months ended March 31, 2025. New gas connections were also down by 30.0% in the same period. Gas distribution volume decreased by 9.3% during this period.

Vector is committed to sustainability, targeting a reduction of absolute Scope 1 & 2 GHG emissions by 53.5% by FY2030 from a FY2020 base year. The company's strategic focus on the energy transition, combined with its investments in technology and digital platforms, positions it for future growth. These initiatives are designed to improve network capabilities and future earnings.

- Divestments of non-core assets to focus on core business.

- Investments in digital solutions and strategic alliances.

- Commitment to reducing greenhouse gas emissions.

- Adaptation to new trends and competitive threats.

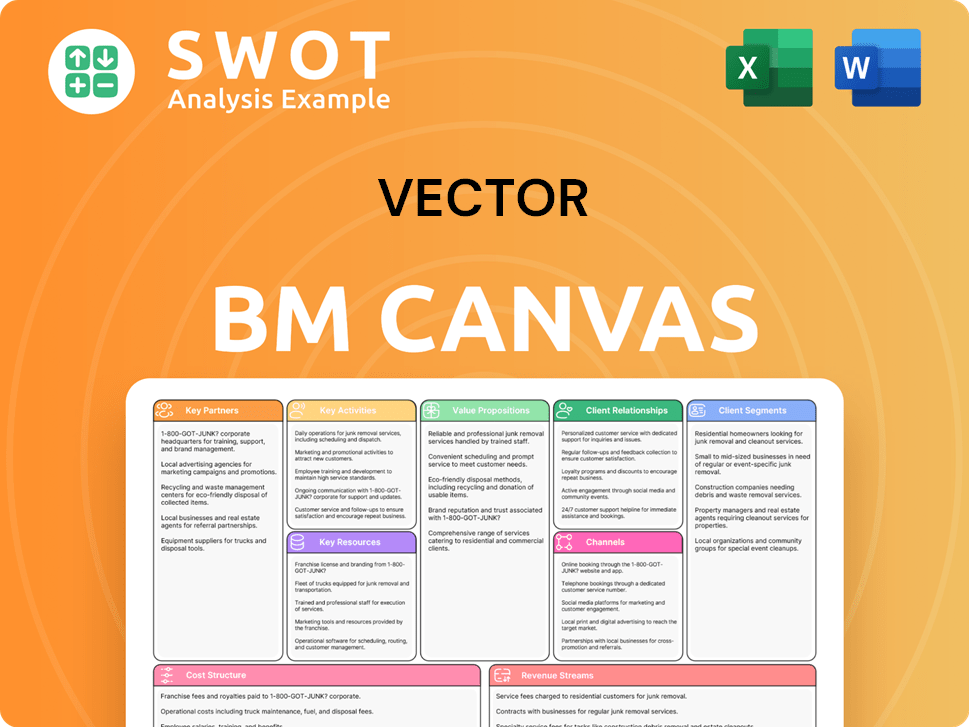

Vector Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vector Positioning Itself for Continued Success?

As of April 2025, Vector Limited maintains a robust market position as the foremost provider and distributor of gas and electricity infrastructure in New Zealand, serving over 620,000 residential and commercial customers. The company's market capitalization was valued at S$3.14 billion. The company's strategic focus on regulated monopoly businesses is expected to strengthen its business risk profile.

Vector faces several challenges, including regulatory changes and economic headwinds. The Commerce Commission's final determination on the next regulatory period will significantly influence revenue and earnings. While the draft regulatory determination on electricity tariffs supports cash flow, revisions to Vector's dividend policy could lead to increased leverage. Climate change and a broader economic slowdown also pose risks. To learn more about the potential for growth, check out the Target Market of Vector.

Vector is New Zealand's largest provider of gas and electricity infrastructure. It serves a substantial customer base and has a high market capitalization. The company's focus on regulated businesses provides a stable foundation.

Regulatory changes, particularly from the Commerce Commission, pose a risk. Climate change and economic slowdowns also present challenges. Changes to dividend policy could affect leverage.

Vector is pursuing its 'Symphony strategy' to accelerate the transition to a lower carbon energy system. This includes investments in core networks and growth through Vector Technology Solutions. The new five-year regulatory period is expected to provide earnings visibility.

Adjusted EBITDA for the full year is projected to be in the range of $400 to $415 million. Gross capital expenditure is expected between $495 to $525 million. Earnings and revenue are forecast to grow by 9.3% and 5.2% per annum, respectively.

Vector's 'Symphony strategy' is central to its future, focusing on decarbonization and network investment. The company's financial outlook includes significant capital expenditure and positive growth forecasts. The new regulatory period, commencing April 1, 2025, is expected to stabilize revenues.

- Focus on transitioning to a lower carbon energy system.

- Continued investment in core networks and exploring growth opportunities.

- Anticipated adjusted EBITDA between $400 and $415 million.

- Gross capital expenditure expected to be between $495 and $525 million.

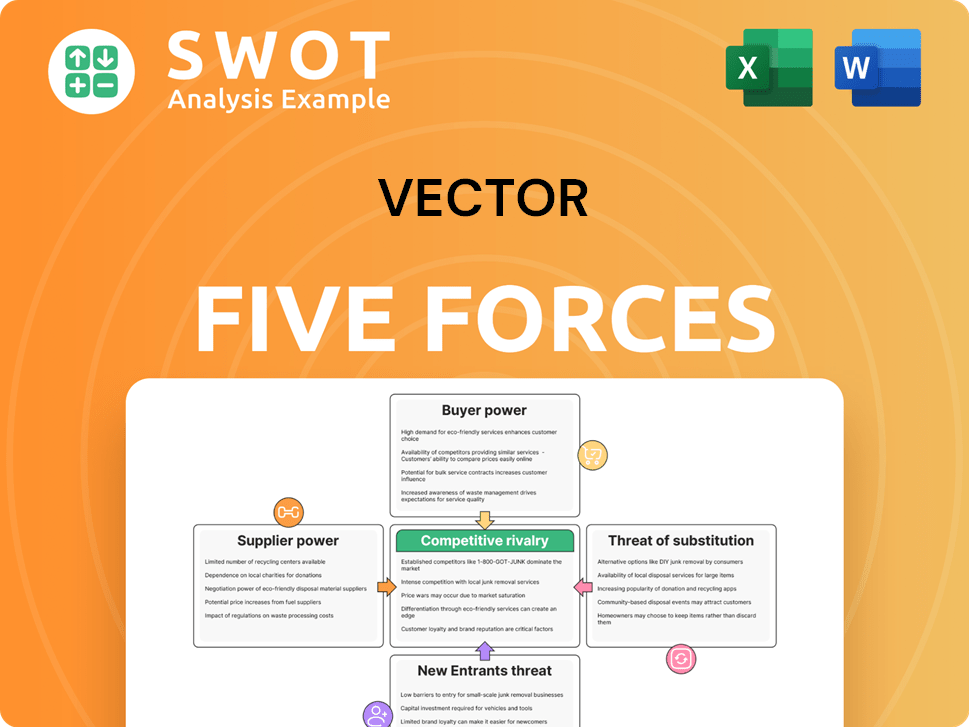

Vector Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vector Company?

- What is Competitive Landscape of Vector Company?

- What is Growth Strategy and Future Prospects of Vector Company?

- What is Sales and Marketing Strategy of Vector Company?

- What is Brief History of Vector Company?

- Who Owns Vector Company?

- What is Customer Demographics and Target Market of Vector Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.