Vector Bundle

How Does Vector Company Stack Up in New Zealand's Infrastructure Race?

New Zealand's energy and telecommunications sectors are undergoing a massive transformation, and at the heart of it all is Vector Limited. From its humble beginnings as an electricity distributor, Vector has become a key player in a dynamic market. Understanding Vector's competitive landscape is crucial for anyone looking to navigate this evolving environment.

This exploration dives deep into the Vector SWOT Analysis, examining its market position, key rivals, and strategic advantages. We'll dissect the competitive landscape, identifying the major players and their strategies. Furthermore, we'll analyze Vector's ability to adapt to changing industry trends, including the push towards renewable energy and smart grid technologies, to understand its future outlook and competitive threats. This comprehensive analysis will equip you with the insights needed to assess Vector's performance and potential within the context of its competitors.

Where Does Vector’ Stand in the Current Market?

Vector Limited is a key player in New Zealand's infrastructure scene, focusing on electricity, gas, and telecommunications. It's a major owner and operator of electricity and gas networks, particularly in Auckland and parts of the North Island. The company's operations are crucial for delivering essential services to a large customer base.

The company has evolved, moving beyond traditional energy distribution to include smart energy solutions and telecommunications. This strategic shift reflects a broader digital transformation, positioning Vector to meet changing market demands. Its financial strength underscores its significant presence in the industry.

Vector holds a strong market position, especially in Auckland for electricity and gas distribution. While specific market share figures are complex due to regional monopolies, its extensive network coverage highlights its dominance. The company's infrastructure is critical for delivering essential services.

As of December 31, 2023, Vector reported total assets of NZ$7.3 billion, demonstrating substantial financial strength. Operating revenue for the six months ended December 31, 2023, was NZ$786.7 million. This financial scale is robust compared to industry averages.

Vector has strategically diversified, expanding into telecommunications with fiber optic network services. This move reflects a digital transformation strategy. The company's focus on smart energy solutions further enhances its competitive advantage.

Vector's competitive advantages include its established infrastructure, regulatory framework, and strategic diversification. Owners & Shareholders of Vector benefit from the company's strong market position and financial performance. These factors contribute to Vector's resilience and growth potential.

Vector's market position is strong due to its infrastructure assets and strategic initiatives. The company's financial performance and diversification strategies support its competitive standing. Understanding Vector's competitive landscape is crucial for investors and stakeholders.

- Dominant player in electricity and gas distribution in Auckland.

- Significant investments in fiber optic networks.

- Strong financial performance, with substantial assets and revenue.

- Strategic shift towards smart energy solutions.

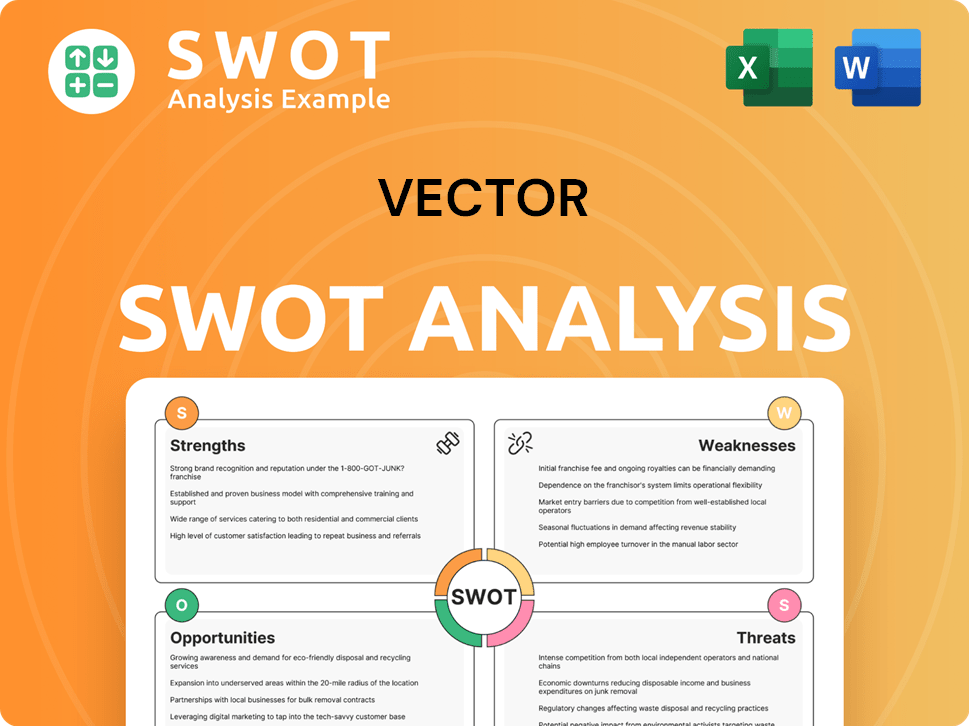

Vector SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vector?

The competitive landscape for Vector Limited is multifaceted, encompassing both direct rivals in infrastructure and emerging players within the broader energy and telecommunications sectors. The company's operations face competition from various entities, each vying for market share and customer engagement. Understanding these competitive dynamics is crucial for assessing Vector's strategic positioning and future prospects.

In the electricity and gas distribution segments, while direct competition for network ownership is limited due to the regulated nature of these assets, other regional network companies serve as benchmarks. These companies present potential competitive threats in terms of future growth and service expansion. The telecommunications space sees Vector competing with established providers and new entrants, all aiming to capture a share of the market.

Emerging trends in the energy sector, such as distributed generation and smart home technologies, also indirectly influence the competitive environment. The ongoing consolidation and strategic alliances within the telecommunications sector further shape the competitive dynamics, potentially impacting Vector's market position.

In the electricity and gas distribution sectors, Vector faces competition from other regional network companies. These companies act as benchmarks for operational efficiency and service quality. Companies like Powerco and Orion Group, which operate significant networks, are key players.

Vector's fiber optic network services compete with established telecommunications providers in New Zealand. Chorus, the dominant fixed-line access network provider, is a major competitor. Retail internet service providers, such as Spark, One New Zealand, and 2degrees, also pose a challenge.

Indirect competition comes from emerging players in the energy sector. These include companies focused on distributed generation, renewable energy solutions, and smart home technologies. These companies offer alternatives to traditional grid-supplied energy, influencing Vector's market position.

Consolidation and strategic alliances within the telecommunications sector impact the competitive dynamics. Mergers and partnerships, such as the Vodafone New Zealand and Sky Network Television broadband merger, can reshape the competitive landscape. These changes affect Vector's strategic planning.

Competitors challenge Vector through service innovation and pricing strategies. Expansion of network capabilities is another key strategy. These strategies directly impact Vector's market share and customer acquisition efforts.

The regulated nature of electricity and gas distribution assets limits direct competition for network ownership. However, regulatory changes and policy shifts can influence the competitive environment. These factors affect Vector's operational flexibility and strategic decisions.

Analyzing the competitive landscape requires considering several key factors. These include network infrastructure, service offerings, pricing strategies, and customer acquisition methods. Understanding these factors is crucial for a comprehensive Vector company analysis.

- Network Infrastructure: The quality and coverage of network infrastructure, including fiber optic and distribution networks, are critical.

- Service Offerings: The range of services offered, such as broadband, electricity, and gas, impacts competitiveness.

- Pricing Strategies: Competitive pricing models and value propositions influence customer decisions.

- Customer Acquisition: Effective marketing and customer service strategies are essential for attracting and retaining customers.

- Market Share: Assessing Vector market share relative to competitors provides insights into market positioning.

- Industry Trends: Staying informed about Vector industry trends, such as the growth of renewable energy and smart home technologies, is crucial.

- Competitive Advantages: Identifying Vector company competitive advantages, such as technological expertise and customer relationships, is important.

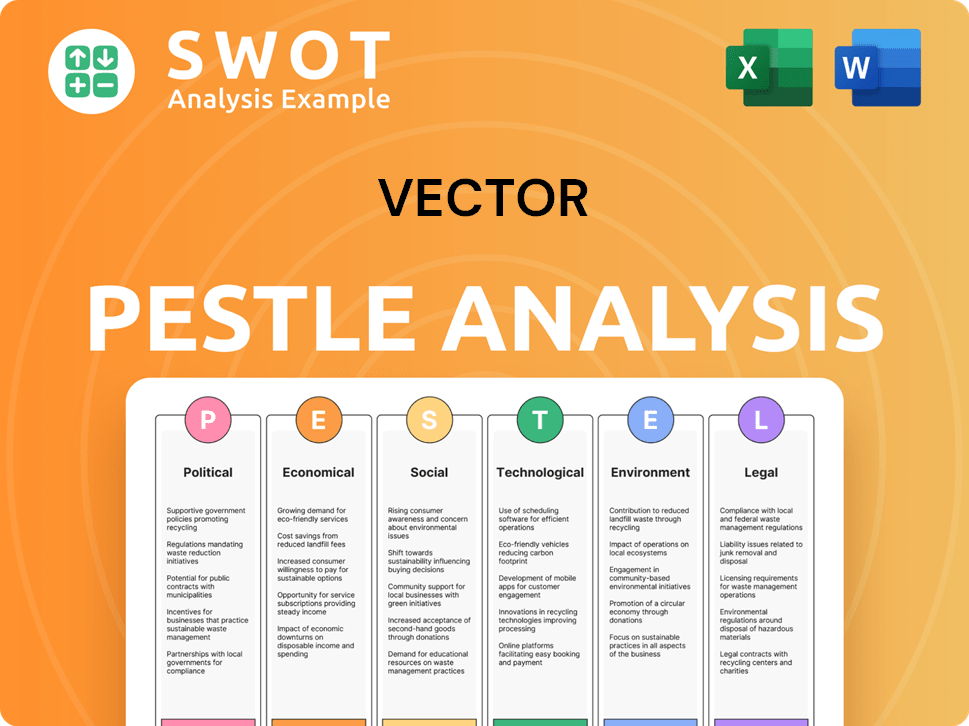

Vector PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vector a Competitive Edge Over Its Rivals?

The competitive advantages of Vector Limited are rooted in its established infrastructure and strategic diversification. Owning and operating electricity and gas networks in major urban areas creates a significant barrier to entry, providing a stable revenue stream and a degree of natural monopoly. This foundation allows Vector to expand into related sectors, enhancing its resilience and market position. For a comprehensive understanding, consider exploring the Marketing Strategy of Vector.

Vector's strategic moves into telecommunications, leveraging its existing infrastructure for fiber optic deployment, create synergies and allow for diversified revenue streams. This focus on innovation, particularly in smart metering and grid technologies, positions it at the forefront of energy transition in New Zealand. Vector's brand equity, built over decades of reliable service, fosters customer loyalty in a sector where reliability is paramount.

Operational efficiencies, derived from long-standing experience in managing complex utility networks, contribute to cost advantages. These advantages have evolved from simply being a utility provider to a more integrated energy and connectivity solutions company. Vector leverages these strengths in developing new services, forming strategic partnerships, and attracting talent. While regulatory changes or rapid technological shifts could pose threats, Vector's fundamental infrastructure assets and ongoing investment in smart solutions suggest these advantages are largely sustainable.

Vector's ownership of critical electricity and gas networks provides a significant competitive edge. This infrastructure creates high barriers to entry, protecting its market position. The company's investment in smart grid technologies further strengthens its infrastructure advantage, ensuring efficient energy distribution.

Diversification into telecommunications, particularly fiber optic deployment, enhances Vector's resilience. This strategy allows Vector to tap into new revenue streams, reducing dependence on a single sector. Diversification also helps in mitigating risks associated with regulatory changes or technological disruptions.

Vector's focus on smart metering and grid technologies positions it at the forefront of energy transition. This commitment to innovation enhances operational efficiency and customer service. The company's investments in technology also support its sustainability goals and future growth.

Vector's long-standing presence and reliable service have built strong brand equity. This brand recognition fosters customer loyalty, which is crucial in the utilities sector. Customer loyalty contributes to stable revenues and a strong market position.

Vector's operational efficiencies, stemming from years of experience, provide cost advantages. These efficiencies are critical in maintaining profitability and competitiveness in a regulated market. The company's focus on cost management supports its ability to offer competitive pricing and maintain a strong financial position.

- Cost Reduction: Streamlining operations to reduce expenses.

- Efficiency Gains: Improving processes for better performance.

- Competitive Pricing: Offering attractive rates to customers.

- Financial Stability: Ensuring long-term profitability.

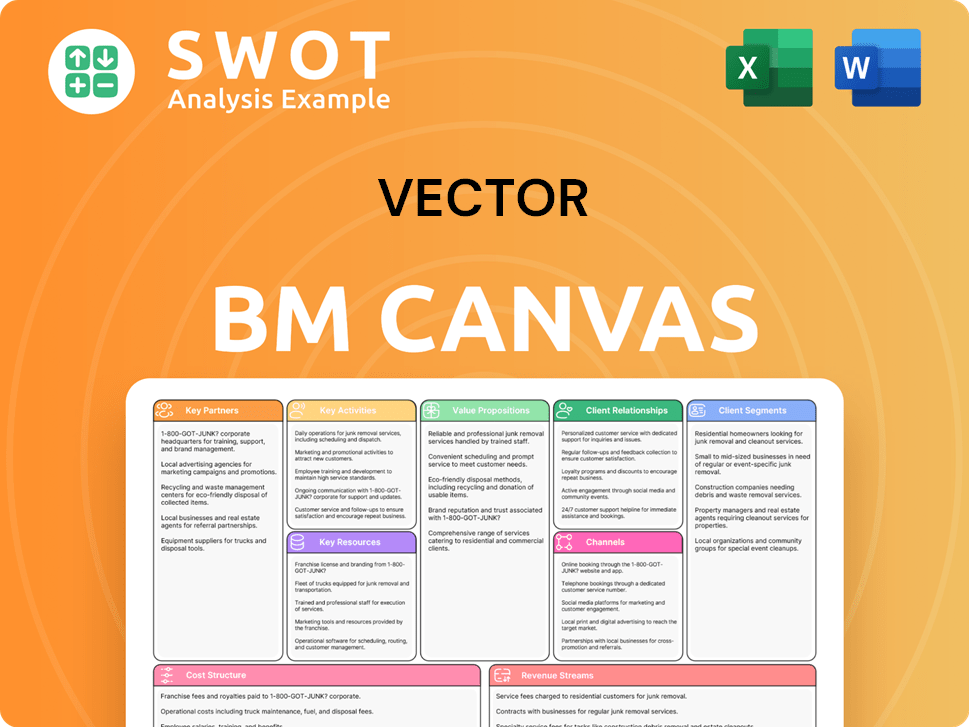

Vector Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vector’s Competitive Landscape?

The competitive landscape for Vector is shaped by industry trends, including decarbonization, smart grid advancements, and digital connectivity demands. These factors present both challenges and opportunities for the company. A thorough Vector company analysis reveals a need to navigate a complex environment to maintain and grow its market position.

Vector market share and its ability to adapt to changing customer expectations are key. The company must also address potential disruptions from new market entrants offering innovative energy and connectivity solutions. This requires strategic agility and a focus on innovation to remain competitive.

The industry is moving towards decarbonization, requiring investment in renewable energy and grid modernization. Smart grid technologies are advancing rapidly, demanding integration and upgrades. The demand for digital connectivity continues to grow, necessitating infrastructure investments.

Transitioning to a low-carbon economy requires significant capital expenditure and regulatory compliance. Customer expectations for personalized services and control over energy consumption are rising. New market entrants could disrupt the industry with innovative solutions.

The adoption of EVs and renewable energy creates demand for smart charging infrastructure and grid flexibility. The ongoing demand for high-speed internet and 5G technology offers growth avenues. Vector can expand its offerings in these areas.

Deploying battery energy storage systems and smart metering enhances grid resilience. Focusing on sustainability, innovation, and customer-centric solutions is crucial. Vector is evolving into an integrated energy and digital services provider.

Vector company competitive advantages lie in its ability to integrate energy and digital services. The company strategically positions itself to capitalize on the growth in EVs and renewable energy. Its focus on customer-centric solutions and innovation is key to maintaining its competitive edge.

- Investment in smart grid technologies and infrastructure upgrades is ongoing.

- Expansion into renewable energy solutions and EV charging infrastructure is a priority.

- Enhancing digital platforms and customer interfaces to meet evolving needs is crucial.

- Focus on sustainability and reducing carbon footprint is a key strategic goal.

To understand the competitive landscape, it's essential to analyze the Vector company competitors and their strategies. The Target Market of Vector article provides additional insights into the company's customer base and market positioning. The company's financial performance, compared to competitors, will be crucial for understanding its position. Vector’s future outlook depends on its ability to navigate these challenges and seize emerging opportunities in the energy and telecommunications sectors. Recent acquisitions and their impact will also be important in the Vector company competitive intelligence.

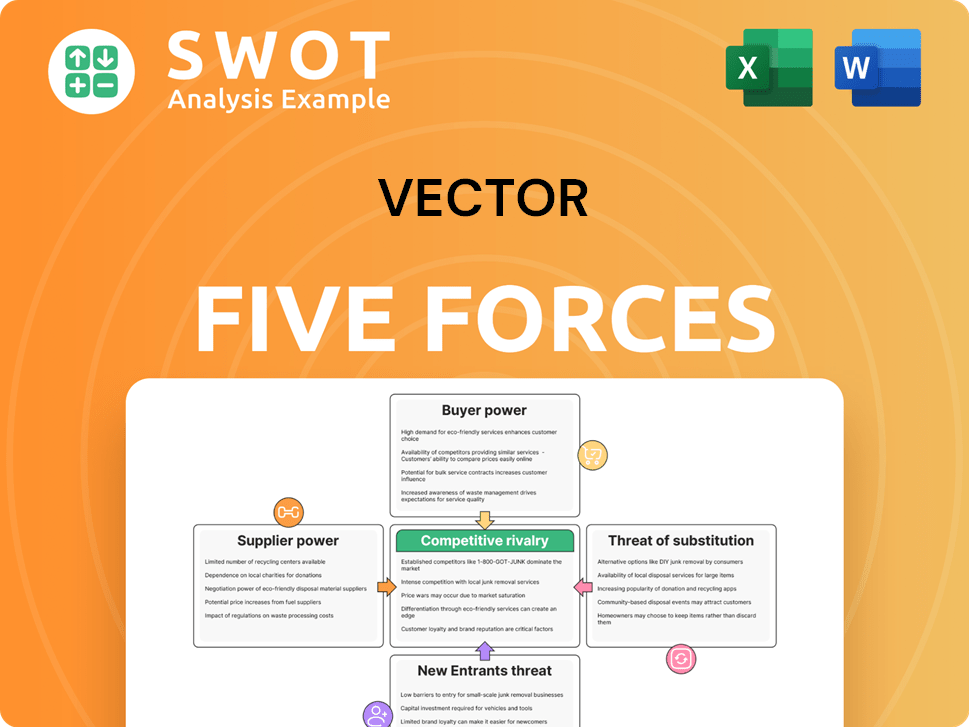

Vector Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vector Company?

- What is Growth Strategy and Future Prospects of Vector Company?

- How Does Vector Company Work?

- What is Sales and Marketing Strategy of Vector Company?

- What is Brief History of Vector Company?

- Who Owns Vector Company?

- What is Customer Demographics and Target Market of Vector Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.