Vector Bundle

Can Vector Company Power the Future?

Vector Limited, a key player in New Zealand's energy and telecommunications sectors, is charting a course through a rapidly evolving landscape. Its Vector SWOT Analysis reveals critical insights into its strategic positioning. This exploration delves into Vector's growth strategy and future prospects, examining how it plans to navigate the energy transition and capitalize on emerging opportunities.

From its foundational role in providing essential services, Vector is now focused on business development and strategic planning to ensure long-term success. This includes an in-depth market analysis to understand its competitive landscape and identify new avenues for growth. The company's commitment to innovation and sustainability initiatives positions it well to address the future trends in vector graphics and beyond, making it a compelling case study for investors and strategists alike.

How Is Vector Expanding Its Reach?

The Vector company is focusing on a growth strategy centered on adapting to the energy transition and leveraging technological advancements. This involves entering new product categories, divesting non-core assets, and forming strategic partnerships. The company's approach is designed to position itself for the future of energy and technology.

A key aspect of Vector's expansion includes divesting from natural gas trading. This strategic move allows the company to concentrate on its core networks and technology solutions, which are crucial for the energy transition. This shift is part of a broader strategy to focus on areas where Vector can lead in the evolving energy landscape.

Vector is actively expanding into energy management and smart grid technologies. These initiatives are designed to create a more affordable, reliable, and safe energy system, aligning with customer needs and managing the variability of energy demand resulting from decarbonization efforts.

Vector completed the sale of its remaining natural gas trading businesses by July 1, 2024. This strategic move allows the company to focus on its core networks and technology solutions, which are crucial for the energy transition. The divestment includes Vector Ongas and its shareholding in Liquigas.

Vector is expanding into energy management through initiatives like the Distributed Energy Resource Management Systems (DERMs) pilot program. This program, initiated in February 2025 with ChargeNet NZ Limited, aims to optimize charging efficiency and reduce costs. This expansion supports the company's 'Symphony strategy' for a sustainable energy future.

Vector has extended its strategic alliance with Amazon Web Services (AWS) and is contributing to X's Tapestry project. These partnerships support the development of next-generation platforms for network management. These collaborations are crucial for driving innovation and enhancing Vector's technological capabilities.

Vector's smart meter data program is well advanced, with plans to analyze power quality data. This data analysis will enhance targeted communications to customers regarding planned work. This initiative aims to improve customer service and operational efficiency.

Vector's expansion initiatives are geared towards the energy transition and technological innovation. These strategies are designed to create a sustainable and efficient energy system.

- Divestment from natural gas trading to focus on core networks and technology.

- Expansion into energy management through DERMs pilot programs.

- Strategic partnerships with AWS and contribution to X's Tapestry project.

- Advancement of the smart meter data program to improve customer communication.

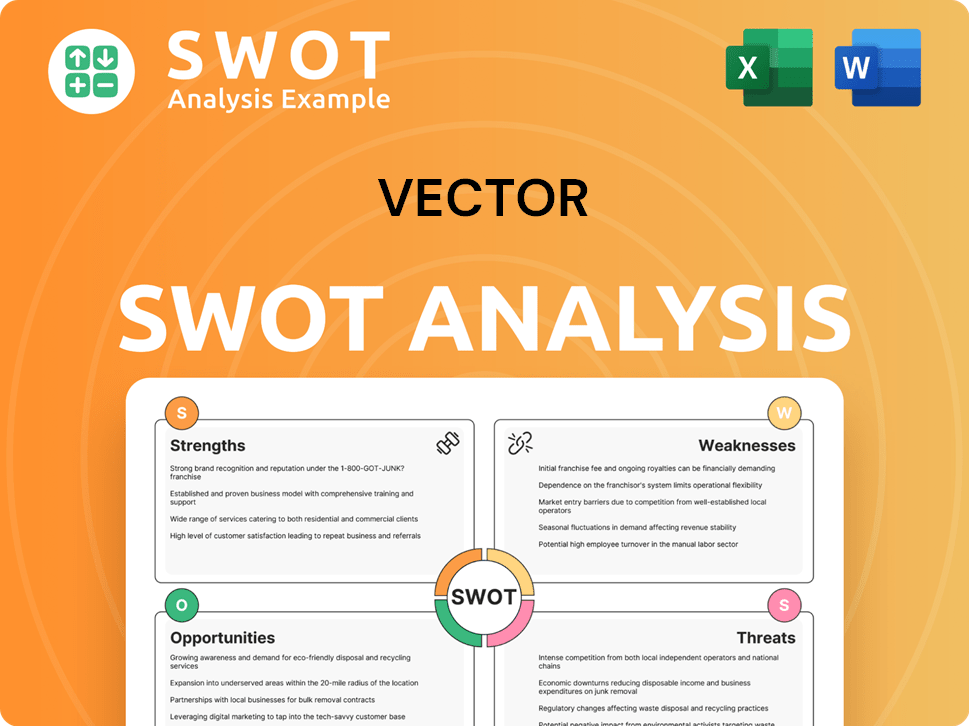

Vector SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vector Invest in Innovation?

The innovation and technology strategy of the company is crucial for its sustained growth, focusing on digitalization and leveraging cutting-edge technologies to transform the energy sector. This approach is designed to create an energy system that is affordable, reliable, and safe, while also addressing decarbonization and the increasing integration of Distributed Energy Resources (DERs).

A key component of the company's technological advancement is its smart meter data program. This program aims to provide reliable access to near real-time smart meter data for strategic and operational decision-making. The company has also partnered with global technology companies to virtualize its electricity network. This 'moonshot project' aims to create a digital copy of the network to simulate its behavior in future scenarios, particularly with the rise of electric vehicles (EVs), solar, and battery storage, which are making energy flow more complex.

The company's commitment to innovation is further demonstrated by its ISO14001 certification since 2017, highlighting its environmental management standards. This commitment to sustainability aligns with the broader industry trends, which are increasingly focused on environmental responsibility and reducing carbon emissions. The company's efforts in this area contribute to its overall growth strategy and enhance its future prospects in a market that values sustainable practices.

The company is heavily investing in network modernization to enhance the reliability and efficiency of its electricity distribution infrastructure. This involves upgrading existing assets and deploying advanced technologies to improve grid performance. These upgrades are essential to support the increasing demand for electricity and the integration of renewable energy sources.

The company is focused on orchestrating Distributed Energy Resources (DERs) to optimize energy management and provide customers with more control over their energy consumption. This includes integrating solar panels, battery storage systems, and electric vehicle charging stations into the grid. This approach supports the transition to a more decentralized and sustainable energy system.

The company is developing and implementing digital systems, integration protocols, and new data platforms to improve operational efficiency and enhance customer service. These digital tools enable better monitoring, control, and analysis of energy flows across the network. The use of advanced data analytics allows for more informed decision-making and proactive management of grid operations.

The smart meter data program is a critical initiative, providing access to near real-time smart meter data for strategic and operational decisions. This data enables the company to better understand energy consumption patterns, identify potential issues, and optimize grid performance. This data-driven approach supports proactive grid management and enhances customer service.

The company has established partnerships with leading technology companies, such as Amazon Web Services (AWS) and X (formerly Google X), to drive innovation and accelerate its digital transformation. These collaborations bring expertise in areas like cloud computing, data analytics, and artificial intelligence. These partnerships support the development of advanced solutions.

The company is working on creating a digital twin of its electricity network to simulate its behavior under various scenarios. This digital replica allows the company to test different strategies, anticipate potential issues, and optimize grid performance. This proactive approach ensures the reliability and resilience of the network.

The company's focus on innovation is evident in its strategic initiatives. These initiatives are designed to enhance operational efficiency, improve customer service, and support the transition to a sustainable energy future.

- Smart Grid Technologies: Implementing advanced metering infrastructure (AMI) and smart grid technologies to improve grid management and reliability.

- Data Analytics: Utilizing data analytics to gain insights into energy consumption patterns, optimize grid performance, and enhance customer service.

- Renewable Energy Integration: Supporting the integration of renewable energy sources, such as solar and wind power, into the grid.

- Customer Engagement: Developing digital platforms and tools to enhance customer engagement and provide them with more control over their energy usage.

The company's commitment to innovation and technology is a core element of its Mission, Vision & Core Values of Vector, driving its growth strategy and shaping its future prospects in the energy sector. By embracing digital transformation, investing in network modernization, and leveraging strategic partnerships, the company is well-positioned to meet the evolving needs of its customers and the challenges of a changing energy landscape. The company's focus on sustainability, combined with its technological advancements, positions it for long-term success in the energy market.

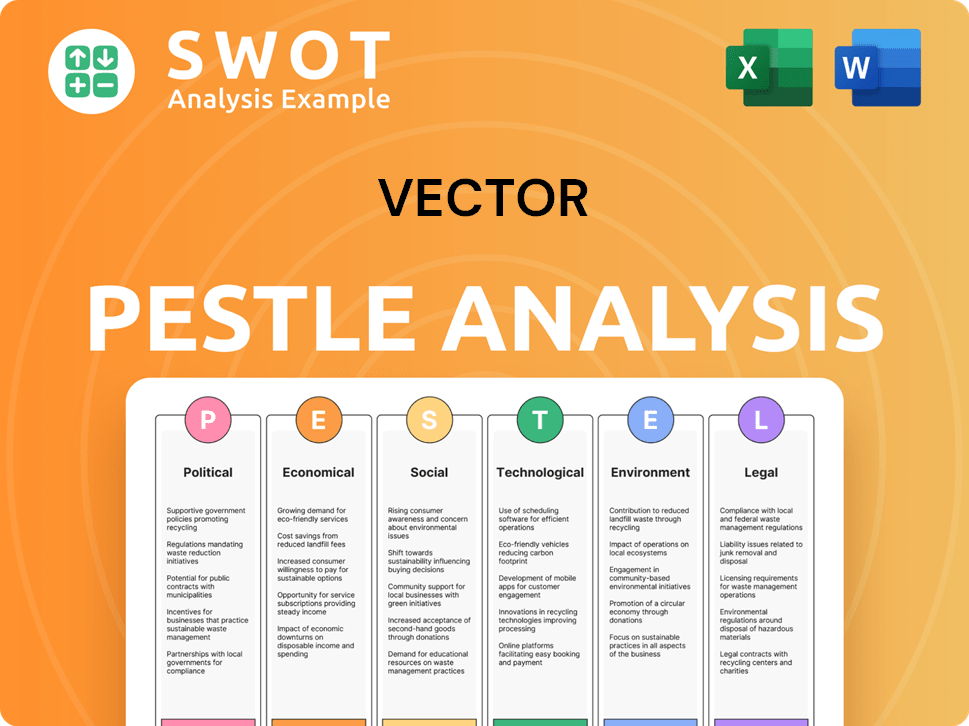

Vector PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vector’s Growth Forecast?

The financial outlook for the Vector company is positive, with continued growth expected. The company's performance in recent periods indicates a strong foundation for future expansion and investment. This positive trajectory is supported by strategic initiatives and favorable market conditions.

For the fiscal year ending June 30, 2024, Vector reported solid financial results. Revenue increased to NZD 1,141.2 million, reflecting a growth in sales. The adjusted EBITDA for continuing operations rose to $365.2 million, demonstrating improved profitability. The company's financial strategy, including capital expenditure and customer contributions, supports its growth objectives.

Looking ahead, Vector's financial projections for the 2025 financial year are promising. The company anticipates continued growth in adjusted EBITDA, with a range of $400 million to $415 million. Capital expenditure is planned, and the company's FFO-to-debt ratio is expected to strengthen. These factors contribute to a positive outlook for the Vector company.

Vector's revenue for the full year ended June 30, 2024, reached NZD 1,141.2 million, up from NZD 1,082.7 million the previous year. This growth highlights the company's ability to increase sales and market share. The increase in revenue is a key indicator of successful business development and strategic planning.

Adjusted EBITDA for continuing operations increased by 14% to $365.2 million for the full year ended June 30, 2024. This demonstrates improved profitability and operational efficiency. The adjusted EBITDA growth is a key factor in assessing the company's financial health and future prospects.

In the first half of the 2025 financial year (H1 FY25), Vector reported a group net profit after tax for continuing operations of $118 million. Adjusted EBITDA for continuing operations was $202 million, a 16% increase compared to H1 FY24. These results indicate a strong start to the fiscal year.

Vector announced a final dividend of 13 cents per share for the full year ended June 30, 2024, plus a special dividend of 1.75 cents per share. The company's dividend policy is expected to be finalized once the Commerce Commission's determination on the next regulatory period (DPP4, starting April 1, 2025) is released.

Vector's future prospects are supported by its strategic initiatives and financial performance. The company's focus on growth and innovation positions it well for long-term success. Understanding the Target Market of Vector is crucial for its strategic planning and future expansion.

- Adjusted EBITDA for the full year is expected to be in the range of $400 million to $415 million.

- Gross capital expenditure is projected to be between $495 million and $525 million.

- The FFO-to-debt ratio is anticipated to strengthen to about 20% over the next two to three years.

- These projections highlight the company's commitment to sustainable growth and financial stability.

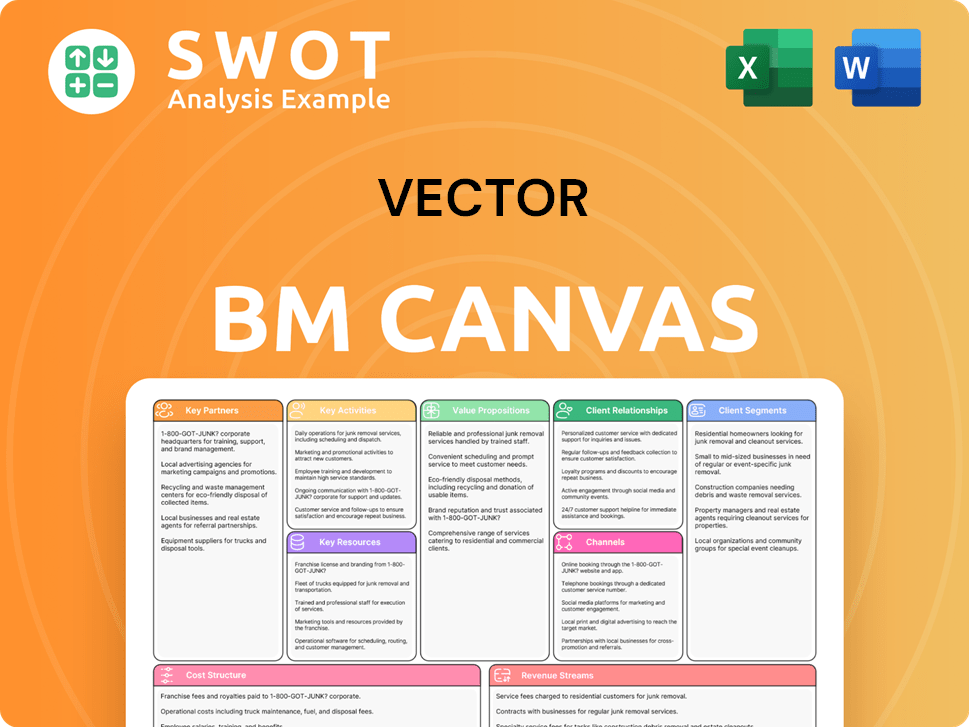

Vector Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vector’s Growth?

The Vector company faces several potential risks and obstacles in its pursuit of its growth strategy. These challenges primarily arise from market competition, regulatory changes, and the complexities of the energy transition. Understanding these risks is crucial for effective strategic planning and navigating the evolving business landscape.

One significant risk stems from the uncertainty surrounding future policy and regulatory settings for gas, especially as the industry awaits the Gas Transition Plan. The lack of appropriate settings could lead to regulated gas pipeline assets becoming stranded and energy becoming unaffordable for consumers. Vector company has expressed concerns about the potential for under-recovering costs.

Market competition, particularly in the telecommunications and smart metering sectors, also poses a risk. The company's venture, Bluecurrent, faces potential competition in advanced metering services, which could impact its future. Furthermore, the rapid pace of technological innovation and changing customer behaviors add uncertainties to electricity infrastructure planning.

Uncertainty around the Gas Transition Plan and future regulations poses a significant risk. Without appropriate regulatory frameworks, gas pipeline assets could become stranded, potentially leading to financial losses. The Vector company must navigate these regulatory changes carefully to ensure its long-term viability and investment security.

Competition in telecommunications and smart metering sectors is a key risk factor. The Vector company's Bluecurrent faces potential competition in advanced metering services, which could affect its market share and revenue. This necessitates a strong focus on innovation and differentiation to maintain a competitive edge.

Rapid technological innovation and evolving customer behavior introduce uncertainties in electricity infrastructure planning. The rise of electric vehicles and distributed energy resources requires the Vector company to adapt its infrastructure and business models to meet changing demands. This includes strategic investments in new technologies and services.

The potential for under-recovering costs, particularly in the gas sector, presents a financial risk. Initial scenario analysis estimates a risk of $973 million to gas networks by 2050 if no government or regulatory intervention occurs in a wind-down scenario. Effectively managing these financial challenges is crucial.

The increasing demand for hyperscale data centers in Auckland presents a complex challenge, impacting the network. Managing this growth requires significant investment and careful planning to ensure the network can support the increasing load and maintain reliability. This also impacts the future prospects.

The 'Symphony strategy' aims to mitigate some of these risks by focusing on non-network solutions and demand-side response. This proactive approach will help optimize distribution network costs and improve resilience. For more information, you can read about the Competitors Landscape of Vector.

The Vector company's growth strategy faces several hurdles. These include regulatory uncertainties, market competition, and rapid technological advancements. Addressing these challenges requires proactive measures and strategic investments.

Regulatory changes pose a significant risk, particularly concerning the Gas Transition Plan. The potential for stranded assets and under-recovery of costs could impact the company's financial performance. A comprehensive understanding of regulatory dynamics is essential.

Competition in the telecommunications and smart metering sectors adds to the challenges. The company must differentiate its services and adapt to changing market conditions. Effective market analysis will be vital for success.

Technological innovation and changing customer behaviors, such as the growth of electric vehicles, introduce uncertainty. Planning for long-term infrastructure requires flexibility and adaptability. The Vector company's ability to innovate is crucial.

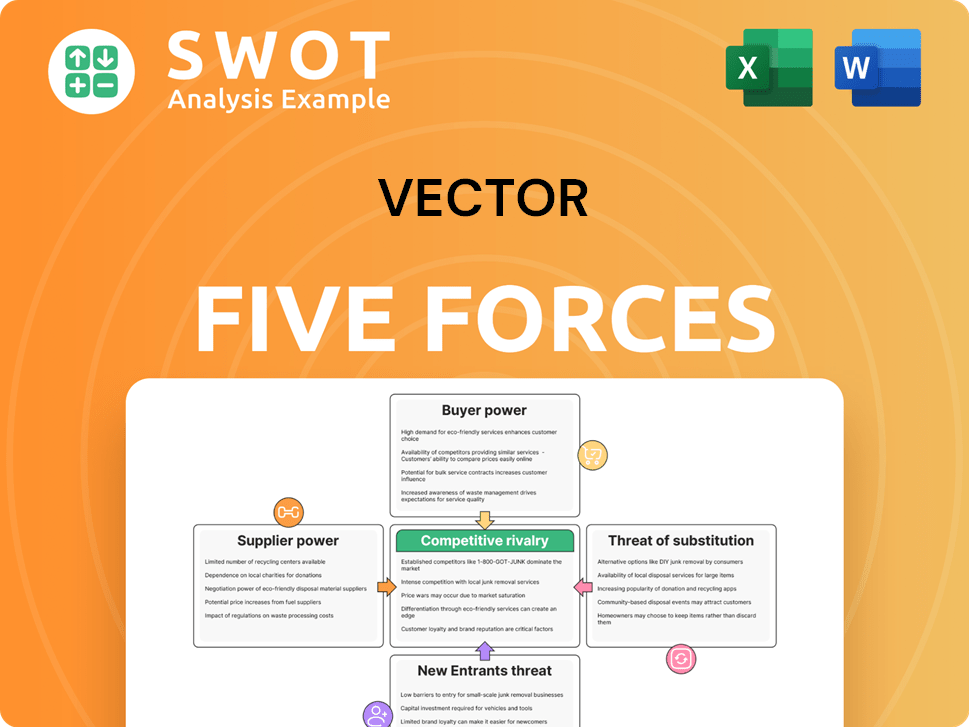

Vector Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vector Company?

- What is Competitive Landscape of Vector Company?

- How Does Vector Company Work?

- What is Sales and Marketing Strategy of Vector Company?

- What is Brief History of Vector Company?

- Who Owns Vector Company?

- What is Customer Demographics and Target Market of Vector Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.