Veolia Environnement Bundle

How did Veolia Environnement become a global environmental leader?

Dive into the fascinating Veolia Environnement SWOT Analysis and uncover the story of a company that started with a simple mission: providing clean water. From its roots in 1853 France, Veolia's journey is a testament to strategic foresight and adaptability. Discover how this environmental services giant has evolved, shaping the world's approach to sustainability.

The brief history of Veolia Environnement reveals a remarkable transformation. From its early focus on water management, the Veolia company broadened its scope to include waste management and energy services, becoming a global leader. Understanding the Veolia history and key milestones provides valuable insights into its business model and its enduring commitment to environmental solutions. Veolia's major acquisitions and strategic shifts have solidified its global presence and financial performance, making it a critical player in the sustainability landscape.

What is the Veolia Environnement Founding Story?

The Veolia Environnement story begins on December 14, 1853. It was founded as Compagnie Générale des Eaux (CGE) by a decree from Napoleon III. This marked the start of a company that would become a global leader in environmental services.

The initial focus of the company was on water supply and management, a crucial need in a rapidly industrializing France. CGE provided water concessions to municipalities, establishing a vital public service. The company's early business model was centered around providing and managing water networks.

The company's name, 'Compagnie Générale des Eaux,' directly reflected its primary purpose: a general company for waters. Over time, CGE expanded its services, laying the groundwork for its evolution into a multifaceted environmental services provider. The demand for reliable public utilities was high during the 19th century, which CGE was established to fulfill.

The early days of Veolia history are rooted in providing essential water services. The company's initial operations involved constructing and managing water networks. This was a significant undertaking for the time, driven by the need for public utilities.

- Founded on December 14, 1853, as Compagnie Générale des Eaux (CGE).

- Established by an Imperial decree from Napoleon III.

- Initial focus on water supply and management in France.

- The company's name, 'Compagnie Générale des Eaux,' reflected its primary purpose.

The early Veolia company focused on water distribution and management. This foundation allowed for future diversification into other environmental services. The company adapted to the needs of a growing industrial society.

For a deeper dive into the company's strategic evolution, consider reading about the Growth Strategy of Veolia Environnement.

Veolia Environnement SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Veolia Environnement?

The early growth of the Veolia Environnement, originally known as Compagnie Générale des Eaux (CGE), was centered on securing water concessions in France. Over time, the Veolia company expanded its Veolia services beyond water, diversifying into waste management, energy, and transportation. This strategic move aimed to provide comprehensive utility management.

Initially, CGE concentrated on water concessions, which fueled its early growth. The company broadened its scope to include waste management, energy, and transportation. This expansion was driven by a vision of comprehensive utility management.

Between 1998 and 2003, operating as Vivendi Environnement, the company shifted its focus to environmental services. In 2003, it was officially renamed Veolia Environnement, establishing its current brand identity. This refocus marked a significant change in strategy.

Veolia acquisitions and mergers accelerated its growth, notably the integration of Suez in 2022. This boosted EBITDA by nearly 40%. The company also streamlined operations, exiting many country operations and transport activities to concentrate on core environmental services.

Veolia's history has been shaped by market trends, including the circular economy and decarbonization. The 'GreenUp' plan, launched in 2024, aims to accelerate ecological transformation. In the first quarter of 2025, Veolia demonstrated solid organic revenue growth of 3.9% and an EBITDA increase of 5.5%, showing the effectiveness of its growth strategies. Learn more about the company's values by reading Mission, Vision & Core Values of Veolia Environnement.

Veolia Environnement PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Veolia Environnement history?

The Veolia Environnement has achieved numerous milestones throughout its history, demonstrating its growth and evolution in the environmental services sector. Key moments include strategic rebranding and significant acquisitions that have shaped its global presence and service offerings. This Veolia history reflects its adaptability and commitment to environmental solutions.

| Year | Milestone |

|---|---|

| 2005 | The 'Veolia' brand was adopted, unifying all divisions under a single identity. |

| 2020 | Acquired a 29.9% stake in Suez, marking a significant strategic move. |

| 2022 | Full integration of Suez, substantially increasing EBITDA. |

| 2024 | Launched the 'GreenUp' strategic program for 2024-2027. |

| May 2025 | Completed industry testing on PFAS waste incineration. |

Veolia Environnement has consistently pursued innovations to enhance its Veolia services. The company's focus on new technologies and market strategies has been crucial. For more insights, check out the Target Market of Veolia Environnement.

The adoption of the 'Veolia' brand in 2005 unified its diverse operations. This rebranding helped create a single recognizable identity for all divisions.

In May 2025, the company completed industry testing on PFAS waste incineration. This innovation highlights its commitment to address emerging pollutants.

Veolia launched its 'BeyondPFAS' offering. The aim is to achieve €1 billion in sales by 2030 in the fight against micropollutants.

The 'GreenUp' program focuses on accelerating ecological transformation. It prioritizes investments in high-growth areas like hazardous waste treatment.

Despite its successes, Veolia company has faced challenges, including market fluctuations and competitive pressures. The company's ability to adapt and innovate has been critical in overcoming these obstacles. The Veolia acquisitions, along with strategic initiatives, have been key to its resilience.

The company has navigated global economic, health, geopolitical, and energy shocks. These challenges tested its resilience in the market.

Veolia faces competition in the environmental services sector. Strategic moves, like the Suez acquisition, aim to strengthen its position.

Veolia achieved €398 million in cost savings in 2024, exceeding its annual target. Synergies from the Suez acquisition reached €435 million, surpassing expectations.

In 2024, Veolia invested €133.5 million in its plan to phase out coal in Europe. This investment demonstrates its commitment to decarbonization.

Veolia Environnement Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Veolia Environnement?

The Veolia Environnement has a rich history marked by significant milestones in the environmental services sector. From its inception as Compagnie Générale des Eaux (CGE) in 1853, the company has undergone several transformations, including a period as Vivendi Environnement, before adopting the Veolia Environnement name. Key moments include the establishment of 'Veolia' as its umbrella brand and the merger with Suez, solidifying its position as a global leader in environmental solutions. The company's journey also encompasses strategic acquisitions and a commitment to sustainable practices, shaping its evolution into a prominent player in water, waste, and energy management. Learn more about the Marketing Strategy of Veolia Environnement.

| Year | Key Event |

|---|---|

| 1853 | Compagnie Générale des Eaux (CGE) is created by Imperial decree. |

| 1998-2003 | The company operates as Vivendi Environnement, spun off from Vivendi Universal. |

| 2003 | Vivendi Environnement is renamed Veolia Environnement. |

| 2005 | 'Veolia' is established as the umbrella brand for all Group divisions. |

| 2020 | Veolia makes an offer to ENGIE to acquire a 29.9% stake in Suez. |

| May 2021 | Terms for the merger with Suez are signed. |

| July 2022 | Estelle Brachlianoff becomes CEO, succeeding Antoine Frérot. |

| 2023 | Veolia reports a 9% rise in sales and increases dividend, marking the 7th consecutive year of earnings growth. |

| 2024 | Launch of the 'GreenUp' strategic program for 2024-2027, focusing on decarbonization, depollution, and resource regeneration. |

| 2024 | Consolidated revenue reaches €44.7 billion, with 5.0% organic growth. |

| February 2025 | Veolia reports strong 2024 financial results, exceeding targets, with a record current net income of €1,530 million. |

| March 2025 | CriteriaCaixa announces intent to acquire up to a 5% stake in Veolia Environnement. |

| April 2025 | Veolia's AGM approves 2024 financial statements and a dividend of €1.40 per share. |

| May 2025 | Veolia acquires CDPQ's 30% stake in Water Technologies and Solutions, achieving full ownership. |

The 'GreenUp' strategic program (2024-2027) is designed to accelerate ecological transformation globally. This initiative focuses on decarbonization, depollution, and resource regeneration, setting the stage for future growth. The company plans to allocate significant capital expenditures to support these initiatives, particularly in hazardous waste, water technologies, and bioenergy.

Veolia Environnement anticipates continued organic revenue growth and EBITDA growth of 5-6% in 2025. The company aims for efficiency gains above €350 million and has raised its synergy target from the Suez acquisition to €530 million by the end of 2025. These targets reflect Veolia's commitment to financial performance and operational excellence.

Analysts project a positive outlook for Veolia's stock, with an average price target of $45.09 in 2025, representing a 29.93% increase. Long-term forecasts suggest continued growth, with an average price of $232.03 by 2050, a 568.67% change. These projections indicate confidence in Veolia's long-term value creation and market position.

Veolia's leadership is committed to reconciling environmental protection, human progress, and economic performance. This commitment aligns with the company’s founding vision of providing essential environmental services. By focusing on sustainability initiatives and strategic acquisitions, Veolia continues to evolve and lead the environmental services sector.

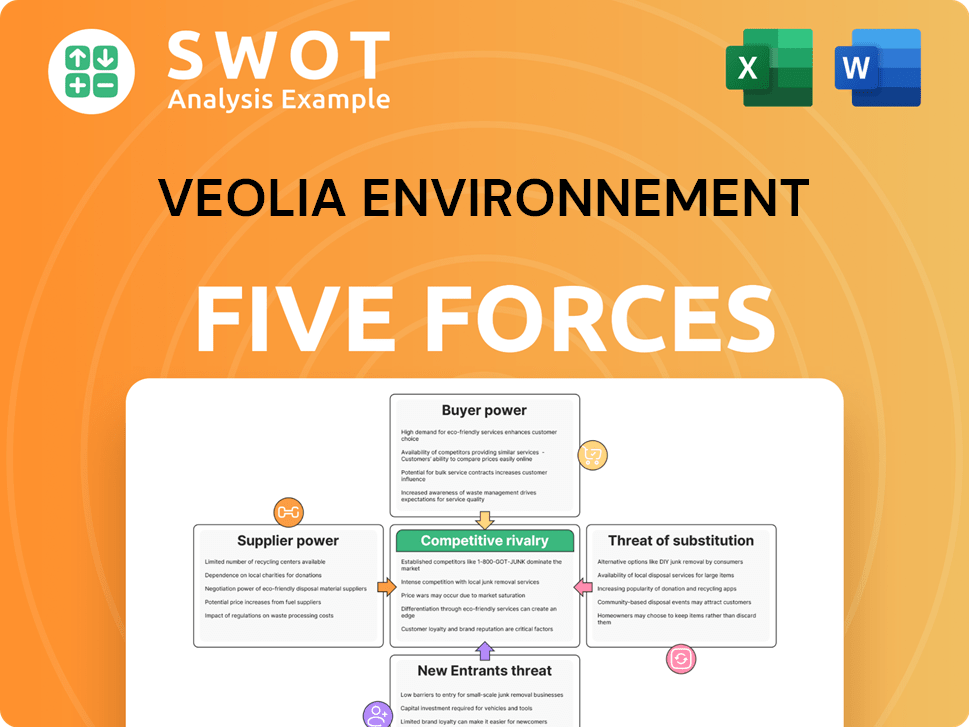

Veolia Environnement Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Veolia Environnement Company?

- What is Growth Strategy and Future Prospects of Veolia Environnement Company?

- How Does Veolia Environnement Company Work?

- What is Sales and Marketing Strategy of Veolia Environnement Company?

- What is Brief History of Veolia Environnement Company?

- Who Owns Veolia Environnement Company?

- What is Customer Demographics and Target Market of Veolia Environnement Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.