Veolia Environnement Bundle

Who Really Controls Veolia Environnement?

Understanding the ownership of a company is crucial for grasping its strategic direction and future prospects. Veolia Environnement, a global leader in environmental solutions, offers a compelling case study in how ownership shapes a company's destiny. From its origins as Compagnie Générale des Eaux to its current multinational status, Veolia's journey is a testament to the impact of its ownership structure.

The evolution of Veolia Environnement SWOT Analysis, from a national water utility to a global environmental services giant, showcases the dynamic nature of corporate ownership. Examining Veolia ownership unveils a complex interplay of institutional investors, public shareholders, and strategic partnerships, all influencing its operations. This exploration will dissect Veolia's ownership structure, revealing the key players and their impact on this pivotal company. Understanding the Veolia Environnement SWOT Analysis will help you understand the company's strengths and weaknesses.

Who Founded Veolia Environnement?

The story of Veolia Environnement, originally known as Compagnie Générale des Eaux (CGE), began in 1853. Unlike modern startups, its inception wasn't driven by individual founders but by a decree from Napoleon III. The primary aim was to supply water services to French municipalities, setting the stage for a unique ownership structure.

Early Veolia ownership was characterized by a public-private partnership model, distinct from today's entrepreneurial ventures. Initial capital came from a group of French bankers and industrialists who bought shares in the newly formed company. These early investors saw the long-term potential of a centralized water utility, which was backed by government support.

The original vision, as outlined in the company's charter, was centered on providing public services and infrastructure development. Control was distributed among the early Veolia shareholders, with significant influence from the largest subscribers and representatives from the municipalities it served. Disputes, if any, likely revolved around service agreements rather than internal equity issues, reflecting its nature as a public utility.

Established by imperial decree in 1853 to provide water services.

Initial capital came from French bankers and industrialists.

Operated under a public-private partnership framework.

Influence from major shareholders and municipalities.

Emphasis on public service and infrastructure.

Driven by stable, government-backed returns.

The evolution of Veolia Environnement from its inception showcases a unique ownership structure shaped by its mission to provide essential public services. The company's history reflects a commitment to infrastructure development and stable, long-term returns for its investors, a model quite different from the rapid growth and equity-driven dynamics of modern tech companies. For more information on the company's business model and revenue streams, you can read Revenue Streams & Business Model of Veolia Environnement. As of the latest financial reports, Veolia Environnement's annual revenue is in the billions of euros, reflecting its significant presence in the global environmental services market. The company continues to be a major player, with its ownership structure reflecting its long-standing commitment to public service and sustainable development.

Understanding the early ownership of Veolia Environnement provides context for its current structure and operations.

- Founded by imperial decree in 1853.

- Early investors were primarily French bankers and industrialists.

- Ownership model was a public-private partnership.

- Focus was on public service and infrastructure development.

- Control was distributed among shareholders and municipalities.

Veolia Environnement SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Veolia Environnement’s Ownership Changed Over Time?

The evolution of Veolia Environnement's ownership reflects its transformation from a public utility to a global leader in environmental services. Initially, as Compagnie Générale des Eaux (CGE) in 1853, ownership was primarily held by private investors and the French state. The late 20th century saw CGE diversify and rebrand as Vivendi, with a broader shareholder base. A pivotal moment was the 2000 spin-off, creating Veolia Environnement as a distinct public company, listed on Euronext Paris. This strategic shift shaped its current ownership structure, primarily influenced by institutional investors.

The acquisition of Suez in early 2022 further reshaped Veolia's ownership, increasing its scale and shareholder base. While the company remains publicly traded, the influence of major institutional investors is substantial. These investors, including BlackRock, The Vanguard Group, and Norges Bank Investment Management (NBIM), hold significant stakes, often exceeding 60-70% of outstanding shares. The French state, through public investment vehicles, also maintains a notable, though not controlling, stake. These ownership dynamics directly impact company strategy, particularly in capital allocation and sustainable development initiatives. For more insights, check out the Target Market of Veolia Environnement.

| Key Event | Impact on Ownership | Year |

|---|---|---|

| CGE's Founding | Initial private and state ownership | 1853 |

| Vivendi Rebranding | Wider shareholder base, increased institutional investors | 1998 |

| Veolia Environnement Spin-off | Creation of a distinct public company | 2000 |

| Acquisition of Suez | Increased scale, changes in shareholder base | 2022 |

As of late 2024 and early 2025, Veolia's ownership structure is dominated by institutional investors. These major Veolia shareholders significantly influence company strategy. The company's focus on environmental services and sustainable development goals is driven by investor expectations. The Veolia company continues to adapt its operations and strategy to meet these demands. The current market capitalization and Veolia Environnement stock price reflect its leadership in environmental services.

Veolia Environnement's ownership has evolved significantly since 1853, reflecting its changing business focus and market dynamics.

- Institutional investors, such as BlackRock and The Vanguard Group, hold a dominant position.

- The acquisition of Suez in 2022 impacted the shareholder base and company scale.

- The French state maintains a notable stake through public investment vehicles.

- Ownership structure directly influences company strategy, especially in sustainable development.

Veolia Environnement PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Veolia Environnement’s Board?

The current Board of Directors at Veolia Environnement plays a critical role in its governance. As of early 2025, the board typically includes a mix of executive and non-executive directors, along with independent directors. These directors represent shareholder interests and bring expertise to the company's strategic direction. Representatives from major institutional investors often hold seats, ensuring their alignment with the company's goals. The Chairman of the Board and the Chief Executive Officer are key figures, ensuring corporate governance best practices.

The composition of the board reflects a balance between shareholder representation and independent expertise. The board's structure is designed to promote effective oversight and decision-making. The board's decisions are crucial for the company's performance and its ability to meet its environmental and financial objectives. The board's role includes overseeing the company's strategy, risk management, and compliance with regulations.

| Board Member | Role | Notes |

|---|---|---|

| Estelle Brachlianoff | Chief Executive Officer | Oversees the company's day-to-day operations and strategic direction. |

| Antoine Frérot | Chairman | Leads the board and ensures effective governance. |

| Non-Executive Directors | Various | Represent major shareholders and provide independent oversight. |

Veolia operates under a 'one-share-one-vote' structure. This means each share generally carries one voting right. This structure encourages broader shareholder participation. The collective voting power of large institutional investors, such as BlackRock and Vanguard, remains significant due to the volume of shares they hold. These institutions often engage with management on governance issues, including executive compensation and environmental policies. The absence of specific 'golden shares' means that major decisions are subject to the collective will of the shareholders.

The governance structure of Veolia Environnement is designed for shareholder participation and oversight. The board's composition and voting structure ensure accountability. The company's focus on environmental and financial objectives is reflected in its governance practices.

- One-share-one-vote structure.

- Significant influence from institutional investors.

- Focus on environmental, social, and governance (ESG) initiatives.

- The board oversees strategy and risk management.

Veolia Environnement Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Veolia Environnement’s Ownership Landscape?

Over the past few years, the ownership of Veolia Environnement has been significantly influenced by strategic moves, most notably the acquisition of Suez, finalized in early 2022. This merger created a global leader in ecological transformation and reshaped the company's shareholder base. While the structure remained public, the transaction involved share exchanges and the integration of Suez shareholders, leading to shifts in the composition of institutional and individual investors. Understanding the Veolia ownership structure is crucial for anyone looking to invest or analyze the company's trajectory.

Beyond the Suez acquisition, Veolia company has continued to adjust its portfolio, divesting non-core assets to optimize operations and reduce debt, indirectly impacting ownership. Share buyback programs also influence the ownership structure by reducing outstanding shares. Industry trends show a rise in institutional ownership, particularly from ESG-focused funds. This trend can lead to more stable institutional ownership but also increased scrutiny on Veolia's environmental performance. The consolidation within the environmental services sector, as seen with the Suez acquisition, is another key trend impacting ownership dynamics. For more insights, you can explore the Growth Strategy of Veolia Environnement.

| Metric | Value (2024) | Source |

|---|---|---|

| Annual Revenue | Approximately €45.3 billion | Veolia Environnement Financial Reports |

| Number of Employees | Around 220,000 | Veolia Environnement Company Profile |

| Market Capitalization | Approximately €12 billion (as of May 2024) | Financial Markets Data |

Looking ahead, Veolia's focus on integrating acquired assets and driving sustainable growth will continue to shape its investor base. The emphasis on circular economy solutions and resource optimization is likely to further solidify its appeal to long-term, sustainability-minded investors. Public statements and analyst reports suggest a continued focus on these strategic directions. The company's evolving strategies in response to global environmental challenges will keep influencing its shareholder dynamics.

Major shareholders include institutional investors like investment funds and asset management companies. The specific percentages change over time.

Yes, Veolia is a publicly traded company. You can find information on its stock price and financial reports.

The company is headquartered in Aubervilliers, France. This is a key detail in understanding the company's operations and global reach.

Veolia provides services in water management, waste management, and energy management. They offer solutions for the circular economy.

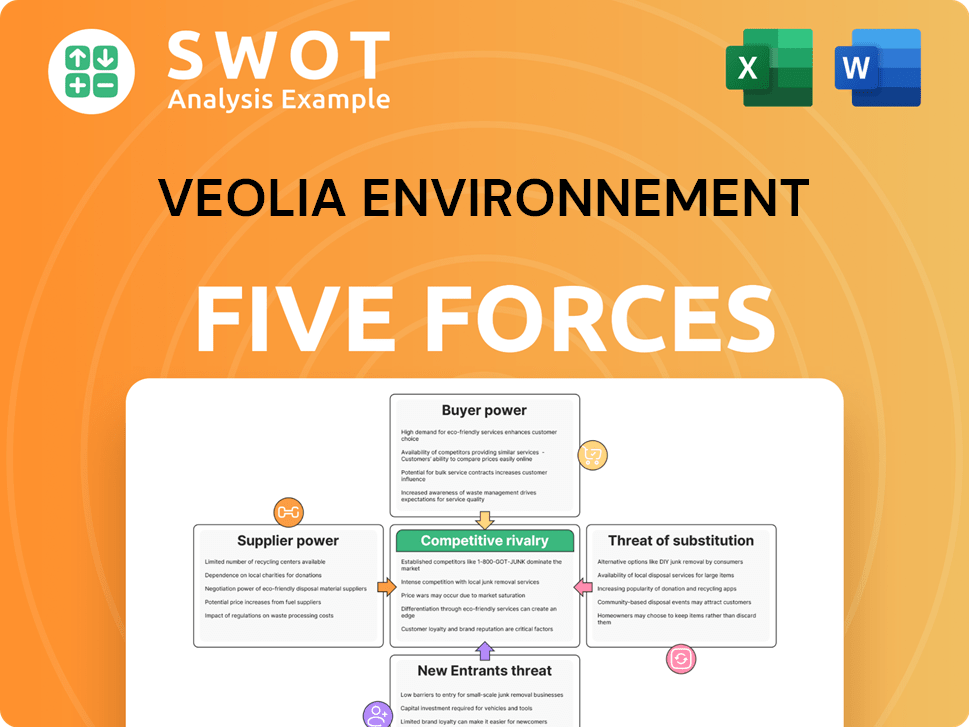

Veolia Environnement Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Veolia Environnement Company?

- What is Competitive Landscape of Veolia Environnement Company?

- What is Growth Strategy and Future Prospects of Veolia Environnement Company?

- How Does Veolia Environnement Company Work?

- What is Sales and Marketing Strategy of Veolia Environnement Company?

- What is Brief History of Veolia Environnement Company?

- What is Customer Demographics and Target Market of Veolia Environnement Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.