Veolia Environnement Bundle

How Does Veolia Environnement Thrive in the Environmental Services Sector?

Veolia Environnement, a global juggernaut in Veolia Environnement SWOT Analysis, is at the forefront of tackling critical environmental challenges. With a staggering €44.7 billion in revenue in 2024 and continued growth in early 2025, the

This exploration of

What Are the Key Operations Driving Veolia Environnement’s Success?

Veolia Environnement delivers essential environmental services, focusing on water, waste, and energy management. The company's core operations are designed to provide integrated solutions to municipalities, industrial clients, and commercial entities. Their approach emphasizes sustainability and resource efficiency, offering a range of services that address critical environmental challenges.

The Veolia company operates globally, providing services across the entire water cycle, waste management, and energy solutions. They are committed to protecting public health, enhancing industrial competitiveness, and securing strategic resources for their clients. This integrated model allows Veolia to offer comprehensive services that drive both environmental and economic benefits.

Veolia Environnement's value proposition lies in its ability to offer integrated environmental solutions. This approach allows them to provide essential services, protect public health, enhance industrial competitiveness, and secure strategic resources, which translates directly into customer benefits and market differentiation.

Veolia provides comprehensive water management solutions, including resource management, drinking water distribution, and wastewater treatment. They offer advanced technologies for treating micropollutants, aiming for €1 billion in sales by 2030 in this area. In 2024, Veolia supplied drinking water to 111 million inhabitants and sanitation services to 98 million.

Veolia's waste management services include collection, recycling, and treatment of various waste types. They focus on material recovery, waste-to-energy solutions, and hazardous waste treatment. In 2024, Veolia treated 65 million tonnes of waste, utilizing sophisticated sorting and recycling techniques.

Veolia offers energy services such as urban heating and air conditioning network management, thermal and multi-technique services, and industrial services. In 2024, Veolia produced 42 million megawatt hours of energy. Their supply chain is supported by global partnerships and distribution networks.

Veolia's unique approach combines expertise and technologies across water, waste, and energy. This integrated model promotes sustainable development and resource efficiency. For more details, consider reading about the Growth Strategy of Veolia Environnement.

Veolia Environnement provides essential environmental services globally, with a focus on water management, waste management, and energy solutions. Their integrated approach allows them to offer comprehensive services and drive sustainability. They emphasize innovation and technological advancements to meet evolving environmental challenges.

- Supplied drinking water to 111 million people in 2024.

- Provided sanitation services to 98 million people in 2024.

- Treated 65 million tonnes of waste in 2024.

- Produced 42 million megawatt hours of energy in 2024.

Veolia Environnement SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Veolia Environnement Make Money?

Veolia Environnement, a global leader in environmental services, generates revenue through a diverse range of services. The company focuses on water, waste, and energy management. This approach allows Veolia to serve various clients and markets worldwide.

The company's revenue streams are primarily derived from its core environmental services. These include water services, waste management, and energy solutions. Veolia uses various monetization strategies, such as service contracts, product sales, and fees for specialized environmental solutions.

In 2024, Veolia reported consolidated revenue of €44.692 billion. The revenue breakdown by activity shows that water-related services accounted for approximately 40.4%, waste management services contributed 35%, and energy services made up 24.6% of the total. This diversified revenue structure highlights the company's broad market presence and service offerings.

Veolia employs several monetization strategies across its business segments. These include service contracts, product sales, and fees for specialized environmental solutions. Water services generate revenue through water distribution, wastewater collection, and treatment, as well as the design and construction of water treatment facilities. The waste management segment benefits from waste collection, treatment, and recycling services.

- In 2024, the water and waste divisions were primary drivers of growth, with revenues increasing by 5.6% and 6.4%, respectively.

- Hazardous waste treatment, a 'booster' activity, showed strong performance due to high demand and price increases.

- Tariff indexations and price increases in water and waste activities also contributed to revenue growth. In Q1 2025, favorable price effects added €175 million to revenue.

- Innovative monetization strategies include the development of 'booster' activities such as water technologies, hazardous waste, bioenergies, and energy flexibility and efficiency solutions, which saw a 6.6% organic growth in 2024. In Q1 2025, these booster activities increased by 7.2%.

- Veolia's strategic acquisition of CDPQ's 30% stake in its Water Technologies and Solutions business for approximately €1.5 billion is expected to accelerate value creation and generate around €90 million in additional synergies annually by 2027.

- The company engages in asset rotation, with over €1 billion in non-strategic asset divestitures closed since the beginning of 2024, partly funding further bolt-on acquisitions of approximately €1 billion. This dynamic capital allocation policy contributes to value creation.

Veolia Environnement PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Veolia Environnement’s Business Model?

Veolia Environnement has strategically positioned itself as a global leader in environmental services through key milestones and strategic initiatives. A significant move was the acquisition of Suez, which has strengthened its market position and is expected to generate substantial synergies. The company's focus on innovation and adaptation to emerging environmental challenges further enhances its competitive edge.

The company's financial performance reflects its strategic decisions and operational efficiency. Despite facing macroeconomic uncertainties and lower energy prices, Veolia demonstrated resilience by achieving significant cost savings. These efforts, combined with strategic investments in growth areas, are designed to drive long-term value creation.

Veolia's commitment to sustainability and its diversified portfolio of water, energy, and waste management services underscore its ability to adapt to evolving market demands. The company's strategic plan and investments in research and development are designed to ensure long-term growth and profitability.

The acquisition of Suez was a pivotal strategic move, significantly expanding Veolia's operational scope. The company is targeting cumulative synergies of €530 million by the end of 2025 from this acquisition. In Q1 2025, Veolia acquired CDPQ's 30% stake in Water Technologies and Solutions, accelerating value creation in key areas.

Veolia has focused on efficiency and cost savings to navigate market challenges. The company achieved €398 million in cost savings in 2024, exceeding its annual target. For 2025, efficiency gains are targeted above €350 million. The 'GreenUp' strategic plan for 2024-2027 aims for over €8 billion in EBITDA by 2027.

Veolia's competitive advantages stem from its global presence and diversified service offerings in environmental services. The company's 'BeyondPFAS' offering aims for €1 billion in sales by 2030. Veolia invests approximately €800 million annually in R&D, demonstrating its commitment to innovation and technological advancement.

In 2024, synergies from the Suez acquisition reached €435 million, surpassing initial expectations. Veolia's focus on cost savings and operational efficiency has helped mitigate the impact of external challenges. The company's financial strategy supports its long-term growth objectives.

Veolia's strategic focus includes expanding its 'booster' activities and investing in innovation to address emerging environmental challenges. The company's 'GreenUp' plan aims for significant growth and profitability. The company's history and evolution can be further understood by reading the Brief History of Veolia Environnement.

- Focus on hazardous waste management and water technologies.

- 'GreenUp' strategic plan for 2024-2027.

- Targeting approximately 10% annual growth in current net income group share over 2023-2027.

- Continuous investment in R&D, approximately €800 million annually.

Veolia Environnement Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Veolia Environnement Positioning Itself for Continued Success?

Veolia Environnement, a global leader in environmental services, holds a strong market position, particularly in water and waste management. The company's diversified operations, including municipal water, waste management, and district heating, contribute to stable cash flow. In 2024, it provided drinking water to 111 million inhabitants and sanitation services to 98 million people.

As of April 2025, Veolia's market capitalization was at €15.8 billion. The company's significant scale and wide range of services underscore its importance in the environmental sector. Veolia treated 65 million tonnes of waste and produced 42 million megawatt hours of energy.

Veolia faces risks such as regulatory changes, fluctuating energy prices, and macroeconomic uncertainties. Labor costs, especially in inflationary environments, pose a challenge given its 215,000 employees. These factors can impact operations and revenue.

To manage these risks, Veolia focuses on strict financial discipline and operational efficiency. The company's proactive approach helps mitigate potential negative impacts, ensuring financial stability and operational resilience.

Veolia's future looks positive, driven by its GreenUp strategic plan for 2024-2027. The company anticipates solid organic revenue growth and an organic EBITDA growth of between 5% and 6% for 2025. Current net income group share is expected to grow by around 9% in 2025, with a focus on sustainable resource management.

Veolia plans disciplined investments of about €3.3 billion annually, with €2.0 billion-€2.5 billion allocated to growth. The company also plans share buybacks dedicated to employee share ownership programs for 2025-2027. For more insights, explore the Marketing Strategy of Veolia Environnement.

Veolia aims for over €8 billion in EBITDA by 2027 and approximately 10% annual growth in current net income group share over 2023-2027. This growth is supported by strategic investments and a commitment to ecological transformation. Sustainability is a core element of Veolia's strategy, driving profitability and expansion.

- Focus on water technologies and hazardous waste for growth.

- Emphasis on sustainable resource management.

- Continued investment in environmental services.

- Commitment to financial discipline and efficiency.

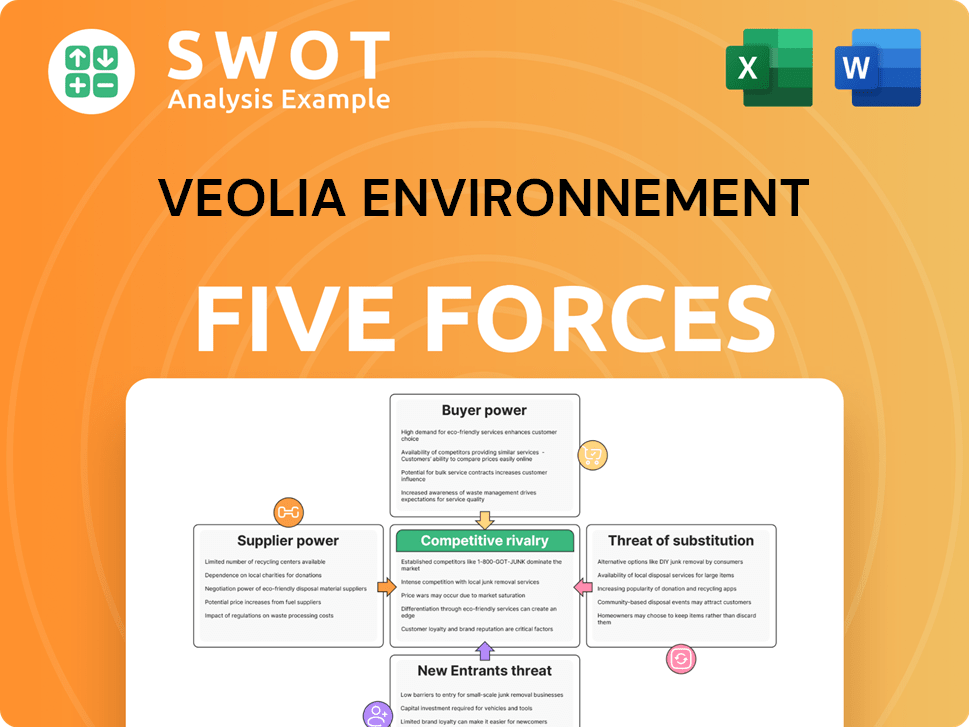

Veolia Environnement Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Veolia Environnement Company?

- What is Competitive Landscape of Veolia Environnement Company?

- What is Growth Strategy and Future Prospects of Veolia Environnement Company?

- What is Sales and Marketing Strategy of Veolia Environnement Company?

- What is Brief History of Veolia Environnement Company?

- Who Owns Veolia Environnement Company?

- What is Customer Demographics and Target Market of Veolia Environnement Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.