Vishay Intertechnology Bundle

How Did Vishay Intertechnology Become an Electronics Giant?

Ever wondered how a company could transform from a niche resistor manufacturer into a global leader in electronic components? This is the story of Vishay Intertechnology, a company whose innovations have powered countless devices. From its inception with a groundbreaking invention to its current status, Vishay's journey is a testament to adaptability and strategic growth. Dive into the Vishay Intertechnology SWOT Analysis to understand its competitive landscape.

Vishay Intertechnology's history is a compelling narrative of technological innovation and strategic expansion within the dynamic world of electronic components. Founded in 1962, the company's initial focus on high-precision passive components, particularly Bulk Metal® Foil resistors, laid the groundwork for its future success. Understanding the brief history of Vishay Intertechnology provides valuable context for investors and industry professionals alike, offering insights into its evolution as a major semiconductor manufacturer.

What is the Vishay Intertechnology Founding Story?

The founding of Vishay Intertechnology in 1962 marks a significant event in the history of electronic components. Dr. Felix Zandman, a Holocaust survivor, established the company in Malvern, Pennsylvania, USA. This marked the beginning of what would become a major player in the semiconductor manufacturer industry.

Dr. Zandman's vision and technological innovations were the driving force behind the company's inception. With initial funding from his cousin, Alfred P. Slaner, and his own savings, Vishay began its journey.

The company's name, 'Vishay,' pays tribute to the ancestral village of Zandman's family, honoring those lost in the Holocaust. This personal connection underscores the company's founding story and its commitment to innovation in the field of electronic components.

Vishay Intertechnology was founded in 1962 by Dr. Felix Zandman in Malvern, Pennsylvania, USA.

- Initial funding: $200,000 from Alfred P. Slaner and $4,000 from Dr. Zandman.

- Ownership: 50/50 split between Zandman and Slaner.

- Product Focus: Bulk Metal® Foil resistors, developed by Dr. Zandman.

- Early Products: Foil resistance strain gages, developed by J.E. Starr.

The initial business model of Vishay Intertechnology revolved around the development and production of Dr. Zandman's patented Bulk Metal® Foil resistors. These resistors were designed to provide exceptional precision and stability, representing a significant advancement in the electronics industry. Simultaneously, the company incorporated foil resistance strain gages, developed by J.E. Starr, into its product portfolio.

Dr. Zandman's academic background, including degrees in mathematics, engineering, and a doctorate in physics from the University of Paris, Sorbonne, greatly influenced the foundational technology of Vishay. His expertise in stress testing for structures directly contributed to the development of the company's core products. The company's early success laid the groundwork for its future growth and expansion in the electronic components market. For more insights, you can explore the Competitors Landscape of Vishay Intertechnology.

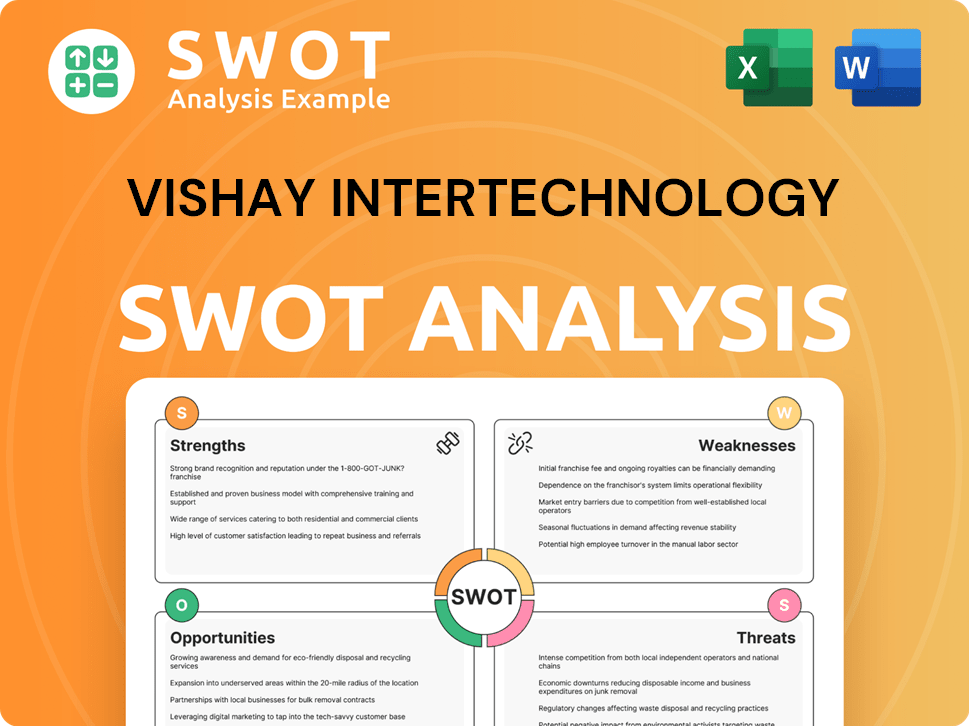

Vishay Intertechnology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Vishay Intertechnology?

The early growth of Vishay Intertechnology, a semiconductor manufacturer, was marked by its leadership in foil resistors, PhotoStress products, and strain gages during the 1960s and 1970s. A significant strategic shift began in 1985, as the company embarked on a series of acquisitions. This move transformed Vishay Intertechnology from a specialized resistor manufacturer into a broad-line electronic components supplier.

Early acquisitions were key to Vishay Intertechnology's expansion. These included Mann Components in 1983, Geka in 1984, and the purchase of Angstrohm Precision and Elliot Industries in the same year. These acquisitions helped boost sales to $48.5 million in 1984. The company also acquired the resistor and power capacitor business of Corning Glass.

By the early 1990s, Vishay Intertechnology expanded its acquisition strategy into the capacitor market. Major acquisitions included Sprague Electric in 1992, Roederstein, and Vitramon. In 2002, the acquisition of BCcomponents, the former passive components business of Philips Electronics, and Beyschlag further enhanced Vishay's global market position.

Vishay Intertechnology went public in 1972, initially issuing 20% of its shares. The company also expanded its manufacturing footprint, opening its own plant in Israel in 1969. A second facility was opened in Israel after the acquisition of Dale and Draloric. This strategic approach shaped Vishay's history.

This multi-decade acquisition strategy built a diversified portfolio across resistors, capacitors, inductors, diodes, and transistors. The company's deliberate expansion fundamentally changed its scale and market reach. The company maintained the brand names of most acquired businesses due to their strong market recognition. For more details on their strategic approach, see the Marketing Strategy of Vishay Intertechnology.

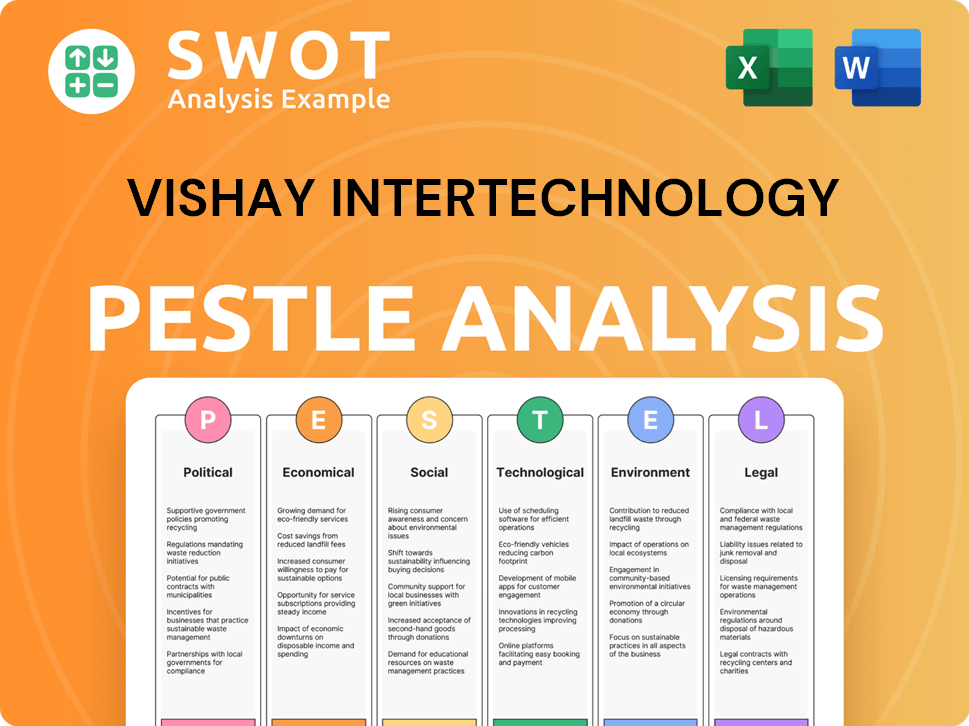

Vishay Intertechnology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Vishay Intertechnology history?

The Vishay Intertechnology company's history is marked by significant milestones, from its inception to its evolution as a leading electronic components supplier. The company's strategic shifts and technological advancements have shaped its trajectory in the semiconductor manufacturer industry.

| Year | Milestone |

|---|---|

| 1962 | Founded by Felix Zandman, Vishay Intertechnology began with the invention of the Bulk Metal® Foil resistor. |

| 1985 | Acquired Dale Electronics, expanding its product portfolio. |

| 1992 | Acquired the tantalum capacitor business of Sprague Electric, entering the capacitor market. |

| 1998 | Acquired an 80.4% stake in Siliconix, entering the power MOSFET market. |

| 2001 | Acquired General Semiconductor, expanding its discrete semiconductor business. |

| 2010 | Spun off its non-core resistive foil technology products into Vishay Precision Group (VPG). |

| 2024 | Announced the 'Vishay 3.0' growth strategy, including restructuring and capacity expansion. |

Vishay Intertechnology has consistently introduced groundbreaking innovations. A key innovation was the Bulk Metal® Foil resistor, which set the standard for precision in passive components. They also developed Power Metal Strip® resistors for precision current monitoring.

This innovation established Vishay Intertechnology as a leader in high-precision resistors, providing superior performance and stability.

These resistors are designed for precision current monitoring, crucial in applications like electric power meters and automotive electronic controls.

Through acquisitions, Vishay Intertechnology broadened its product lines to include capacitors, offering a more comprehensive portfolio of electronic components.

The acquisition of Siliconix significantly expanded Vishay Intertechnology's presence in the power MOSFET market, essential for power management in various electronic devices.

The expansion of discrete semiconductor products, through acquisitions like General Semiconductor, broadened the company's offerings.

Vishay Intertechnology has made several strategic acquisitions to broaden its product lines and expand its market reach.

Vishay Intertechnology has faced several challenges, including market downturns and intense price competition. In fiscal year 2024, the company reported a decrease in revenue to $2.94 billion from $3.40 billion in the previous year, with gross profit margins declining to 21.3%.

The company has experienced cyclical downturns in key end markets, impacting revenue and profitability. The consumer and industrial sectors have been particularly volatile.

Intense price competition within the electronic components market has put pressure on profit margins. This has affected the company's financial performance.

Supply chain disruptions have created challenges, impacting the availability of components and production schedules. These issues have added to operational complexities.

Changes in market demand and inventory corrections have affected Vishay's financial results. These fluctuations require strategic adjustments.

In 2024, Vishay Intertechnology saw a decrease in revenue and gross profit margins due to market conditions. Operating income also declined significantly.

The company has incurred restructuring and severance costs as part of its strategic initiatives. These costs are part of the 'Vishay 3.0' plan.

To address these challenges, Vishay Intertechnology has implemented strategic initiatives. The 'Vishay 3.0' growth strategy, announced in 2024, aims to enhance operational efficiency through restructuring, including the closure of three manufacturing facilities and workforce reduction. The company is investing approximately $2.6 billion from 2023 to 2028 in capacity expansion and to improve its product mix towards higher-margin products, such as increasing MOSFET capacity by 12% in 2025 and semiconductor products by 5.5% in 2024. For more details, you can read about the Growth Strategy of Vishay Intertechnology.

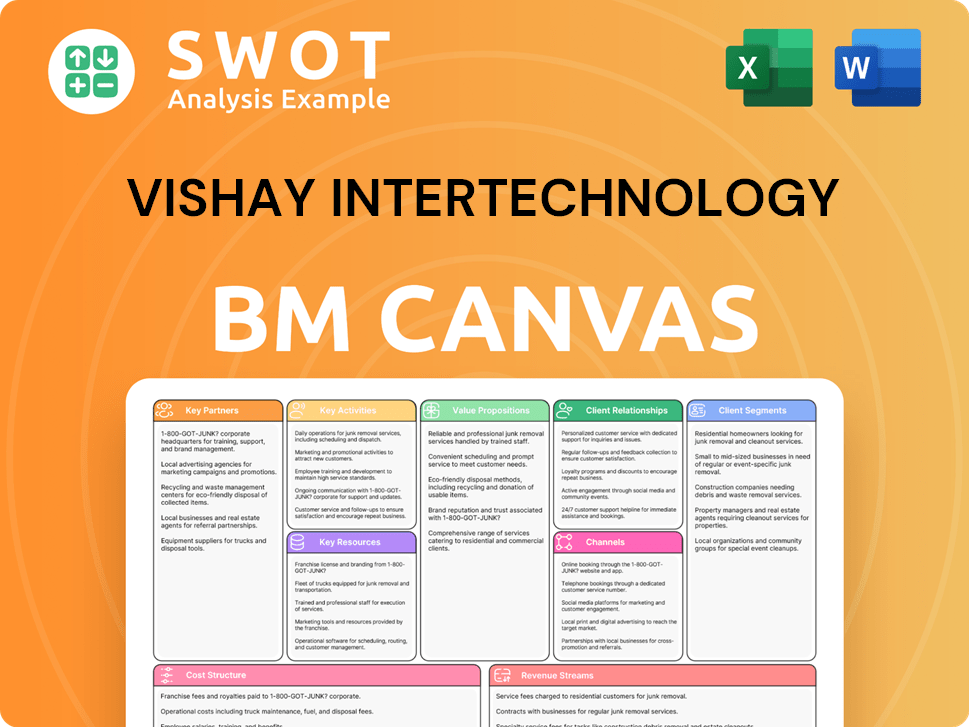

Vishay Intertechnology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Vishay Intertechnology?

The Vishay Intertechnology company history is marked by significant strategic moves and expansions. Founded in 1962 by Dr. Felix Zandman, the company initially focused on foil resistors and strain gages. Over the years, it evolved through strategic acquisitions, becoming a key player in the electronic components market. Key milestones include going public in 1972, expanding into capacitors with the Sprague Electric acquisition in 1992, and entering the power MOSFET market in 1998 with Siliconix. Further growth came with the acquisitions of General Semiconductor in 2001 and BCcomponents in 2002. In 2010, the company spun off its resistive foil technology into Vishay Precision Group. Recent developments include a multi-year investment plan and the acquisition of Newport Wafer Fab in March 2024 to boost semiconductor manufacturing.

| Year | Key Event |

|---|---|

| 1962 | Dr. Felix Zandman founded Vishay in Malvern, Pennsylvania, introducing Bulk Metal® Foil resistors. |

| 1969 | Opened its first manufacturing plant in Israel. |

| 1972 | Became a public company, listing on the New York Stock Exchange. |

| 1985 | Began a long-term strategy of growth through strategic acquisitions, diversifying beyond foil resistors. |

| 1992 | Acquired Sprague Electric's tantalum capacitor business, significantly expanding into the capacitor market. |

| 1998 | Acquired an 80.4% stake in Siliconix, gaining a major foothold in the power MOSFET semiconductor market. |

| 2001 | Acquired General Semiconductor, further expanding its discrete semiconductor business. |

| 2002 | Acquired BCcomponents (Philips Electronics' passive components business) and Beyschlag, enhancing its global market position. |

| 2010 | Spun off its resistive foil technology products into an independent company, Vishay Precision Group (NYSE: VPG). |

| 2023-2028 | Initiated a multi-year investment cycle of approximately $2.6 billion for capacity expansion and product mix improvement. |

| March 2024 | Acquired Newport Wafer Fab to expand semiconductor manufacturing, particularly for silicon carbide (SiC) Trench MOSFETs and diodes, with a planned £250 million investment. |

| Q4 2024 | Reported revenues of $714.7 million and a GAAP loss per share of ($0.49), with full-year 2024 revenues at $2.94 billion. |

| Q1 2025 | Reported revenues of $715.2 million and a loss per share of ($0.03), with a book-to-bill ratio of 1.08. |

Vishay's future is guided by the 'Vishay 3.0' strategic plan. This plan focuses on organic growth, new product development, and enhanced market penetration. The company aims to capitalize on trends like e-mobility and sustainability.

For Q2 2025, revenue is projected at $760 million +/- $20 million. The gross profit margin is estimated at 19.0% +/- 50 basis points. Despite a negative outlook from S&P Global Ratings, improvements are expected in the latter half of 2025.

Vishay is investing in technologies like SiC and expanding manufacturing capacity. This includes MOSFETs and inductors to meet rising customer demand. The company is targeting higher-margin markets.

Analysts predict an average stock price of $22.52 in 2025, a potential 60.05% rise from $14.07. The high prediction is $28.50. The company's long-term vision remains focused on providing essential electronic components.

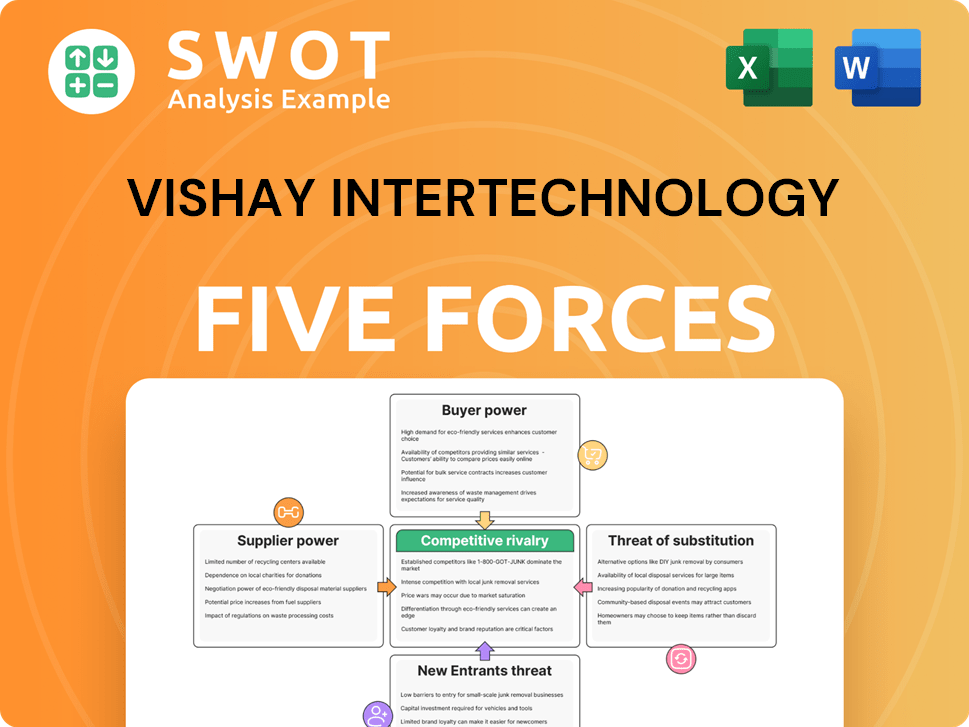

Vishay Intertechnology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Vishay Intertechnology Company?

- What is Growth Strategy and Future Prospects of Vishay Intertechnology Company?

- How Does Vishay Intertechnology Company Work?

- What is Sales and Marketing Strategy of Vishay Intertechnology Company?

- What is Brief History of Vishay Intertechnology Company?

- Who Owns Vishay Intertechnology Company?

- What is Customer Demographics and Target Market of Vishay Intertechnology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.