Vishay Intertechnology Bundle

How Does Vishay Intertechnology Dominate the Electronic Components Market?

Vishay Intertechnology, a titan in the discrete semiconductors and passive components arena, employs a dynamic sales and marketing strategy to maintain its competitive edge. The company's recent strategic shift, 'Vishay 3.0,' highlights substantial investments in capacity expansion, particularly for MOSFETs, and optimization of its global manufacturing footprint. This proactive approach, coupled with strong order intake for smart grid projects, underscores Vishay's ability to adapt and thrive in a rapidly evolving technological landscape.

Founded in 1962, Vishay has evolved its Vishay Intertechnology SWOT Analysis to include a vast array of semiconductors and passive components, serving diverse industries. Understanding Vishay's Vishay marketing strategy and Vishay business model is crucial for investors and industry analysts alike. This document delves into Vishay's Vishay Intertechnology sales approach, examining its distribution channels, brand positioning, and the key campaigns driving its recent growth, offering a comprehensive Vishay market analysis of this industry leader.

How Does Vishay Intertechnology Reach Its Customers?

The sales and marketing strategy of Vishay Intertechnology centers around a multi-channel approach, designed to reach a diverse global customer base. This strategy includes direct sales, wholesale distributors, and online platforms. This diversified approach allows the company to cater to various customer preferences and market segments within key industries such as automotive, industrial, computing, telecommunications, and consumer electronics.

Vishay's focus on customer relationship management is a key element of its sales strategy. The company aims to build long-term relationships and provide tailored solutions to meet specific customer needs. This customer-centric approach is crucial for maintaining a competitive edge in the electronic components market. The company's ability to adapt its sales channels to market dynamics is a core strength.

The evolution of Vishay's sales channels reflects its strategic adaptation to market dynamics. The company has established strategic partnerships with key distributors and channel partners to expand its reach and market presence, ensuring its products are readily available worldwide.

Vishay's extensive distribution network is a critical component of its sales strategy. The company leverages partnerships with major distributors to ensure broad product availability and efficient order fulfillment. This network supports Vishay's global presence and enables it to serve customers across various regions effectively.

Vishay strategically partners with key distributors to enhance its market reach and customer service capabilities. These partnerships are designed to strengthen relationships with channel partners. By collaborating with these distributors, Vishay ensures its products are accessible and readily available to a wide range of customers. This approach is important for sales growth.

Efficient inventory management is a cornerstone of Vishay's sales strategy. The company focuses on optimizing product availability and minimizing lead times to meet customer demands promptly. This includes adding nearly 50,000 SKUs to its distributor shelves, positioning inventory for point-of-sale (POS) growth. This proactive approach helps the company maintain strong relationships with distributor partners and enhance its market share.

In Q1 2025, Vishay observed improving demand from distribution partners, with the book-to-bill ratio for semiconductors increasing to 1.12 and passives holding at 1.04. This indicates a positive demand trend after a prolonged period of inventory digestion. This performance reflects the effectiveness of Vishay's sales and marketing efforts in navigating market challenges and capitalizing on growth opportunities. Read more about the company's performance at Owners & Shareholders of Vishay Intertechnology.

Vishay's sales and marketing efforts are designed to drive revenue growth and enhance market share. The company's approach includes a focus on expanding its distribution network, strengthening partnerships, and optimizing inventory management. These strategies are crucial for navigating the competitive landscape of the electronic components industry.

- Expanding Distribution: Increasing the number of SKUs available through distributors.

- Strengthening Partnerships: Collaborating closely with distributors to improve market reach.

- Inventory Optimization: Managing inventory levels to meet customer demands efficiently.

- Market Analysis: Monitoring market trends to adjust sales strategies.

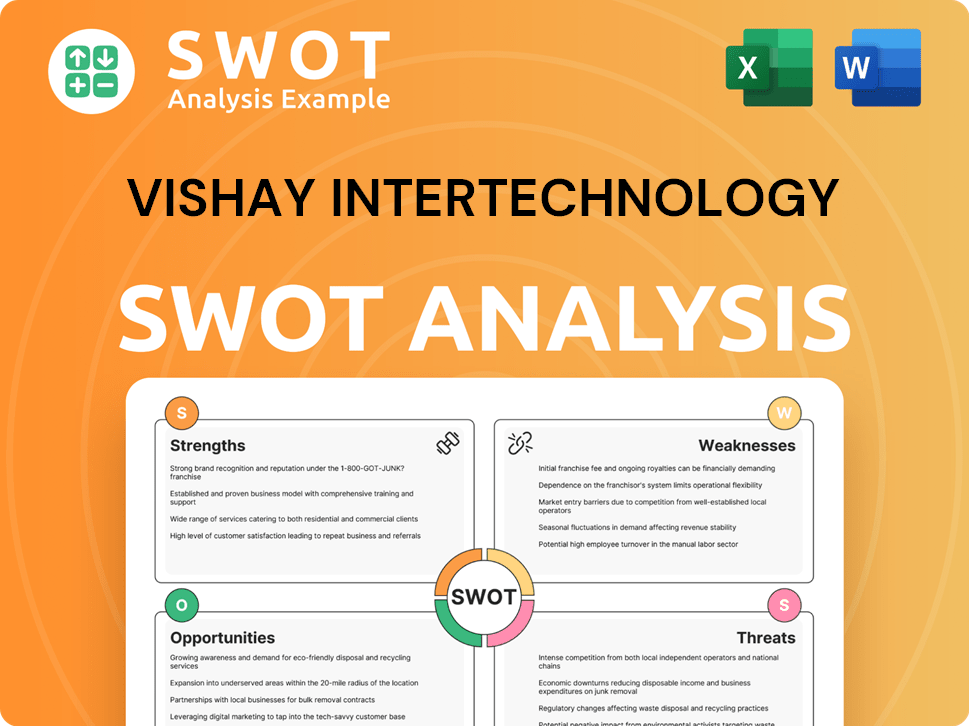

Vishay Intertechnology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Vishay Intertechnology Use?

The marketing tactics of Vishay Intertechnology are designed to enhance its Vishay Intertechnology sales and strengthen its position in the competitive electronic components industry. This involves a blend of digital strategies, product innovation, and industry engagement. The company's approach is geared towards increasing brand awareness, generating leads, and ultimately driving sales growth.

Vishay marketing strategy focuses on a multi-channel approach, leveraging both online and offline channels to connect with its target audience. This includes a strong emphasis on digital marketing through website optimization, social media engagement, and participation in industry events. These efforts are crucial for showcasing its diverse Vishay product portfolio and maintaining a competitive edge.

The company's marketing efforts are closely aligned with its strategic goals, including expanding its product offerings and reaching new markets. For example, the acquisition of Ametherm in June 2024 for approximately $31.5 million in cash, demonstrates a commitment to expanding its product offerings. This acquisition is expected to boost its presence in the electric vehicle and battery management system markets.

Vishay's digital marketing initiatives are centered around its website, vishay.com, which serves as the primary hub for product information. The company also uses social media platforms like LinkedIn, YouTube, Facebook, and Twitter to engage with its audience.

Marketing efforts are often tied to new product launches and acquisitions. For instance, the integration of Ametherm products into the Vishay product portfolio is supported by focused sales and marketing campaigns.

Vishay actively participates in industry events, such as electronica 2024 in Munich and electronica China 2024 in Shanghai. These events provide opportunities to showcase its solutions and engage with potential customers.

Acquisitions like Ametherm are strategically marketed to highlight the expansion of the company's offerings. This is part of the broader Vishay business model.

Vishay's marketing campaigns and promotions are often targeted towards specific industries, such as automotive and e-mobility, to highlight relevant products and solutions.

The company continuously monitors the Vishay competitive landscape to adjust its marketing strategies and maintain a strong market position. This includes assessing the Vishay market analysis and adapting to industry trends.

The company's marketing strategy is designed to address the Vishay sales and marketing challenges by focusing on digital channels, product-specific promotions, and industry engagement. By participating in events like electronica 2024, Vishay aims to strengthen its market position and showcase its innovations. To learn more about the company's history, read the Brief History of Vishay Intertechnology.

Vishay's sales growth strategies involve a combination of digital marketing, product-focused campaigns, and industry event participation. The company's approach is tailored to enhance its brand visibility and drive sales within the electronic components market.

- Website Optimization: Improving vishay.com for better search engine visibility.

- Social Media Engagement: Utilizing platforms like LinkedIn, YouTube, Facebook, and Twitter.

- Product Launches and Promotions: Marketing new products and acquisitions, such as Ametherm.

- Industry Events: Participating in trade shows like electronica to showcase solutions.

- Targeted Campaigns: Focusing on specific industries, such as automotive and e-mobility.

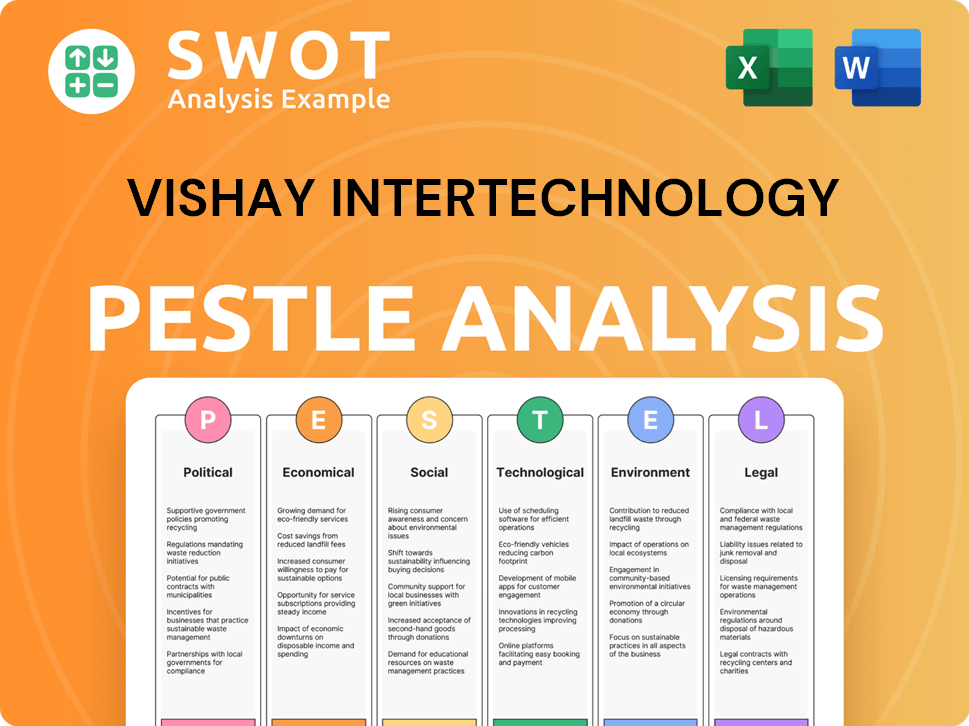

Vishay Intertechnology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Vishay Intertechnology Positioned in the Market?

Vishay Intertechnology's brand positioning is centered on quality, innovation, and reliability within the discrete semiconductor and passive electronic components market. The company's core message, 'The DNA of tech™,' highlights its fundamental role in electronic innovation. This positioning underscores its long-standing presence and trustworthiness in the industry, serving as a critical supplier for over 50 years.

The company consistently delivers high-quality products that meet stringent industry standards, particularly in automotive-grade components. This focus ensures that Vishay maintains a strong reputation and customer loyalty. Its commitment to innovation is evident through significant investments in research and development, which totaled approximately $150 million in 2024, ensuring it remains at the forefront of technological advancements.

Vishay's customer-centric approach focuses on building long-term relationships, achieving a high customer satisfaction rate, which was at 92% in 2024. The company's global presence, spanning over 20 countries, reinforces its position as a global leader. Its brand consistency across various touchpoints and proactive response to market shifts, such as e-mobility and sustainability, are key elements of its 'Vishay 3.0' strategy.

Vishay emphasizes its commitment to high-quality products, particularly in automotive-grade components. This focus ensures that the company maintains a strong reputation for reliability. The company's dedication to meeting stringent industry standards is a key aspect of its brand positioning.

Innovation is a cornerstone of Vishay's strategy, with approximately $150 million invested in research and development in 2024. This investment ensures the company remains at the forefront of technological advancements. This forward-thinking approach supports its growth strategy.

Vishay prioritizes building long-term customer relationships, reflected in its high customer satisfaction rate of 92% in 2024. This customer-centric approach is critical to its sales and marketing strategy. The company focuses on understanding and meeting customer needs.

With a presence in over 20 countries, Vishay reinforces its position as a global leader in the electronic components industry. This extensive global footprint supports its sales and distribution efforts. It allows Vishay to serve a diverse customer base worldwide.

Vishay's brand positioning is built on several key attributes that differentiate it in the market. These attributes are consistently communicated across all touchpoints.

- Quality: Meeting stringent industry standards.

- Innovation: Significant R&D investment ($150 million in 2024).

- Reliability: Consistent product performance.

- Customer Focus: High customer satisfaction (92% in 2024).

- Global Presence: Operations in over 20 countries.

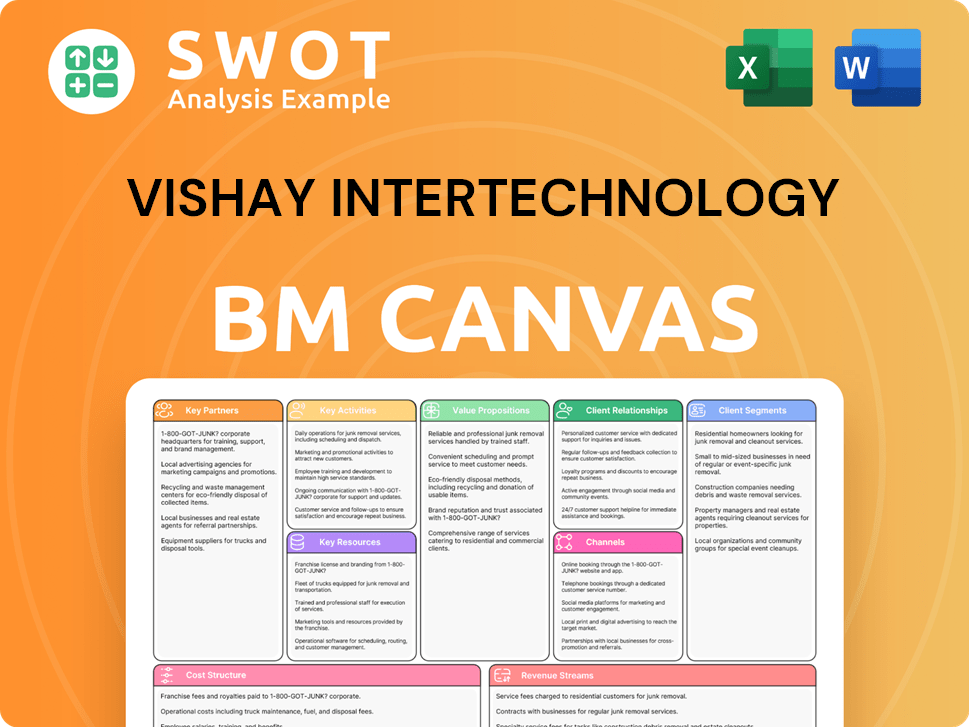

Vishay Intertechnology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Vishay Intertechnology’s Most Notable Campaigns?

The sales and marketing strategies of Vishay Intertechnology are heavily influenced by key campaigns and strategic initiatives. These campaigns often serve as a cornerstone for defining the brand and driving growth within the competitive landscape of the electronic components industry. The company's approach involves a combination of product launches, strategic investments, and market-focused initiatives, all designed to boost revenue streams and strengthen its position.

A key focus involves aligning with emerging technologies and market demands, particularly in sectors like smart grid infrastructure and AI servers. These efforts are complemented by targeted acquisitions and strategic partnerships to broaden Vishay's product portfolio and address evolving customer needs. The company's commitment to innovation and market responsiveness is evident in its marketing campaigns and product promotions.

Vishay Intertechnology's sales strategy for electronic components is further enhanced by a strategic focus on cost optimization and efficiency. This includes streamlining global manufacturing operations and expanding capacity in key areas to meet growing demand. These initiatives are actively communicated through investor calls, press releases, and industry events, ensuring stakeholders are well-informed about the company's direction and market alignment.

The 'Vishay 3.0' strategy, announced at the Investor Day in April 2024, is a critical sales and marketing campaign. It's a five-year plan involving a $2.6 billion investment from 2023 to 2028. This strategy aims to reach growth targets at a lower cost by optimizing global manufacturing and streamlining operations.

A significant portion of the investment, about 70%, is dedicated to capacity expansion. This includes increasing MOSFET capacity by 12% in 2025. Semiconductor products are expected to increase by 5.5% in 2024, demonstrating a commitment to meet market demand.

The plan involves the planned closure of three manufacturing facilities by the end of 2026. This includes a facility in Shanghai and two resistor facilities in Germany and Milwaukee. Simultaneously, there is expansion in Mexico and Europe.

The campaign is expected to yield at least $23 million in annualized cost savings by the end of 2026. Approximately $9 million in immediate annualized cost savings are anticipated starting in Q1 2025, improving Vishay's business model.

Another key aspect of Vishay's sales and marketing strategy involves capitalizing on emerging technologies, particularly in smart grid infrastructure and AI servers. In Q4 2024, the company experienced strong order intake for smart grid projects and initial shipments for AI servers, contributing to a book-to-bill ratio of 1.01. The book-to-bill ratio for semiconductors improved to 1.12 in Q1 2025, with passives holding at 1.04, indicating positive demand trends. These initiatives are communicated through investor calls and press releases, highlighting Vishay's alignment with growing megatrends.

Vishay focuses on smart grid infrastructure and AI servers to drive sales growth. The company reported strong order intake for these projects in Q4 2024. This strategic emphasis is communicated to investors and the public.

The book-to-bill ratio was 1.01 in Q4 2024, indicating healthy demand. The book-to-bill for semiconductors improved to 1.12 in Q1 2025. Passives held at 1.04, showing sustained demand.

Vishay showcased its solutions for the 'All-Electric Society' at electronica 2024. This demonstrates commitment to e-mobility and sustainability. The company actively promotes its products in these areas.

The acquisition of Ametherm in June 2024 for approximately $31.5 million expanded the product portfolio. This acquisition targets needs in electric vehicles and battery management systems. Sales and marketing efforts promote these new products.

Vishay's marketing approach for semiconductors and other components is aligned with market megatrends. The company uses investor calls and press releases. This approach builds brand awareness.

Vishay actively promotes its passive components and semiconductors through various channels. These efforts support the company's sales growth strategies. These promotions are part of the overall marketing campaign.

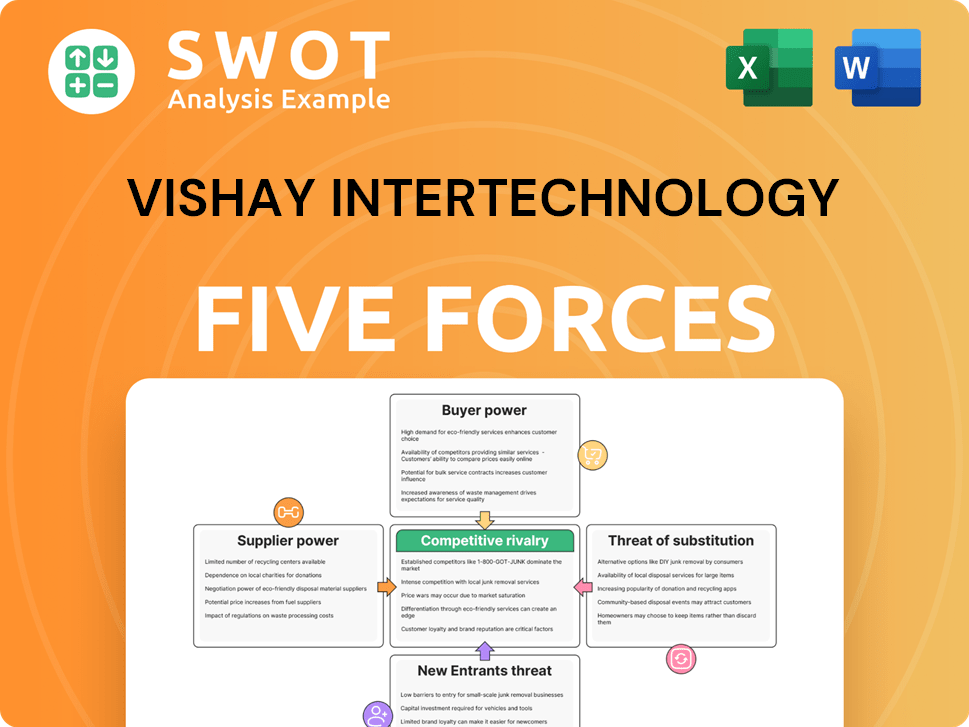

Vishay Intertechnology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vishay Intertechnology Company?

- What is Competitive Landscape of Vishay Intertechnology Company?

- What is Growth Strategy and Future Prospects of Vishay Intertechnology Company?

- How Does Vishay Intertechnology Company Work?

- What is Brief History of Vishay Intertechnology Company?

- Who Owns Vishay Intertechnology Company?

- What is Customer Demographics and Target Market of Vishay Intertechnology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.