Vishay Intertechnology Bundle

How Does Vishay Intertechnology Thrive in the Electronics Arena?

In a world driven by technological innovation, understanding the competitive dynamics of key players is crucial. Vishay Intertechnology, a global leader in electronic components, faces a complex landscape. This analysis dives into the competitive arena, providing a detailed look at Vishay Intertechnology SWOT Analysis, its rivals, and its strategic positioning within the ever-evolving electronics market.

This comprehensive market analysis explores the competitive landscape of Vishay Intertechnology, examining its financial performance comparison against Vishay competitors, and offering insights into its strategic partnerships. We'll uncover who are Vishay Intertechnology's main competitors, evaluating Vishay Intertechnology's market share analysis and its competitive advantages, providing a clear industry overview. Furthermore, we will explore Vishay Intertechnology's future outlook and the market trends shaping the future of the company, offering valuable insights for investors and industry professionals alike, including a look at Vishay stock.

Where Does Vishay Intertechnology’ Stand in the Current Market?

Vishay Intertechnology holds a significant position in the electronic components industry, particularly in discrete semiconductors and passive components. A thorough market analysis reveals its strong standing. The company is a leading global manufacturer, supplying essential components like resistors, inductors, and capacitors across various applications.

The company's core operations revolve around producing and distributing a broad range of electronic components. These include diodes, rectifiers, MOSFETs, and optoelectronics. These components are crucial for numerous industries, including automotive, industrial, computing, telecommunications, and consumer electronics. Vishay’s value proposition lies in providing high-quality, reliable components that meet diverse industry needs.

Geographically, Vishay maintains a global presence with manufacturing facilities and sales offices strategically located in Asia, Europe, and the Americas. This global footprint allows the company to serve a diverse international customer base. The company has consistently expanded its offerings to meet evolving market demands, including components for high-growth areas like electric vehicles and renewable energy. If you want to know more about the target market of Vishay, read this article: Vishay Intertechnology's Target Market.

Vishay is a top global manufacturer in several segments. While specific market share figures fluctuate, the company consistently ranks high in the production of resistors, inductors, and capacitors. This strong market position is a key factor in the company's competitive landscape.

The company's product portfolio includes a wide array of components. This includes diodes, rectifiers, MOSFETs, optoelectronics, and various passive components. This diversification allows Vishay to serve a broad spectrum of industries, enhancing its resilience in the market.

Vishay's financial health reflects its stable market position. In 2023, the company reported revenues of approximately $3.25 billion. This financial performance indicates the company's ability to navigate the cyclical nature of the electronic components market.

Vishay has a global presence with manufacturing facilities and sales offices across Asia, Europe, and the Americas. This strategic geographic distribution enables the company to serve a diverse international customer base efficiently. This global footprint supports its competitive advantages.

Vishay's competitive advantages include a diversified product portfolio, a global manufacturing and distribution network, and a focus on high-reliability components. The company's ability to serve multiple industries and adapt to evolving market demands strengthens its position. This is a key factor in the competitive landscape.

- Diversified Product Portfolio: Offers a wide range of components.

- Global Presence: Manufacturing and sales offices worldwide.

- Focus on High-Reliability: Components for critical applications.

- Adaptability: Ability to meet evolving market demands.

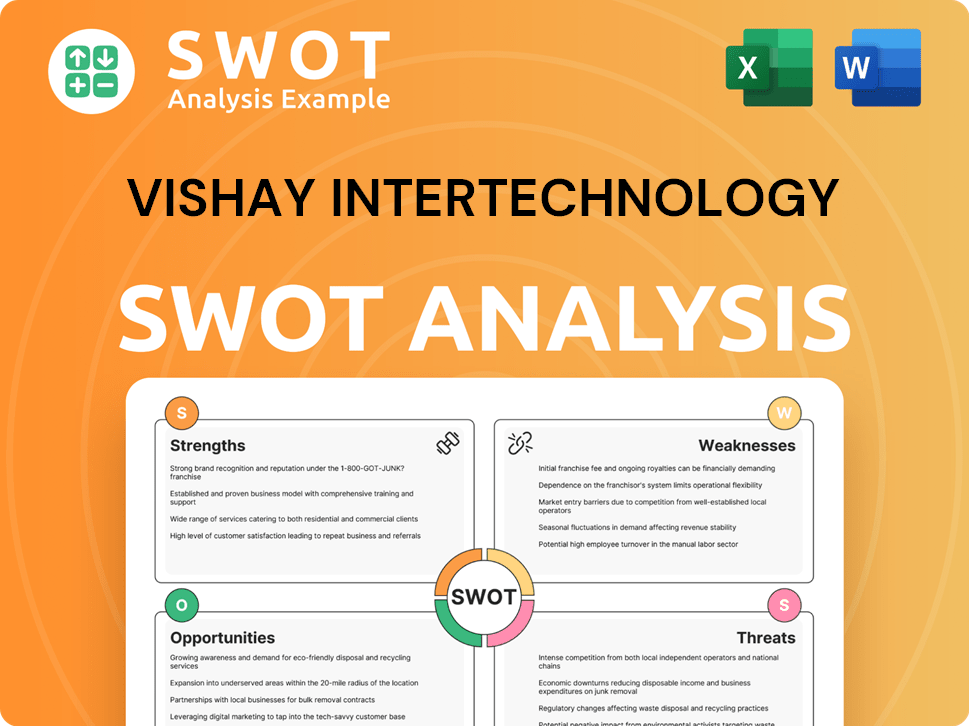

Vishay Intertechnology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vishay Intertechnology?

The competitive landscape for Vishay Intertechnology is complex, shaped by a global market with numerous direct and indirect Vishay competitors. This analysis delves into the key players and competitive dynamics influencing Vishay Intertechnology's position in the industry. Understanding these competitive pressures is crucial for investors and stakeholders assessing Vishay stock and the company's future prospects.

Market analysis reveals that Vishay Intertechnology operates in both the discrete semiconductor and passive components sectors, facing distinct sets of rivals in each. The industry overview highlights the importance of technological innovation, cost efficiency, and strong distribution networks in maintaining a competitive edge. The following sections provide a detailed examination of Vishay Intertechnology's main competitors and the strategies they employ.

Vishay Intertechnology competes in a dynamic market, facing challenges from both direct and indirect competitors. The competitive environment is characterized by constant innovation, pricing pressures, and the need for robust distribution networks. To understand Vishay Intertechnology's position, it's essential to identify its main rivals and analyze their strategies. This includes examining their product portfolios, market presence, and financial performance.

In the discrete semiconductor space, Vishay Intertechnology faces competition from major players. These competitors include Infineon Technologies, STMicroelectronics, NXP Semiconductors, and Onsemi. These companies compete across various product lines, including power semiconductors and analog ICs.

Infineon is a significant competitor, particularly in power semiconductors and automotive electronics. They challenge Vishay with a broad product portfolio and a strong market presence in high-growth segments. Infineon's focus on innovation and strategic partnerships helps maintain its competitive advantage.

STMicroelectronics competes across various semiconductor product lines, including power and analog ICs, microcontrollers, and sensors. They serve similar end markets as Vishay. STMicroelectronics invests heavily in R&D to stay competitive.

Onsemi is another significant competitor, especially in power management and sensing solutions. They have a strong focus on automotive and industrial applications. Onsemi's growth strategy includes strategic acquisitions to expand its product offerings.

In the passive components sector, Vishay faces competition from TDK Corporation, Murata Manufacturing, Yageo Corporation, and KEMET (now part of Yageo). These companies are known for their broad product ranges and advanced material technologies.

TDK and Murata are global leaders known for their extensive range of passive components. They often challenge Vishay through innovation and economies of scale. These companies continually invest in R&D to stay ahead.

The competitive landscape is further shaped by factors such as pricing strategies, technological advancements, and the ability to meet customer demands. The article Owners & Shareholders of Vishay Intertechnology provides additional insights into the company's performance and strategic direction. Vishay Intertechnology's ability to navigate this competitive environment will be crucial for its future success. The industry is also influenced by mergers and acquisitions, which can reshape market dynamics. For example, the acquisition of KEMET by Yageo has significantly altered the competitive balance in the passive components market. Continuous innovation and cost efficiency are key drivers of competition across all product lines and geographic regions.

The Vishay Intertechnology market share analysis reveals that competitors employ diverse strategies. These include aggressive pricing, rapid technological innovation, and expansive distribution networks. The push for technological superiority and cost efficiency drives constant competition.

- Aggressive Pricing: Competitors often use pricing strategies to gain market share.

- Technological Innovation: Rapid innovation in new technologies is a key competitive factor.

- Strong Brand Recognition: Established brands have a significant advantage.

- Expansive Distribution Networks: Wide distribution ensures product availability.

- Advanced Manufacturing: Efficient manufacturing capabilities are crucial.

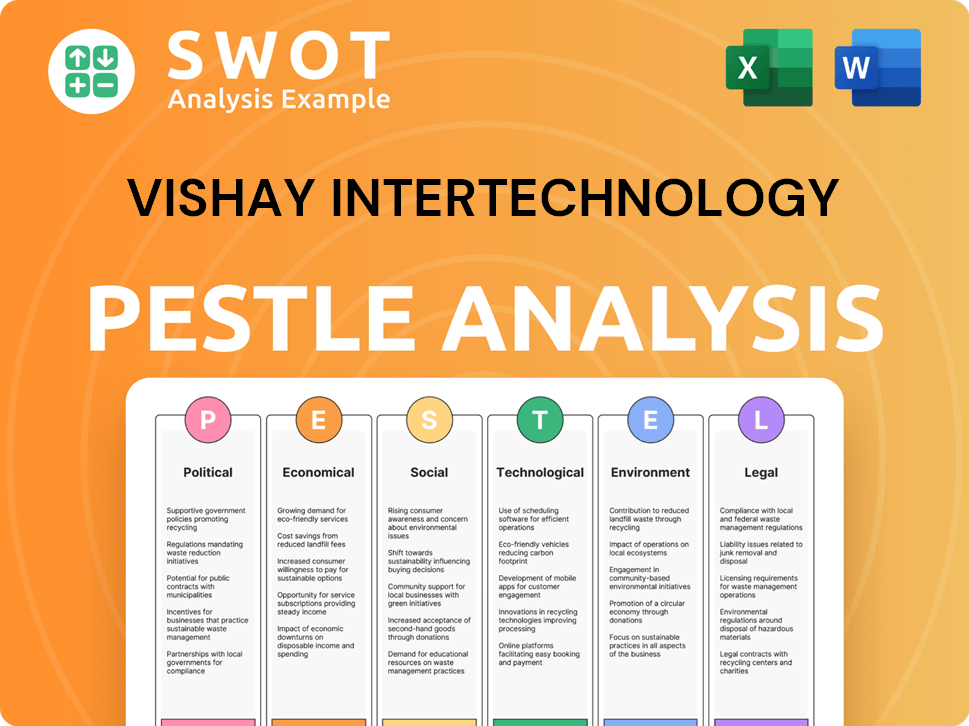

Vishay Intertechnology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vishay Intertechnology a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of companies like Vishay Intertechnology requires a deep dive into their strategic advantages. These advantages are pivotal in determining their market position and future prospects. The company's ability to innovate and adapt to market changes is crucial for maintaining its competitive edge.

A comprehensive Marketing Strategy of Vishay Intertechnology reveals how the company leverages its strengths. Key elements include a diverse product portfolio, a global manufacturing presence, and strong customer relationships. These factors collectively contribute to its resilience and growth potential within the electronic components market.

The company's strategic moves and competitive edge are shaped by its product offerings and market positioning. The following sections will explore these aspects in detail, providing a clear picture of Vishay's competitive advantages.

Vishay Intertechnology boasts a broad and diversified product portfolio. This includes a wide array of discrete semiconductors and passive components. This comprehensive offering serves various industries and applications, reducing reliance on single market segments.

The company strategically locates its production facilities across multiple continents. This global presence optimizes manufacturing efficiency and ensures supply chain resilience. This allows the company to adapt to regional market demands and regulatory requirements effectively.

Vishay has established long-term relationships with a vast customer base. These relationships are built on decades of delivering high-quality and reliable components. Application engineering support and customized solutions further reinforce customer loyalty.

The company focuses on operational efficiency and cost management. This allows it to offer competitive pricing while maintaining profitability. Continuous investment in R&D enhances product performance and expands into new technologies.

Vishay Intertechnology's competitive advantages are multifaceted, contributing to its strong market position. These advantages include a diversified product range, global manufacturing capabilities, and strong customer relationships. The company's ability to innovate and adapt is also a key factor.

- Diversified Product Portfolio: Offers a wide range of components, reducing dependence on any single segment.

- Global Manufacturing Footprint: Enhances supply chain resilience and efficiency.

- Customer Relationships: Long-term relationships built on quality and support.

- Operational Efficiency: Focus on cost management and competitive pricing.

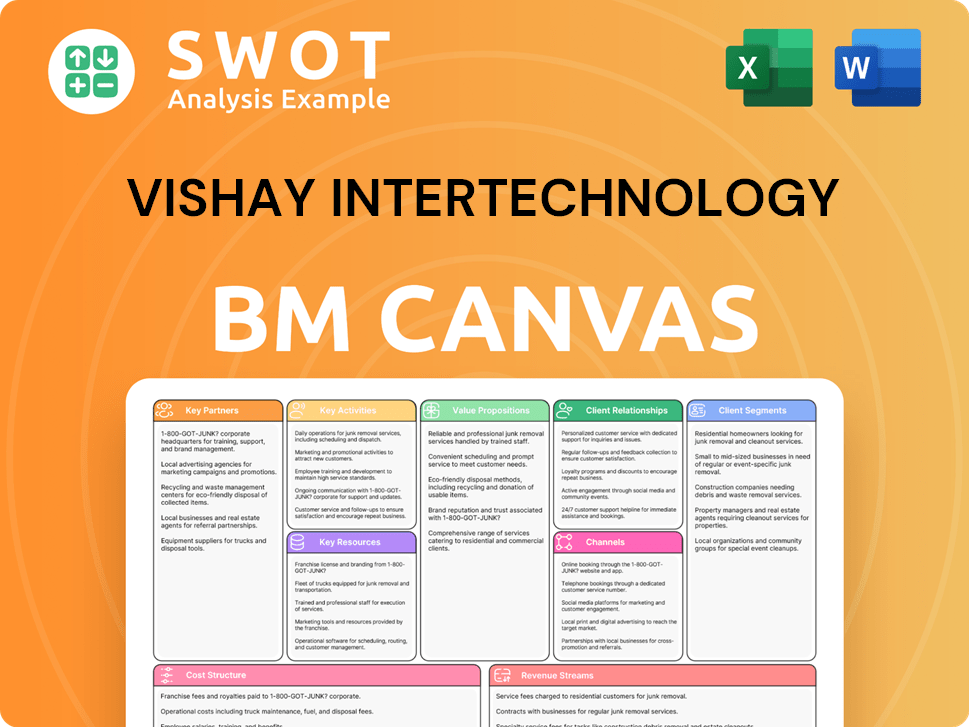

Vishay Intertechnology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vishay Intertechnology’s Competitive Landscape?

The Competitive Landscape of Vishay Intertechnology reflects a dynamic environment shaped by technological advancements, market shifts, and global economic factors. The company faces both opportunities and challenges as it navigates the evolving needs of various industries. A thorough market analysis reveals key trends and potential growth areas for Vishay, as well as competitive pressures from established and emerging players. Understanding the industry overview is crucial for assessing the company's strategic positioning and future outlook.

The electronic components industry, including Vishay, is subject to inherent risks such as supply chain disruptions, geopolitical tensions, and fluctuating raw material costs. These factors can significantly impact manufacturing, distribution, and profitability. Furthermore, changes in regulatory environments and environmental standards add complexity. Despite these challenges, Vishay continues to adapt and innovate, aiming to strengthen its market position and capitalize on emerging opportunities. For more information, read Brief History of Vishay Intertechnology.

Technological advancements, including AI, IoT, and 5G, drive demand for advanced components. The electrification of the automotive industry, particularly EVs, presents significant growth opportunities. Continuous innovation and investment in R&D are essential for staying competitive in this evolving landscape.

Intense pricing pressure and the need for constant R&D investment are key challenges. Geopolitical tensions and supply chain disruptions pose risks to manufacturing and distribution. Regulatory changes related to environmental standards and material sourcing add complexity.

Expanding in emerging markets with rapid industrialization and device adoption offers growth. Strategic partnerships and potential acquisitions can strengthen market position. Focus on higher-value, application-specific components can improve margins and differentiation.

Optimizing the global manufacturing footprint and investing in automation are crucial. Fostering a culture of innovation is essential for navigating the competitive landscape. Focusing on digitalization and advanced technologies is key to future growth.

Vishay's success hinges on its ability to adapt to market trends. The company must balance innovation with cost-effectiveness to maintain its competitive edge. Strategic partnerships and acquisitions can enhance its capabilities and market reach.

- Focus on high-growth applications like EVs and IoT.

- Optimize supply chain resilience to mitigate disruptions.

- Invest in R&D to stay ahead of technological advancements.

- Explore strategic alliances to expand market presence.

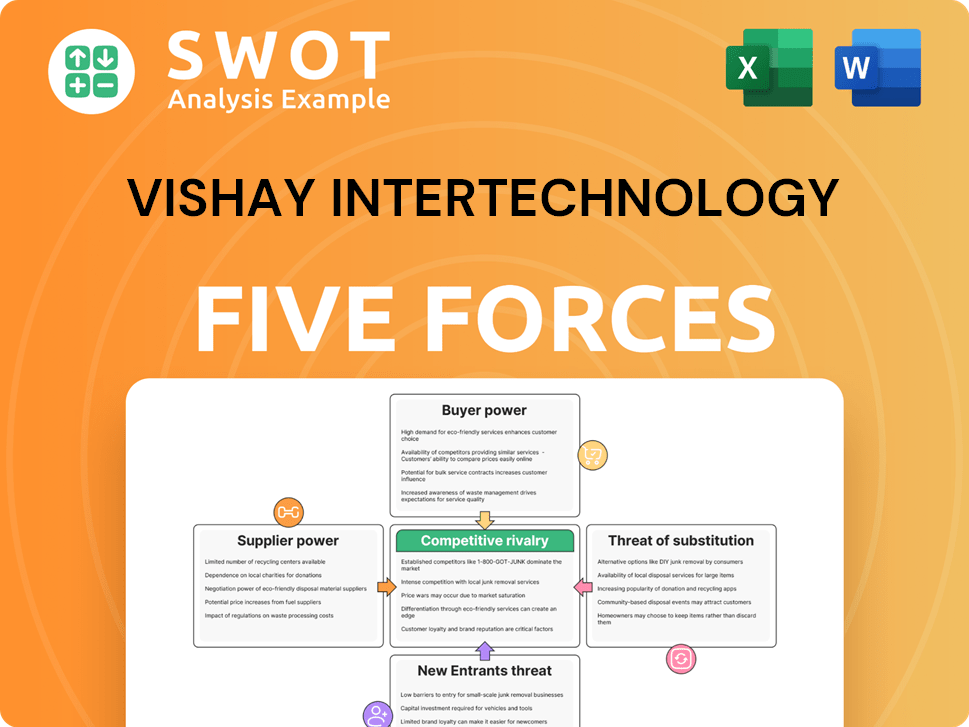

Vishay Intertechnology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vishay Intertechnology Company?

- What is Growth Strategy and Future Prospects of Vishay Intertechnology Company?

- How Does Vishay Intertechnology Company Work?

- What is Sales and Marketing Strategy of Vishay Intertechnology Company?

- What is Brief History of Vishay Intertechnology Company?

- Who Owns Vishay Intertechnology Company?

- What is Customer Demographics and Target Market of Vishay Intertechnology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.