Vishay Intertechnology Bundle

Who Really Controls Vishay Intertechnology?

Ever wondered who pulls the strings at a global powerhouse like Vishay Intertechnology? Understanding the Vishay Intertechnology SWOT Analysis is crucial, but the ownership structure of any company is a key determinant of its future. From its humble beginnings in 1962, Vishay has grown into a critical player in the electronic components industry. This analysis unveils the key players shaping Vishay's strategic direction and market influence.

This exploration into Vishay ownership will examine the evolution of its shareholder base, from its founding to its current status as a publicly traded company. We'll dissect the roles of major shareholders and the impact of public markets on Vishay stock. Knowing who owns Vishay provides valuable insights into its governance and prospects, offering a deeper understanding of this key player in the electronics sector. The insights gained will help investors and analysts alike.

Who Founded Vishay Intertechnology?

The story of Vishay Intertechnology begins with its founder, Dr. Felix Zandman, who established the company in 1962. The initial funding of $200,000 came from his relative, Alfred P. Slaner, with Dr. Zandman contributing $4,000. This early financial backing was crucial for launching the company.

At its inception, the ownership of Vishay was split evenly between Dr. Zandman and Alfred P. Slaner, each holding a 50% stake. The company's name, 'Vishay,' held sentimental value, commemorating the Lithuanian village where their ancestors had lived. This personal connection underscored the company's origins.

Vishay's initial success was built on Dr. Zandman's innovative Bulk Metal® Foil resistors and foil resistance strain gauges. These products quickly established the company's reputation for precision. In 1972, the company went public, with only 20% of shares offered to the public.

The early ownership structure of Vishay Intertechnology was defined by the founders' significant control. This allowed Dr. Zandman to shape the company's strategic direction and corporate culture. The company's history is marked by innovation and strategic acquisitions, as highlighted in Revenue Streams & Business Model of Vishay Intertechnology.

- Dr. Felix Zandman, the founder, was a Holocaust survivor.

- Alfred P. Slaner provided initial funding.

- The company's name honors the founders' heritage.

- The initial public offering (IPO) occurred in 1972.

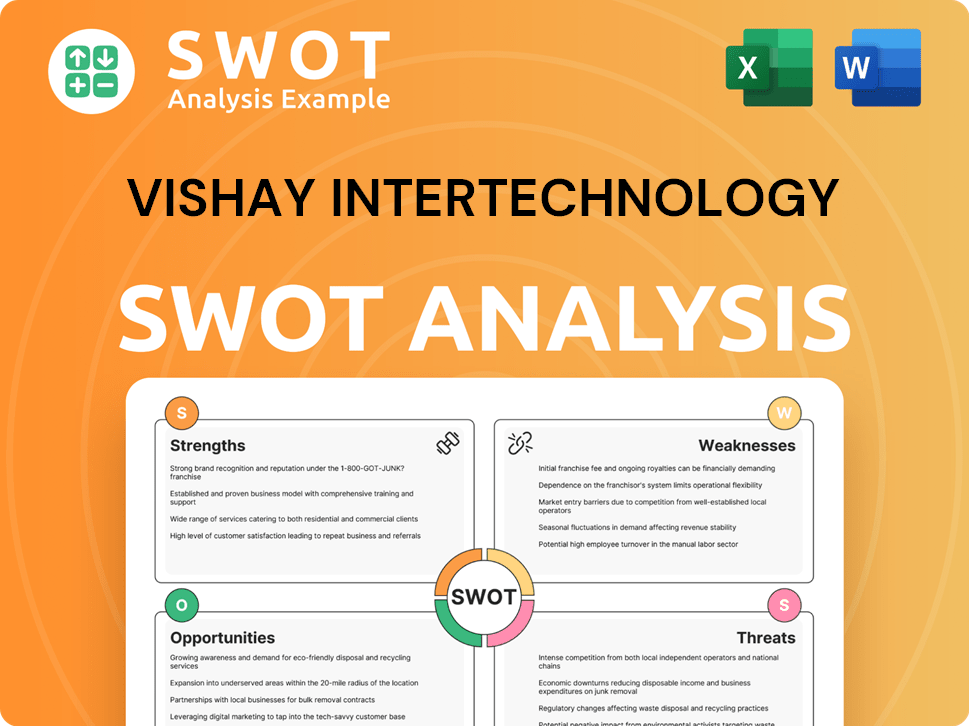

Vishay Intertechnology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Vishay Intertechnology’s Ownership Changed Over Time?

The ownership of Vishay Intertechnology has evolved significantly since its inception. The company went public and was listed on the New York Stock Exchange (NYSE) under the ticker symbol VSH, with an IPO date of March 17, 1980. However, other sources indicate the company went public in 1962 or January 4, 1988. This marked a pivotal moment, transforming Vishay from a privately held entity to a publicly traded corporation, subject to the scrutiny and regulations of the financial markets. The shift allowed for broader investment and increased visibility.

A key aspect of Vishay's ownership structure is its dual-class share system, approved by shareholders in 1987. This structure includes Class A common stock, which is publicly traded with one vote per share, and Class B common stock, which is not publicly traded and carries ten votes per share. This setup was designed to maintain the voting control of the founder, Dr. Felix Zandman, and his family, ensuring their influence over the company's strategic direction. This dual-class structure has played a significant role in shaping the company's governance and strategic decisions over the years.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | March 17, 1980 | Transitioned from private to public ownership, increasing the shareholder base. |

| Approval of Dual-Class Share Structure | 1987 | Preserved founder's voting control through Class B shares. |

| Death of Dr. Felix Zandman | June 2011 | Family's continued control through the family trust holding Class B shares. |

| Strategic Acquisitions | Various Dates | Expanded the company's market reach and product portfolio, impacting overall market capitalization and shareholder value. |

As of late 2024 and early 2025, the major stakeholders in Vishay include institutional investors, insiders, and individual investors. Institutional investors, such as BlackRock and Vanguard, hold a significant portion of the company's shares, providing substantial capital and expertise. Insiders, including executives and directors, also have a considerable stake, aligning their interests with other shareholders. Individual investors also contribute to the ownership structure. Following Dr. Felix Zandman's passing in June 2011, his family continues to hold significant voting power. Mrs. Ruta Zandman, Marc Zandman, and Ziv Shoshani are co-trustees of a family trust that holds a substantial portion of the Class B common stock. Mrs. Ruta Zandman controls approximately 34.5% of the total voting power, Marc Zandman controls approximately 27.1%, and Ziv Shoshani approximately 27.9% as of April 2024. This family control continues to significantly influence the company's strategic direction and governance. For more information, you might find the Competitors Landscape of Vishay Intertechnology article helpful.

Vishay Intertechnology's ownership structure is shaped by its dual-class shares and major stakeholders.

- Institutional investors hold a substantial stake, providing capital and expertise.

- The Zandman family retains significant voting power through Class B shares.

- Strategic acquisitions have expanded the company's market reach.

- Understanding the ownership structure is crucial for investors.

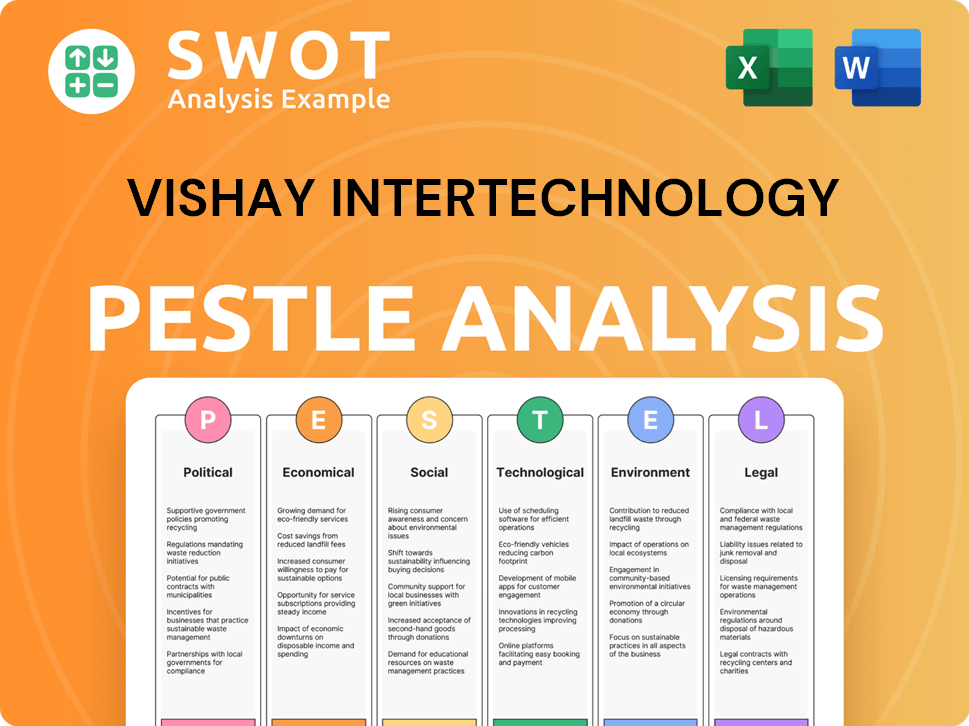

Vishay Intertechnology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Vishay Intertechnology’s Board?

The governance of Vishay Intertechnology is overseen by its Board of Directors, which is accountable to its shareholders. The company's structure includes a dual-class stock system, which significantly affects voting rights. Class A common stock, which is publicly traded, has one vote per share, while Class B common stock, which is not publicly traded, has ten votes per share. This setup allows certain individuals or entities to have considerable control over the company.

As of April 2025, the Zandman family maintains substantial voting power through the Class B common stock. Mrs. Ruta Zandman, along with Mr. Marc Zandman and Ziv Shoshani, are co-trustees of a family trust that holds a significant portion of the Class B shares. In April 2024, Ruta Zandman controlled, either alone or jointly with Marc Zandman and Ziv Shoshani, about 34.5% of the total voting power. Marc Zandman controlled roughly 27.1%, and Ziv Shoshani approximately 27.9% of the total voting power. This concentration of voting power gives them considerable influence in the election of directors and other shareholder actions.

| Board Member | Title | Key Role |

|---|---|---|

| Marc Zandman | Executive Chairman and Chief Business Development Officer | Represents major shareholders |

| Joel Smejkal | President and CEO | Oversees daily operations |

| Ziv Shoshani | Former Board Member | Resigned in February 2025 to focus on role at Vishay Precision Group |

The dual-class capitalization has historically faced scrutiny. In December 2005, Amalgamated Bank MidCap 400 Index Fund proposed a recapitalization to a one-vote-per-share structure for all stock. This proposal highlighted concerns about management entrenchment and the company's performance. The Board did not support this proposal, instead announcing an intent to create a new Class C common stock with even less voting power, which was seen as a move to further preserve the voting control of Dr. Zandman and other members of management. For more insights, you can explore the Growth Strategy of Vishay Intertechnology.

The ownership structure of Vishay Intertechnology is complex, with a dual-class stock system impacting shareholder voting power. The Zandman family, through Class B shares, holds significant control, influencing key decisions. This structure has led to past debates about corporate governance and shareholder rights.

- Dual-class stock structure.

- Zandman family's substantial voting power.

- Historical proposals for recapitalization.

- Impact on corporate governance.

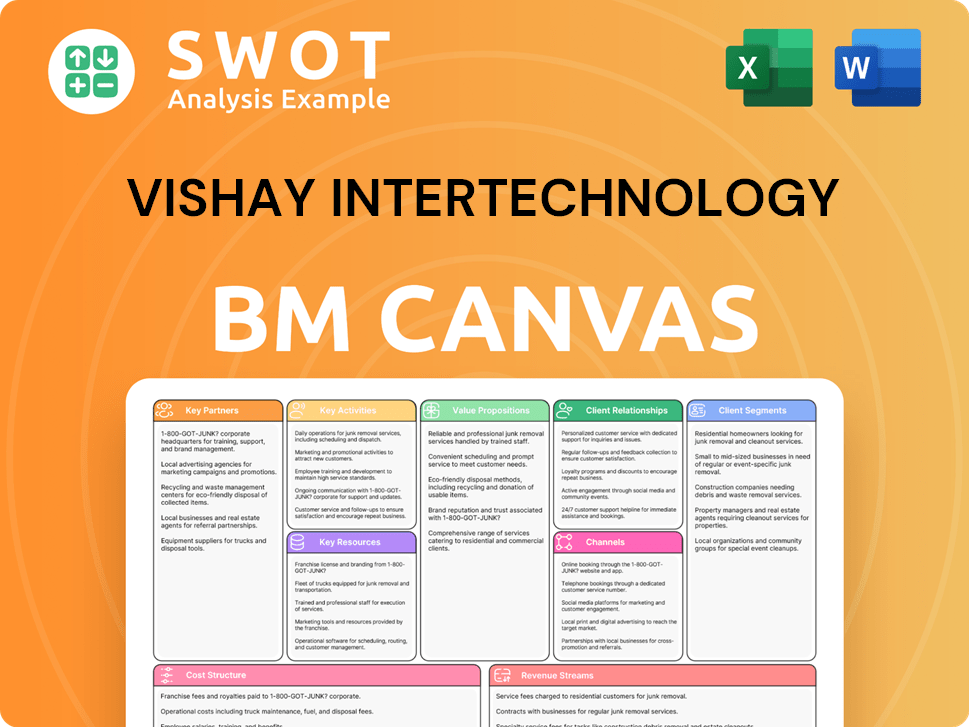

Vishay Intertechnology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Vishay Intertechnology’s Ownership Landscape?

Over the past few years, the ownership landscape of Vishay Intertechnology has seen some notable shifts. A significant development in late 2024 was a substantial investment in the Newport wafer fab in Wales, which aligns with the company's strategic direction. This investment, supported by the Welsh Government, focuses on expanding production lines for power devices, especially silicon carbide (SiC) power devices. This move strengthens Vishay's position within the semiconductor market, particularly in the automotive and industrial sectors.

In terms of leadership, Joel Smejkal was appointed President and CEO, with his employment agreement terms confirmed in February 2024. Marc Zandman continues to serve as Executive Chairman of the Board of Directors and Chief Business Development Officer. Notably, Ziv Shoshani resigned from the Board of Directors in February 2025. As a publicly traded entity, Vishay continues to attract significant institutional interest, with major asset managers like BlackRock and Vanguard holding key stakes. Recent insider buying activity, observed in the three months leading up to March 2025, indicates internal confidence in the company's prospects.

| Ownership Aspect | Details | Latest Data (April 2025) |

|---|---|---|

| Institutional Ownership | Key stakeholders include major asset managers | Substantial |

| Insider Activity | Buying activity within the company | Noted in the three months leading up to March 2025 |

| Leadership Changes | Appointment of Joel Smejkal as President and CEO | February 2024 |

Financially, Vishay reported revenues of $714.7 million for Q4 2024. The company experienced a positive book-to-bill ratio of 1.01, driven by strong order intake. Management anticipates Q1 2025 revenues in the range of $710 million +/- $20 million. Despite challenges, analysts project a return to profitability in 2025. Vishay has consistently paid dividends for 12 consecutive years, with a current quarterly dividend of $0.10 per share. However, projected negative free operating cash flow for fiscal 2024 and 2025 due to revenue and profitability weakness and elevated capital expenditures, which include significant investments in capacity for power semiconductors.

Vishay is a publicly traded company, with a significant portion of its shares held by institutional investors. Key shareholders include major asset management firms. Understanding the ownership structure is crucial for investors.

In Q4 2024, Vishay's revenue was $714.7 million. The company is focusing on expanding its production capacity for power semiconductors. The financial results are key for understanding the company's current standing.

Vishay's investment in the Newport wafer fab and leadership changes, including the appointment of a new CEO, are key developments. These moves aim to strengthen the company's position in the semiconductor market.

Analysts anticipate a return to profitability in 2025. The company is also focused on expanding its production capacity for power semiconductors. For more insights, consider the Target Market of Vishay Intertechnology.

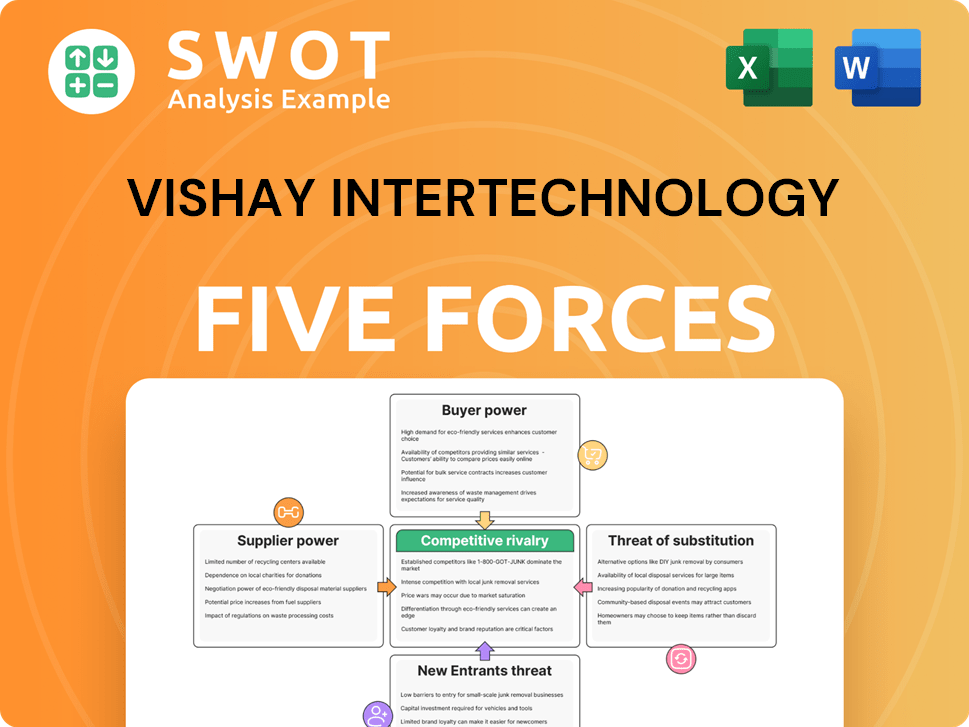

Vishay Intertechnology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vishay Intertechnology Company?

- What is Competitive Landscape of Vishay Intertechnology Company?

- What is Growth Strategy and Future Prospects of Vishay Intertechnology Company?

- How Does Vishay Intertechnology Company Work?

- What is Sales and Marketing Strategy of Vishay Intertechnology Company?

- What is Brief History of Vishay Intertechnology Company?

- What is Customer Demographics and Target Market of Vishay Intertechnology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.