Vishay Intertechnology Bundle

How Does Vishay Intertechnology Thrive in the Electronics World?

Ever wondered how the devices we rely on daily actually work? Vishay Intertechnology, a key player in the electronics industry, is the unseen engine powering countless gadgets and systems. From your car's engine control unit to your smartphone's charging circuit, Vishay Intertechnology SWOT Analysis reveals the strategies behind this global semiconductor manufacturer's success.

This deep dive explores the inner workings of Vishay, examining its robust product portfolio of Vishay components, from passive components to semiconductors, and its strategic moves in a competitive landscape. We'll analyze how the Vishay company navigates market challenges, capitalizes on growth opportunities, and maintains its crucial role in the global supply chain, all while keeping a close eye on the latest news and investor relations updates. Understanding Vishay's operations is vital for anyone seeking insights into the future of electronics.

What Are the Key Operations Driving Vishay Intertechnology’s Success?

Vishay Intertechnology designs, manufactures, and markets a wide range of discrete semiconductors and passive electronic components. These components are essential for electronic devices and equipment. As a leading semiconductor manufacturer, Vishay components are found in various industries, including automotive, industrial, and consumer electronics.

The company's core offerings include diodes, rectifiers, MOSFETs, optoelectronics, resistors, inductors, and capacitors. Its diverse product portfolio allows it to serve a broad customer base. The automotive sector, a significant market for Vishay, often accounts for over 30% of its total revenue.

Vishay's operations are global, with numerous manufacturing sites across the Americas, Europe, and Asia. This global footprint supports localized production and supply chain resilience. The company employs a vertically integrated model, controlling key production steps to ensure quality and cost efficiency. This approach is crucial for maintaining competitiveness in the electronic components market.

Vishay's manufacturing processes are highly specialized, requiring significant expertise and precision. The company focuses on advanced manufacturing execution systems (MES) to standardize production steps. This includes WIP tracking, master data management, and equipment maintenance.

Vishay's exceptionally diverse product range positions it as a 'one-stop-shop' for many customers. This breadth provides stability against sector-specific downturns. The company's ability to offer a wide array of electronic components simplifies procurement for its clients.

The company's strong technical expertise and consistent R&D investments drive innovation. Long-standing customer relationships and strategic acquisitions enhance technological capabilities and market reach. These factors contribute to the company's sustained growth.

Customers benefit from a reliable supply of high-quality components and tailored solutions. Vishay meets evolving technological needs, particularly in trends like electrification and digitalization. This focus ensures long-term partnerships and customer satisfaction.

Vishay's success stems from its diverse product range, strong technical expertise, and strategic acquisitions. Consistent R&D investments, estimated around $155 million in 2024, drive innovation. These strengths enable Vishay to meet the evolving needs of its customers.

- Broad product portfolio offering a 'one-stop-shop' solution.

- Strong R&D investments focused on power efficiency and miniaturization.

- Long-standing customer relationships built on reliability and quality.

- Strategic acquisitions that enhance technological capabilities and market reach.

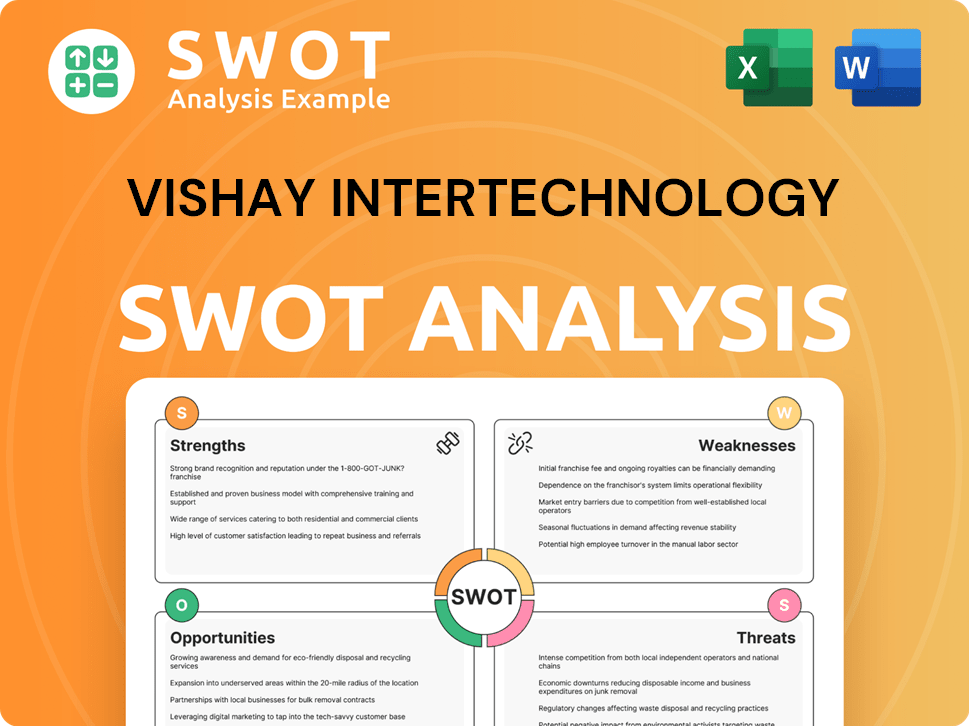

Vishay Intertechnology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vishay Intertechnology Make Money?

Vishay Intertechnology, a prominent semiconductor manufacturer, generates revenue primarily through the design, manufacture, and sale of electronic components. The company's revenue streams are diversified across various product lines and end markets, which provides stability against sector-specific downturns. In Q1 2025, Vishay reported revenues of $715.2 million. For the full year 2024, the company's revenues were $2.94 billion.

The company's product portfolio includes discrete semiconductors and passive components, serving diverse applications. This includes MOSFETs, diodes, resistors, inductors, and capacitors. Vishay components are integral to numerous industries, including automotive, industrial, and consumer electronics. The company's financial performance reflects its ability to adapt to market demands and maintain a competitive edge.

Vishay Intertechnology focuses on long-term relationships with Original Equipment Manufacturers (OEMs) and distributors worldwide. This strategy provides tailor-made solutions for specific applications. The company also emphasizes operational efficiency and cost management to maintain margins. For more details on their target market, read this article about the Target Market of Vishay Intertechnology.

In Q1 2025, MOSFETs accounted for 19.9% of total revenues, generating $142.1 million, while Diodes contributed 19.7% with $141 million in revenue. Optoelectronics saw a 4.1% year-over-year increase, reaching $51.2 million (7.2% of total revenues). Inductors contributed $84.1 million (11.8% of total revenues), and Capacitors brought in $117.4 million (16.4% of total revenues) in the same quarter.

- Monetization Strategies: Cultivating long-term relationships with OEMs and distributors worldwide.

- Distribution Channels: Historical data indicates a significant reliance on distribution channels.

- Financial Outlook: Management guides for a sequential revenue increase of 6% for Q2 2025, projecting revenues between $740 million to $780 million.

- Future Plans: Vishay aims to generate higher levels of free cash flow post-2025, supporting dividends and share repurchases.

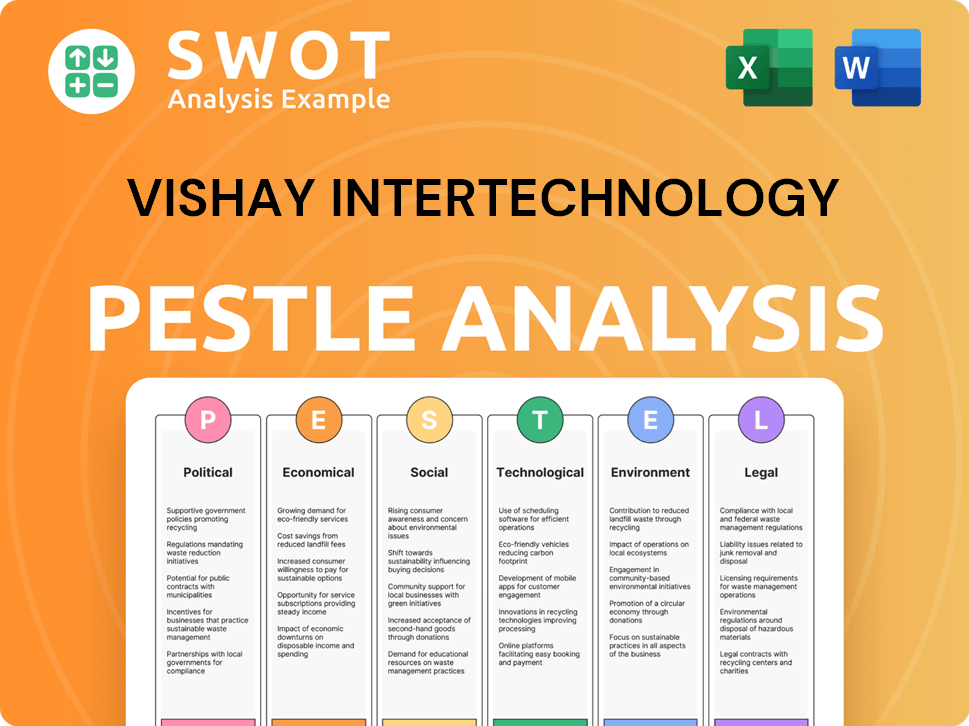

Vishay Intertechnology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vishay Intertechnology’s Business Model?

Vishay Intertechnology, a prominent player in the electronic components sector, has navigated significant strategic shifts and operational challenges. The company's trajectory is marked by key acquisitions and investments aimed at strengthening its market position. These moves are coupled with responses to economic pressures and strategic initiatives designed to enhance efficiency and competitiveness.

One of the most notable strategic moves for Vishay Intertechnology was the acquisition of Newport Wafer Fab in March 2024. This acquisition is pivotal for expanding its capabilities in silicon carbide (SiC) MOSFETs and diodes. Moreover, Vishay has committed to substantial investments in capacity expansion, totaling $2.6 billion from 2023 to 2028. These investments are designed to increase MOSFET capacity by 12% in 2025, thereby boosting overall semiconductor product capacity.

Despite these strategic expansions, Vishay has faced headwinds, including macroeconomic weakness and pricing pressures. In response, the company initiated a global restructuring in September 2024 as part of its 'Vishay 3.0' growth strategy, focusing on consolidating manufacturing facilities and reducing its workforce. This restructuring aims to achieve annualized cost savings of at least $23 million.

The acquisition of Newport Wafer Fab in March 2024 is a significant milestone, bolstering Vishay's SiC capabilities. Capacity expansion investments, totaling $2.6 billion from 2023 to 2028, are essential for future growth. The company's strategic moves highlight its commitment to innovation and market leadership.

Vishay has focused on strategic acquisitions, like Newport Wafer Fab, to enhance its product offerings. The company is investing heavily in capacity expansion. Restructuring efforts, including facility consolidation and workforce reduction, are part of the 'Vishay 3.0' strategy.

Vishay's broad product portfolio allows it to be a 'one-stop-shop' for customers. Strong R&D investments, approximately $155 million in 2024, support innovation. The company's global manufacturing footprint provides economies of scale and supply chain flexibility.

Vishay's EBITDA margin fell to 13% for the 12-month period ending in Q3 2024. The company is targeting cost savings of at least $23 million annually through restructuring. These financial adjustments reflect the current market conditions and strategic initiatives.

Vishay Intertechnology's competitive edge is rooted in its diverse product offerings and strong customer relationships. The company's commitment to innovation, particularly in SiC technology, is a key differentiator. Furthermore, its global manufacturing capabilities enhance its ability to serve a wide range of customers effectively.

- Broad product portfolio, serving as a 'one-stop-shop'.

- Substantial R&D investments, approximately $155 million in 2024, driving innovation.

- Long-standing customer relationships and global manufacturing footprint.

- Focus on high-growth areas like e-mobility and 5G infrastructure.

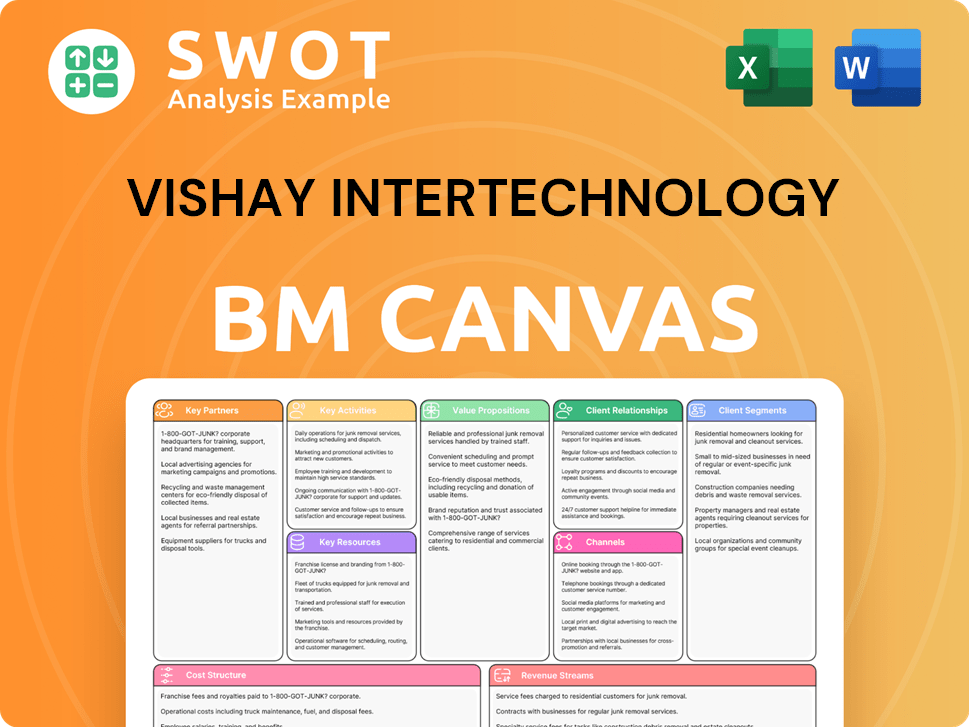

Vishay Intertechnology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vishay Intertechnology Positioning Itself for Continued Success?

As a leading Vishay Intertechnology manufacturer, the company holds a significant position in the global market for discrete semiconductors and passive electronic components. It distinguishes itself through its diverse product range, serving sectors like automotive (a major revenue source, often contributing over 30% of total revenue), industrial, military/aerospace, and medical markets. Despite facing larger competitors in specific product categories, Vishay company leverages its established channels, reliability, and comprehensive component offerings.

The future outlook for Vishay components hinges on navigating cyclical end-market demand while executing strategic initiatives focused on capacity expansion and higher-margin products. The company is investing approximately $2.6 billion over a five-year period (2023 to 2028) to improve its product mix and expand manufacturing capabilities, including a new 12-inch wafer fab in Germany.

Vishay is a significant player in the electronic components market, particularly in passive components and discrete semiconductors. Its broad product portfolio and established distribution network provide a competitive edge. The company serves diverse sectors, with automotive representing a major revenue source.

Risks include macroeconomic weakness, inventory adjustments, pricing pressure, and softer industrial demand. Negative free operating cash flow (FOCF) is projected for fiscal years 2024 and 2025. Supply chain disruptions, market volatility, and competitive pressures also pose risks.

Vishay is focused on capacity expansion and higher-margin products. The company anticipates a demand recovery in the second half of 2025 and expects revenues to grow by about 5% with EBITDA margins improving by 2% for the full year 2025. Management expects a sequential revenue increase of 6% for Q2 2025.

Vishay is investing significantly in expanding manufacturing capabilities, including a new wafer fab. These investments aim to improve the product mix and increase profitability. The company is well-positioned to capitalize on long-term trends in electrification, automation, and AI technologies.

Vishay's investment strategy includes capacity expansion and product mix improvements, targeting higher-margin products. The company anticipates revenue growth in 2025, driven by demand recovery and strategic initiatives. For more details, you can read about Brief History of Vishay Intertechnology.

- Capital expenditures are elevated due to strategic investments.

- The company aims to capitalize on long-term trends in key markets.

- Management expects a sequential revenue increase of 6% for Q2 2025.

- EBITDA margins are expected to improve by 2% in 2025.

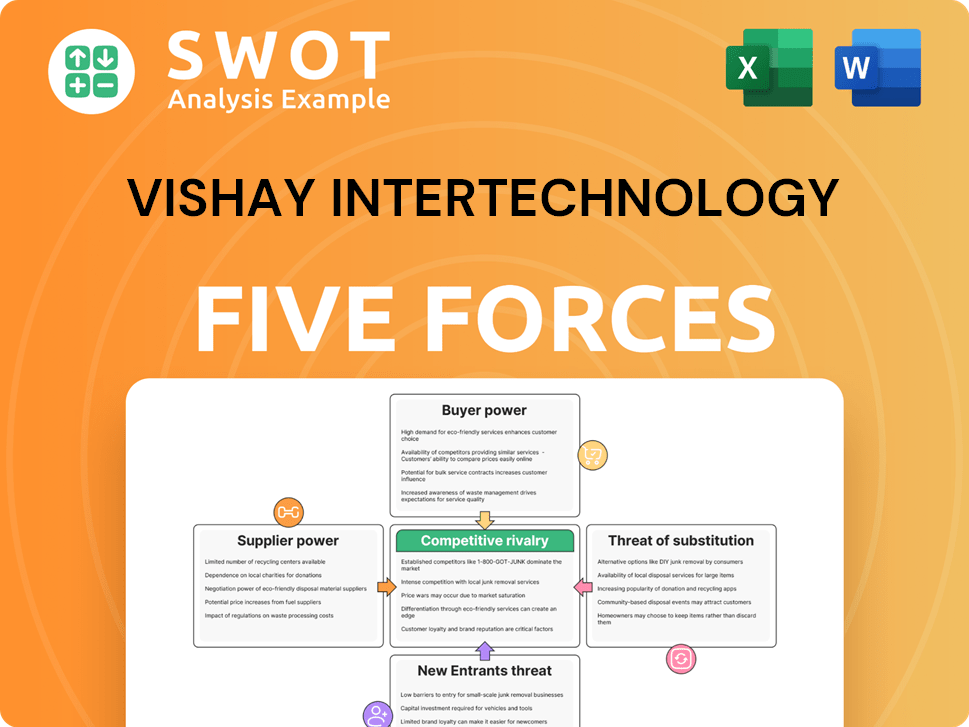

Vishay Intertechnology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vishay Intertechnology Company?

- What is Competitive Landscape of Vishay Intertechnology Company?

- What is Growth Strategy and Future Prospects of Vishay Intertechnology Company?

- What is Sales and Marketing Strategy of Vishay Intertechnology Company?

- What is Brief History of Vishay Intertechnology Company?

- Who Owns Vishay Intertechnology Company?

- What is Customer Demographics and Target Market of Vishay Intertechnology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.