Vornado Realty Trust Bundle

How Did Vornado Realty Trust Shape the Real Estate Landscape?

Ever wondered how a real estate giant like Vornado Realty Trust built its empire? From its humble beginnings in 1962, Vornado's journey is a fascinating story of strategic acquisitions and savvy management. Discover the key moments that transformed this Vornado Realty Trust SWOT Analysis into a leading Real estate investment trust (REIT).

The brief history of Vornado Realty Trust reveals a company that has consistently adapted to market changes, particularly in the dynamic world of New York City real estate. Understanding Vornado's early years provides valuable insights into its current investment strategy and its impact on the urban landscape. Explore the Vornado company's evolution and see how it became a major player in the REIT history.

What is the Vornado Realty Trust Founding Story?

The story of Vornado Realty Trust, a prominent player in the real estate investment trust (REIT) sector, begins in 1962. It started as Two Guys from Harrison, Inc., a discount department store chain. This marked the initial phase of what would eventually evolve into a major real estate entity, laying the groundwork for its future endeavors.

The transformation of Two Guys from Harrison, Inc. into Vornado Realty Trust involved a strategic shift. This pivot recognized the value of the real estate holdings underlying the retail operations. The company saw an opportunity to leverage these physical assets independently of its retail business, setting the stage for its transition into a pure-play real estate investment trust.

The journey of Vornado Realty Trust, from its retail roots to its current status as a significant REIT, showcases a strategic evolution. This transition involved divesting retail operations and focusing on property ownership, management, and development. This strategic move allowed the company to capitalize on its extensive real estate portfolio, particularly in key markets like New York City.

The name 'Vornado' marked a clear departure from its retail past, signifying a new identity as a dedicated real estate enterprise. Initial funding for its real estate ventures largely stemmed from the assets accumulated during its retail phase.

- The company's shift towards real estate was influenced by the evolving retail landscape and the growing recognition of real estate as a distinct asset class.

- The initial focus was on leveraging the value of the real estate assets owned by the retail chain.

- This strategic pivot allowed the company to focus solely on property ownership, management, and development.

- Vornado's early investments were fueled by its existing asset base, providing a solid foundation for expansion.

The cultural and economic context of the time, with changing retail landscapes and the rise of real estate as a distinct asset class, significantly influenced the creation of Vornado. The company's focus on prime commercial properties, particularly in New York City, has shaped its identity and investment strategy. For more insights into the competitive environment, consider exploring the Competitors Landscape of Vornado Realty Trust.

Vornado's early success was built on its ability to identify and capitalize on the value of its real estate holdings. The company's strategic decisions, from divesting its retail operations to focusing on property management and development, have positioned it as a leading REIT. As of early 2024, the company continues to adapt to market changes and pursue strategic investments.

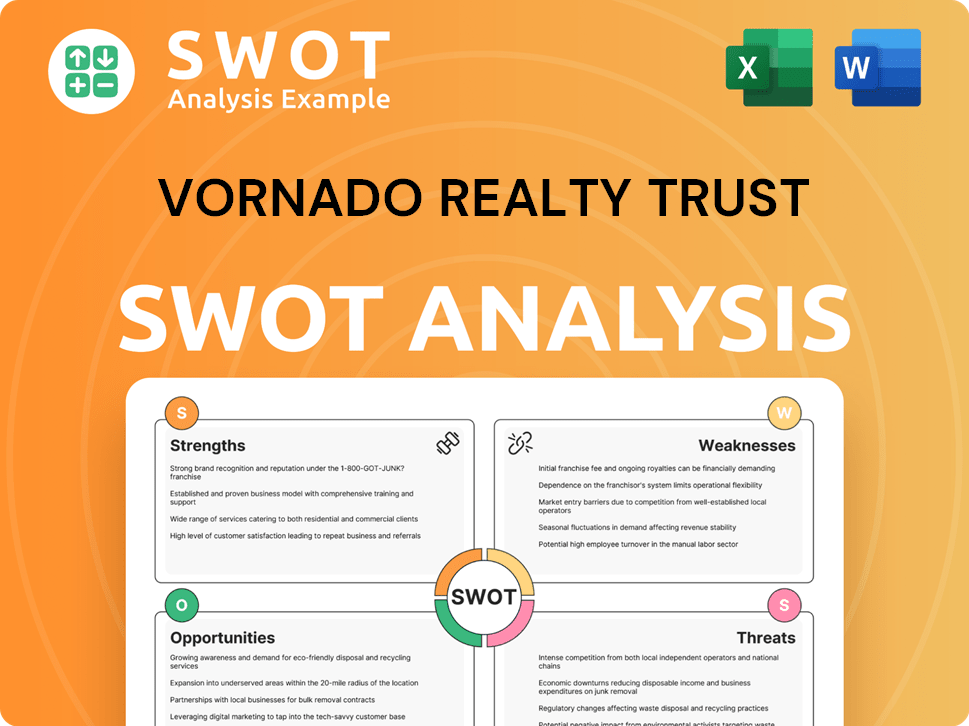

Vornado Realty Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Vornado Realty Trust?

Following its shift to a real estate investment trust (REIT), Vornado Realty Trust experienced significant growth through strategic acquisitions and developments. This expansion included acquiring key properties, particularly in the New York metropolitan area. The company focused on building a portfolio of office and retail properties, recognizing their long-term value. This period is crucial in understanding the brief history of Vornado Realty Trust.

Vornado Realty Trust's early growth was fueled by identifying and acquiring properties with potential for redevelopment or repositioning. This strategy involved substantial capital raises, including public offerings, to fund its ambitious acquisition plans. These acquisitions were key to shaping Vornado's real estate portfolio. The company's focus on prime locations helped it maintain strong occupancy rates.

Leadership transitions played a crucial role in Vornado's evolution. Steven Roth, as Chairman and CEO, guided the company's growth trajectory. Expansion into new markets, such as Chicago and San Francisco, diversified its portfolio beyond New York. This strategic move was driven by strong real estate fundamentals in other major U.S. cities, contributing to Vornado's history.

Market reception to Vornado's strategy was generally positive, with investors recognizing the value in its high-quality asset portfolio. The company navigated the competitive landscape by focusing on prime locations and active asset management. This approach allowed Vornado to maintain strong occupancy rates and rental income. For more insights, explore the Target Market of Vornado Realty Trust.

During its early years, Vornado Realty Trust demonstrated strong financial performance, driven by its strategic acquisitions and effective property management. While specific figures from the early expansion phase are not readily available, the company's focus on high-value assets and strategic market entries set the stage for future growth. The company's ability to secure capital through public offerings was crucial for funding its expansion strategy.

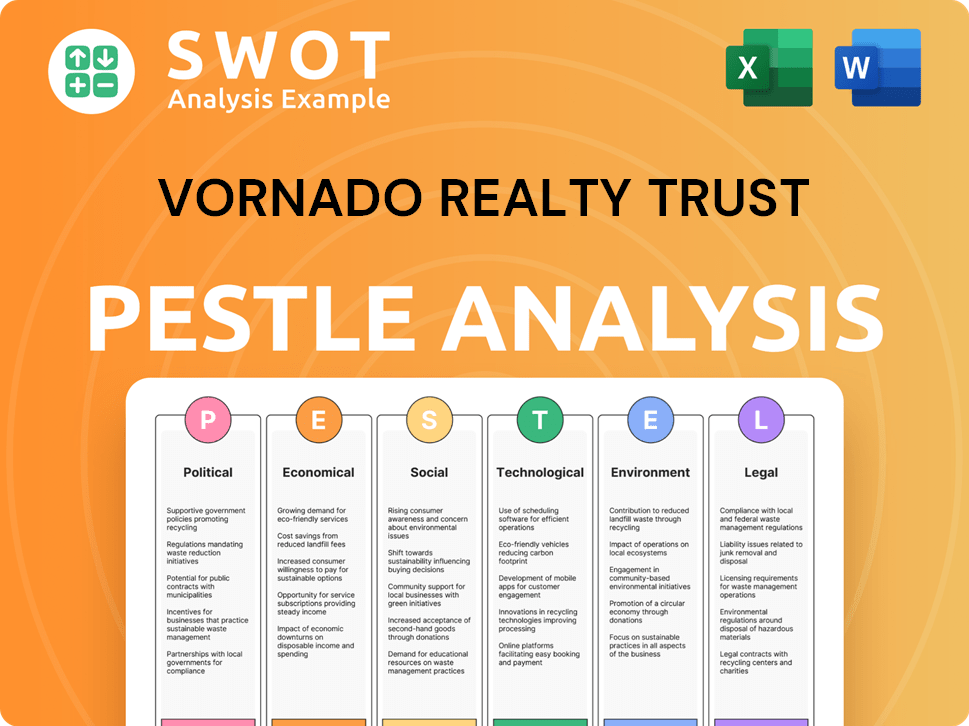

Vornado Realty Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Vornado Realty Trust history?

The Vornado Realty Trust has a rich history marked by significant milestones, innovations, and the navigation of various challenges within the real estate sector. Understanding the Vornado history is key to grasping its current position in the market.

| Year | Milestone |

|---|---|

| 1982 | Founded as a real estate investment trust (REIT) focused on acquiring and managing commercial properties. |

| 1997 | Acquired the Pennsylvania Plaza complex in New York City, a significant addition to its portfolio. |

| 2000s | Expanded its portfolio through strategic acquisitions, including properties in New York City and other major urban areas. |

| 2010s | Undertook major redevelopment projects, such as the transformation of the Farley Post Office into the Moynihan Train Hall. |

| 2020-2024 | Navigated the challenges of the COVID-19 pandemic, adapting strategies to address the changing dynamics of office and retail real estate. |

One of the key innovations of Vornado Realty Trust has been its approach to urban mixed-use development, integrating office, retail, and residential components. This strategy creates vibrant urban ecosystems and enhances property values.

Vornado has been a pioneer in developing properties that combine office, retail, and residential spaces, creating dynamic environments. This integrated approach enhances property values and attracts a diverse tenant base.

The company has a history of acquiring and redeveloping iconic properties, such as the transformation of the Farley Post Office into the Moynihan Train Hall. These projects often involve significant capital investments and long-term vision.

Vornado has invested in technology to enhance tenant experiences and improve property management efficiency. This includes smart building technologies and digital platforms for tenants.

Vornado has maintained a focus on acquiring and managing high-quality, well-located assets, particularly in prime locations within New York City. This strategy aims to maximize long-term value and resilience.

The company has engaged in public-private partnerships to undertake large-scale projects, such as the Moynihan Train Hall, which exemplifies its ability to navigate complex projects. These partnerships often involve significant urban renewal efforts.

Vornado has faced several challenges, including economic downturns and shifts in market dynamics. These events have required strategic adjustments and a focus on core assets.

The company has had to navigate market downturns, such as the dot-com bubble burst and the 2008 financial crisis, which impacted its financial performance. These periods required strategic pivots, including divestment of non-core assets.

The COVID-19 pandemic significantly impacted office and retail real estate, necessitating adjustments in strategies to address changing work patterns and tenant needs. This led to reconfiguring office spaces to meet evolving work patterns.

Rising interest rates in 2023-2024 have impacted financial strategies, leading to careful management of debt and capital expenditures. This has required a focus on financial discipline and strategic planning.

Evolving tenant preferences and the rise of hybrid work models have required Vornado to adapt its properties to meet new demands. This involves investing in amenities and flexible office spaces.

The real estate market is highly competitive, with various players vying for tenants and investment opportunities. This necessitates a focus on differentiation and strategic positioning.

Careful capital allocation and a strategic investment strategy are essential for long-term success. This includes making informed decisions about property acquisitions, redevelopments, and asset management.

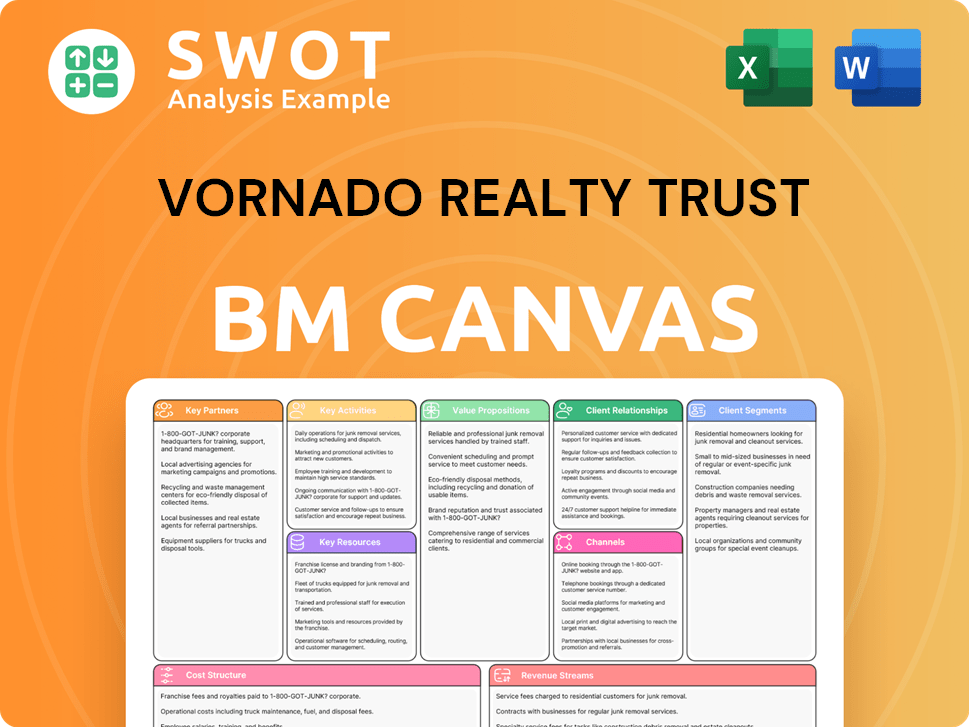

Vornado Realty Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Vornado Realty Trust?

The Vornado Realty Trust, a prominent player in the real estate investment trust (REIT) sector, has a rich history marked by strategic acquisitions and developments. The company's journey began in 1962, evolving into a REIT, and subsequently expanding its portfolio through significant acquisitions. Key milestones include the 1998 acquisition of the Merchandise Mart in Chicago, a pivotal move that broadened its reach. The company has strategically divested assets in the 2010s, streamlining its portfolio. The completion of major phases of the Moynihan Train Hall redevelopment in 2021 and 2022 represents significant achievements in urban infrastructure and real estate transformation. In 2023-2024, Vornado has focused on strengthening its balance sheet and optimizing its portfolio in response to economic conditions.

| Year | Key Event |

|---|---|

| 1962 | Vornado Realty Trust was founded. |

| 1998 | Acquisition of Merchandise Mart in Chicago. |

| 2021-2022 | Completion of major phases of the Moynihan Train Hall redevelopment. |

| 2023-2024 | Focus on strengthening the balance sheet and optimizing the portfolio. |

Vornado's future strategy emphasizes its core New York City office and retail properties. The company aims to create value through redevelopment and active management. This involves investing in high-quality, well-located properties to command premium rents. The company's focus on the New York City real estate market is expected to continue.

Strategic initiatives include enhancing technology infrastructure within its buildings and implementing sustainable practices. Vornado is adapting office spaces to cater to hybrid work models, reflecting evolving industry trends. The company is also expected to continue selective dispositions of non-core assets.

Industry trends such as the flight to quality in office real estate and the evolution of retail will significantly impact Vornado's future. Analyst predictions suggest a continued focus on its New York City portfolio, with potential for further redevelopment opportunities. The company's focus on high-quality assets is a key component of its long-term strategy.

Leadership statements emphasize a commitment to maximizing shareholder value through disciplined capital allocation and operational excellence. This forward-looking approach remains consistent with its founding vision of creating and maximizing value from premier real estate assets. Vornado's financial performance is closely tied to its success in the New York City real estate market.

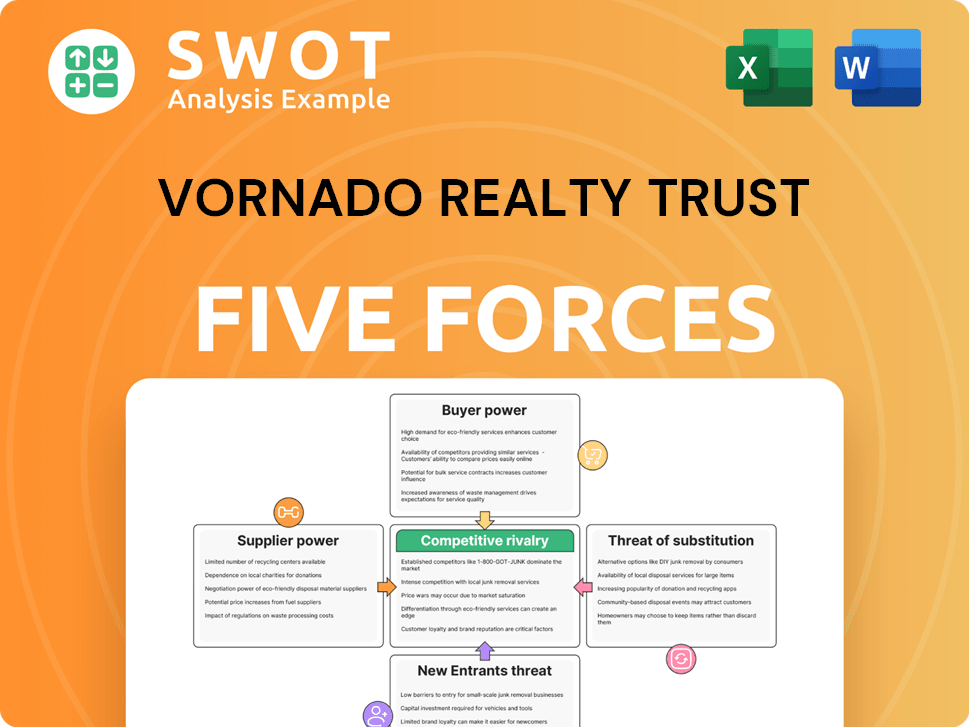

Vornado Realty Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Vornado Realty Trust Company?

- What is Growth Strategy and Future Prospects of Vornado Realty Trust Company?

- How Does Vornado Realty Trust Company Work?

- What is Sales and Marketing Strategy of Vornado Realty Trust Company?

- What is Brief History of Vornado Realty Trust Company?

- Who Owns Vornado Realty Trust Company?

- What is Customer Demographics and Target Market of Vornado Realty Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.