Vornado Realty Trust Bundle

What Drives Vornado Realty Trust's Success?

Understanding a company's core principles is crucial for any investor or strategist. Delve into the heart of Vornado Realty Trust (Vornado Company) and discover the driving forces behind its real estate investment trust (REIT) endeavors.

Unraveling Vornado's Vornado Realty Trust SWOT Analysis can provide insights into its strategic positioning. This exploration of Vornado's Mission Vision Core Values, and how they shape its corporate values, is essential for anyone seeking to understand Vornado's strategy and its impact on the real estate market. Learn about Vornado's long-term vision and goals and how these are reflected in its commitment to sustainability and employee engagement.

Key Takeaways

- Vornado focuses on premier NYC office/retail, aiming to maximize asset value.

- Vision: Maintain a top-tier portfolio, drive innovation, and prioritize sustainability.

- Core values: Active ownership, strong management, and sustainable development.

- Alignment with mission, vision, and values is key to long-term success.

- Navigating market challenges and capitalizing on opportunities are critical.

Mission: What is Vornado Realty Trust Mission Statement?

Vornado Realty Trust's mission is to maximize shareholder value through strategic investments, superior property management, and development of premier office and retail assets, particularly in high-growth, high-barrier-to-entry markets such as New York City.

Understanding the Mission Vision Core Values of a company is crucial for investors and stakeholders. While a formal, publicly stated mission statement for Vornado Realty Trust is not readily available in the same way as for some other companies, we can infer its core objectives from its actions and communications. The Vornado Company focuses on creating value through its real estate portfolio.

Vornado's mission is evident in its active management of its portfolio. This includes acquiring and enhancing high-quality assets in prime locations, such as its significant presence in Manhattan. This strategy aims to generate stable revenue and long-term value appreciation.

Development projects, like those in the PENN District, are central to Vornado's mission. These projects are designed to transform and maximize the value of key urban areas. They represent a commitment to long-term growth and value creation.

Attracting and retaining high-quality tenants is a critical component of Vornado's mission. This focus ensures stable revenue streams and contributes to the overall financial health of the Real estate investment trust. Effective tenant management is a key operational priority.

Vornado’s mission is market-focused, emphasizing strategic investments and operational excellence. This approach is designed to benefit shareholders by capitalizing on opportunities in high-demand markets. It prioritizes value creation.

The ultimate goal of Vornado's mission is to deliver superior returns to shareholders. This is achieved through a combination of strategic property management, development, and prudent financial decisions. The focus is on long-term value.

Operational excellence is a key element of Vornado's mission, ensuring efficient property management and maximizing asset value. This involves optimizing all aspects of property operations to enhance profitability. Vornado's commitment to operational excellence is evident in its ability to adapt to changing market conditions and maintain a competitive edge.

The Vornado strategy is clearly value-centric. The company's actions reflect a commitment to maximizing the value of its assets and delivering returns to its shareholders. For instance, Vornado's investments in the PENN District, which includes significant redevelopment projects, demonstrate its long-term vision and commitment to creating value in key urban areas. As of Q1 2024, Vornado's portfolio comprised approximately 28.6 million square feet of office space and 2.1 million square feet of retail space, primarily in New York City. This portfolio generates substantial revenue, with a focus on maintaining high occupancy rates and attracting premium tenants. The company's focus on strategic acquisitions and active management of its properties is a testament to its mission of creating and preserving shareholder value. To learn more about the history of the company, you can read a brief history of Vornado Realty Trust.

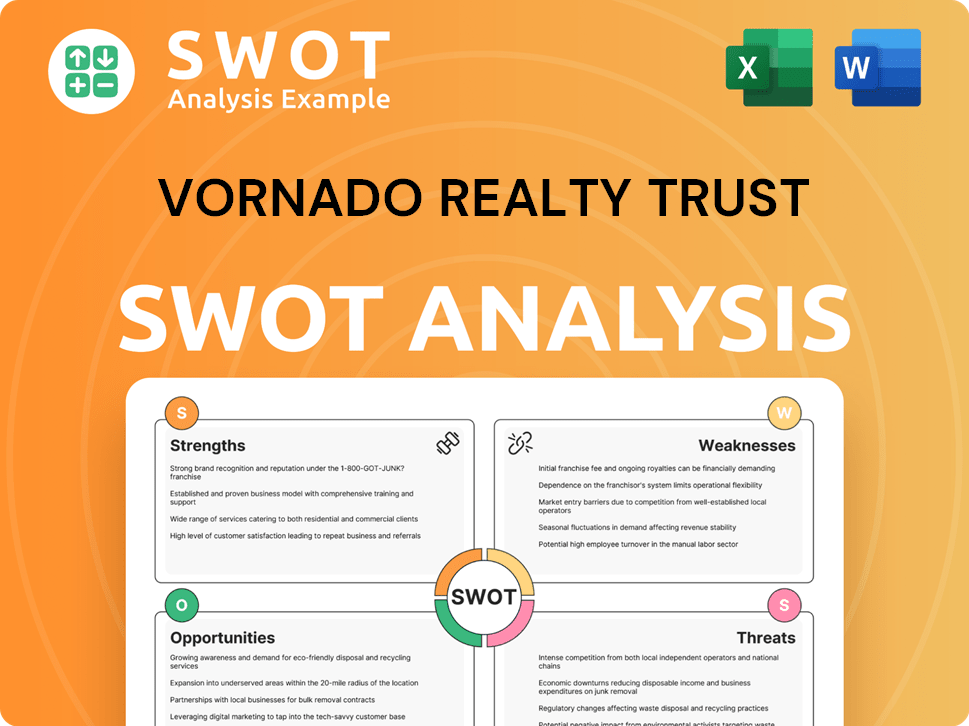

Vornado Realty Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Vornado Realty Trust Vision Statement?

Vornado's vision is to be the premier real estate investment trust, creating superior shareholder value through strategic investments, operational excellence, and a commitment to innovation and sustainability.

Let's delve into Vornado Realty Trust's vision, a critical element of understanding the Owners & Shareholders of Vornado Realty Trust. The company's vision is not merely a statement; it's a compass guiding its strategic direction and future endeavors.

At the core of Vornado's vision is the commitment to enhance shareholder value. This is achieved through strategic property investments, focusing on high-potential markets and assets. The goal is to deliver consistent returns and long-term growth for investors.

Vornado's strategy involves carefully selecting and investing in properties that offer significant growth potential. This includes acquisitions, developments, and redevelopments in key urban markets. Recent data shows Vornado has been actively managing its portfolio, with a focus on high-quality assets.

Operational excellence is a key pillar of Vornado's vision. This involves efficient property management, cost control, and maximizing the value of existing assets. By optimizing operations, Vornado aims to improve profitability and enhance shareholder returns.

Vornado's vision prioritizes maintaining a superior portfolio of premier assets, particularly in key urban markets like New York City. These prime locations offer stability and growth opportunities, contributing to the company's overall success. The company's focus on high-quality assets is evident in its portfolio composition.

Driving innovation and sustainability is a forward-looking aspect of Vornado's vision. This includes incorporating sustainable practices in development and management, as well as embracing technological advancements. This commitment reflects a focus on long-term value creation and responsible business practices.

Vornado's vision is decidedly future-oriented, aiming to adapt to evolving market dynamics and technological advancements. This strategic foresight positions Vornado to capitalize on emerging opportunities and maintain its leadership in the real estate investment trust sector. The company's forward-thinking approach is crucial for long-term success.

Vornado's vision provides a clear roadmap for its operations, emphasizing shareholder value, strategic investments, and a commitment to excellence. The company's focus on premier assets and innovation, particularly in sustainability, highlights its dedication to creating long-term value and adapting to future market trends. The vision serves as a guiding principle for all aspects of Vornado's business, from investment decisions to operational strategies. Understanding this vision is crucial for anyone seeking to analyze Vornado's strategy and assess its potential for future growth.

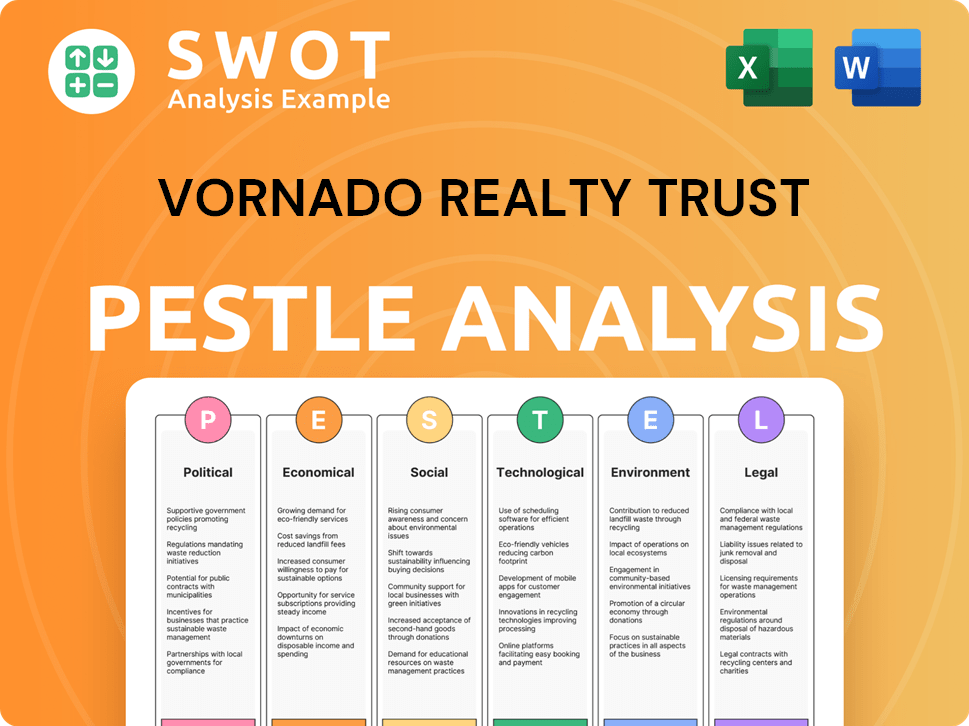

Vornado Realty Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Vornado Realty Trust Core Values Statement?

Understanding the core values of Vornado Realty Trust is crucial to grasping its operational philosophy and strategic direction. While not explicitly and comprehensively outlined in a single document, Vornado's actions and communications reveal a set of guiding principles that shape its corporate identity and drive its success as a leading real estate investment trust.

Active Ownership is a cornerstone of the Vornado Company's approach, emphasizing a hands-on, strategic approach to managing its properties. This value is demonstrated through consistent efforts to enhance properties via renovations and repositioning, ultimately attracting high-quality tenants and driving long-term value. This hands-on approach to their portfolio distinguishes Vornado in the real estate market.

Operational excellence is a key value for Vornado. This involves prioritizing tenant satisfaction and efficient operations to maximize property performance. Vornado focuses on maintaining high occupancy rates and generating increased income from existing properties, which enhances the tenant experience and operational efficiency. The company’s focus on operational excellence contributes to its unique corporate identity.

Vornado consistently seeks and executes value-creation opportunities through development and redevelopment projects. Their work in the PENN District is a prime example of their commitment to bold asset transformations that create long-term value. This proactive approach to development sets them apart and shapes their corporate identity as a forward-thinking real estate company. In 2023, Vornado invested significantly in projects aimed at enhancing its portfolio through active development, demonstrating its commitment to this core value.

Vornado is a leader in sustainability within the real estate industry. They have achieved 100% LEED certification across their in-service office portfolio and have ambitious goals for energy reduction and carbon neutrality by 2030. This strong commitment to environmental responsibility differentiates them and is becoming an increasingly important aspect of their corporate identity, appealing to environmentally conscious tenants and investors. This commitment is reflected in their environmental, social, and governance (ESG) reports, which detail their progress and future plans.

These core values of Vornado Realty Trust collectively shape the company's strategy and define its approach to the real estate market. To further understand how these values translate into strategic decisions, explore the next chapter, which examines how mission and vision influence the company's strategic decisions, and how they impact the overall Revenue Streams & Business Model of Vornado Realty Trust.

How Mission & Vision Influence Vornado Realty Trust Business?

Vornado Realty Trust's (Vornado Company) Mission Vision & Core Values are not merely statements; they are the foundational pillars that guide its strategic decisions and shape its operational approach. These principles influence every facet of the company, from property acquisitions and development to tenant relations and sustainability initiatives.

Vornado's mission and vision statements directly influence its business strategy, particularly its focus on premier assets in key urban markets. Their strategy involves acquiring quality properties, developing and redeveloping assets, and investing in operating companies with significant real estate components. This strategic alignment is crucial for long-term value creation.

- Acquiring and managing high-quality properties in prime locations.

- Developing and redeveloping assets to maximize value.

- Investing in operating companies with significant real estate components.

- Prioritizing long-term leases with high-quality tenants.

The redevelopment of the PENN District in New York City is a prime example of Vornado's mission in action. This large-scale project aims to transform a key urban area, creating significant value and aligning with their mission of maximizing value from premier assets. The project is designed to enhance the urban landscape and improve the overall tenant experience.

Securing long-term leases with high-quality tenants, such as the master lease with NYU at 770 Broadway, reflects Vornado's operational excellence value. This strategy contributes to the stability and value of their properties, ensuring consistent revenue streams and reducing risk. This approach is fundamental to their long-term financial health.

Vornado's commitment to sustainability initiatives, including achieving 100% LEED certification across their portfolio and setting ambitious carbon reduction goals, demonstrates their vision of driving innovation and sustainability in real estate. This commitment enhances their corporate social responsibility and attracts environmentally conscious tenants. This is a key aspect of their target market strategy.

Measurable success metrics, such as projected office occupancy rates exceeding 90% by 2025 in the Manhattan market, demonstrate the effectiveness of their operational strategies. Furthermore, the increase in comparable same-store Net Operating Income (NOI) by 3.9% in 2024 indicates strong financial performance and effective management. These metrics validate the alignment between their mission, vision, and strategic execution.

These guiding principles shape day-to-day operations by informing property management decisions, tenant relations, and investment evaluations. They also influence long-term planning for portfolio growth and sustainability targets, ensuring a cohesive and forward-thinking approach. This ensures that all activities are aligned with the company's core values.

Vornado's core values also significantly influence its corporate culture, fostering a work environment that emphasizes operational excellence, innovation, and sustainability. This culture attracts and retains top talent, further driving the company's success. Employee engagement and satisfaction are directly linked to the company's core principles.

In conclusion, the Mission Vision & Core Values of Vornado Realty Trust are not just aspirational statements; they are the driving force behind its strategic decisions, operational excellence, and commitment to sustainable growth. These principles ensure that Vornado remains a leader in the real estate investment trust (REIT) industry, consistently creating value for its stakeholders. Ready to delve deeper? Let's explore the next chapter: Core Improvements to Company's Mission and Vision.

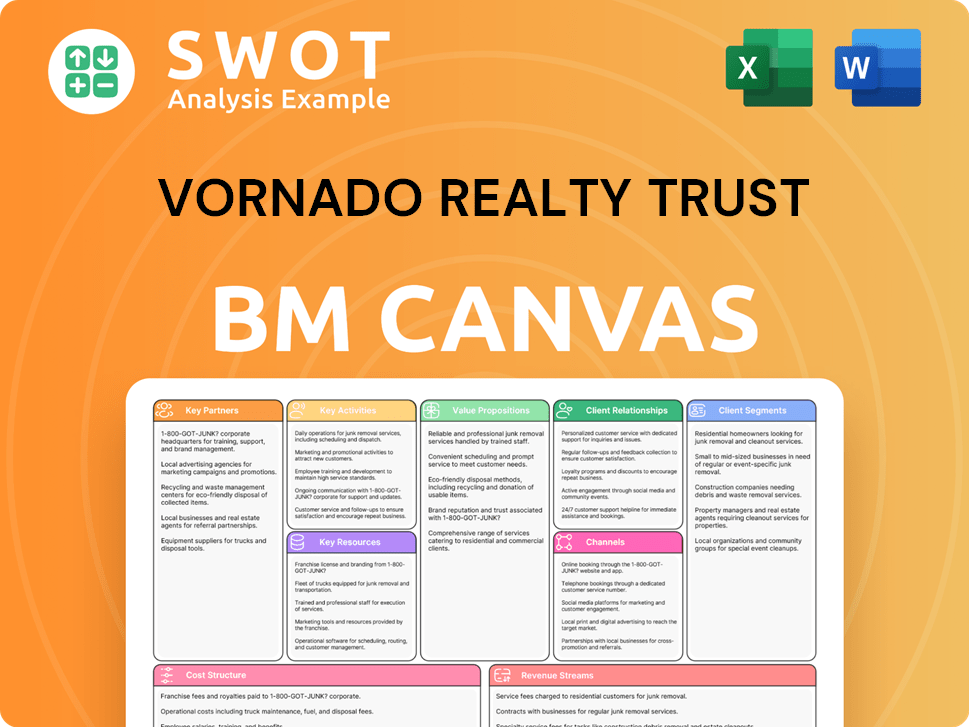

Vornado Realty Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Vornado Realty Trust's current approach is functional, there's room to amplify its impact and align with evolving industry standards. These improvements focus on enhancing clarity, transparency, and responsiveness to market dynamics, ultimately strengthening the Vornado Company's brand and appeal to stakeholders.

Creating a clear and concise mission statement is crucial for Vornado Realty Trust. This statement should explicitly define their purpose, target stakeholders (investors, tenants, employees), and the value they aim to deliver within the real estate investment trust (REIT) sector. This would provide greater clarity for investors, tenants, and employees, solidifying the Vornado Company's identity.

Formalizing and publicly listing core values with detailed explanations would significantly strengthen Vornado's corporate identity. This would provide a clear framework for expected behaviors and practices, fostering a stronger company culture and enhancing transparency for both internal and external stakeholders. This is especially important in a competitive market where corporate values influence investment decisions and employee engagement.

Vornado should explicitly integrate innovation and technology into its mission and vision statements. This reflects the increasing importance of these factors in modern real estate, including smart building technologies, data analytics for property management, and digital tenant experiences. This proactive approach can help Vornado stay competitive and capitalize on emerging opportunities, as demonstrated by the growing investment in proptech, which reached $32 billion in 2023.

The mission and vision should explicitly address the changing nature of work and its impact on office space demand. This includes adapting to hybrid work models, prioritizing flexible office designs, and investing in amenities that attract tenants. Furthermore, Vornado's strong sustainability efforts should be further integrated into its core mission, reflecting the growing importance of environmental, social, and governance (ESG) factors in real estate investment, with ESG-focused real estate funds experiencing significant growth in recent years. For more context, you can explore the Competitors Landscape of Vornado Realty Trust.

How Does Vornado Realty Trust Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible actions and outcomes. For Vornado Realty Trust, this implementation is seen through its operational practices and strategic initiatives, ensuring alignment across the organization.

Vornado Realty Trust demonstrates its commitment to its mission and vision through specific business initiatives and operational practices. The company's strategic focus on premier assets in key urban markets is evident in its significant investments, such as the PENN District redevelopment, which aims to transform the area into a modern mixed-use destination. Leadership plays a crucial role in reinforcing these statements through public communications, investor calls, and an emphasis on strategic priorities.

- Focus on Premier Assets: Vornado's strategy centers around owning and operating high-quality real estate, particularly in prime locations. This is a direct reflection of its mission to create value through superior real estate assets.

- PENN District Redevelopment: A major initiative, the PENN District project, exemplifies Vornado's vision for the future by transforming a key area into a vibrant, modern hub.

- Active Management: Vornado's approach to maintaining high occupancy rates and fostering strong tenant relationships reflects its commitment to its core values of operational excellence and tenant satisfaction.

- Sustainability Initiatives: Achieving 100% LEED certification across its in-service office portfolio showcases Vornado's commitment to sustainability, aligning with its values of responsible corporate citizenship.

Communicating the mission, vision, and core values to stakeholders is essential for ensuring alignment and building trust. Vornado utilizes various channels to disseminate this information, including investor presentations, annual reports, and its corporate website. These communications highlight the company's strategic objectives and demonstrate how its actions align with its stated values.

Vornado provides concrete examples of how it aligns its stated values with its business practices. The achievement of 100% LEED certification across its in-service office portfolio demonstrates its commitment to sustainability. Furthermore, the company's active management approach, aimed at maintaining high occupancy rates and strong tenant relationships, reflects its core values in action. For a deeper dive into Vornado's growth strategy, consider reading about the Growth Strategy of Vornado Realty Trust.

While specific formal programs solely focused on mission and vision alignment are not explicitly detailed, the integration of these principles into Vornado's strategic planning, operational management, and sustainability initiatives indicates a systemic approach to ensuring alignment. This holistic approach helps to embed the company's values into its culture and operations.

Vornado's performance is often measured through key metrics that reflect its mission and values. These include occupancy rates, which are crucial for demonstrating the value of its assets and its ability to attract and retain tenants. Financial metrics, such as funds from operations (FFO) and net operating income (NOI), also provide insights into the company's financial health and its ability to deliver on its strategic objectives. For example, in Q1 2024, Vornado reported an FFO of $0.60 per share, reflecting its ongoing efforts to optimize its portfolio and manage its financial performance.

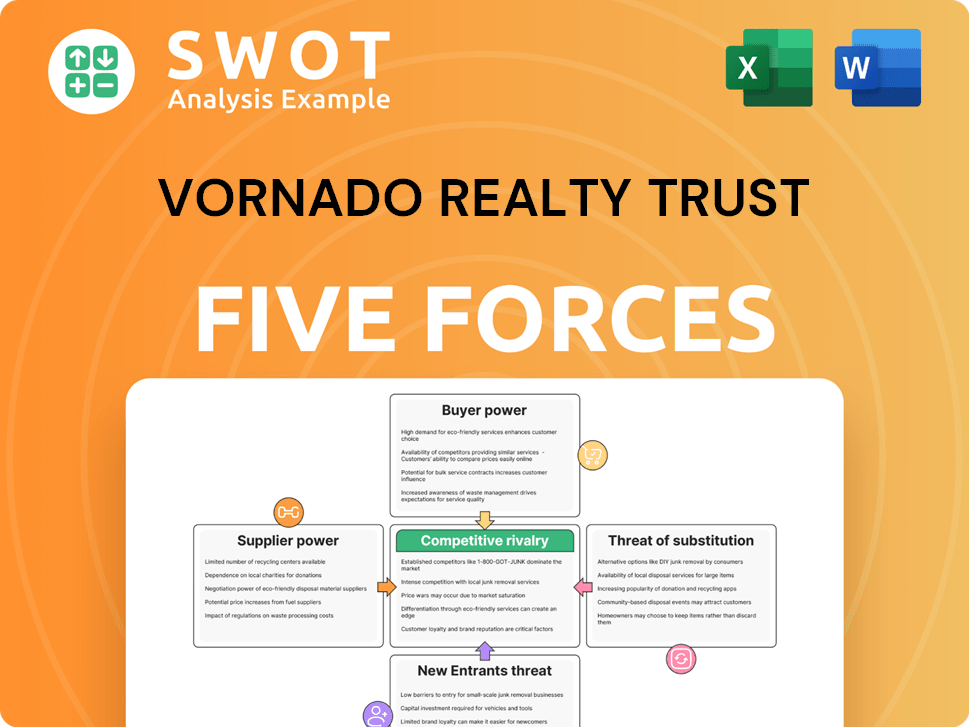

Vornado Realty Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vornado Realty Trust Company?

- What is Competitive Landscape of Vornado Realty Trust Company?

- What is Growth Strategy and Future Prospects of Vornado Realty Trust Company?

- How Does Vornado Realty Trust Company Work?

- What is Sales and Marketing Strategy of Vornado Realty Trust Company?

- Who Owns Vornado Realty Trust Company?

- What is Customer Demographics and Target Market of Vornado Realty Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.