Vornado Realty Trust Bundle

Can Vornado Realty Trust Continue Its Reign in Commercial Real Estate?

Vornado Realty Trust, a leading Real Estate Investment Trust (REIT), has carved a significant niche in the competitive real estate landscape. Its journey from a Manhattan decorating company to a commercial real estate powerhouse highlights the importance of a robust growth strategy. The company's strategic focus on premier office and retail properties, particularly in key markets like New York City, is central to its success.

From its humble beginnings, Vornado Realty Trust has consistently adapted and expanded, demonstrating its commitment to long-term growth. Understanding its Vornado Realty Trust SWOT Analysis is crucial for investors and analysts. Analyzing the company's financial performance and future outlook provides valuable insights into its potential within the commercial real estate sector. Exploring Vornado's growth opportunities and expansion plans will be key to assessing its future prospects as a REIT.

How Is Vornado Realty Trust Expanding Its Reach?

The expansion initiatives of Vornado Realty Trust, a prominent Real Estate Investment Trust (REIT), are primarily focused on strengthening its position in key markets, particularly New York City. The company's growth strategy involves strategic developments, asset optimization, and diversification to drive revenue and enhance shareholder value. These initiatives are designed to capitalize on market opportunities and maintain a competitive edge in the commercial real estate sector.

A core element of Vornado's strategy is the continued development and leasing of its Penn District properties. This area is seen as a significant growth engine, contributing to the company's long-term success. Furthermore, Vornado is exploring opportunities beyond traditional office spaces, such as small apartment developments, indicating a strategic diversification of its portfolio to adapt to evolving market demands.

The company's expansion plans are supported by robust financial performance and strategic transactions. For instance, in Q1 2025, Vornado leased 1.04 million square feet across its portfolio, with 709,000 square feet in New York City alone, at starting rents of $95 per square foot. This strong leasing activity is expected to increase occupancy rates to over 90% by 2025.

The Penn District is a central component of Vornado's growth strategy. Ongoing leasing activities in properties such as Penn 1 and Penn 2 are crucial. The company aims to capitalize on the prime location and high demand for office spaces in this area.

Vornado actively manages its asset base through strategic transactions. This includes master leases and property sales to enhance revenue streams and asset valuations. These moves are designed to optimize the company's portfolio and financial performance.

Vornado is exploring opportunities beyond traditional office spaces. This includes small apartment developments in the Penn District. Such diversification helps the company adapt to market changes and explore new revenue streams.

The company has engaged in significant transactions to optimize its asset base. The master lease agreement with New York University (NYU) for 1,076,000 square feet at 770 Broadway, a 70-year triple net lease completed on May 5, 2025, which included a $935 million upfront payment.

Vornado's expansion strategy is supported by strong financial performance and strategic transactions. The company's leasing activity and asset management efforts are key drivers of its growth. These initiatives are aimed at enhancing revenue streams and maintaining a competitive advantage.

- In January 2025, Vornado completed the sale of a portion of UNIQLO's flagship store at 666 Fifth Avenue for $350 million, generating net proceeds of $342 million.

- Vornado's joint venture agreed to sell 512 West 22nd Street, a Class A office building, for $205 million, with the transaction expected to close in Q3 2025.

- The company's focus on the Penn District and strategic asset management are expected to drive long-term growth.

- To learn more about how Vornado generates revenue, you can read about the Revenue Streams & Business Model of Vornado Realty Trust.

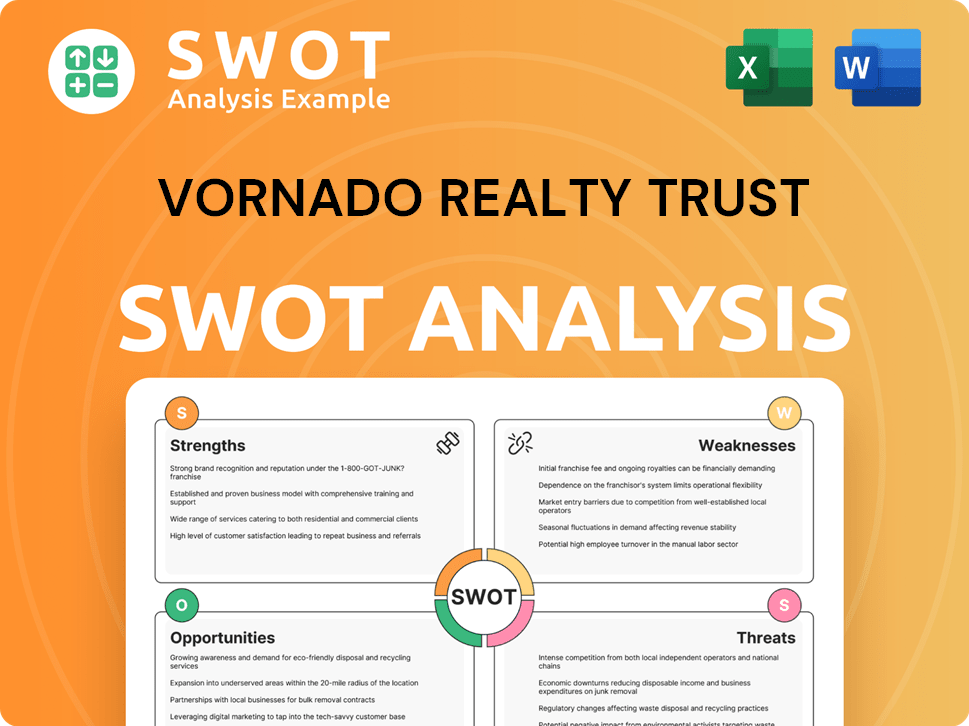

Vornado Realty Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vornado Realty Trust Invest in Innovation?

Vornado Realty Trust (VNO) integrates innovation and technology to drive its growth strategy, focusing on sustainability and digital transformation within the Real Estate Investment Trust (REIT) sector. This approach is crucial for maintaining a competitive edge in the commercial real estate market. The company's commitment to these areas is designed to enhance property values and attract high-quality tenants, improving its long-term financial performance.

The company's strategy includes leveraging technology for efficient operations and tenant services. While specific details about in-house R&D investments or collaborations with external innovators are not extensively detailed, the company's active management and optimization of its asset base suggest an embrace of modern tools and strategies. This proactive stance is essential for navigating the competitive landscape and capitalizing on growth opportunities.

Vornado Realty Trust's dedication to environmental sustainability and digital transformation is a key component of its overall growth strategy. The company's focus on these areas not only contributes to environmental responsibility but also enhances the long-term value proposition of its properties, attracting high-quality tenants and bolstering asset valuations.

Vornado Realty Trust is the first major real estate entity to achieve 100% LEED® certification across its in-service building portfolio. This commitment underscores its dedication to sustainable practices and environmental responsibility.

The company released its 16th consecutive sustainability report in 2024, highlighting key accomplishments. These reports provide transparency and demonstrate Vornado's ongoing efforts in environmental stewardship.

Vornado Realty Trust won the inaugural Nareit Impact at Scale Award for The Penn District transformation. This award recognizes the company's significant contributions to the industry.

The company received the Energy Star Partner of the Year with Sustained Excellence award for the 9th year. This recognition highlights its consistent efforts in energy efficiency.

Vornado ranks in the top 3% among Office REITs in GRESB, demonstrating its leadership in sustainable practices. This ranking reflects its strong performance in environmental, social, and governance (ESG) factors.

Vornado actively manages and optimizes its asset base, often relying on technological platforms for efficient operations and tenant services. This includes the use of modern tools and strategies to enhance its competitive position.

Vornado Realty Trust's focus on innovation and technology is evident through its sustainability initiatives and digital transformation efforts. These strategies are integral to the company's growth strategy and future prospects.

- Sustainability Initiatives: Achieving 100% LEED certification and consistently publishing sustainability reports.

- Digital Transformation: Utilizing technological platforms for efficient operations and tenant services.

- Energy Efficiency: Receiving the Energy Star Partner of the Year award for sustained excellence.

- Asset Optimization: Proactive management of the asset base to enhance value and attract tenants.

- Market Positioning: Focusing on securing high-quality tenants and optimizing its portfolio. See the Target Market of Vornado Realty Trust for more information.

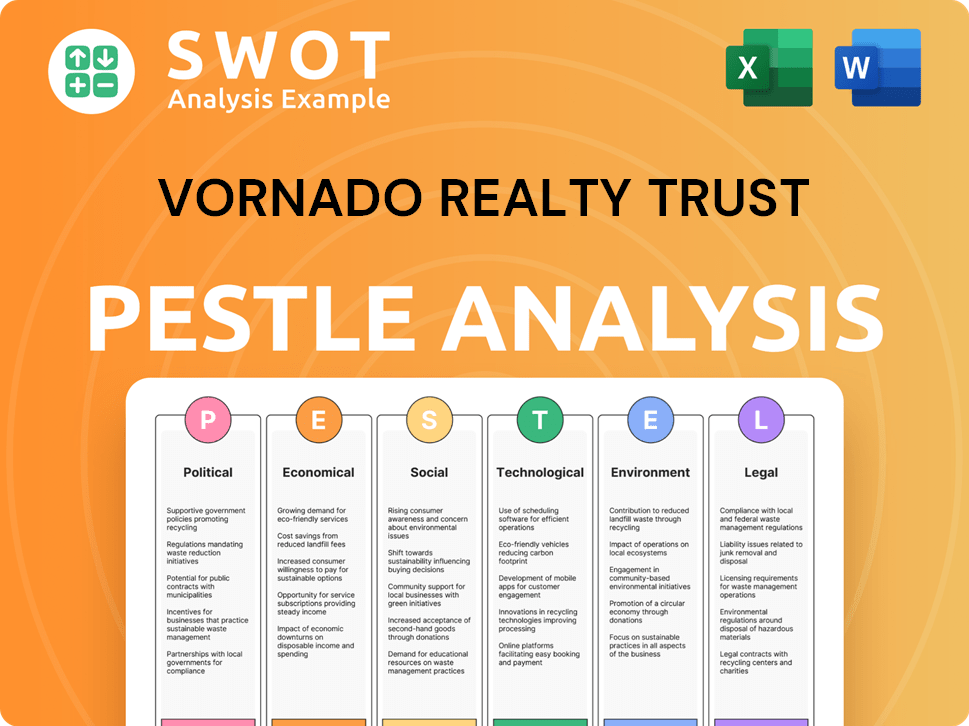

Vornado Realty Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vornado Realty Trust’s Growth Forecast?

In early 2025, Vornado Realty Trust (Vornado) showed a significant improvement in its financial health. The company, a prominent Real Estate Investment Trust (REIT), reported a strong start to the year, reflecting strategic moves and favorable market conditions. This performance is crucial for understanding the future prospects of Vornado and its growth strategy within the commercial real estate sector.

The financial outlook for Vornado is promising, with key metrics showing positive trends. The company's ability to navigate the complexities of the commercial real estate market and adapt to changing economic conditions is a key factor in its success. Investors and analysts are closely watching Vornado Realty Trust stock price and its ability to maintain this positive momentum.

For the first quarter of 2025, Vornado's net income attributable to common shareholders reached $86.8 million, or $0.43 per diluted share, a notable increase from a net loss in the same period of 2024. Funds From Operations (FFO), an important measure for REITs, also saw a rise, reaching $135.0 million, or $0.67 per diluted share, in Q1 2025. This positive trend in Vornado Realty Trust financial performance is a key indicator of its operational efficiency and strategic decisions.

Revenue for Q1 2025 was $461.5 million, exceeding the $436.3 million reported in Q1 2024. This increase demonstrates the company's ability to generate income from its property portfolio. This is a critical element in Vornado Realty Trust's investment strategy.

Strategic dispositions, such as the sale of a portion of the UNIQLO flagship store, contributed to the improved results. This generated a net gain of approximately $76 million recognized in Q1 2025. These actions are part of Vornado's broader growth strategy.

For the full year 2024, total revenue was $1.788 billion, a slight decrease of 1.3% from 2023. Net income for 2024 was $8.275 million, or $0.04 per diluted share. The Vornado Realty Trust earnings report reflects the company's overall financial health.

The company anticipates significant earnings growth by 2027, primarily driven by the lease-up of Penn 1 and Penn 2, expected to contribute $125 million in incremental net operating income (NOI). Wall Street analysts project an annual earnings growth rate of 70.7% for 2025-2027.

Vornado's financial performance is influenced by several key factors. The company's focus on capital management and strategic investments is crucial for its long-term success. Understanding these aspects provides insight into Vornado Realty Trust's future outlook.

- Q1 2025 Net Income: $86.8 million, or $0.43 per diluted share.

- Q1 2025 FFO: $135.0 million, or $0.67 per diluted share.

- 2024 Revenue: $1.788 billion.

- 2024 Net Income: $8.275 million, or $0.04 per diluted share.

Vornado's commitment to maintaining liquidity and capital management is evident in its financial strategies. The company's debt-to-equity ratio as of December 31, 2024, was 1.45:1, with total debt at approximately $11.78 billion. The company's expansion plans include potential debt refinancing and equity repurchases to support long-term growth. Vornado's ability to manage its finances effectively is key to its ability to navigate the competitive landscape.

In Q1 2025, Vornado completed a $450 million financing for 1535 Broadway, a premier Times Square retail destination. This demonstrates the company's ability to secure financing for its projects. To learn more about the company's values, you can read the article about Mission, Vision & Core Values of Vornado Realty Trust.

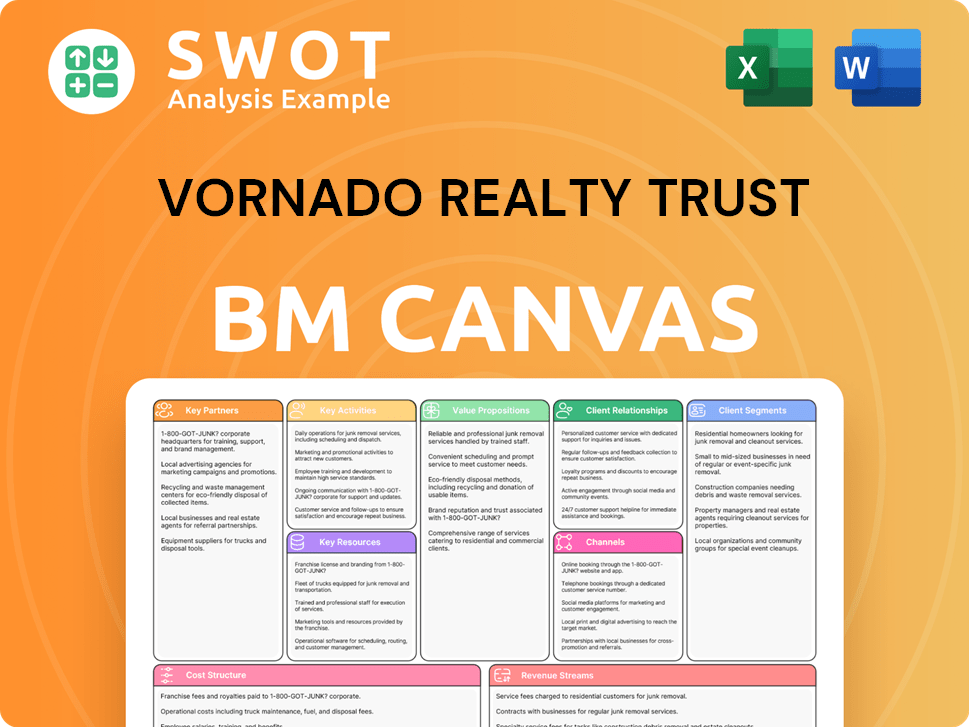

Vornado Realty Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vornado Realty Trust’s Growth?

The growth strategy of Vornado Realty Trust (VNO), a Real Estate Investment Trust (REIT), faces several significant risks. The commercial real estate market, particularly in urban office spaces, is undergoing substantial changes. These shifts, including the rise of remote work, could impact Vornado's financial performance.

Economic challenges, such as high interest rates and inflation, further complicate Vornado's strategic plans. These factors can increase borrowing costs and potentially lower property values. The company's financial health is also influenced by its debt levels and the risk of a credit rating downgrade.

Competitive pressures within the Manhattan office market and macro uncertainties also pose challenges. Vornado's concentration in the New York metropolitan area makes it susceptible to local economic cycles. The company actively manages these risks through disciplined financial planning and strategic initiatives.

The shift towards remote and hybrid work models poses a risk to Vornado's office properties. This could lead to higher vacancy rates and reduced rental income. The company must adapt to these changing tenant needs to maintain its financial stability.

Rising interest rates and inflation present significant economic challenges. These factors can increase the cost of debt and potentially depress property valuations. Careful financial management is crucial to navigate these conditions.

Vornado's debt-to-equity ratio was approximately 1.74 and its interest coverage ratio was around 1.93 as of February 2025. The company has $276 million in debt maturing within the next 24 months. These figures highlight the importance of managing debt and interest expenses effectively.

The Manhattan office market is highly competitive, adding to the challenges. High construction costs and macro uncertainties can affect leasing activity. Vornado needs to maintain its competitive edge to secure tenants and maintain profitability.

Vornado's significant presence in the New York metropolitan area makes it vulnerable to local economic cycles. Regulatory changes and shifts in the local economy can directly impact the company's performance. Diversification efforts are also important.

The company uses disciplined financial management, including hedging strategies, to mitigate risks. Strategic leasing and development activities are also crucial. Exploring diversification opportunities, such as small apartment developments, helps manage risks.

Vornado faces potential risks related to vacancy and default rates. A potential vacancy rate of 15.2% and a potential tenant default rate of 7.3% could significantly reduce rental revenue. These rates directly impact the company's income streams and overall financial stability.

A potential credit rating downgrade could increase Vornado's borrowing costs. This would make it more expensive for the company to finance its operations and development projects. Careful financial planning is essential to maintain a strong credit profile.

Vornado's focus on securing high-quality tenants and optimizing its asset base is a key strength. This strategy helps the company remain competitive in the market. The ability to attract and retain strong tenants is crucial for long-term success.

Understanding market dynamics is crucial for Vornado's success. The company needs to adapt to changing tenant needs and economic conditions. For more information, consider reading the Brief History of Vornado Realty Trust.

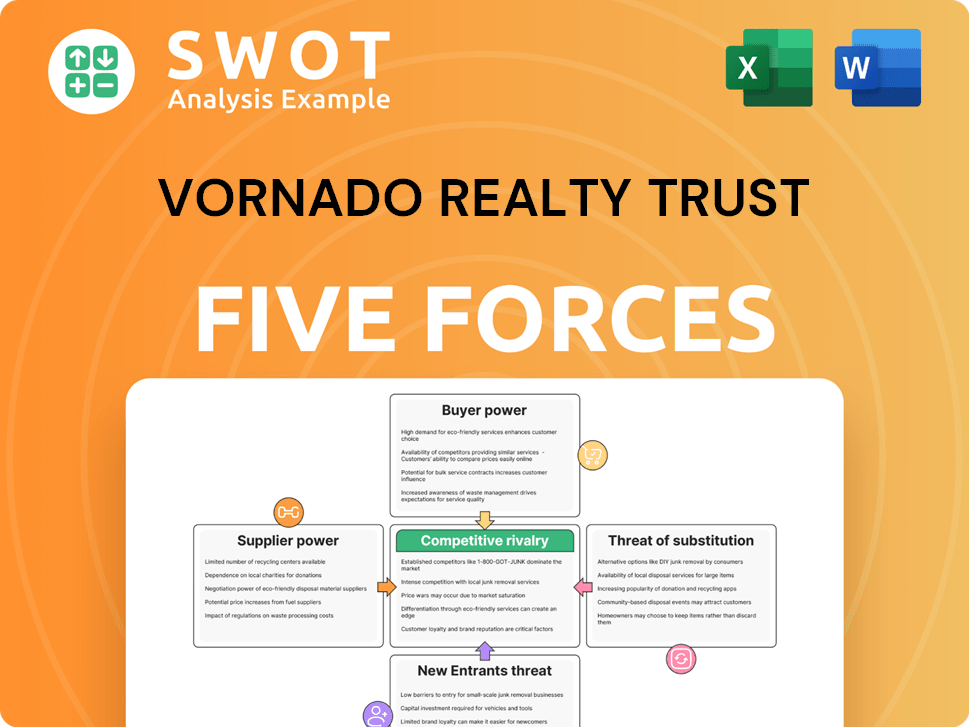

Vornado Realty Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vornado Realty Trust Company?

- What is Competitive Landscape of Vornado Realty Trust Company?

- How Does Vornado Realty Trust Company Work?

- What is Sales and Marketing Strategy of Vornado Realty Trust Company?

- What is Brief History of Vornado Realty Trust Company?

- Who Owns Vornado Realty Trust Company?

- What is Customer Demographics and Target Market of Vornado Realty Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.