Voya Financial Bundle

How Well Do You Know the Voya Financial Story?

Voya Financial, a key player in financial services, boasts a fascinating history of growth and adaptation. From its roots as a subsidiary to its current status, the company's journey reflects significant shifts in the financial landscape. Understanding the Voya Financial SWOT Analysis is key to grasping their strategic evolution. This exploration will uncover the pivotal moments that shaped Voya Financial into the industry leader it is today.

The Voya Financial story began in 1999 as ING U.S., a branch of the ING Group, aiming to provide robust retirement plans and other financial services to the American market. This strategic move allowed them to leverage ING's global expertise. The company's transformation into Voya Financial marked a new chapter, solidifying its commitment to serving millions of customers with innovative investment products and insurance solutions.

What is the Voya Financial Founding Story?

The Voya Financial story began in 1999. At this time, ING Groep N.V. brought together its U.S. retirement, investment, and insurance businesses under the name ING U.S. This move was a strategic effort to simplify operations and strengthen ING's presence in the American financial market, influenced by the increasing demand for financial planning and retirement solutions.

The initial focus of ING U.S. was to offer a wide range of financial products. These included retirement plans, annuities, life insurance, and investment management services. Leveraging ING's global reputation and financial strength, ING U.S. quickly established itself. The strategic decision by ING Groep N.V. to consolidate its U.S. operations was a key moment in the Voya history. The company utilized ING's existing client base and distribution networks for rapid market penetration.

Financial backing came directly from ING Groep N.V., providing significant capital for growth and expansion. This eliminated the need for external funding in the early stages.

The founding of Voya Financial was a strategic consolidation by ING Groep N.V. to strengthen its U.S. financial services offerings. This move was in response to the growing demand for retirement and financial planning solutions in the U.S. market.

- 1999: ING Groep N.V. consolidates its U.S. businesses under ING U.S.

- Business Model: Focused on a broad range of financial products, including retirement plans and investment management.

- Funding: Primarily supported by ING Groep N.V., ensuring financial stability for growth.

- Market Strategy: Utilized ING's existing infrastructure for rapid market penetration.

Voya Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Voya Financial?

The early years of Voya Financial, formerly known as ING U.S., were marked by significant growth and strategic expansion within the financial services sector. This period focused heavily on establishing a strong presence in the defined contribution retirement plan market. Key to this growth was a series of strategic acquisitions and the development of new financial products.

During its initial phase, Voya Financial concentrated on the defined contribution retirement plan market. This focus allowed the company to capitalize on the increasing demand for retirement solutions. The strategic direction helped in establishing a strong foundation in the financial services industry. The company aimed to provide comprehensive financial planning services.

A pivotal acquisition was Aetna Financial Services in 2000, which significantly increased Voya Financial's presence in the retirement plan and annuity markets. This acquisition provided the company with additional scale and expertise. These strategic moves were crucial for expanding its market share and service offerings. The company continued to seek opportunities to enhance its portfolio.

Voya Financial expanded its offerings by developing new investment products and enhancing its insurance offerings. This diversification was crucial for meeting the evolving needs of its clients. The company aimed to provide a comprehensive suite of financial services under a unified brand. This approach helped in attracting a broader customer base.

The market generally responded positively to Voya Financial's growth strategy, benefiting from the strong brand recognition of its parent company, ING Group. The increasing demand for financial security products further boosted its growth. The company's ability to integrate diverse financial products under one brand was key. For more insights, explore the Competitors Landscape of Voya Financial.

Voya Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Voya Financial history?

The Voya Financial journey has been marked by significant milestones, including its evolution from a subsidiary of ING Group to an independent, publicly traded entity. This transformation has allowed the company to redefine its strategic direction and focus on its core mission of helping individuals plan for their financial futures.

| Year | Milestone |

|---|---|

| May 2013 | Initial Public Offering (IPO) marked a crucial step towards independence for the company, then operating as ING U.S. |

| April 2014 | Official rebranding to Voya Financial, Inc., signaling a new chapter focused on empowering Americans in financial planning. |

| 2024 | Recognized as one of the 'World's Most Ethical Companies' by Ethisphere for the eleventh consecutive year, highlighting commitment to ethical business practices. |

| 2024 | Included in the Bloomberg Gender-Equality Index for six consecutive years, demonstrating efforts in promoting gender equality. |

Voya Financial continually innovates within the financial services sector, particularly in retirement plans and investment products. The company leverages technology to enhance customer experience, offering personalized solutions to meet evolving financial needs.

Voya Financial has been developing more personalized retirement solutions to cater to the diverse needs of its customers. These solutions are designed to provide tailored financial advice and planning tools.

The company utilizes technology to improve customer experience, making financial planning and management more accessible. This includes user-friendly online platforms and mobile applications.

Voya Financial continuously updates its investment product offerings to meet market demands and provide competitive options. This includes a range of investment products.

Voya focuses on enhancing customer service through various channels, including digital and in-person support. This ensures customers receive timely and effective assistance.

Voya provides a suite of financial planning tools to help customers make informed decisions about their financial futures. These tools cover retirement, investments, and insurance needs.

The company invests in digital platforms that offer easy access to account information, educational resources, and financial planning tools. These platforms enhance customer engagement.

Navigating challenges such as market volatility and regulatory changes has been a constant for Voya Financial. The company addresses these issues by focusing on innovation in its product offerings and enhancing its customer service capabilities.

Voya Financial manages market volatility through strategic investment approaches and risk management strategies. These strategies help protect customer investments.

The company adapts to evolving regulatory landscapes by ensuring compliance and updating its practices. This includes staying informed about new financial regulations.

Voya addresses competitive pressures by continuously improving its products and services. This includes offering competitive pricing and innovative solutions.

Voya Financial navigates economic fluctuations by diversifying its investment portfolio. This reduces the impact of economic downturns on customer investments.

The company invests in technological advancements to enhance customer experience and streamline operations. This includes adopting new digital tools.

Voya Financial responds to changing customer needs by offering flexible and customizable financial solutions. This includes providing tailored financial advice.

Voya Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Voya Financial?

The Voya Financial journey began in 1999 when ING Groep N.V. consolidated its U.S. financial services businesses, setting the stage for what would become a major player in the financial services sector. Over the years, Voya Financial has undergone significant transformations, including strategic acquisitions and a rebranding, shaping its focus on retirement plans, investment management, and benefits solutions. The company's commitment to ethical practices and its dedication to serving its customers have been consistent themes throughout its history, making it a notable entity in the financial landscape.

| Year | Key Event |

|---|---|

| 1999 | ING Groep N.V. consolidates its U.S. financial services businesses to form ING U.S. |

| 2000 | Acquires Aetna Financial Services, expanding its retirement and annuity businesses. |

| May 2013 | ING U.S. completes its initial public offering (IPO) on the New York Stock Exchange. |

| April 2014 | ING U.S. officially rebrands to Voya Financial, Inc. |

| 2018 | Voya Financial completes the sale of its individual life insurance and annuity businesses, focusing on workplace and institutional markets. |

| 2020 | Voya named one of the 'World's Most Ethical Companies' by Ethisphere for the seventh consecutive year. |

| 2024 | Voya named one of the 'World's Most Ethical Companies' by Ethisphere for the eleventh consecutive year. |

Voya Financial is concentrating on strengthening its position in workplace and institutional markets. The company is actively investing in digital transformation to improve both client experiences and operational efficiency. This strategic direction is designed to meet the evolving needs of its customers and maintain a competitive edge in the industry.

A key aspect of Voya's future involves digital transformation. This includes enhancing online platforms and mobile applications to provide seamless and efficient services. By embracing technology, Voya aims to improve how customers manage their retirement plans and other financial products, offering greater convenience and accessibility.

Voya is committed to offering holistic financial wellness solutions. This involves providing comprehensive support for retirement planning, investment management, and benefits solutions. The goal is to address the diverse financial needs of its approximately 14.7 million individual and institutional customers. This approach helps individuals and institutions secure their financial futures.

Looking ahead, Voya Financial is focused on innovation in retirement planning and investment management. The company is also expanding its health solutions offerings, integrating its wealth management capabilities further. These initiatives are designed to drive growth and maintain Voya's leadership in the financial services sector.

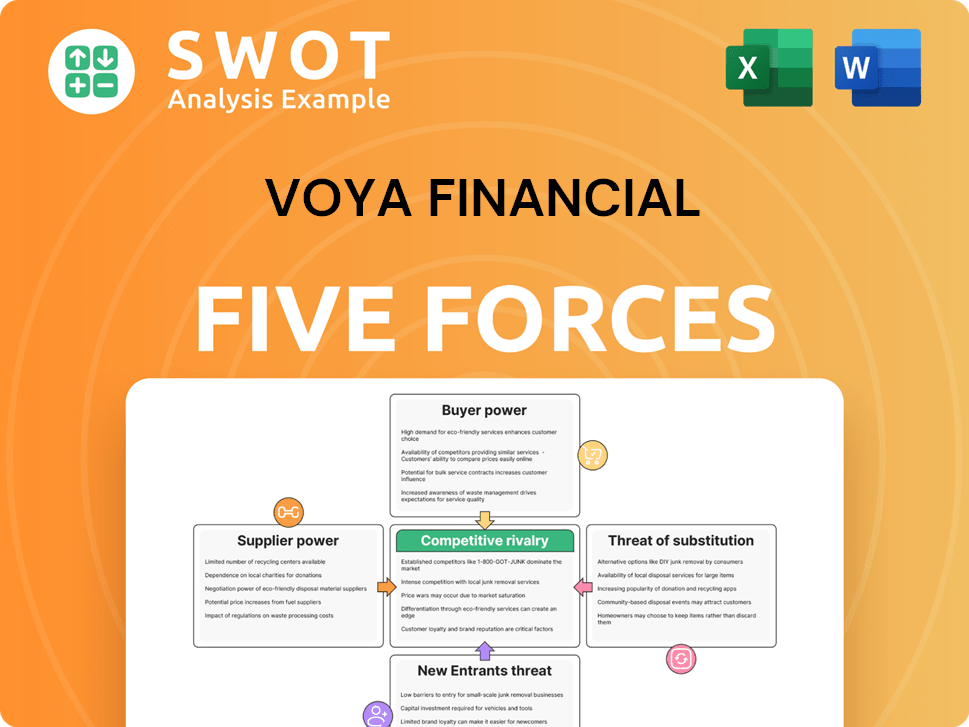

Voya Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Voya Financial Company?

- What is Growth Strategy and Future Prospects of Voya Financial Company?

- How Does Voya Financial Company Work?

- What is Sales and Marketing Strategy of Voya Financial Company?

- What is Brief History of Voya Financial Company?

- Who Owns Voya Financial Company?

- What is Customer Demographics and Target Market of Voya Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.