Voya Financial Bundle

How Does Voya Financial Thrive in Today's Market?

Voya Financial, a major player in the U.S. financial services sector, serves millions with its retirement plans, investment options, and insurance products. The company's strategic focus on workplace and individual solutions highlights its commitment to helping Americans secure their financial futures. Understanding Voya's operations is key for anyone looking to navigate the complexities of the financial landscape.

For investors, understanding Voya Financial SWOT Analysis offers a strategic edge, revealing the company's strengths, weaknesses, opportunities, and threats. This knowledge is crucial for evaluating Voya's financial health and growth potential, especially considering its ongoing efforts to optimize its business model. Whether you're researching Voya Financial 401k plan details or seeking Voya Financial retirement planning services, this analysis provides essential insights into Voya Company's operations and market position.

What Are the Key Operations Driving Voya Financial’s Success?

Voya Financial creates value by offering a comprehensive suite of financial solutions designed to help individuals plan, invest, and protect their savings. Their core offerings span workplace solutions, including retirement plans, and individual products such as investment management and insurance. This approach allows Voya to serve a broad customer base, from large corporations to individual clients seeking financial guidance.

Operationally, Voya Financial leverages a robust technological infrastructure to efficiently manage retirement plans, investment platforms, and insurance policies. They utilize digital portals, advisory tools, and automated processes for transactions and claims. Distribution occurs through multiple channels, including direct sales, financial advisors, and partnerships. This integrated strategy provides a holistic view of financial well-being across different life stages.

The company's value proposition lies in its integrated approach, digital accessibility, and personalized advice, which simplifies financial management, tailors investment strategies, and provides comprehensive protection. This differentiates Voya in a competitive market. For those interested in understanding the company's strategic direction, exploring the Growth Strategy of Voya Financial can provide further insights.

Voya Financial provides various retirement plans, including 401(k)s, 403(b)s, and 457s, to help individuals save for retirement. These plans are a core part of Voya's workplace solutions, offering a range of investment options and services to plan participants. In 2024, the retirement market saw significant growth, reflecting the importance of these services.

Voya offers investment management services to both institutional and individual clients, providing diverse investment options. These services include managed accounts, mutual funds, and other investment products designed to meet various financial goals. The investment management sector has seen increased demand, reflecting the need for expert guidance.

Voya provides a range of insurance products, including life, disability, and voluntary benefits, to protect individuals and their families. These products offer financial security and peace of mind. The insurance market continues to be vital, with many people seeking coverage.

Voya serves diverse customer segments, including large corporations, small businesses, and individual clients. This broad customer base allows Voya to offer its financial products and services to a wide range of individuals. The ability to serve varied customer needs is a key strength.

Voya's operations are highly reliant on technology, data management, and a skilled workforce. They use digital platforms for plan participants and financial professionals. The company's distribution network includes direct sales, financial advisors, and strategic partnerships.

- Technology Infrastructure: Voya invests heavily in technology to ensure efficient administration of retirement plans and insurance policies.

- Distribution Channels: The company utilizes multiple channels, including direct sales and partnerships, to reach its customers.

- Workforce: A skilled workforce of financial professionals and customer service representatives supports Voya's operations.

- Customer Service: Voya focuses on providing excellent customer service to ensure customer satisfaction.

Voya Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Voya Financial Make Money?

Voya Financial, a prominent player in the financial services sector, generates revenue through various streams, reflecting its diverse offerings in retirement, investment, and insurance. The company's financial model is built on a foundation of fees, premiums, and investment income, designed to provide consistent returns and support its operational activities. Understanding these revenue sources is key to grasping Voya's overall financial health and strategic direction.

The company's approach to monetization involves a mix of strategies, including asset-based fees, premium collections, and investment returns. These methods are complemented by targeted efforts such as cross-selling and strategic business adjustments. This multifaceted strategy enables Voya to adapt to market changes and maintain a strong financial position.

A significant portion of Voya's revenue comes from fees associated with managing retirement plans and investment assets. These fees are typically calculated as a percentage of assets under management (AUM) or through per-participant fees for administrative services. In early 2024, Voya reported substantial AUM, contributing significantly to its revenue. This fee-based model is a stable source of income, directly linked to the value of the assets it manages.

Voya Financial's revenue streams are diversified across several key areas, each contributing to the company's financial performance. These streams are designed to capture value from various financial products and services, ensuring a robust and resilient business model.

- Retirement Plans: Revenue is generated through fees for managing retirement plans, including 401(k)s and other defined contribution plans. These fees are typically based on a percentage of assets under management (AUM) or per-participant charges.

- Investment Options: Fees are earned from offering various investment options within retirement plans and through individual investment accounts. This includes fees related to the management of mutual funds, annuities, and other investment products.

- Insurance Products: Premiums from life, disability, and voluntary benefits insurance policies constitute a significant revenue stream. These premiums are collected regularly, providing a consistent source of income.

- Investment Income: Voya generates investment income from its general account, which holds assets supporting its insurance liabilities. This income is derived from investments in various assets, contributing to overall profitability.

Another crucial revenue stream for Voya is derived from premiums collected on its insurance products. These include life insurance, disability insurance, and voluntary benefits. These premiums form the core of its insurance business and provide a steady income stream. Voya's ability to manage and price these products effectively is essential for its profitability. For more insights into Voya's strategic direction, consider reading about the Growth Strategy of Voya Financial.

Voya employs various monetization strategies to maximize its revenue potential. Tiered pricing for retirement plan services is used, where larger plans or those with complex needs may be subject to different fee structures. Cross-selling is another key strategy, where clients utilizing one Voya product are offered other services, such as individual investment accounts or insurance policies. The company also earns revenue through investment income from its general account, which holds assets supporting its insurance liabilities.

Voya Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Voya Financial’s Business Model?

Voya Financial has undergone significant transformations, shaping its operational and financial standing. A key strategic move was its spin-off from ING Group in 2013, establishing its independent identity in the U.S. financial market. More recently, the company has focused on strategic acquisitions and divestitures to streamline its business model.

These moves reflect a deliberate effort to enhance its competitive advantage by focusing on core strengths and higher-growth areas, such as workplace and institutional clients. The company has also adapted to evolving regulatory landscapes and market downturns. Its competitive advantages stem from strong brand recognition, an extensive distribution network, and a commitment to technology-driven solutions.

Ongoing investment in digital platforms and data analytics allows Voya to offer personalized advice and streamlined services, adapting to trends like the increasing demand for holistic financial wellness solutions. This continuous adaptation, coupled with its established market presence, sustains its business model. For more details on the company's structure, you can explore the information about Owners & Shareholders of Voya Financial.

The spin-off from ING Group in 2013 marked a pivotal moment, establishing Voya as an independent entity. Strategic acquisitions and divestitures, such as the sale of individual life insurance and annuities, have streamlined operations. These changes reflect a focus on core strengths and growth areas, particularly in workplace and institutional clients.

Voya has strategically focused on workplace and institutional clients. The company has divested certain business lines to concentrate on core competencies and high-growth areas. These moves aim to improve efficiency and customer service through technology and data analytics.

Voya's strong brand recognition within the retirement and benefits space is a key advantage. An extensive distribution network reaches a broad base of employers and individuals. The company's commitment to technology-driven solutions enhances customer experience and operational efficiency.

Adapting to evolving regulatory landscapes in the financial services industry is a constant challenge. Responding to market downturns and economic fluctuations requires strategic agility. Maintaining customer trust and satisfaction during periods of change is crucial.

Voya Financial reported total revenue of approximately $1.4 billion for the first quarter of 2024. The company's strategic focus includes expanding its wealth solutions and enhancing its digital capabilities. These initiatives are aimed at improving customer engagement and operational efficiency.

- Retirement plans are a core offering, with significant assets under management.

- Investment options are diversified to meet various client needs.

- Insurance products provide financial security.

- Technology investments are ongoing to improve customer experience and streamline operations.

Voya Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Voya Financial Positioning Itself for Continued Success?

Voya Financial holds a strong position in the U.S. financial services sector, particularly in workplace retirement and institutional investment. The company is a top provider of defined contribution plans, showing significant market share and customer loyalty. Its main focus is the U.S. market, where it uses its established brand and distribution capabilities.

However, Voya faces risks like regulatory changes and competition from fintech companies. Technological advancements and changing consumer preferences also require Voya to adapt. The company is working on enhancing its digital capabilities and expanding advisory services to meet evolving client needs.

Voya Financial is a key player in the U.S. financial services market, specializing in retirement plans and institutional investments. It consistently ranks among the top providers of retirement plans, demonstrating strong market presence. Its focus is primarily on the U.S. market, where it leverages its established brand and distribution networks.

Voya faces risks from regulatory changes in financial services, which could increase compliance costs. Competition from fintech companies and technological disruptions like AI also pose challenges. Adapting to changing consumer preferences for digital experiences and sustainable investing is crucial.

Voya is focused on enhancing its digital capabilities and expanding advisory services. The company aims to grow by focusing on its core strengths in workplace and institutional markets. They are also exploring opportunities in areas like health savings accounts and financial wellness programs.

Voya is working on improving its digital platforms and advisory services. They are also focused on deepening relationships with institutional clients. Leadership emphasizes sustainable growth, innovation in product development, and data-driven financial solutions.

Voya Financial's strategy involves enhancing its digital platforms and advisory services to meet evolving client needs. They are focused on sustainable growth by focusing on core strengths in workplace and institutional markets. They also aim to expand into areas like health savings accounts and financial wellness programs.

- Focus on digital transformation to improve customer experience and operational efficiency.

- Expand advisory services to provide more personalized financial advice.

- Strengthen relationships with institutional clients to increase market share.

- Explore new market opportunities, such as health savings accounts and financial wellness programs.

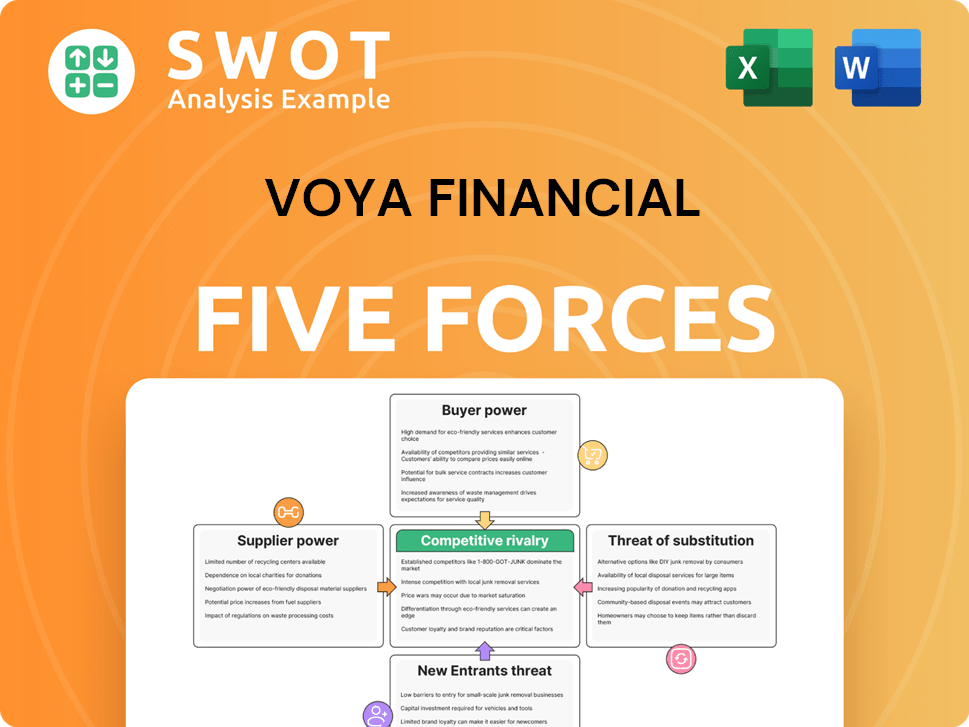

Voya Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Voya Financial Company?

- What is Competitive Landscape of Voya Financial Company?

- What is Growth Strategy and Future Prospects of Voya Financial Company?

- What is Sales and Marketing Strategy of Voya Financial Company?

- What is Brief History of Voya Financial Company?

- Who Owns Voya Financial Company?

- What is Customer Demographics and Target Market of Voya Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.