Workiva Bundle

How Did Workiva Revolutionize Financial Reporting?

Imagine a world where financial reporting is seamless, accurate, and transparent. That's the vision that sparked the creation of Workiva, a company that would transform how businesses handle critical data. From its inception, Workiva aimed to simplify complex processes, especially those related to SEC reporting and compliance. This journey began in 2008, leading to the development of the innovative Workiva SWOT Analysis.

This brief history of Workiva unveils its evolution from a startup to a global SaaS leader. Understanding the Workiva company background, including its founding date and early years, is crucial for grasping its impact. Today, Workiva's platform supports thousands of enterprises, making it a key player in the industry, with significant market share and a strong growth trajectory. Exploring Workiva's key milestones reveals how it has shaped the landscape of financial reporting and compliance.

What is the Workiva Founding Story?

The story of the Workiva company began in August 2008, when WebFilings LLC was established in California. This marked the beginning of what would become a significant player in the world of financial reporting and compliance. The founders, including Matthew Rizai, Martin Vanderploeg, and Jeff Trom, saw an opportunity to revolutionize how businesses handled their financial data.

The founders' prior experience at Engineering Animation Inc. (acquired by Siemens in 2000) gave them a unique perspective on the challenges of enterprise software. They recognized the need for a more efficient system, especially after the Sarbanes-Oxley Act. Their aim was to simplify the complex processes of SEC reporting and compliance, using a cloud-based solution.

The initial focus of the company was on SEC reporting solutions, and in 2010, the first product was launched. This cloud-based platform automated SEC filings, using document tags and linking, allowing companies to file electronically with the SEC in XBRL format. This innovation quickly made an impact, with a Workiva customer being the first to file Inline XBRL with the SEC.

Workiva's early years were marked by a focus on solving the inefficiencies of SEC reporting. The founders' experience in enterprise software and their understanding of data management challenges were key to their success. The company's initial cloud-based platform was designed to streamline the SEC filing process.

- Founded in August 2008 as WebFilings LLC.

- Focused on simplifying SEC reporting and compliance.

- Launched its first cloud-based product in 2010.

- The platform utilized XBRL format for electronic filings.

While specific details about early funding are not widely available, the founders' experience in the software industry likely played a key role. The company's name changed from WebFilings LLC to Workiva LLC in July 2014. This change signaled the company's expansion beyond SEC filings to a wider range of compliance and reporting solutions. The founding team's expertise in enterprise software and their shared experience were instrumental in pursuing this venture to revolutionize financial and compliance reporting.

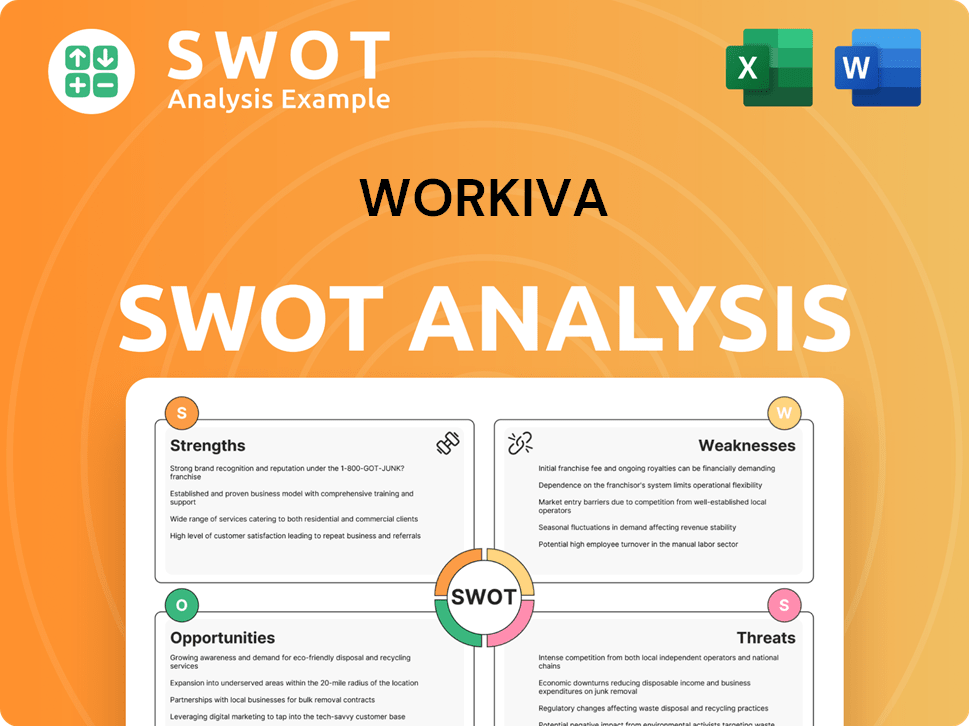

Workiva SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Workiva?

The early years of Workiva, a Workiva company, were marked by the launch of its flagship product, Wdesk. This cloud-based platform transformed how businesses handled critical data. The initial focus was on SEC reporting solutions, which quickly gained traction in the market.

By 2012, Workiva reached a significant milestone, with 1,000 customers. In 2013, the company expanded its product offerings to include SOX compliance solutions. This expansion broadened the appeal of Workiva products to a wider range of corporate compliance needs.

A major strategic shift occurred in July 2014 when the company rebranded from WebFilings LLC to Workiva LLC. This rebranding signaled its intent to address a broader spectrum of compliance and reporting challenges. This rebranding coincided with its preparation for an initial public offering (Workiva IPO), which was completed on December 12, 2014, raising approximately $101 million.

Following its Workiva IPO, the company introduced the Workiva platform in 2015, further expanding its capabilities beyond regulatory reporting. In 2016, the launch of Wdata enhanced the platform's data integration capabilities. This allowed customers to connect and manage financial and non-financial data from multiple sources.

Workiva's growth strategy has emphasized multi-solution adoption. In Q1 2025, 69% of subscription revenue came from customers using multiple Workiva products, up from 66% in Q1 2024. Geographically, approximately 85% of revenue came from the United States in Q1 2024, with international revenue contributing about 15% and growing 25% year-over-year.

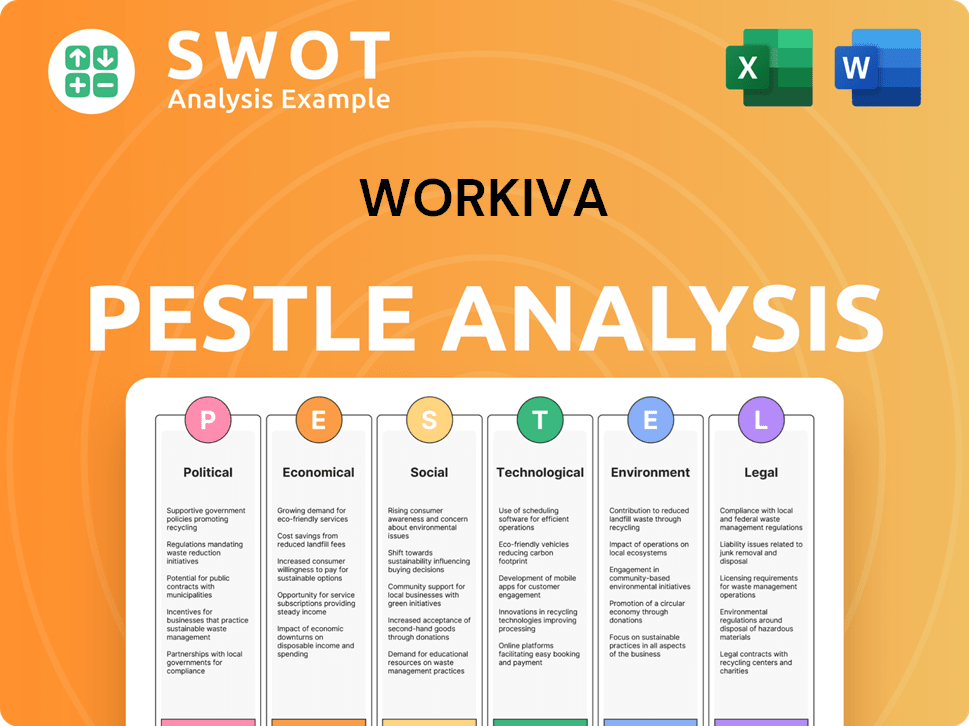

Workiva PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Workiva history?

The Workiva company has achieved several significant milestones since its founding, particularly in cloud-based reporting and compliance. The Workiva history demonstrates a commitment to innovation and adaptation within the enterprise software sector, evolving from its initial focus on SEC reporting to a broader suite of financial and compliance solutions.

| Year | Milestone |

|---|---|

| 2008 | Founded as WebFilings, the company launched its cloud-based platform for SEC reporting. |

| 2010 | WebFilings changed its name to Workiva and expanded its product offerings. |

| 2014 | Workiva completed its IPO, marking a significant step in its growth trajectory. |

| 2021 | The company formed a strategic partnership with Wilson Sonsini to automate SEC Form S-1 generation. |

| 2025 | Workiva plans to 'supercharge' workflows with native AI tools and Assured Integrated Reporting. |

A groundbreaking innovation in the Workiva company background was the development of its cloud-based enterprise software-as-a-service platform, enabling real-time data collection, management, and analysis. The ability to integrate information from various sources into a single cloud-based report was a key differentiator for the Workiva platform.

The development of a cloud-based enterprise software-as-a-service platform was a key innovation. This platform enabled companies to collect, manage, report, and analyze critical business data in real time.

The Workiva products allowed corporations to automate SEC filings using XBRL. This made it possible for a customer to become the first to file Inline XBRL with the SEC.

The platform's ability to integrate information from disparate content formats, including spreadsheets and presentations, into a single cloud-based report was a key differentiator. This streamlined the reporting process.

In 2025, the company plans to incorporate native AI tools to 'supercharge' workflows. This will enhance the capabilities of the platform.

The introduction of Assured Integrated Reporting aims to address the increasing complexity of regulatory compliance. This provides a more comprehensive solution.

The expanded Wdata module in 2025 provides advanced data preparation tools. This reduces manual effort for users.

Despite its innovations, Workiva has faced challenges, including increasing losses, which grew at a rate of 19.9% annually as of December 2024. Additionally, a shift to partner-driven services and macroeconomic uncertainties have impacted sales and deal cycles, particularly in North America, affecting bookings expectations for the rest of 2025.

The company has remained unprofitable, with losses increasing over the past five years. This is a significant financial challenge.

A strategic shift to partner-driven services for setup and consulting has led to a slight decline in professional services revenue. This could impact revenue stability.

Macroeconomic uncertainties have led to a more cautious buying environment and elongated deal cycles, especially in North America. This has affected bookings expectations.

Reliance on partner-driven sales, particularly in Europe, introduces risks if these relationships are not effectively managed. This requires careful oversight.

The Workiva company operates in a competitive market. Understanding the Competitors Landscape of Workiva is crucial for strategic planning.

The current economic slowdown impacts the buying behavior. This can lead to a decrease in sales.

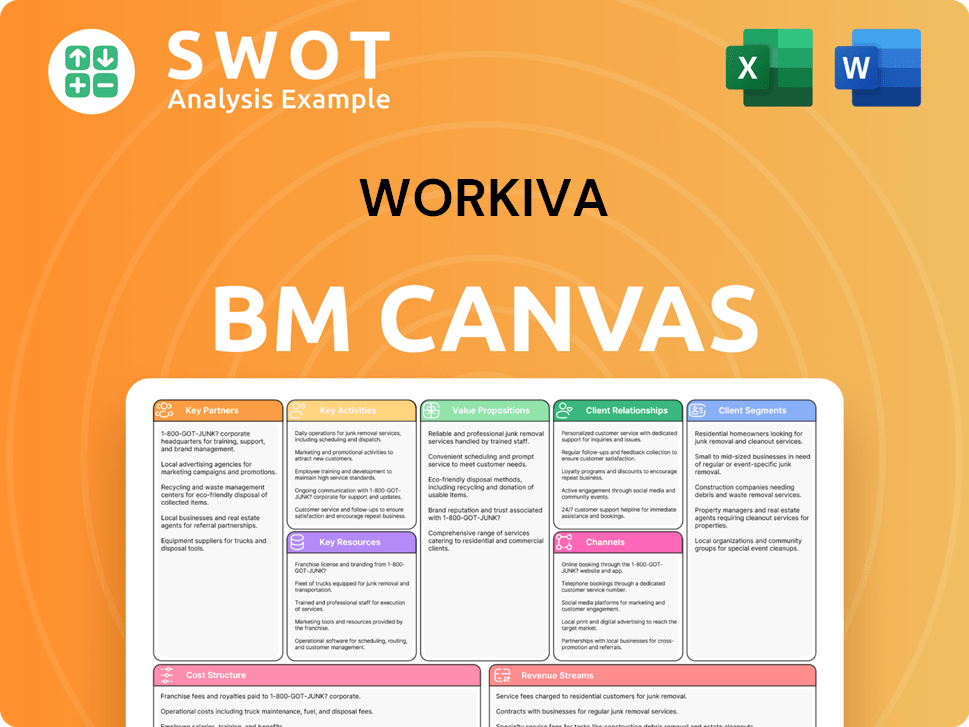

Workiva Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Workiva?

The Workiva company has a rich history, marked by significant milestones that have shaped its trajectory in the realm of financial reporting and compliance solutions. From its inception as WebFilings LLC to its current status as a publicly traded company, Workiva has continuously evolved, expanding its offerings and solidifying its position in the market.

| Year | Key Event |

|---|---|

| 2008 | Founded as WebFilings LLC in California by six entrepreneurs. |

| 2010 | Launched its first cloud-based SEC reporting solution. |

| 2012 | Reached the milestone of 1,000 customers. |

| 2013 | Expanded product offerings to include SOX compliance solutions. |

| July 2014 | Company name changed to Workiva LLC. |

| December 2014 | Completed initial public offering (IPO), raising approximately $101 million. |

| 2015 | Introduced the Workiva platform, expanding capabilities beyond regulatory reporting. |

| 2016 | Launched Wdata, enhancing data integration capabilities. |

| September 2021 | Formed a partnership with Wilson Sonsini to automate SEC Form S-1 generation. |

| Q3 2024 | Reported a 19% increase in subscription revenue and a 17% rise in total revenue. |

| 2024 Full Year | Total revenue reached $739 million, an increase of 17% from 2023. |

| Q1 2025 | Total revenue reached $206 million, a 17% increase from Q1 2024, with subscription and support revenue up 20%. |

| June 2025 | Participated in the William Blair Growth Stock Conference, reiterating strategic direction. |

Workiva is targeting a 20% subscription revenue growth in 2025. The company projects total revenue between $864 million and $868 million for the full year 2025. Workiva aims to expand its non-GAAP operating margin from 5.0%-5.5% guidance for 2025 to approximately 16% by 2027 and 24% by 2030.

The company is focused on expanding into new markets and industries. Workiva is leveraging its expertise in data management and strengthening strategic partnerships. The company is also aiming to increase its European revenue contribution to 25-30%.

Workiva's product roadmap for 2025 emphasizes native AI tools and Assured Integrated Reporting. This is to 'supercharge' workflows and address increasing regulatory complexities, such as SEC climate disclosures and California's SB 253. The company's strategic focus on compliance and sustainability positions it to capitalize on a $12 billion addressable market.

Workiva’s CEO, Julie Iskow, has stated the company remains focused on executing its growth strategy. Workiva's long-term targets for 2027 include over 20% subscription growth and 5-5.5% operating margins. These goals are driven by regulatory tailwinds and continued momentum in large contracts.

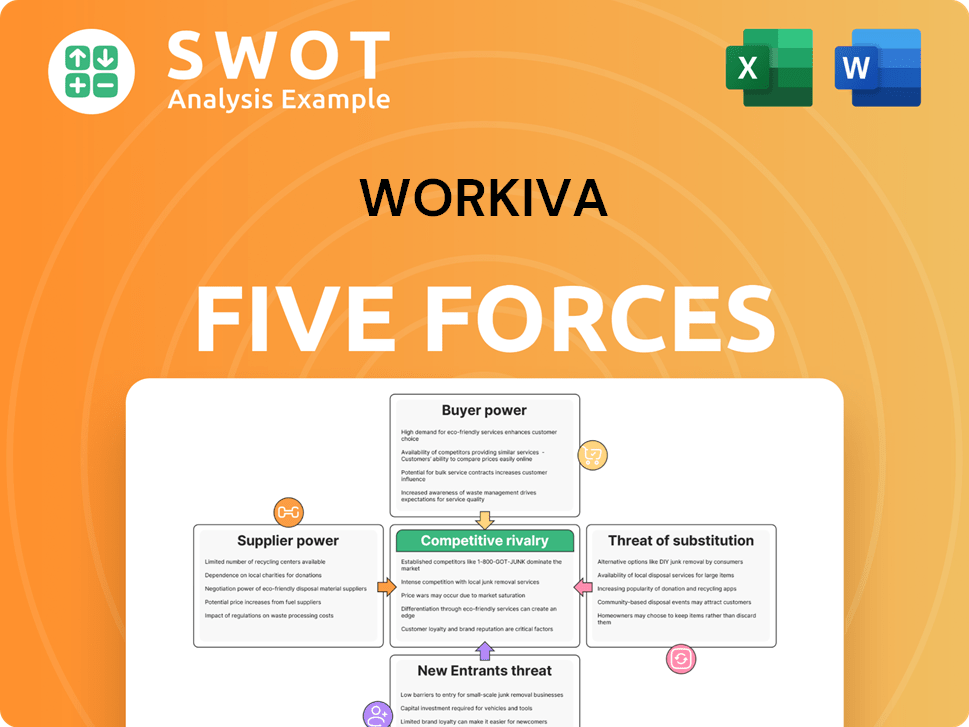

Workiva Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Workiva Company?

- What is Growth Strategy and Future Prospects of Workiva Company?

- How Does Workiva Company Work?

- What is Sales and Marketing Strategy of Workiva Company?

- What is Brief History of Workiva Company?

- Who Owns Workiva Company?

- What is Customer Demographics and Target Market of Workiva Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.