Workiva Bundle

Can Workiva Continue Its Ascent in the Reporting and Compliance Arena?

Workiva, a pioneer in cloud-based reporting and compliance, has transformed how organizations tackle complex financial and ESG reporting. Founded in 2008, the company has rapidly become a critical player for businesses navigating the ever-changing regulatory landscape. With a platform that connects data and teams, Workiva empowers informed decision-making and efficient compliance.

This article dives deep into the Workiva SWOT Analysis, exploring its

How Is Workiva Expanding Its Reach?

The core of the Workiva growth strategy centers on expanding its market reach and enhancing its product suite. A key area of focus involves deepening its presence in the Environmental, Social, and Governance (ESG) reporting sector. This is driven by the increasing regulatory demands and investor interest in sustainability data. Workiva aims to deliver a comprehensive solution for companies to manage and report ESG data more efficiently and accurately.

Geographic expansion is another critical element of Workiva's strategy. While the company has a strong foothold in North America, it is actively pursuing growth in international markets, particularly in Europe and the Asia-Pacific region. These regions are experiencing rapid evolution in ESG and financial reporting regulations. This involves establishing local teams, forging partnerships, and adapting its platform to meet specific regional requirements. Furthermore, Workiva is exploring opportunities to broaden its platform's applicability beyond core financial and ESG reporting to other areas of integrated risk management and compliance, thereby diversifying its revenue streams and increasing its total addressable market.

Workiva is also dedicated to expanding its partner ecosystem, which includes consulting firms and technology providers. This is designed to accelerate market adoption and improve service offerings. The company's strategic initiatives are designed to capitalize on the growing demand for cloud-based solutions and to strengthen its competitive position in the market. Recent financial results and market analysis indicate that Workiva is well-positioned to continue its growth trajectory.

Workiva is actively enhancing its ESG reporting capabilities. This includes addressing new mandates like the EU's Corporate Sustainability Reporting Directive (CSRD) and the SEC's climate disclosure rules in the United States. The goal is to provide a comprehensive solution for companies to streamline their ESG data management and reporting processes.

Workiva is focused on expanding its global footprint, with a particular emphasis on Europe and the Asia-Pacific region. This involves establishing local teams, building partnerships, and tailoring the platform to meet regional regulatory requirements. These initiatives are designed to capitalize on the growing demand for cloud-based solutions and to strengthen its competitive position in the market.

The company is exploring opportunities to expand its platform's applicability beyond core financial and ESG reporting. This includes areas like integrated risk management and compliance. This diversification strategy aims to increase revenue streams and expand the total addressable market.

Workiva is focused on expanding its partner ecosystem. This includes consulting firms and technology providers. These partnerships aim to accelerate market adoption and enhance the service offerings available to customers. This collaborative approach supports Workiva's long-term goals for growth and market leadership.

Workiva's expansion plans are multifaceted, focusing on both product enhancements and market reach. These initiatives are designed to capitalize on the growing demand for cloud-based solutions and to strengthen its competitive position in the market. Workiva's strategic initiatives are designed to drive revenue growth and increase its market share.

- Enhancing ESG reporting capabilities to meet evolving regulatory demands.

- Expanding geographically, particularly in Europe and Asia-Pacific.

- Diversifying the platform to include integrated risk management and compliance.

- Growing the partner ecosystem to accelerate market adoption.

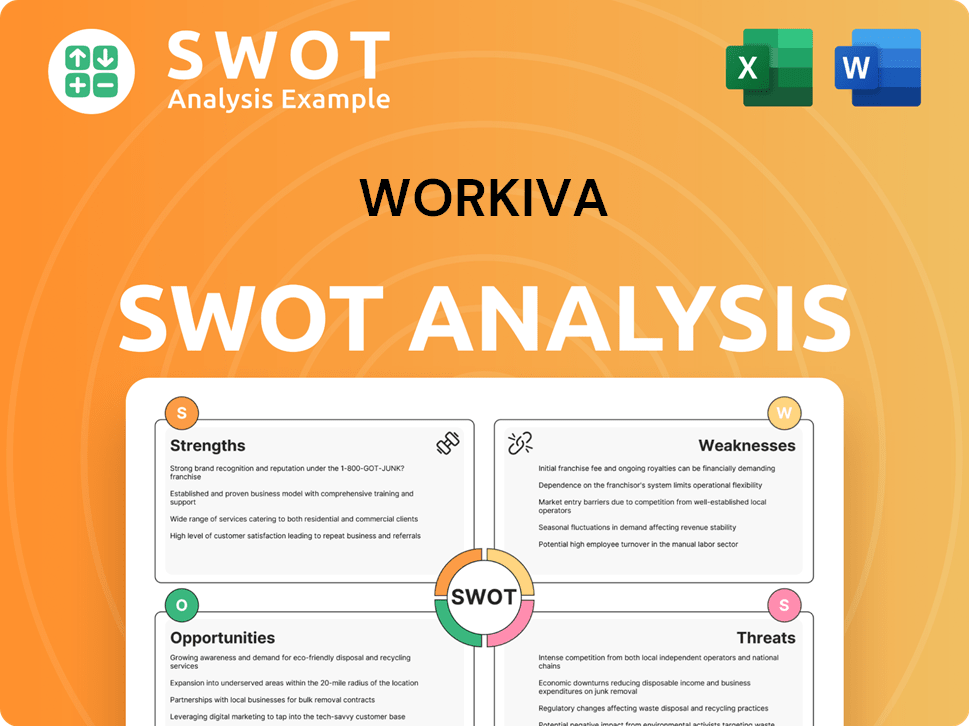

Workiva SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Workiva Invest in Innovation?

The Workiva company's growth strategy is deeply intertwined with its dedication to innovation and technology. This approach is crucial for staying competitive in the rapidly evolving landscape of financial reporting and compliance. The company continuously invests in its cloud-based platform, ensuring it remains at the forefront of technological advancements.

Workiva's future prospects are significantly influenced by its ability to integrate cutting-edge technologies like artificial intelligence (AI) and machine learning (ML). These technologies automate tasks, improve data accuracy, and provide deeper insights, which are essential for its customer base. This focus on technology helps Workiva meet current and future market demands.

Workiva's strategic initiatives are centered on enhancing its platform. The company's commitment to digital transformation provides a connected and collaborative environment for its users. This focus on innovation has solidified its position as a leader in the financial reporting and ESG software space.

Workiva uses AI and ML to automate data collection and validation, reducing manual effort. This leads to more accurate reporting and insights. For instance, AI helps in identifying anomalies in financial data.

The platform offers a connected environment for real-time data sharing and synchronized workflows. This approach breaks down data silos, promoting transparency. This is a key aspect of Workiva's cloud-based solutions.

Workiva prioritizes strengthening its security infrastructure and ensuring compliance with data privacy regulations. This is critical for its enterprise clients. Their commitment to security is a key differentiator.

Workiva's technological advancements are designed to anticipate future regulatory changes and market demands. This proactive approach ensures the platform remains a leading solution. This forward-thinking strategy is vital for Workiva's long-term goals.

The company's continuous innovation in its platform has been recognized, solidifying its position as a leader. This ongoing investment in R&D is a core element of their Workiva growth strategy. Workiva's innovation strategy drives its success.

Workiva's innovative approach helps it maintain a strong market share. The company's focus on technology keeps it ahead of industry trends. Workiva's market share is a testament to its tech-driven strategy.

Workiva's approach to innovation is a key driver of its financial performance. The company's investment in R&D is consistently high, reflecting its commitment to staying ahead in the market. For more details on Workiva's business model, you can read about the Revenue Streams & Business Model of Workiva.

Workiva focuses on several key areas to enhance its platform and maintain its competitive edge. These advancements are crucial for driving Workiva's revenue growth drivers.

- AI-Powered Automation: Implementing AI to automate tasks like data collection and validation, reducing manual work and improving accuracy.

- Enhanced Data Integration: Improving the ability to integrate data from various sources seamlessly, providing users with a unified view of their information.

- Advanced Analytics: Developing advanced analytics capabilities to provide deeper insights and help users make data-driven decisions.

- Real-time Collaboration: Offering real-time data sharing and synchronized workflows to enhance collaboration across departments.

- Robust Security Measures: Strengthening security infrastructure to protect sensitive data and ensure compliance with evolving data privacy regulations.

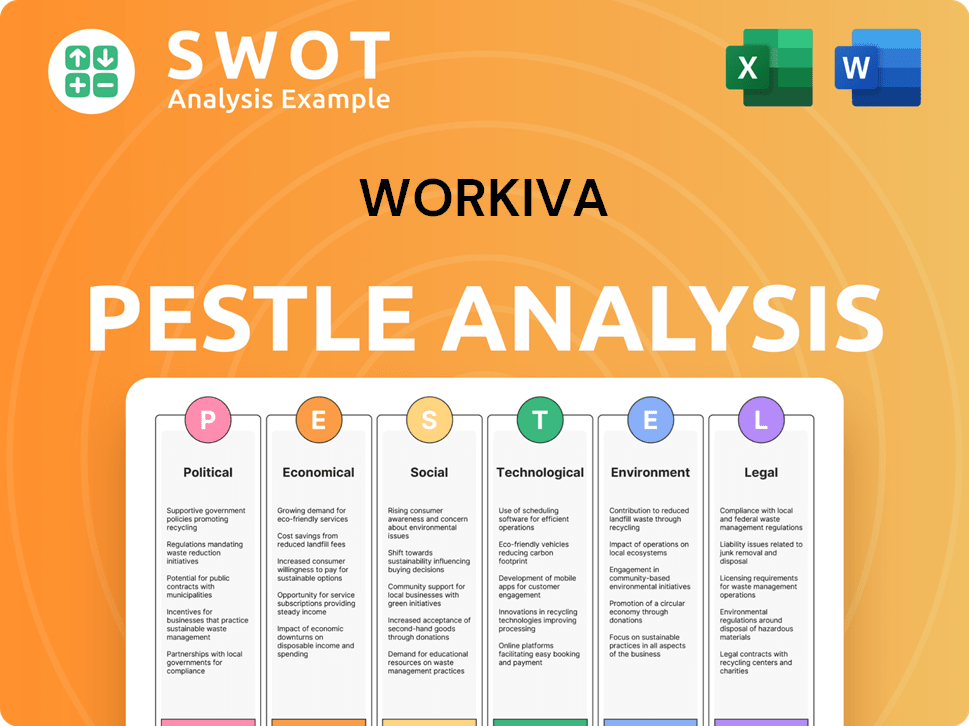

Workiva PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Workiva’s Growth Forecast?

The financial outlook for the company reflects its strategic growth initiatives and strong market position. In the first quarter of 2024, the company reported a revenue of $166.0 million, marking a 17.5% year-over-year increase. This growth is a key indicator of the company's positive trajectory.

Subscription and support revenue, a critical metric for recurring business, reached $154.5 million, reflecting an 18.0% year-over-year increase. The company's focus on expanding its platform's capabilities and attracting high-value enterprise customers is expected to drive continued revenue growth. The company's Competitors Landscape of Workiva shows the competitive environment.

For the second quarter of 2024, the company anticipates revenue to be between $170.0 million and $171.0 million, translating to a 14% to 15% year-over-year growth. For the full fiscal year 2024, the company projects revenue between $688.0 million and $690.0 million, indicating a year-over-year growth of 16% to 17%. This consistent growth demonstrates the effectiveness of the company's strategies.

The company's revenue growth is driven by its focus on high-value enterprise customers and the expansion of its platform. The company is also expanding its product offerings. These factors contribute to the company's overall financial performance and future prospects.

One of the company's long-term financial goals includes expanding its profit margins as it scales its operations. Leveraging its recurring revenue model is a key strategy. This will improve the company's overall financial health.

The company is focusing on expanding its platform's capabilities, particularly in the growing ESG market. This strategic move aligns with industry trends and positions the company for future growth. The ESG market is a significant opportunity for the company.

The company's financial performance is supported by its strong balance sheet, enabling continued investment in R&D and strategic acquisitions. The company reported a non-GAAP net loss of $2.4 million for the first quarter of 2024, or $0.04 per share. These investments fuel future growth.

The company's long-term goals include expanding its profit margins and leveraging its recurring revenue model. This focus on profitability and sustainable growth is crucial. The company is committed to achieving its long-term financial objectives.

The company's market analysis indicates a growing demand for its cloud-based solutions. The company's market share is expected to increase. This positive trend supports the company's expansion plans.

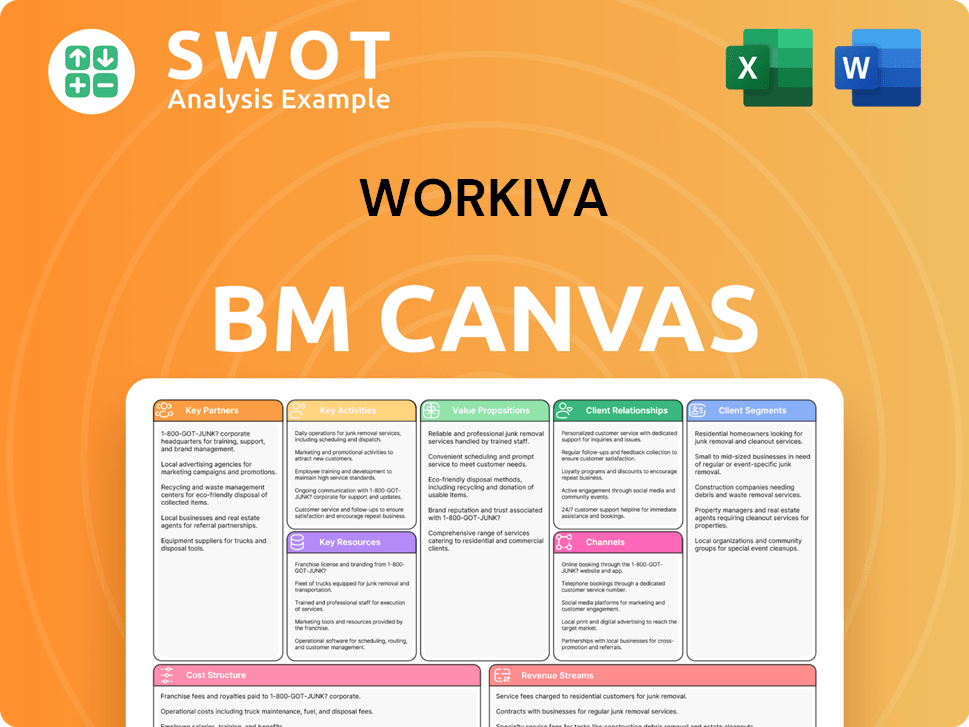

Workiva Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Workiva’s Growth?

The path for the Workiva company, while promising, is not without its hurdles. Understanding these potential risks is crucial for anyone assessing the Workiva future prospects. Several factors could impact the company's ability to maintain its growth trajectory and achieve its Workiva growth strategy goals.

One significant challenge is the competitive landscape. The market for financial reporting and ESG software is becoming increasingly crowded, with both established firms and new entrants vying for market share. This competition could lead to pricing pressures, potentially affecting Workiva's profitability and requiring increased investment in research and development.

Regulatory changes also pose a risk. While new regulations often create opportunities for Workiva, they can also necessitate significant platform adjustments. These changes could increase costs and potentially delay product development, impacting the company's ability to respond swiftly to market demands. For a deeper dive, consider the perspective of Owners & Shareholders of Workiva.

The financial reporting and ESG software market is highly competitive. Competitors may offer similar solutions, potentially leading to pricing pressures or increased R&D spending for Workiva to maintain its competitive edge. This competition could impact Workiva's market share.

Rapid shifts in financial reporting or ESG regulations could necessitate significant platform adjustments. These changes can lead to increased costs and potentially delay product development. Such delays could impact Workiva's ability to capitalize on Workiva's expansion plans.

Rapid advancements in AI and other emerging technologies require continuous innovation. Failure to adapt to new technological paradigms could result in a loss of market share. Workiva's innovation strategy must stay ahead of the curve.

Attracting and retaining top talent in a competitive tech labor market poses a challenge. This could hinder Workiva's capacity to execute its growth initiatives effectively. Addressing this requires a focus on Workiva's internal resource management.

Workiva mitigates risks through continuous market analysis and robust R&D. The company focuses on building a scalable and adaptable Workiva platform. A comprehensive risk management framework is employed to identify and address potential threats to operations.

Workiva's strategic initiatives include expanding its cloud-based solutions and enhancing its product offerings. The company is focused on increasing its customer base and driving Workiva's revenue growth drivers. They are also investing in Workiva's sustainability efforts.

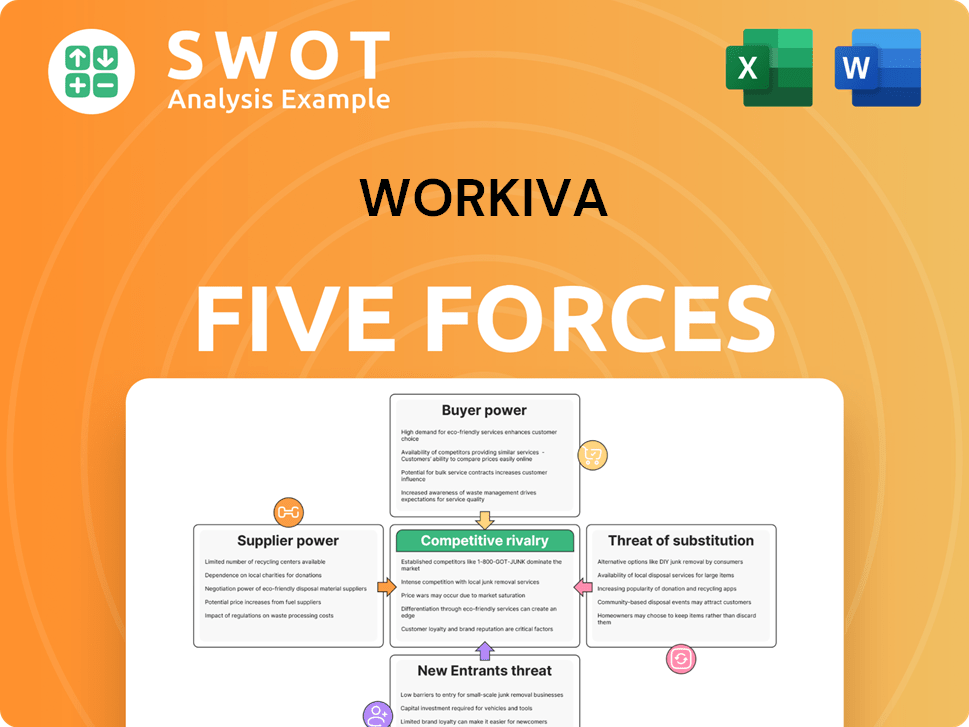

Workiva Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Workiva Company?

- What is Competitive Landscape of Workiva Company?

- How Does Workiva Company Work?

- What is Sales and Marketing Strategy of Workiva Company?

- What is Brief History of Workiva Company?

- Who Owns Workiva Company?

- What is Customer Demographics and Target Market of Workiva Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.