Workiva Bundle

Decoding Workiva: How Does This Tech Powerhouse Operate?

Workiva has revolutionized how businesses manage data and ensure compliance, offering a cloud-based platform that's become indispensable for modern enterprises. Its core strength lies in streamlining crucial processes, particularly in financial reporting, ESG reporting, and risk management, making it a go-to for organizations worldwide. The Workiva SWOT Analysis can provide deeper insights into its strategic position.

This in-depth look at the Workiva company will explore its operational model, revenue streams, and strategic positioning within the competitive landscape. Understanding the Workiva platform is essential for investors, customers, and industry analysts alike, given its impact on data accuracy, transparency, and regulatory compliance. We'll examine how Workiva software helps companies navigate complex global regulations while meeting the demands for reliable data.

What Are the Key Operations Driving Workiva’s Success?

The Workiva company creates value through its unified cloud platform, serving as a central hub for connecting data, documents, and teams. Its core focus is streamlining reporting and compliance workflows, targeting large enterprises, public companies, and government agencies. This includes financial reporting, ESG reporting, internal audit, and risk management.

Workiva operates on a Software-as-a-Service (SaaS) model, constantly developing and delivering new features. The technology emphasizes a collaborative and auditable environment with strong data integration capabilities. Key processes include software development, cloud infrastructure management, sales and marketing, and customer support.

The Workiva platform breaks down data silos, providing a 'single source of truth' for critical business information. This results in reduced manual effort, minimized errors, faster reporting cycles, and improved decision-making. For example, in Q1 2024, Workiva reported a total revenue of $176.2 million, a 13.7% increase year-over-year, demonstrating its continued growth and market adoption.

Workiva software offers solutions for financial reporting, ESG reporting, and internal controls. It helps with SEC filings, such as 10-K and 10-Q reports, and supports compliance with regulations like SOX. The platform is designed to improve efficiency and accuracy in managing complex reporting requirements.

Workiva features include data integration, document collaboration, and audit trail capabilities. These features enable users to pull data from various enterprise systems directly into the platform. The platform provides robust security features to protect sensitive data and ensure compliance. The Workiva platform also offers comprehensive customer support.

The company focuses on continuous software development and cloud infrastructure management. A strong sales and marketing engine drives customer acquisition and retention. Workiva also provides professional services to help customers optimize platform adoption. The company's operational efficiency is a key factor in its success.

Customers experience reduced manual effort and fewer errors. Reporting cycles become faster, and decision-making improves through real-time data. The platform provides a 'single source of truth', which enhances data integrity and reliability. Workiva solutions help organizations streamline their operations and meet regulatory requirements effectively.

Workiva offers a unified cloud platform that streamlines reporting and compliance. It provides a 'single source of truth', reducing manual effort and errors. The platform improves decision-making with reliable, real-time data. Explore the Growth Strategy of Workiva to understand its market approach.

- Reduced manual effort and errors.

- Faster reporting cycles.

- Improved decision-making.

- Enhanced data integrity.

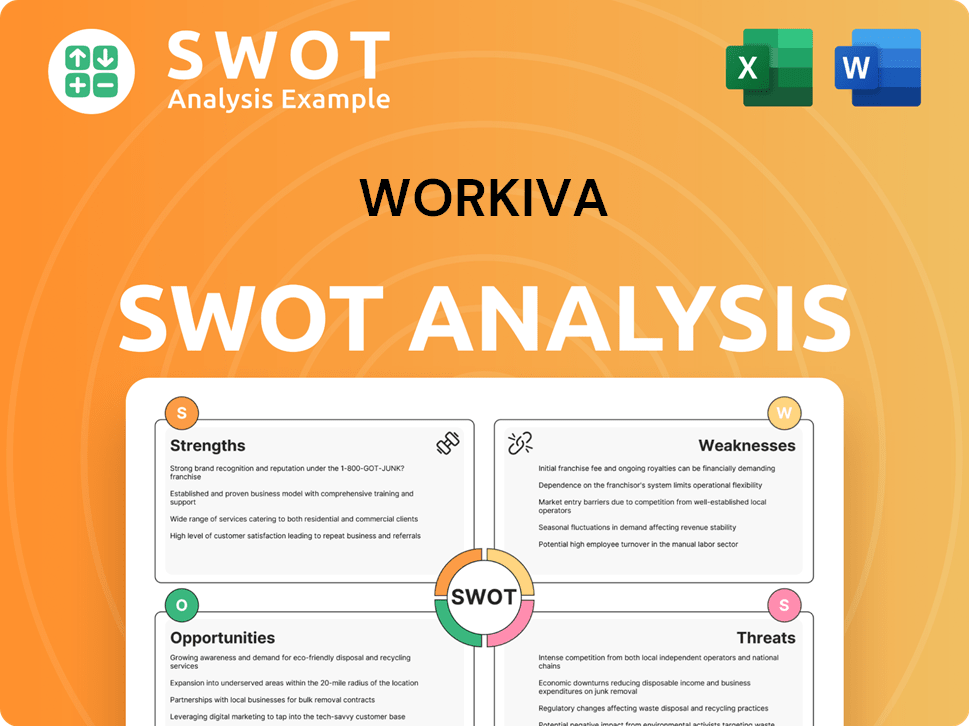

Workiva SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Workiva Make Money?

The Workiva company primarily generates revenue through subscriptions to its cloud-based platform, reflecting a Software as a Service (SaaS) business model. This approach allows the Workiva platform to provide consistent, recurring revenue streams. The company's monetization strategy relies on a tiered pricing model, offering various plans based on user numbers, module access, and client complexity.

For the fiscal year 2024, Workiva reported total revenue of $665.2 million, marking a 17.6% year-over-year increase. Subscription and support revenue accounted for $601.7 million, approximately 90.5% of the total revenue. Professional services, including implementation and training, contributed $63.5 million.

A key aspect of their strategy involves expanding platform capabilities to meet evolving reporting demands, such as the growing need for ESG reporting. This allows for cross-selling additional modules and services, which increases customer lifetime value. To learn more about the company, you can read about the Owners & Shareholders of Workiva.

Workiva's approach to revenue generation and monetization is multifaceted, focusing on long-term customer relationships and platform expansion.

- Subscription-Based Model: The core of Workiva's revenue comes from subscriptions to its cloud-based platform, ensuring predictable, recurring income.

- Tiered Pricing: Pricing is structured based on factors such as the number of users, the modules accessed, and the complexity of the client's reporting needs. This allows for scalability and caters to different customer sizes.

- Multi-Year Contracts: Workiva often uses multi-year contracts, which provide revenue stability and predictability.

- Professional Services: Revenue is also generated from professional services, including implementation, training, and consulting. These services help customers adopt and optimize the Workiva platform, supporting customer retention and expansion.

- Platform Expansion: Workiva continuously expands its platform's capabilities to address new reporting requirements, such as ESG reporting. This allows for cross-selling additional modules and services to existing customers, increasing customer lifetime value.

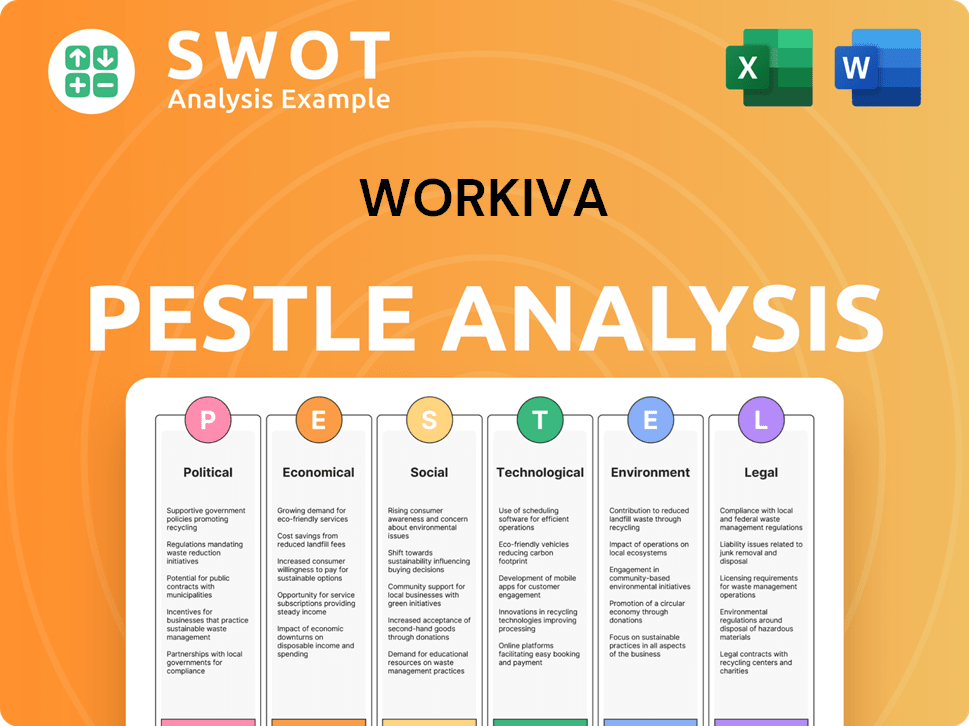

Workiva PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Workiva’s Business Model?

The Workiva company has achieved several significant milestones, shaping its operations and financial performance. A key strategic move was its initial public offering (IPO) in 2014, which provided capital for accelerated platform development and market expansion. The company has consistently expanded its platform capabilities beyond financial reporting to encompass broader enterprise reporting needs, notably with its strong push into ESG reporting.

Workiva strategically acquires companies to enhance its platform and expand its market reach. For instance, the acquisition of AuditNet in 2022 bolstered its internal audit capabilities. Operational challenges have included navigating evolving regulatory landscapes and managing the complexities of data integration across diverse client systems. Workiva has responded by continuously updating its platform to align with new regulations and investing in robust API capabilities.

The company's competitive advantages stem from its strong brand recognition within the financial reporting and compliance sector, its technological leadership in providing a unified cloud platform for complex reporting, and the network effects created by its collaborative environment. The high switching costs associated with migrating complex reporting processes also contribute to customer retention. Workiva continues to adapt to new trends, such as the increasing adoption of AI in financial processes, by exploring how AI can further enhance its platform's capabilities for data analysis and automation. For more insights, consider exploring the Marketing Strategy of Workiva.

Workiva went public in 2014, a pivotal moment that fueled its growth. The company has expanded its platform to cover diverse reporting needs, including ESG. This expansion has been a major driver of growth, especially with the increasing focus on sustainability.

The acquisition of AuditNet in 2022 enhanced Workiva's internal audit capabilities. Workiva continuously updates its platform to align with new regulations and invests in robust API capabilities. These moves are crucial for maintaining a competitive edge in a dynamic market.

Workiva benefits from strong brand recognition and technological leadership in cloud-based reporting. The collaborative environment and high switching costs contribute to customer retention. The company is exploring AI to enhance data analysis and automation capabilities.

Workiva faces challenges in navigating evolving regulations and data integration complexities. The company actively addresses these challenges by updating its platform and investing in robust API capabilities. Adapting to market changes remains a key focus.

Workiva's platform offers a unified cloud solution for complex reporting, enhancing collaboration and data accuracy. The platform streamlines processes, reducing manual errors and improving efficiency. It is designed to meet the needs of diverse industries and regulatory requirements.

- Strong brand recognition and customer loyalty.

- Technological leadership in cloud-based reporting.

- Continuous platform updates to meet regulatory changes.

- Strategic acquisitions to expand capabilities.

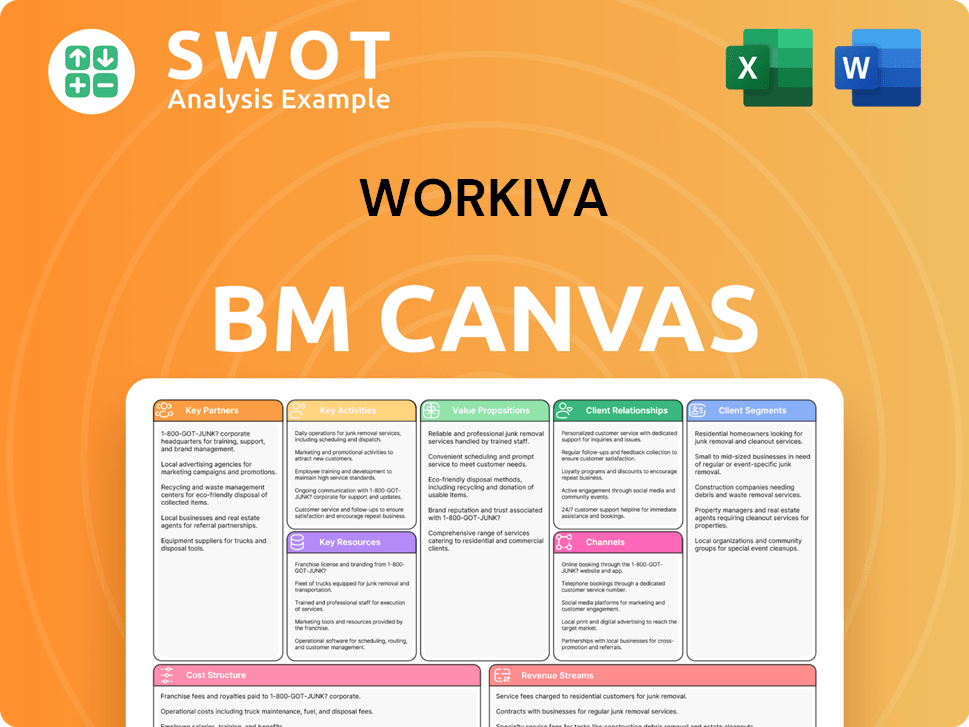

Workiva Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Workiva Positioning Itself for Continued Success?

The Workiva company holds a strong position in the connected reporting and compliance market. It serves a diverse global customer base and is known for its high customer loyalty. The company's focus on innovation and expansion, especially in the realms of AI and machine learning, positions it for continued growth. This is reflected in the company's ability to retain customers and attract new ones.

Workiva faces several risks, including competition and economic downturns. The company is committed to enhancing its platform and expanding its global reach to drive future growth. The increasing demand for transparent and interconnected reporting solutions across financial, operational, and ESG domains supports a positive outlook for the Workiva platform.

Workiva is a key player in the connected reporting and compliance market. The company's platform is widely used by large enterprises and public companies. It is consistently recognized in financial close and reporting, and ESG reporting software.

Key risks include competition from established and emerging software vendors. Changes in regulatory requirements could impact demand. Economic downturns could also affect IT spending. Attracting and retaining top talent is another challenge in the competitive tech market.

Workiva aims to sustain growth through platform innovation, especially in AI and machine learning. The company plans to expand its global footprint and deepen its penetration within existing customer accounts. The increasing demand for transparent reporting solutions supports a positive outlook.

In Q1 2025, Workiva reported a subscription and support revenue retention rate of 97%. The retention rate excluding add-on business was 94%. These figures highlight the company's strong customer loyalty and its ability to retain revenue within its existing customer base.

Workiva is focusing on platform innovation, particularly in AI and machine learning, to improve data automation and insights. The company is also expanding its global presence. These strategies aim to enhance the Workiva software and expand its market reach.

- Leveraging AI and machine learning for enhanced data automation.

- Expanding its global footprint to reach new markets.

- Deepening penetration within existing customer accounts.

- Acquiring new customers across various industries.

To learn more about the company's strategic vision, consider reading about the Growth Strategy of Workiva. This article provides additional insights into how Workiva solutions are positioned for future growth and how the company plans to navigate the competitive landscape. The company's focus on innovation and customer retention is crucial for its continued success.

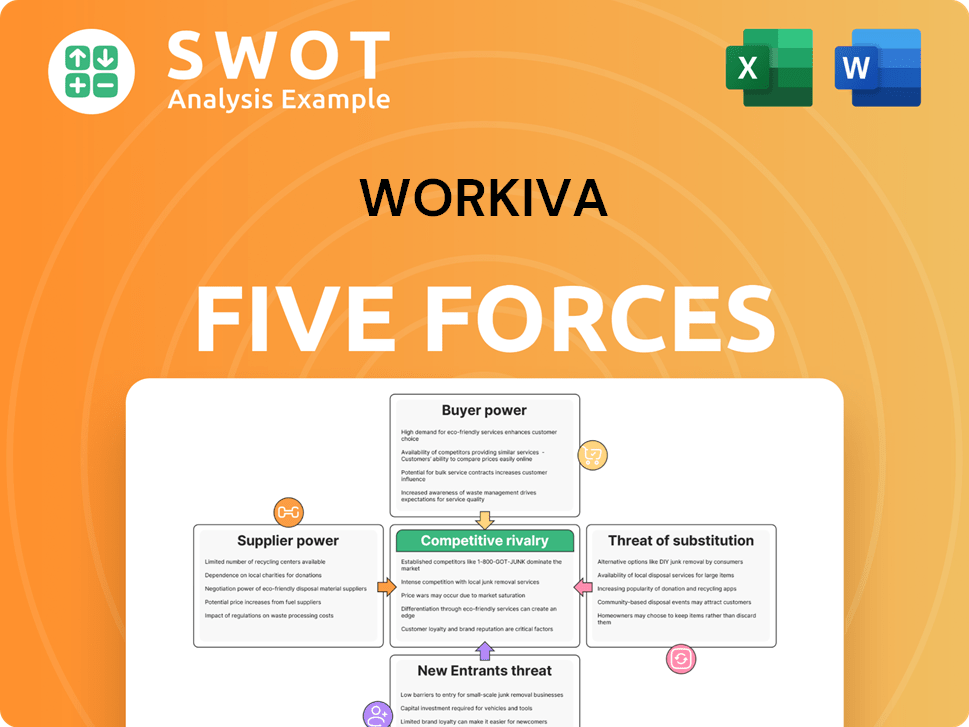

Workiva Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Workiva Company?

- What is Competitive Landscape of Workiva Company?

- What is Growth Strategy and Future Prospects of Workiva Company?

- What is Sales and Marketing Strategy of Workiva Company?

- What is Brief History of Workiva Company?

- Who Owns Workiva Company?

- What is Customer Demographics and Target Market of Workiva Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.