Workiva Bundle

Who are Workiva's Key Players?

In today's data-driven world, understanding the Workiva SWOT Analysis is crucial for strategic success. Workiva, a leader in cloud-based reporting, has experienced significant growth, making its customer base a key area of interest. This analysis delves into the Workiva target market and customer demographics, offering valuable insights for investors and business strategists. Discover how Workiva strategically positions itself within the market to serve its diverse clientele.

This exploration of the Workiva company's customer base provides a comprehensive view of its Workiva users, their needs, and how Workiva tailors its solutions. We will examine the Workiva audience to understand the company's market position and future growth potential. Understanding the Workiva clients is critical for assessing the company's ability to meet the evolving demands of the reporting and compliance landscape.

Who Are Workiva’s Main Customers?

Understanding the customer demographics and target market is crucial for any company, and it's especially important for a B2B SaaS provider like Workiva. Workiva's primary focus is on serving businesses, targeting enterprise and mid-market companies. The company's growth trajectory and customer base provide insights into its strategic focus and market penetration.

As of Q1 2025, Workiva's customer base reached 6,385 customers, demonstrating a growing demand for its services. This represents an increase from 6,074 customers in Q1 2024, indicating a steady expansion of its market presence. The company's strong foothold among Fortune 500 firms, serving approximately 75% of these large enterprises, highlights its ability to cater to the needs of major players in various industries.

The financial performance further underscores the importance of enterprise clients. In 2024, revenue from enterprise clients accounted for roughly 80% of Workiva's total revenue. This indicates that the enterprise segment is a significant driver of the company's financial success and growth.

The target market for Workiva primarily includes professionals in finance, accounting, compliance, and regulatory reporting. These individuals and teams are responsible for critical functions within organizations. They manage financial statements, regulatory filings, ESG disclosures, and risk management.

Workiva's customer profile is characterized by a focus on high-value engagements. Contracts valued over $300,000 increased by 32% in Q1 2025 compared to Q1 2024. Contracts over $500,000 also saw a 32% increase during the same period. This growth in high-value contracts reflects the increasing adoption of Workiva's solutions by larger enterprises.

Workiva has expanded its target segments beyond initial SEC reporting to include ESG and GRC solutions. This expansion is driven by evolving global sustainability disclosure requirements. The demand for data connectivity and regulatory compliance has also increased. Their sustainability solutions, such as Workiva Carbon, have been a top booking solution for ten consecutive quarters.

- Workiva's customer base includes a significant number of Fortune 500 firms.

- The company's focus on enterprise clients generates a substantial portion of its revenue.

- Workiva's target market includes professionals in finance, accounting, and compliance.

- The company's expansion into ESG and GRC solutions reflects evolving market demands. To learn more about the company's strategic direction, consider exploring the Growth Strategy of Workiva.

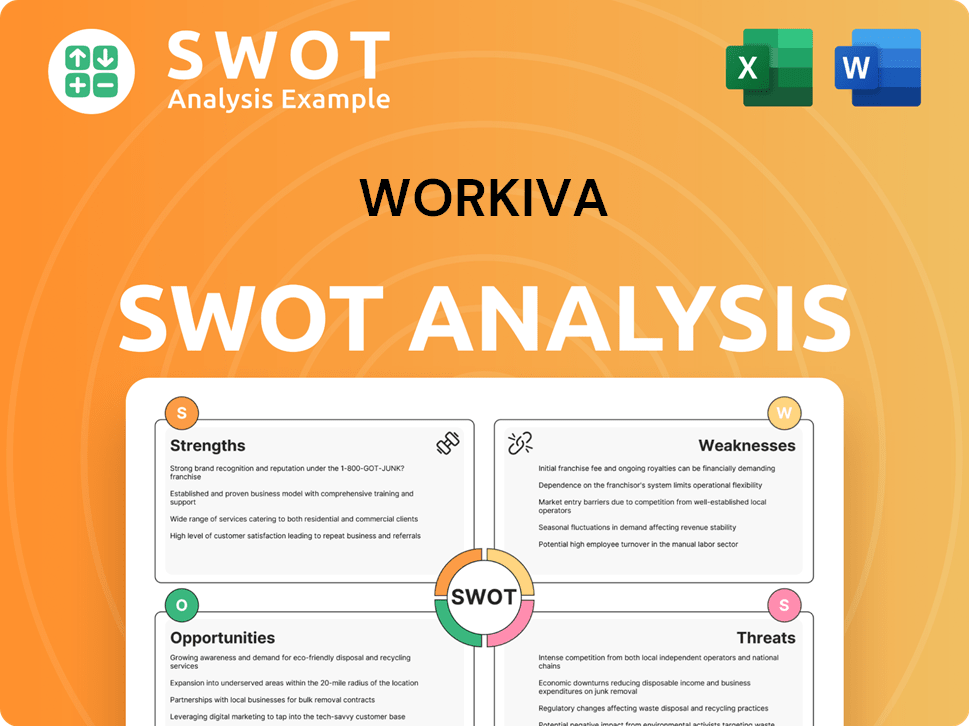

Workiva SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Workiva’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For the company, this involves a deep dive into what drives its users, their purchasing behaviors, and the pain points they aim to solve. This analysis helps tailor the platform to meet the evolving demands of its target market.

The company's customer base is primarily driven by the need for streamlined processes, improved data accuracy, and enhanced transparency in financial reporting, ESG reporting, and risk management. Their purchasing decisions are heavily influenced by the platform's ability to connect data and teams, providing a secure, audit-ready environment. The company's focus on these areas reflects a commitment to meeting the core needs of its clients, ensuring they can trust the platform to deliver on its promises.

The psychological drivers behind choosing the company often revolve around trust, transparency, and accountability in reporting. The company addresses common pain points, such as the complexities of financial reporting, reducing manual errors, and simplifying complex reporting processes. The company continuously seeks new ways to meet changing customer needs, as seen in its Spring 2025 product enhancements.

Customers seek solutions that simplify complex workflows. The company offers a unified platform to streamline financial reporting, ESG, and GRC processes.

Accuracy is paramount in financial reporting and compliance. The platform's ability to link data across documents improves accuracy and reduces errors.

Customers require clear and accessible data for stakeholders. The platform's features facilitate transparency and auditability.

Meeting regulatory requirements is a key concern. The company provides tools to simplify and ensure compliance with various regulations.

Collaboration is essential for efficient reporting. The platform's real-time collaboration features allow teams to work together seamlessly.

Customers need a secure and auditable environment. The platform provides a controlled and secure environment with audit trails.

The company tailors its offerings by providing a unified SaaS platform that integrates financial reporting, ESG, and GRC. For example, the platform's real-time collaboration features and audit trail are critical for financial reporting, and its ability to link data across documents improves accuracy and efficiency. Customers also appreciate the ease of use, implementation, and the readiness of the company's support teams to troubleshoot issues. To learn more about the company's history and development, you can read a Brief History of Workiva.

The company's platform offers several key features and benefits that align with customer needs, including:

- Unified Platform: Integrates financial reporting, ESG, and GRC on a single platform.

- Real-Time Collaboration: Enables teams to work together seamlessly with real-time updates and feedback.

- Audit Trail: Provides a complete audit trail for all activities, ensuring accountability and compliance.

- Data Linking: Links data across documents to improve accuracy and efficiency.

- Ease of Use: Designed for ease of implementation and user-friendliness.

- Support: Offers readily available support teams to assist with any issues.

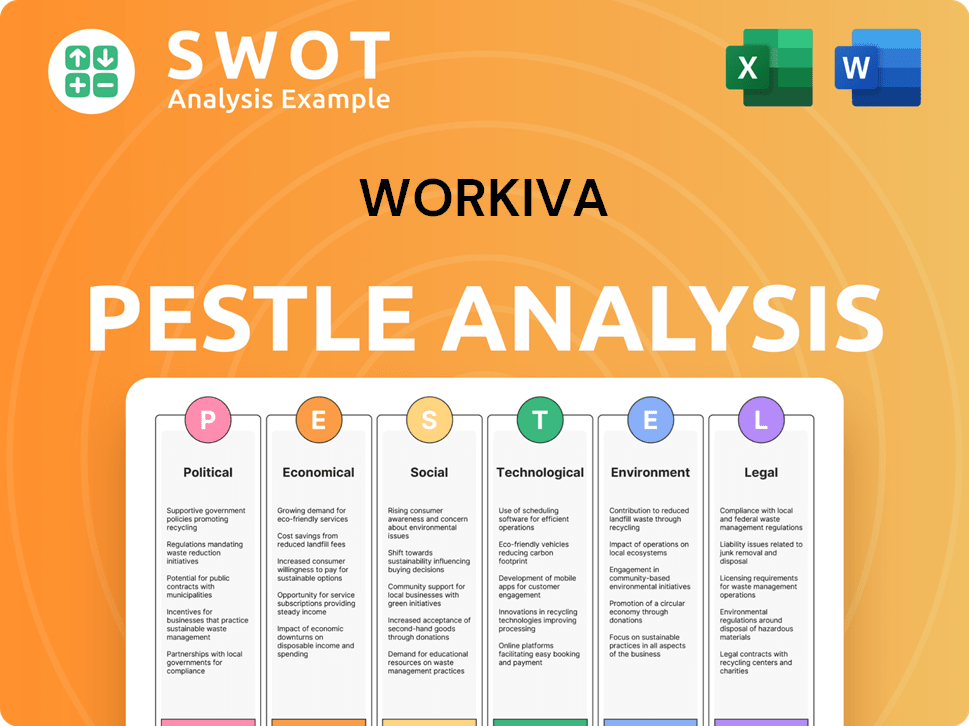

Workiva PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Workiva operate?

The geographical market presence of the company is substantial, with its cloud-based platform accessible to clients worldwide. The United States is the primary market, generating approximately 85% of total revenue in Q1 2024. The international segment, including Europe and Asia-Pacific, is a growing area, contributing about 15% of total revenue in Q1 2024 and experiencing a 25% year-over-year increase, indicating expanding market penetration.

The company's total addressable market (TAM) is distributed across the Americas, Europe, and Asia-Pacific, with significant opportunities in each region. The Americas have a TAM of $16.4 billion, Europe's TAM is $10.9 billion, and Asia-Pacific's TAM is $7.7 billion. The company has strategically expanded its global footprint with new offices in Singapore and additional European locations, demonstrating a commitment to serving its global customer base and capturing market share.

The company's focus on regulatory compliance, particularly in financial and ESG reporting, positions it well in markets with stringent requirements. To succeed in diverse markets, the company localizes its offerings and partnerships. For instance, the company has secured six-figure deals with European travel companies purchasing multiple solutions. The recent proposed changes to the CSRD regulation in the EU directly impact the company's primary target market in Europe, highlighting its focus on adapting to regional regulatory shifts. For more insights into the company's ownership structure, you can read about Owners & Shareholders of Workiva.

The United States remains the primary market, contributing approximately 85% of the total revenue in Q1 2024. This highlights the strong adoption and market penetration within the US, which is a key area for customer demographics and Workiva target market.

The international segment, including Europe and Asia-Pacific, is a growing area, contributing approximately 15% of total revenue in Q1 2024. This segment experienced a 25% year-over-year increase, indicating strong growth potential for the Workiva company.

The total addressable market (TAM) is distributed across the Americas ($16.4 billion), Europe ($10.9 billion), and Asia-Pacific ($7.7 billion). This distribution demonstrates a broad global opportunity for Workiva users.

The company has expanded its global presence with new offices in Singapore and additional European locations. This expansion is a strategic move to better serve its Workiva audience and tap into new markets.

Major markets where the company holds strong brand recognition are those with stringent regulatory compliance requirements, particularly related to financial and ESG reporting. This focus aligns with the Workiva's target market for financial reporting.

To succeed in diverse markets, the company localizes its offerings and partnerships. For instance, the company has seen six-figure deals with European travel companies purchasing multiple solutions. This strategy is key for Workiva customer acquisition strategies.

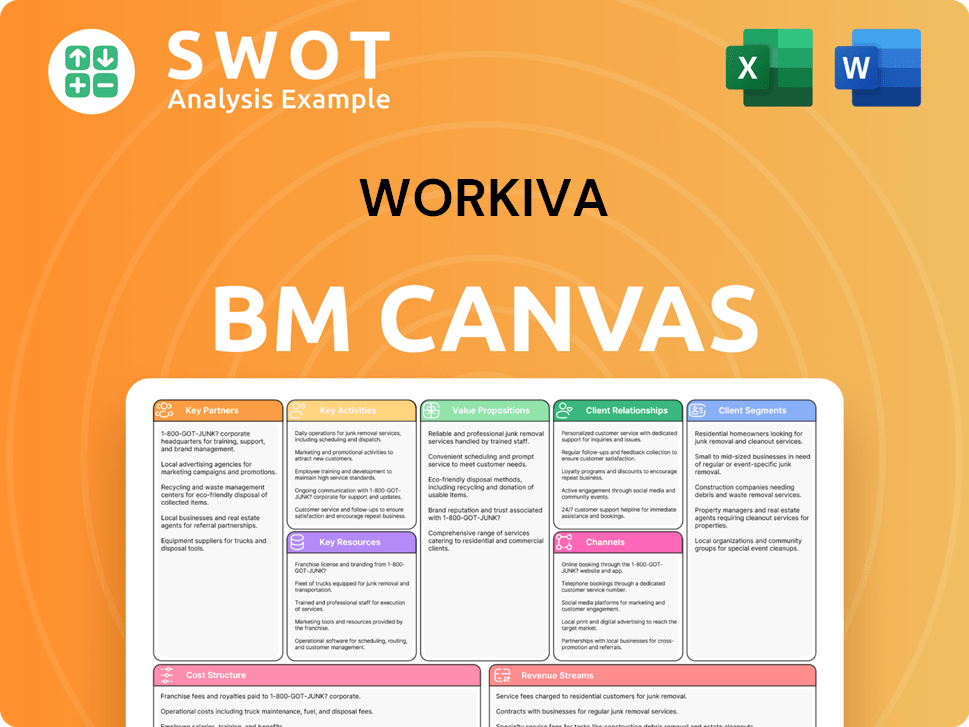

Workiva Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Workiva Win & Keep Customers?

Workiva employs a multifaceted approach to attract and retain customers, focusing on direct sales, strategic partnerships, and digital marketing. This integrated strategy is designed to reach financial and compliance professionals, the core of its target market. The company's customer acquisition and retention tactics are key to its continued growth and market leadership in the SaaS space. They are constantly refining their strategies to enhance customer engagement and drive revenue growth.

The company leverages a combination of sales, partnerships, and digital efforts to reach its target audience. These strategies are supported by robust retention programs, ensuring high customer loyalty and account expansion. These initiatives are essential for maintaining a strong customer base and driving sustainable growth. Workiva's focus on customer success, dedicated support teams, and customized solutions further solidifies its customer relationships.

Workiva's customer acquisition and retention strategies are central to its business model, designed to attract and retain financial and compliance professionals. The company's success in this area is reflected in its strong financial performance and high customer retention rates. This approach is critical for maintaining a competitive edge in the market.

Direct sales, including a dedicated sales team and website SaaS purchases, saw a 15% growth in online sales in 2024. Digital marketing efforts, including Google Ads and LinkedIn, are central to reaching financial and compliance professionals, with 35% of Workiva's marketing spend allocated to digital channels in 2024.

Partnerships, including resellers and consultants, generated 40% of new business in Q1 2024. These partnerships are expected to boost customer acquisition by up to 25% by early 2025. This collaborative approach expands Workiva's reach within its target market.

Content marketing, through webinars, white papers, and success stories, drove a 30% increase in lead generation for Workiva in 2024. The budget for these activities increased by 15% in Q1 2025. Webinars and virtual events have seen a 20% increase in user engagement year-over-year.

Workiva's retention strategies are robust, with a high gross retention rate of 97% and a net retention rate of 110% as of Q1 2025. The customer retention rate within the enterprise segment consistently exceeds 95%. The increase in customers with annual contract values over $500,000 by 32% year-over-year in Q1 2025 underscores their success.

Workiva's success in acquiring and retaining customers is built on a foundation of strategic initiatives. These strategies are designed to engage the Marketing Strategy of Workiva's target audience effectively.

- Direct Sales: A dedicated sales team focuses on acquiring new clients and expanding existing accounts.

- Strategic Partnerships: Collaborations with resellers and consultants extend Workiva's reach.

- Digital Marketing: Targeted campaigns on platforms like Google Ads and LinkedIn attract financial professionals.

- Content Marketing: Webinars, white papers, and success stories drive lead generation and engagement.

- Customer Success: Dedicated support teams and customized solutions ensure high customer satisfaction.

- Account Expansion: Up-selling and cross-selling contribute to a net retention rate of 110% as of Q1 2025.

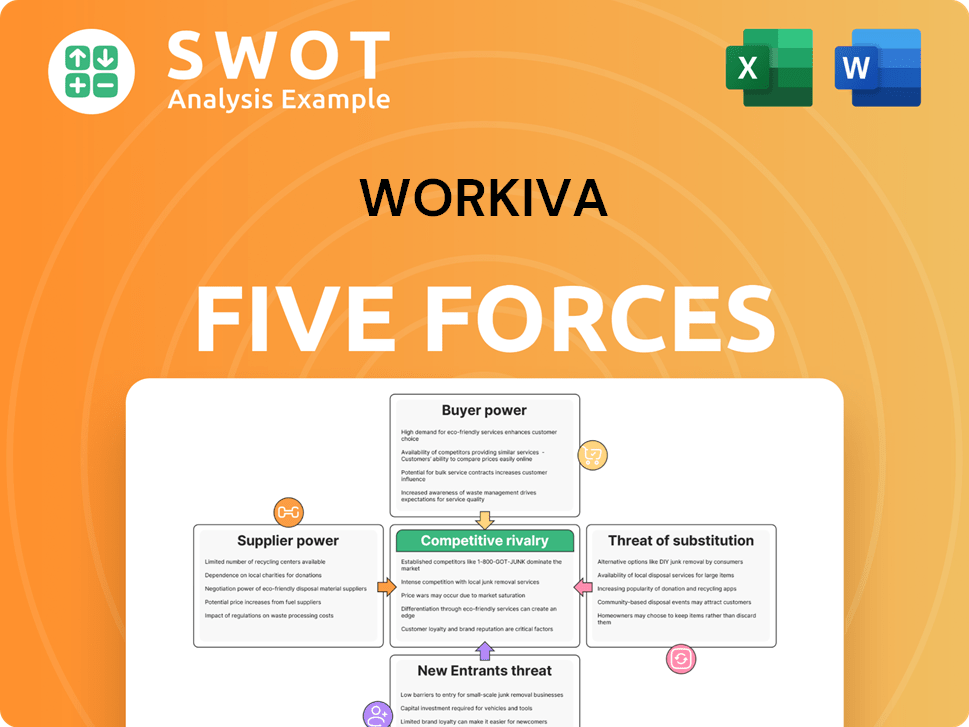

Workiva Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Workiva Company?

- What is Competitive Landscape of Workiva Company?

- What is Growth Strategy and Future Prospects of Workiva Company?

- How Does Workiva Company Work?

- What is Sales and Marketing Strategy of Workiva Company?

- What is Brief History of Workiva Company?

- Who Owns Workiva Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.