Workiva Bundle

Who Really Controls Workiva?

Unraveling the ownership structure of a company is paramount to understanding its trajectory. Workiva, a leading SaaS provider, empowers organizations globally with its connected reporting and compliance platform. This deep dive into Workiva SWOT Analysis will illuminate the key players shaping its future.

From its inception as WebFilings to its current status as a publicly traded entity, the Workiva company has undergone a fascinating evolution. Examining Workiva ownership reveals the strategic influences and financial backing that have propelled its growth. Understanding Who owns Workiva is crucial for investors and stakeholders alike, offering insights into the company's governance and long-term prospects, including its Workiva stock performance and the impact of its Workiva investors.

Who Founded Workiva?

The story of the Workiva company began in August 2008, initially as WebFilings LLC, founded in California. The company was established by six entrepreneurs, with Martin Vanderploeg among them. While the specific initial equity distribution isn't publicly available, the founding team included executive officers who were managing directors before the company became a corporation.

Workiva operates with a dual-class share structure. This structure consists of Class A common stock and Class B common stock. Class A shares have one vote each, while Class B shares have ten votes each. This setup gave significant voting control to certain founding shareholders, particularly the executive officers who held managing director roles before the corporate conversion.

During its early stages, the company secured a total of $56.1 million in funding across 10 rounds, with the first round on September 30, 2008. Ranger Investments was an early institutional investor. This dual-class share structure played a crucial role, allowing the founding team to maintain significant influence over the company's strategic direction as it sought external funding and eventually went public. Understanding the Workiva ownership structure is key to grasping its operational dynamics.

The founders of Workiva, originally WebFilings LLC, established the company in 2008. The company's initial funding totaled $56.1 million across multiple rounds, with Ranger Investments as an early investor. The dual-class share structure, where Class B shares held ten times the voting power of Class A shares, was critical in giving the founders control. This structure is a key aspect of understanding Workiva ownership and the influence of its Workiva leadership.

- Founded in August 2008 as WebFilings LLC.

- Raised $56.1 million in early funding.

- Dual-class share structure with Class B shares having enhanced voting rights.

- Ranger Investments was an early institutional investor.

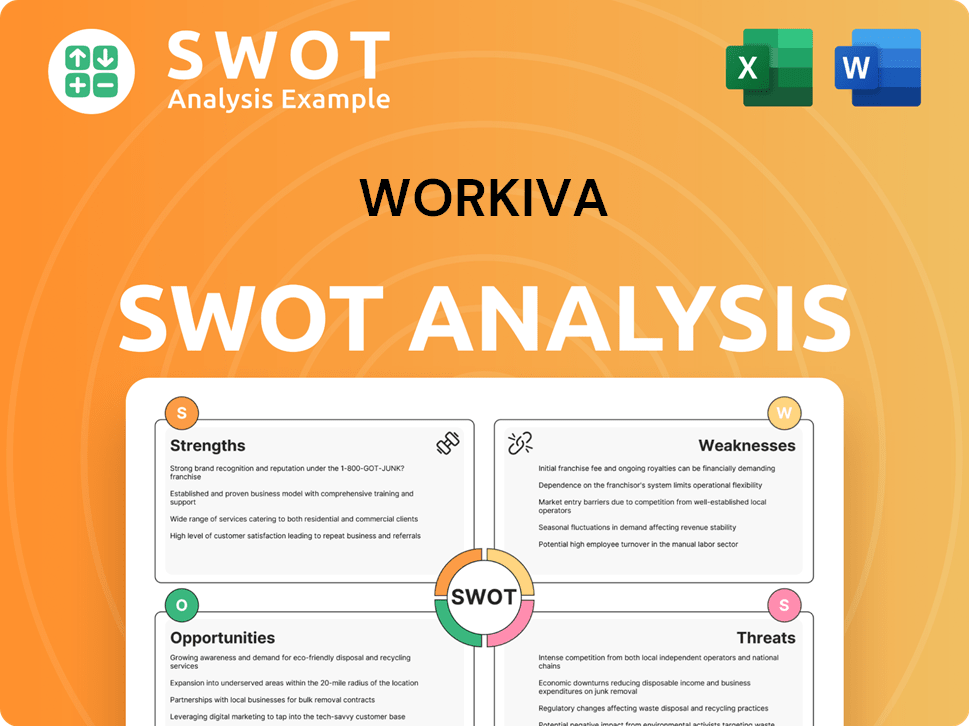

Workiva SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Workiva’s Ownership Changed Over Time?

The transformation of the Workiva company's ownership structure began with its initial public offering (IPO) on December 12, 2014. The company listed its Class A common stock on the New York Stock Exchange under the symbol 'WK'. The IPO involved the sale of 7,200,000 shares of Class A common stock, priced at $14.00 per share. This event marked a significant shift, opening the door for public investment and changing the dynamics of the company's shareholder base.

As of February 19, 2025, the outstanding shares of Workiva included approximately 52,280,439 shares of Class A common stock and 3,845,583 shares of Class B common stock. The shift towards institutional ownership is a common trend as companies mature and become publicly traded, influencing company strategy through their substantial voting power. The company's ownership is primarily held by institutional investors, with a significant portion held by mutual funds and other institutional entities.

| Metric | Details | Date |

|---|---|---|

| Institutional Ownership | 83.89% of Class A common stock | May 2025 |

| Mutual Fund Ownership | 65.93% | May 2025 |

| Insiders Ownership | 3.97% | May 2025 |

Major institutional shareholders in Workiva include Vanguard Group Inc., BlackRock, Inc., T. Rowe Price Investment Management, Inc., Fmr Llc, and State Street Corp. Vanguard Fiduciary Trust Co. held 11.37% of shares, and BlackRock Advisors LLC held 9.31% as of a recent report. T. Rowe Price Investment Management, Inc. held 5.422%, and Fidelity Management & Research Co. LLC held 5.226%. These significant institutional holdings indicate a broad investor base, typical of publicly traded companies. To learn more about how Workiva operates, you can read about the Revenue Streams & Business Model of Workiva.

Workiva's ownership structure is dominated by institutional investors, reflecting its status as a publicly traded company.

- The IPO in 2014 marked the transition to public ownership.

- Institutional investors hold a substantial majority of the shares.

- Major shareholders include Vanguard, BlackRock, and T. Rowe Price.

- Insider ownership is a smaller percentage compared to institutional holdings.

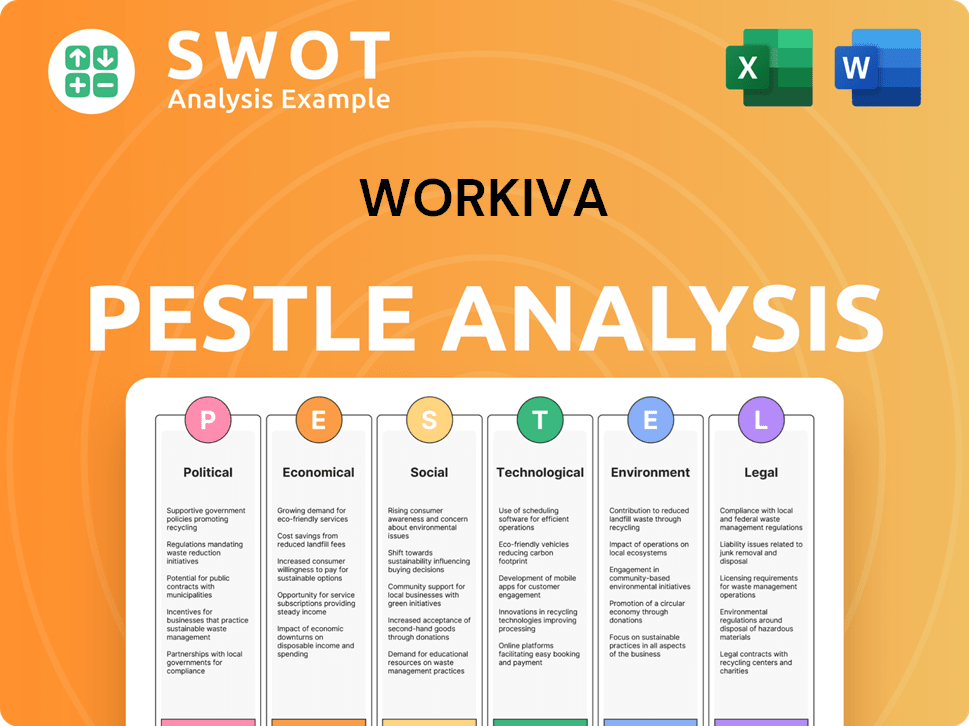

Workiva PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Workiva’s Board?

The current board of directors at Workiva plays a vital role in overseeing the company's strategic direction and governance. The board includes Martin J. Vanderploeg, Ph.D., serving as Non-Executive Chair, and Julie Iskow as President and Chief Executive Officer. Other members include David S. Mulcahy, Michael M. Crow, Ph.D., Robert H. Herz, CPA, FCA, Astha Malik, and Suku Radia. Astha Malik was a notable addition to the slate of nominees for the 2025 annual meeting, demonstrating the company's ongoing efforts to evolve its leadership.

The composition of the board reflects a blend of expertise, including experience in finance, technology, and strategic leadership. This diverse background helps Workiva navigate the complexities of the business landscape and make informed decisions. The board's role is crucial in ensuring that the company operates in the best interests of its shareholders and stakeholders, guiding Workiva's long-term growth and success. Understanding the Workiva board of directors is key for Workiva investors.

| Board Member | Title | Key Role |

|---|---|---|

| Martin J. Vanderploeg, Ph.D. | Non-Executive Chair | Provides strategic oversight and leadership |

| Julie Iskow | President and CEO | Leads the company's operations and strategy |

| David S. Mulcahy | Board Member | Contributes to strategic discussions and decision-making |

| Michael M. Crow, Ph.D. | Board Member | Offers insights and guidance on technology and innovation |

| Robert H. Herz, CPA, FCA | Board Member | Brings financial expertise and oversight |

| Astha Malik | Board Member | Offers insights and guidance on technology and innovation |

| Suku Radia | Board Member | Contributes to strategic discussions and decision-making |

Workiva's voting structure includes two classes of common stock: Class A and Class B. Class A shares have one vote each, while Class B shares have ten votes each. This dual-class structure provides significant voting power to Class B shareholders, who, before the IPO, were primarily the executive officers and managing directors. Following the IPO, Class B shareholders held approximately 82.1% of the total voting power. This structure allows founding shareholders and leadership to retain substantial control over company decisions, including director elections. Shareholders are encouraged to vote in advance of the annual meeting via internet, phone, or mail. The record date for stockholders entitled to vote for the 2025 annual meeting was March 31, 2025. For a broader view, consider the Competitors Landscape of Workiva.

The dual-class structure gives significant voting power to Class B shareholders.

- Class A shares: one vote per share.

- Class B shares: ten votes per share.

- Class B shareholders held approximately 82.1% of total voting power after the IPO.

- This structure allows for continued control by the founders and leadership.

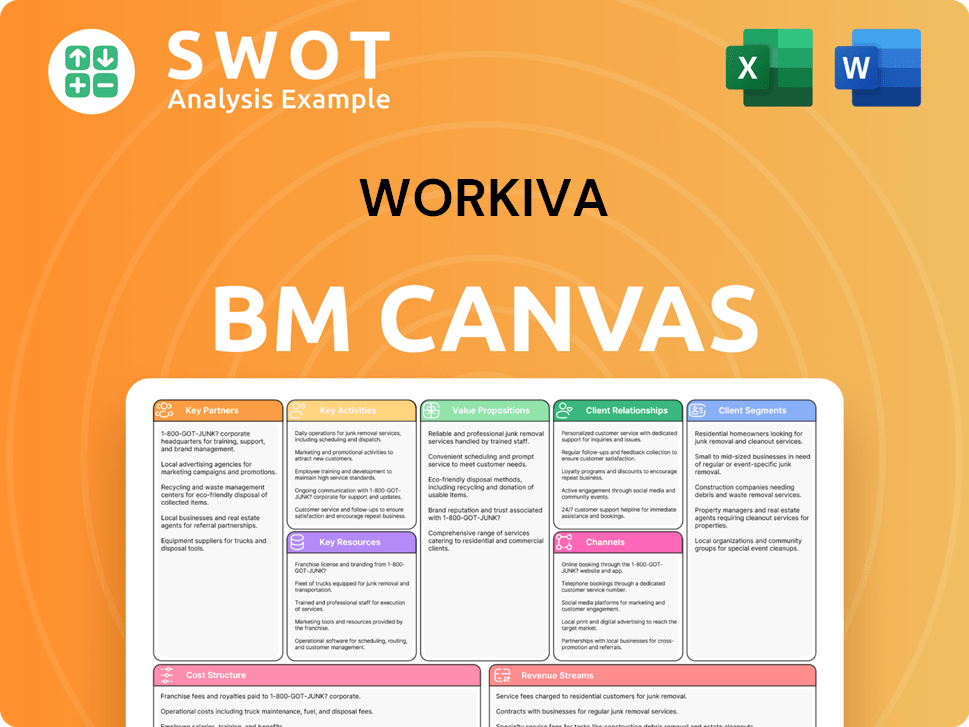

Workiva Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Workiva’s Ownership Landscape?

Over the past few years, several significant developments have influenced the Workiva company's ownership profile and strategic direction. The company has been actively involved in enhancing shareholder value through a share repurchase plan. The board of directors authorized a share repurchase plan for up to $100 million of its outstanding Class A common stock on July 30, 2024. During the first quarter of 2025, under this plan, approximately 462,000 shares were purchased for $40.1 million, with $59.9 million remaining available as of March 31, 2025.

Leadership changes have also occurred, with Julie Iskow succeeding Marty Vanderploeg as CEO, starting April 1, 2023. Additionally, Brigid Bonner decided not to stand for re-election at the company's 2025 annual meeting of stockholders, and Astha Malik was nominated to join the board. These changes, alongside strategic acquisitions, indicate ongoing evolution within the Workiva company.

| Metric | Value | Date |

|---|---|---|

| Institutional Ownership | 83.89% | May 2025 |

| Mutual Fund Ownership | 65.93% | May 2025 |

| Insider Ownership | 3.97% | May 2025 |

| Shares Repurchased (Q1 2025) | Approximately 462,000 | March 31, 2025 |

| Remaining Funds for Share Repurchase | $59.9 million | March 31, 2025 |

Industry trends show an increased institutional ownership in Workiva, with institutional investors holding 83.89% of shares and mutual funds holding 65.93% as of May 2025. Conversely, insider holdings decreased slightly to 3.97% in May 2025. These trends reflect a broader market movement towards greater institutional investment in established public companies. The company anticipates total revenue for 2025 to be in the range of $864 million to $868 million, with a projected non-GAAP operating margin of 5.0% to 5.5% and a free cash flow margin of approximately 10%. For a deeper understanding of the company's financial performance, you can review the detailed analysis in a comprehensive article about Workiva.

The Workiva ownership structure is primarily influenced by institutional investors who hold a significant portion of the shares. This indicates a strong level of confidence from major financial institutions. The company has a clear focus on enhancing shareholder value, as demonstrated by its share repurchase program.

Leadership transitions, such as the appointment of Julie Iskow as CEO, bring in fresh perspectives and strategies. These changes, coupled with board nominations, can influence the company's strategic direction. The decisions made by the Workiva leadership will influence the company's future.

Acquisitions like Sustain.Life are aimed at expanding Workiva's capabilities, particularly in sustainability reporting. These moves are a part of the company's larger growth strategy. The acquisitions help in expanding Workiva's market reach and service offerings.

Workiva anticipates strong financial performance in 2025, with revenue projections between $864 million and $868 million. The company's focus on profitability is evident through its projected non-GAAP operating margin of 5.0% to 5.5% and a free cash flow margin of approximately 10%.

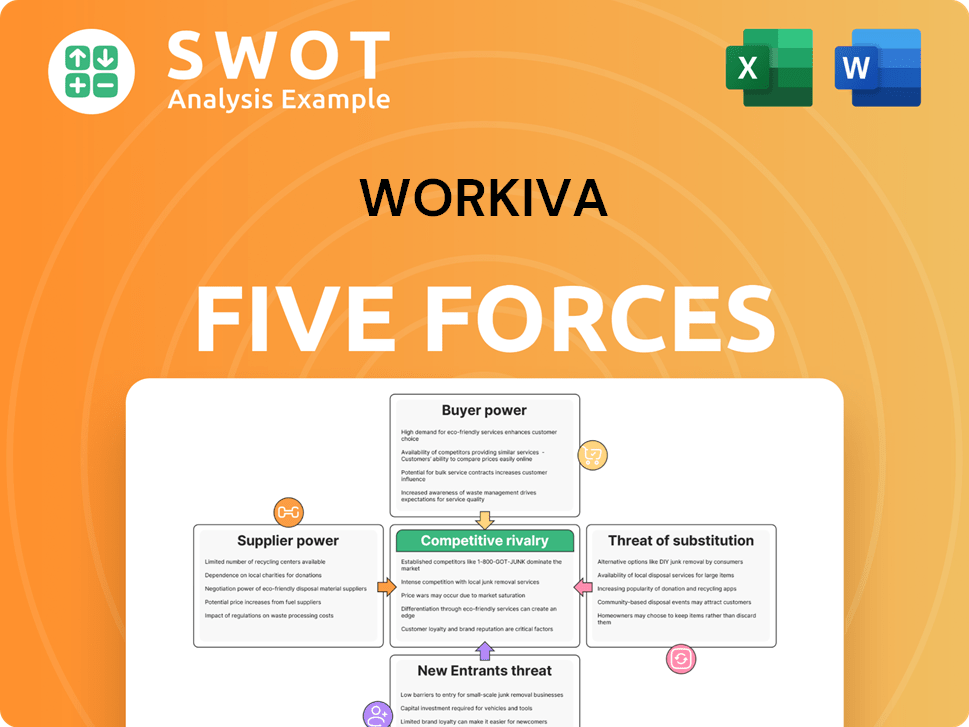

Workiva Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Workiva Company?

- What is Competitive Landscape of Workiva Company?

- What is Growth Strategy and Future Prospects of Workiva Company?

- How Does Workiva Company Work?

- What is Sales and Marketing Strategy of Workiva Company?

- What is Brief History of Workiva Company?

- What is Customer Demographics and Target Market of Workiva Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.